Wisconsin Tod Form With 2 Points

Description

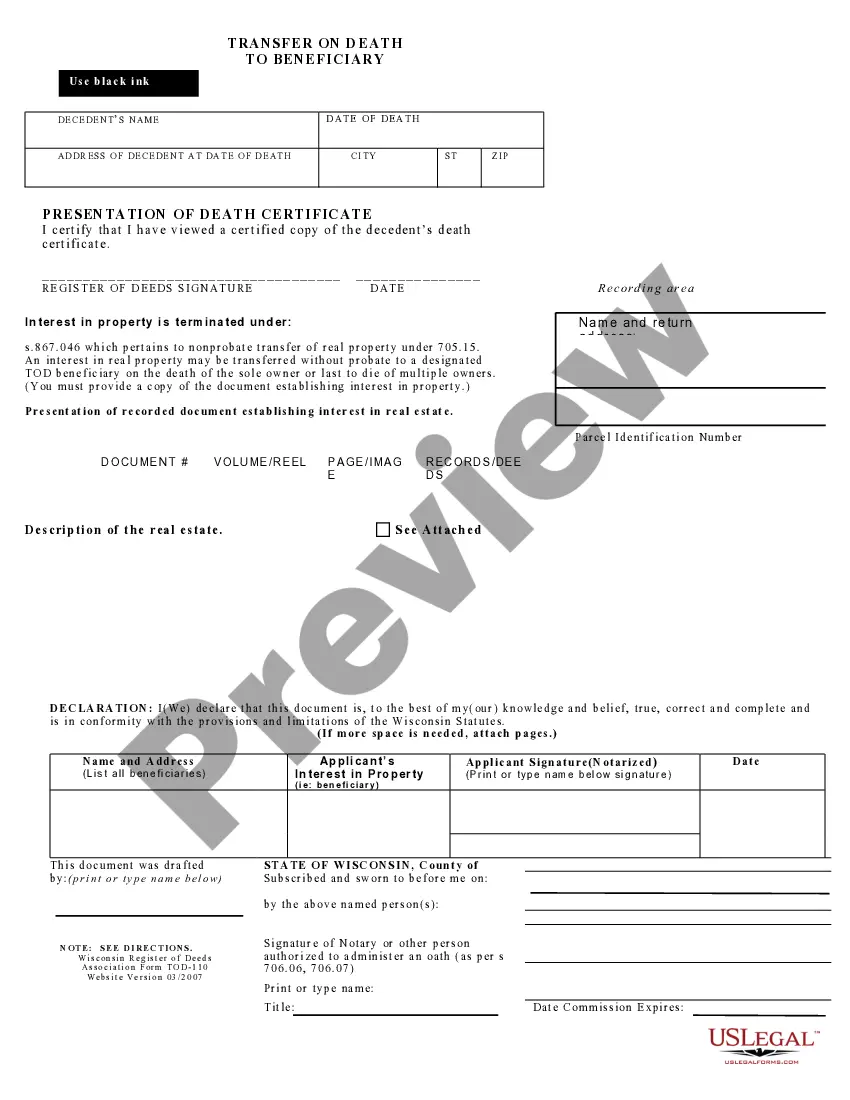

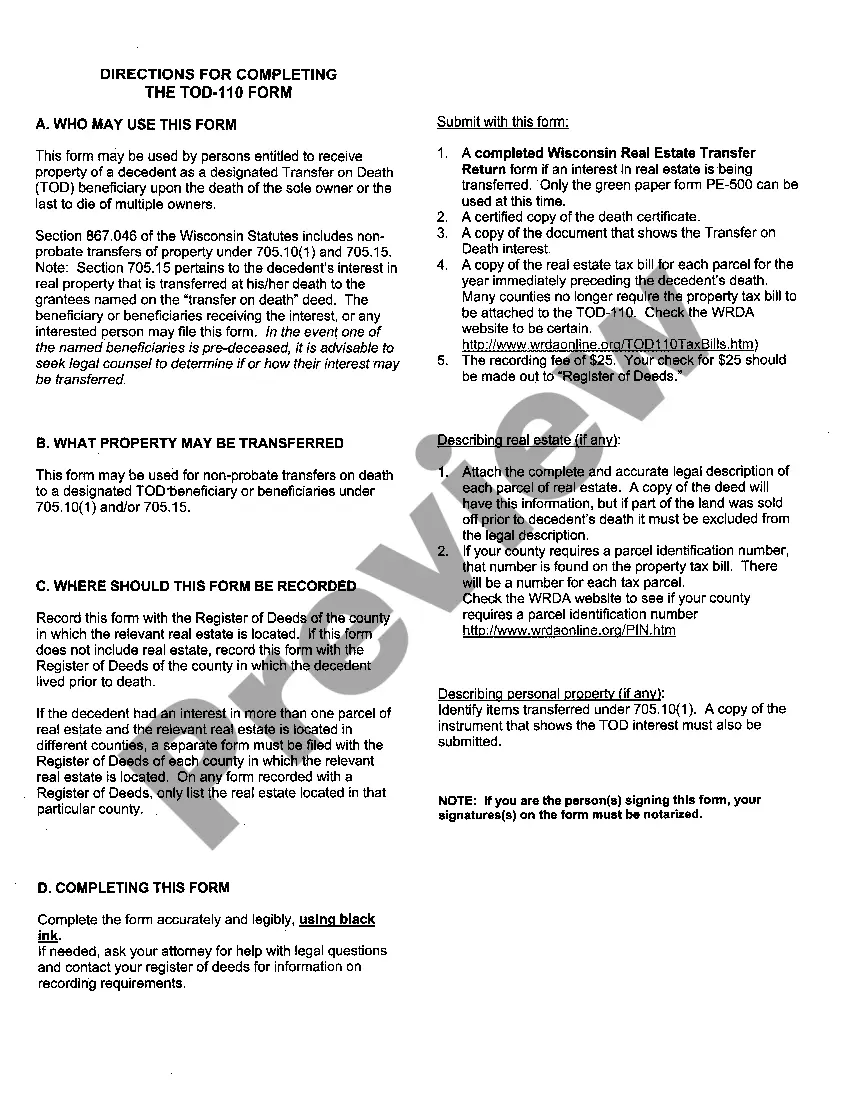

How to fill out Wisconsin Transfer On Death Or TOD To Beneficiary - Official Form Used To Record Beneficiary's Interest Following Death Of Grantor?

It’s common knowledge that you cannot become a legal authority instantly, nor can you quickly comprehend how to draft the Wisconsin Tod Form With 2 Points without possessing specialized expertise.

Creating legal documents is a lengthy endeavor that necessitates specific training and abilities. So why not entrust the preparation of the Wisconsin Tod Form With 2 Points to the specialists.

With US Legal Forms, boasting one of the most comprehensive legal template collections, you can find everything from court documents to templates for internal business communication.

Begin your search anew if you require any other template.

Create a free account and choose a subscription plan to purchase the form. Click Buy now. Once the transaction is complete, you can obtain the Wisconsin Tod Form With 2 Points, complete it, print it, and deliver or send it by mail to the necessary individuals or entities.

- We recognize how vital compliance and adherence to federal and local regulations are.

- That’s why, on our platform, all templates are location-specific and current.

- Here’s how you can initiate your journey with our platform and acquire the document you need in just a few moments.

- Find the document you seek using the search bar at the top of the page.

