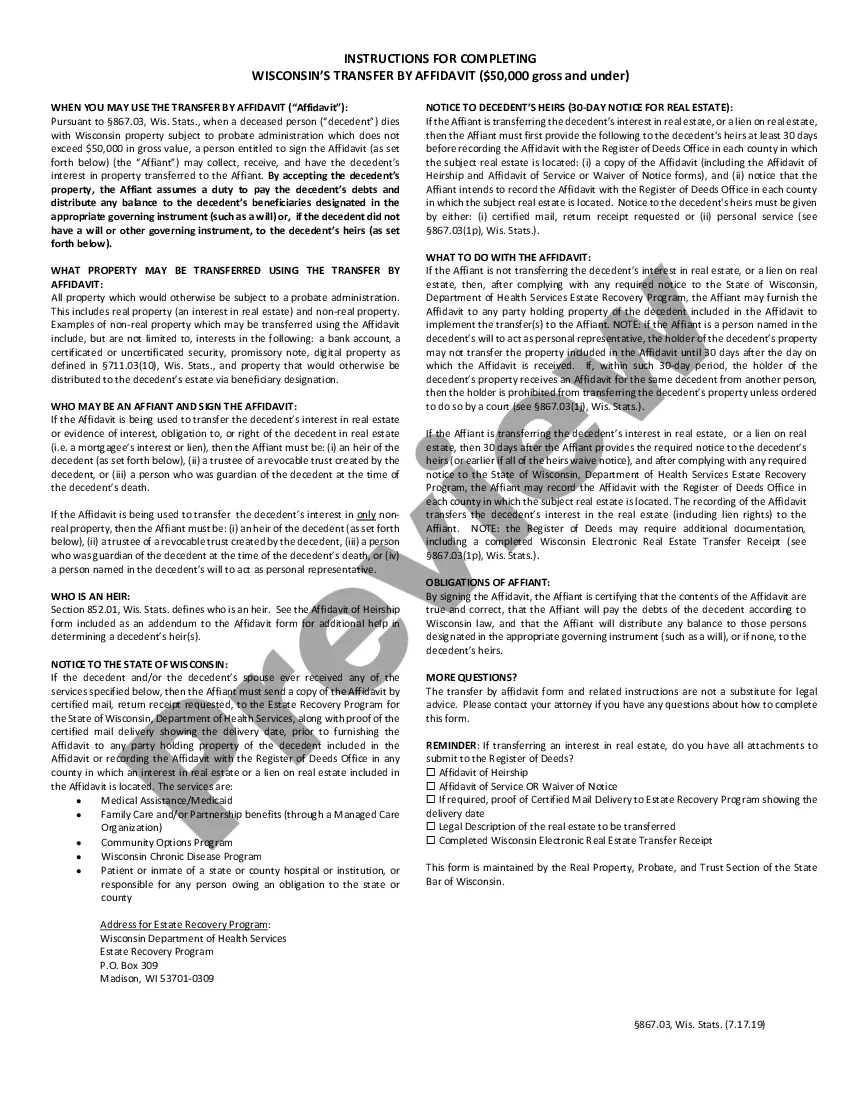

Wisconsin Transfer By Affidavit Brochure

Description

How to fill out Wisconsin Transfer By Affidavit For Estates Valued Under $50,000?

Locating a reliable source to obtain the most up-to-date and pertinent legal samples is part of the challenge of navigating bureaucracy.

Selecting the appropriate legal documents requires accuracy and meticulousness, which is why it is crucial to acquire Wisconsin Transfer By Affidavit Brochure samples solely from trustworthy sources, such as US Legal Forms. An incorrect template will squander your time and delay your situation. With US Legal Forms, you have minimal worries. You can access and verify all the details regarding the document’s application and relevance for your situation and in your state or county.

Eliminate the complications associated with your legal paperwork. Explore the extensive US Legal Forms collection to discover legal samples, assess their relevance to your situation, and download them instantly.

- Use the library navigation or search bar to find your sample.

- Review the form’s description to determine if it meets the criteria of your state and region.

- Access the form preview, if available, to confirm that the template is the one you need.

- Return to the search and find the correct document if the Wisconsin Transfer By Affidavit Brochure does not fulfill your requirements.

- If you are confident about the form’s relevance, download it.

- If you are a registered user, click Log in to verify and access your selected templates in My documents.

- If you do not have an account yet, click Buy now to acquire the form.

- Choose the pricing option that suits your needs.

