Default Letter For Student Loans

Description

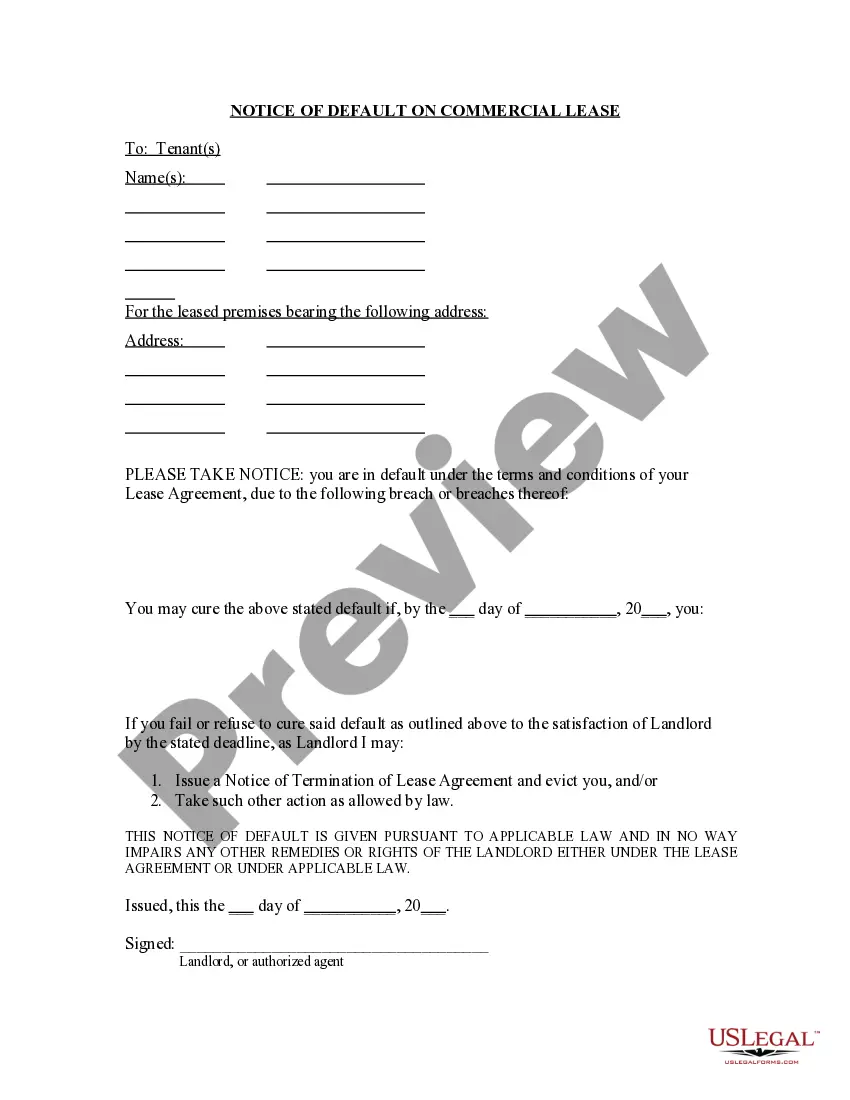

How to fill out Wisconsin Letter From Landlord To Tenant As Notice Of Default On Commercial Lease?

Individuals typically link legal documentation with complexities that only an expert can manage.

To some degree, this is accurate, as composing a Default Letter For Student Loans requires a comprehensive understanding of subject matter standards, which include regional and local laws.

However, thanks to US Legal Forms, the process has become simpler: pre-made legal templates for various life and business scenarios, tailored to state legislation, are gathered in a single online repository and are now accessible to everyone.

All templates in our catalog are reusable: once acquired, they remain saved in your profile. You can access them anytime you need through the My documents tab. Explore all the benefits of using the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current forms compiled by state and application area, enabling users to locate a Default Letter For Student Loans or any specific template in mere minutes.

- Users already registered with an active subscription must Log In to their account and click Download to retrieve the form.

- New users of the platform must first create an account and subscribe before downloading any documents.

- Here’s a guide on how to obtain the Default Letter For Student Loans.

- Carefully review the page content to ensure it meets your requirements.

- Examine the form description or check it using the Preview feature.

- If the prior selection does not meet your needs, search for another sample using the Search field in the header.

- Once you find the appropriate Default Letter For Student Loans, click Buy Now.

- Select a pricing plan that fits your requirements and budget.

- Create an account or Log In to continue to the payment page.

- Complete the payment for your subscription using PayPal or your credit card.

- Choose the format for your sample and click Download.

- Print your document or upload it to an online editor for quicker completion.

Form popularity

FAQ

Defaulted student loans do not automatically disappear after seven years. This period refers to the time it takes for negative information related to the loans to drop from your credit report. Even if the default status is removed, you still owe the debt. For assistance with handling defaulted loans, consider obtaining a default letter for student loans, which can help you clarify your repayment options.

When your student loans go into default, the lender may take several strict actions to recover the owed amount. Your credit score will suffer significantly, affecting future borrowing and financial opportunities. Additionally, the lender may initiate collections, wage garnishment, or tax refund seizures. To navigate this challenging situation, consider using a default letter for student loans to seek repayment options or to negotiate with your lender.

The 7 year rule refers to the period after which defaulted student loans may be removed from your credit report. However, this does not eliminate your responsibility for the debt. Still, it's essential to address your loans proactively, perhaps by utilizing resources like US Legal Forms, to help navigate repayment and avoid the complications of default.

Defaulting on your student loans can lead to severe financial consequences, including credit damage and wage garnishment. It's generally advisable to explore alternative solutions, such as deferment or repayment plans, before considering default. Always consider contacting a professional or using platforms like US Legal Forms to find a structured method to handle your loans effectively.

Student loans typically go into default after you fail to make payments for a certain period, usually 270 days for federal loans. If you want to expedite the process, you can simply stop making your scheduled payments. However, the repercussions of defaulting are significant, so weigh your options carefully before taking this step.

Are Direct Loans that are in default eligible for Public Service Loan Forgiveness (PSLF)? Defaulted Direct Loans are not eligible for PSLF. However, a defaulted loan may become eligible for PSLF if you resolve the default. Learn how to resolve the default through rehabilitation or consolidation.

It can affect your finances and life circumstances for years. If you default on federal student loans, you lose access to benefits like deferment, forbearance, and loan forgiveness. The good news is that you can still be eligible for student loan forgiveness, depending on how you respond to being in default.

Log in to your FAFSA to view your Student Aid Report (SAR). This report will give you your loan servicer's contact information. Once you have resolved the defaulted loan or the overpayment, request a current Clearance Letter be faxed directly to FVTC's Financial Aid office 920-735-5763.

For a loan made under the William D. Ford Federal Direct Loan Program or the Federal Family Education Loan Program, you're considered to be in default if you don't make your scheduled student loan payments for at least 270 days.

To regain eligibility for financial aid, you need to submit a letter from your lender indicating that your loan or loans are no longer in default either because the loan has been paid in full or because satisfactory payment arrangements have been completed to remove the loan from a defaulted status.