Expiring Twenty Deadline With Extension

Description

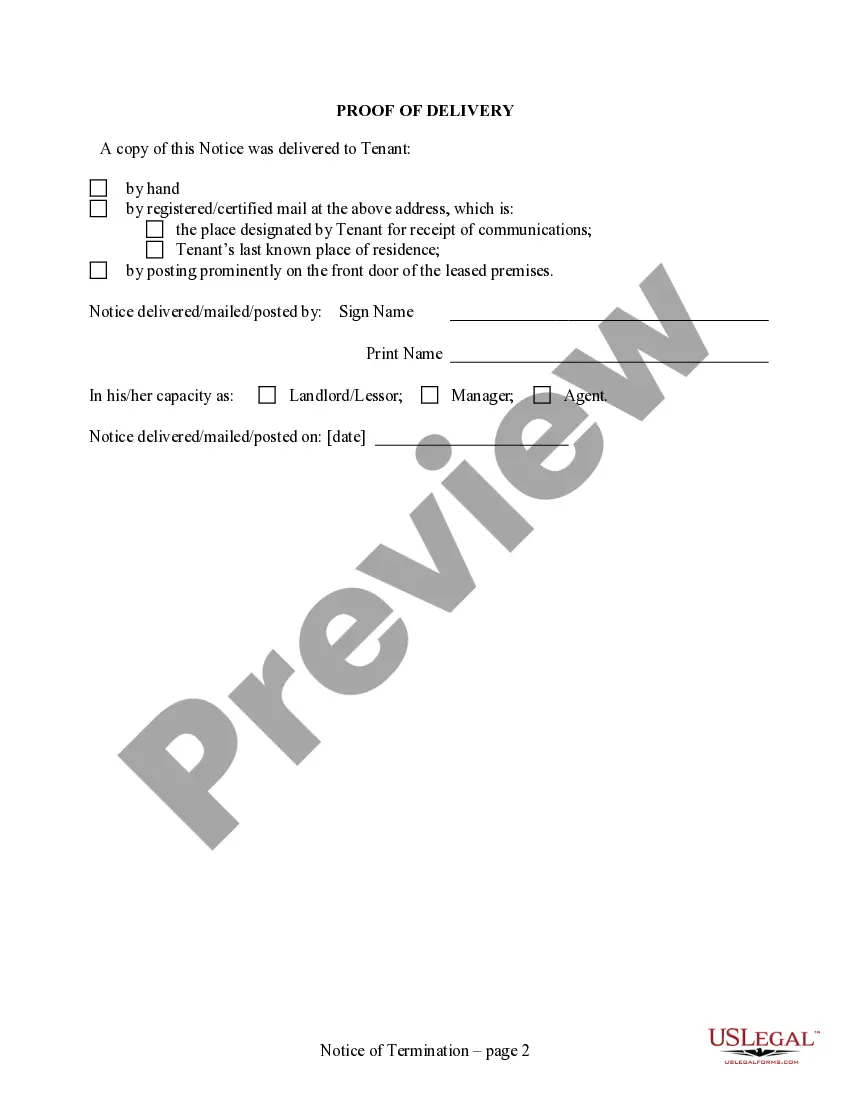

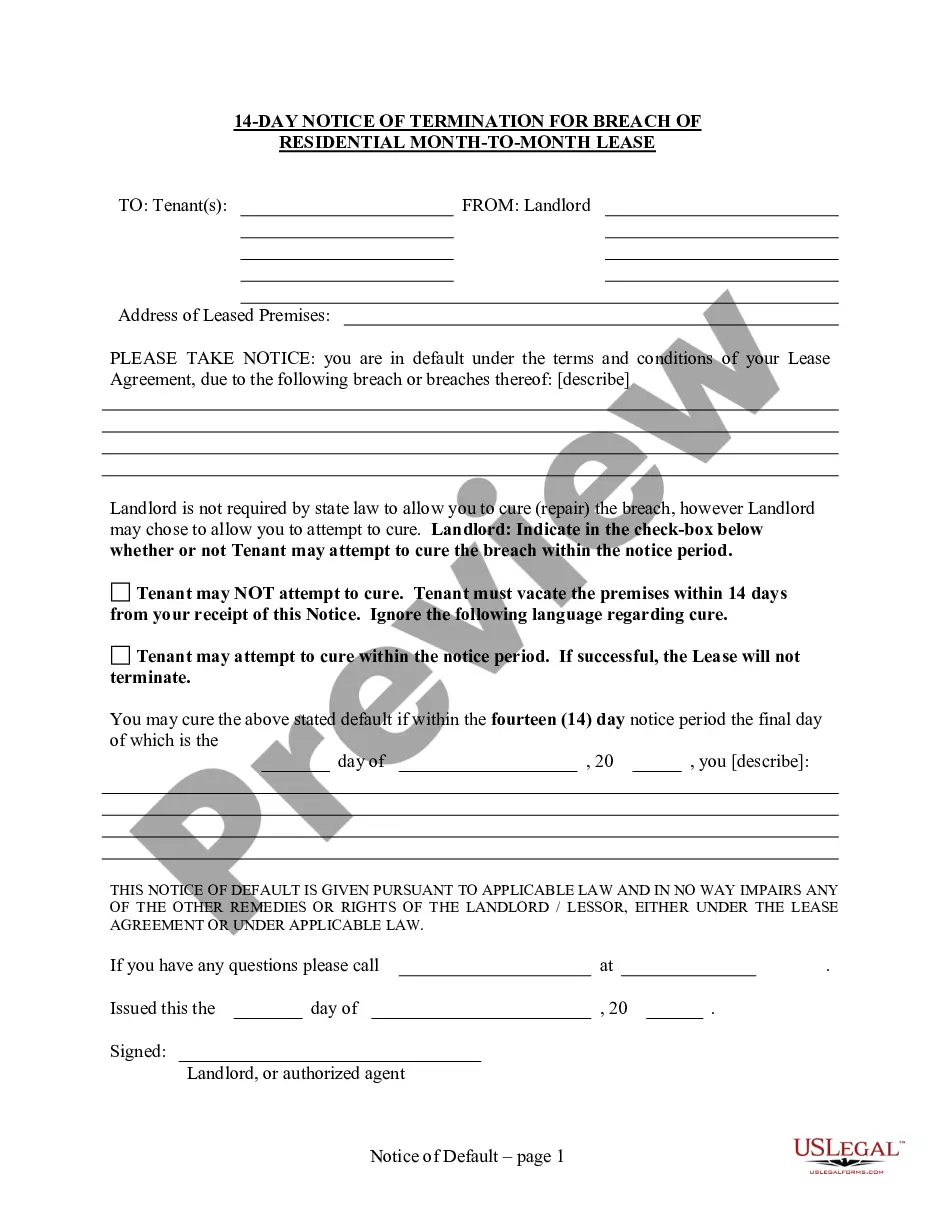

How to fill out Wisconsin 28 Day Notice To Terminate Month To Month Lease - No Right To Cure - Residential?

- If you're a returning user, log in to your account to access your previously purchased form templates. Ensure your subscription remains active; renew it if necessary.

- For new users, begin by reviewing the Preview mode and form description to confirm that the selected legal form meets your local requirements.

- If adjustments are necessary, utilize the Search tab to find the appropriate template, ensuring it satisfies your specific needs.

- Purchase the desired document by clicking the Buy Now button, selecting a suitable subscription plan, and registering for an account to unlock resource access.

- Complete your transaction by entering your payment details via credit card or PayPal.

- Finally, download your selected form and save it to your device. You can find it later in the My Forms section of your profile.

In conclusion, US Legal Forms stands out as a leading provider of legal templates, offering an extensive array of over 85,000 easily editable forms. With user-friendly navigation and premium expert assistance, you can confidently navigate your legal needs.

Start your journey today and experience the benefits of seamless legal form management!

Form popularity

FAQ

The grace period for an I-20 typically lasts 60 days following the expiration date. During this time, you can prepare for your next steps, whether that involves transferring, applying for a new program, or planning to leave the U.S. Understanding the expiring twenty deadline with extension is crucial to avoid overstaying your visa. Always check with your international office to clarify your situation and learn about possible extensions.

Extending your I-20 after it expires is challenging but not impossible. The expiring twenty deadline with extension emphasizes timely action, and once your I-20 has lapsed, you must address the situation promptly. Reach out to your school's international office for assistance in the extension process and to discuss any consequences. They can provide insight into your options moving forward.