- Continue to the registration to complete your purchase.

- Finalise your purchase by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading the Wisconsin Transfer By Affidavit Brochure.

- Once you have the form on your device, you can modify it with the editor or print it and complete it by hand.

Form popularity

FAQ

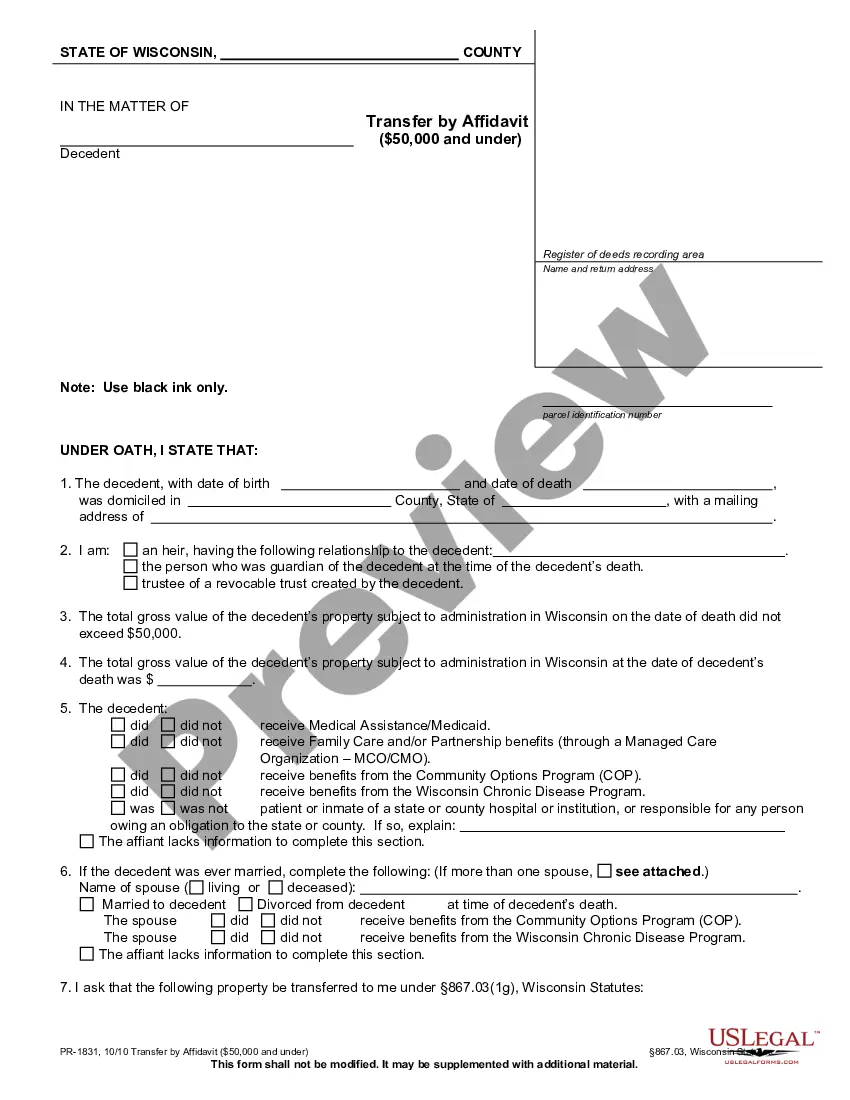

Transfer by Affidavit ($50,000 and under) Any heir, trustee, or person who was guardian, may collect and transfer the solely owned assets by completing an affidavit in duplicate. The original form Wisconsin Court System website must be sent via certified mail to the Wisconsin Department of Health and Family Services.

A Wisconsin small estate affidavit, also known as a Transfer by Affidavit, helps heirs, successors and beneficiaries of estates valued at $50,000 or less receive what they are entitled to more quickly than through traditional means.

WI Form Affidavit Of Service Or Waiver Of Notice is a probate form in Wisconsin. It is used by executors, personal representatives, trustees, guardians & other related parties during the probate & estate settlement process.

Form PR-1831 - Transfer By Affidavit ($50,000 And Under) is a probate form in Wisconsin. To transfer decedent's assets not exceeding $50,000 (gross) to an heir, trustee of trust created by decedent, or person who was guardian of the decedent at the time of the decedent's death for distribution.

The Transfer by Affidavit process may be used to close a person's estate when the deceased had $50,000 or less in assets subject to administration in Wisconsin. It is an alternative to using a court process for smaller estates.