Active Community Supervision Fort Worth

Description

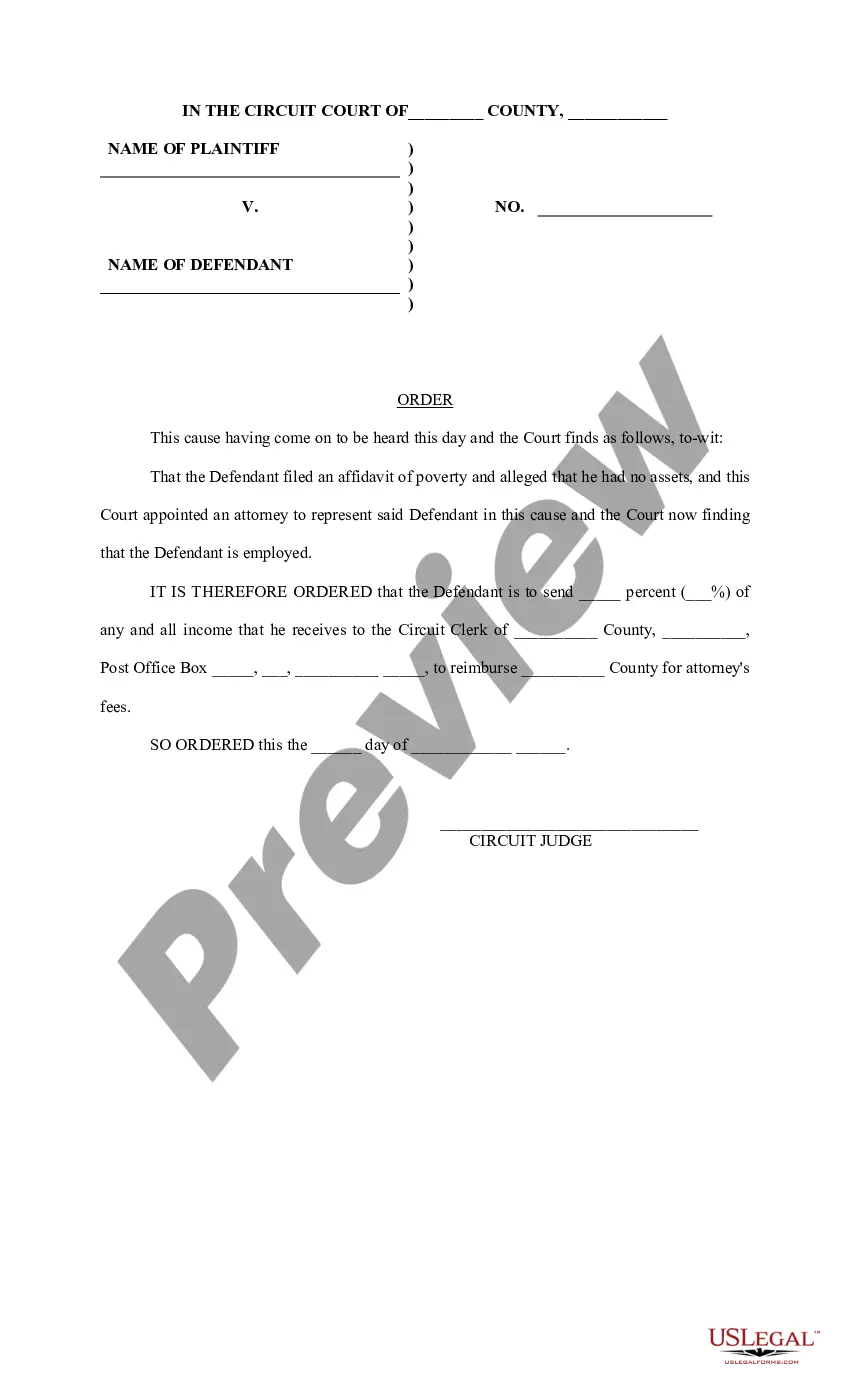

How to fill out Wisconsin Order For Supervised Release?

Acquiring legal templates that comply with federal and state regulations is essential, and the internet provides numerous options to choose from.

However, why waste your time seeking the perfect Active Community Supervision Fort Worth template online when the US Legal Forms digital library has already gathered such documents in one location.

US Legal Forms boasts the largest online legal repository with over 85,000 customizable templates created by attorneys for any professional and personal needs.

Explore the template using the Preview option or through the text outline to ensure it meets your requirements.

- They are easy to navigate with all documents organized by state and intended use.

- Our experts keep up with legal changes, ensuring that your forms are always current and compliant when you obtain an Active Community Supervision Fort Worth from our site.

- Acquiring an Active Community Supervision Fort Worth is straightforward and fast for both new and existing users.

- If you already have an account with a valid subscription, Log In and download the document sample you need in the proper format.

- If you are new to our site, follow these steps.

Form popularity

FAQ

For a personal loan agreement to be enforceable, it must be documented in writing, as well as signed and dated by all parties involved. It's also a good idea to have the document notarized or signed by a witness.

What a personal loan agreement should include Legal names and address of both parties. Names and address of the loan cosigner (if applicable). Amount to be borrowed. Date the loan is to be provided. Repayment date. Interest rate to be charged (if applicable). Annual percentage rate (if applicable).

It's perfectly legal for organizations other than banks and credit unions to lend money. However, private lenders still have to comply with the usury laws and banking laws of the states in which they operate. In other words, the rates that they're able to charge are regulated.

You can certainly loan money to a friend or family member, but you should have established repayment guidelines, including interest rates?if any?and a payment schedule, to ensure both parties are on the same page.

For a personal loan agreement to be enforceable, it must be documented in writing, as well as signed and dated by all parties involved. It's also a good idea to have the document notarized or signed by a witness.