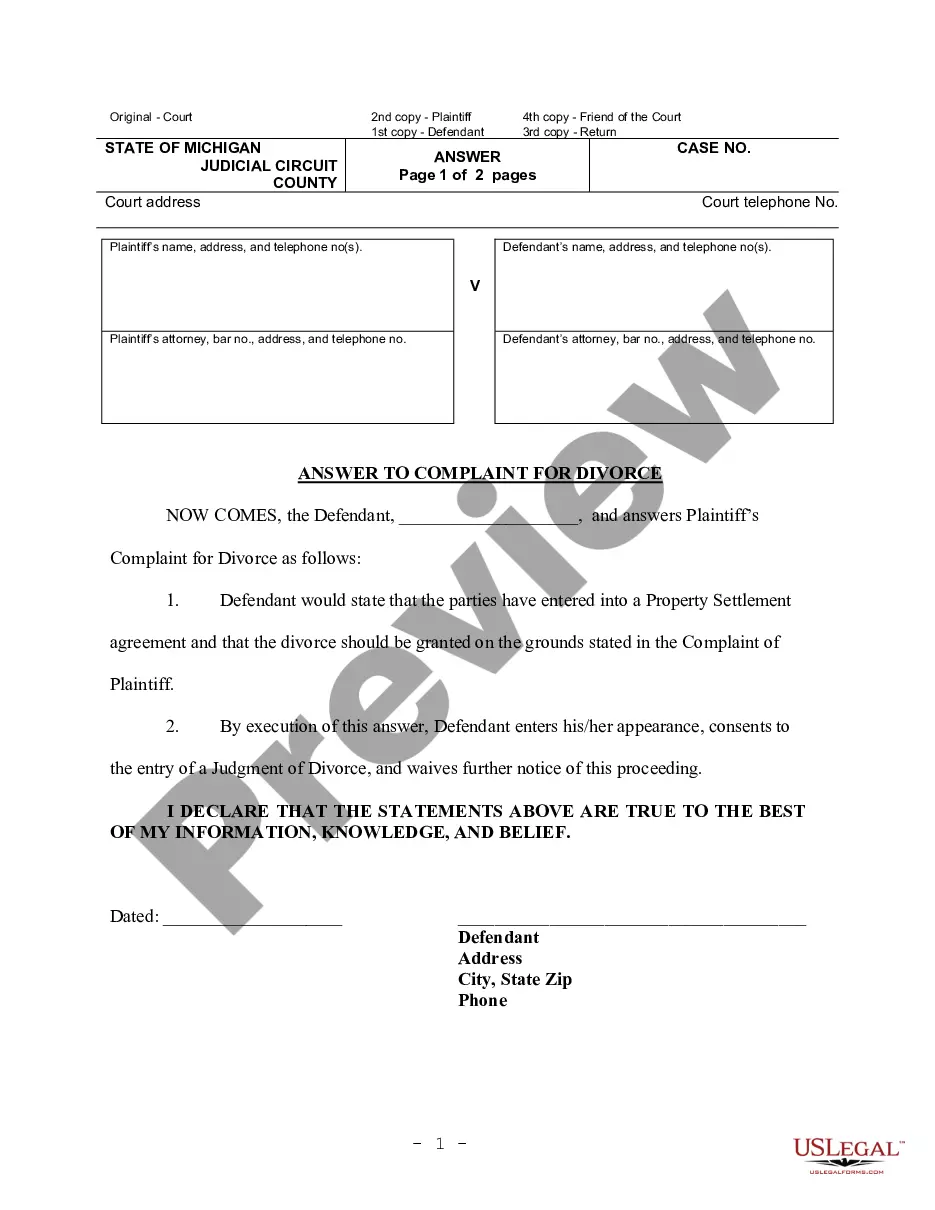

- Preview it (if this option is available) and read the accompanying description to determine if the Wisconsin Tod Form With 2 Points is what you’re looking for.

Form popularity

FAQ

A TOD beneficiary is designated on a deed that must be recorded and is exempt from filing a transfer return. State the exemption from return and fee on the face of the document: "Exempt from transfer return and fee per state law (sec. 77.25(10m), Wis. Stats.)."

Some of these disadvantages are as follows: You cannot name an alternate or contingent beneficiary. There are limits and special rules for minors who are designated for Transfer On Death accounts.

And while the process may vary slightly from state to state, there are some general, basic steps to follow. Get Your State-Specific Deed Form. Look up the requirements for the state the property is in. ... Decide on Your Beneficiary. ... Include a Description of the Property. ... Sign the New Deed. ... Record the Deed.

A Wisconsin TOD deed must include: The name of the property owner or owners whose interest a TOD deed will transfer; The TOD beneficiary's name; and. A statement that the transfer only becomes effective upon the owner's death.

TOD account holders can name multiple beneficiaries and divide assets any way they like. If your TOD investment account is set up to be split evenly between your children, each will receive an even part when you die.