Forgetting to extend your I-20 can lead to unintended consequences regarding your legal status in the United States. The expiring twenty deadline with extension allows you to maintain your status as long as you act swiftly. Contact your school’s international office immediately to discuss potential options for extension. They will help you navigate the process and restore your eligibility.

If you forgot your I-20, you may face issues related to your visa status and study eligibility. The expiring twenty deadline with extension is crucial to maintain legal status while in the U.S. To rectify the situation, you should contact your school's international office as soon as possible. They can guide you on how to obtain a new I-20 and advise you on the necessary steps.

Yes, you can file a joint extension and later decide to file separately. This flexibility allows you to change your mind based on your tax situation. Just be cautious and keep track of the approaching expiring twenty deadline with extension to ensure compliance.

If you file an extension, your tax deadline typically extends to October 15th. However, this date can vary based on specific circumstances, so it’s important to confirm your exact deadline. Don’t miss the expiring twenty deadline with extension to avoid penalties.

You can file married filing separately under various circumstances, such as if you want to separate your finances, or if one spouse does not want to be liable for the other’s tax obligations. It's beneficial to evaluate the pros and cons before the expiring twenty deadline with extension, and consider consulting professionals like uslegalforms.

You can choose to file separately even if you previously filed jointly. This change can be made as long as it is within the tax year and before the expiring twenty deadline with extension. It’s advisable to assess the tax implications of this decision carefully.

Yes, the IRS does provide proof of an extension once your request is submitted. You'll typically receive confirmation via mail or an electronic acknowledgment if filed online. This proof is important for your records, especially when approaching the expiring twenty deadline with extension.

Filing married filing separately may cause you to lose certain tax credits such as the Earned Income Tax Credit and the Child and Dependent Care Credit. These credits are only available to those who file jointly. Therefore, it’s crucial to consider these potential losses when approaching the expiring twenty deadline with extension.