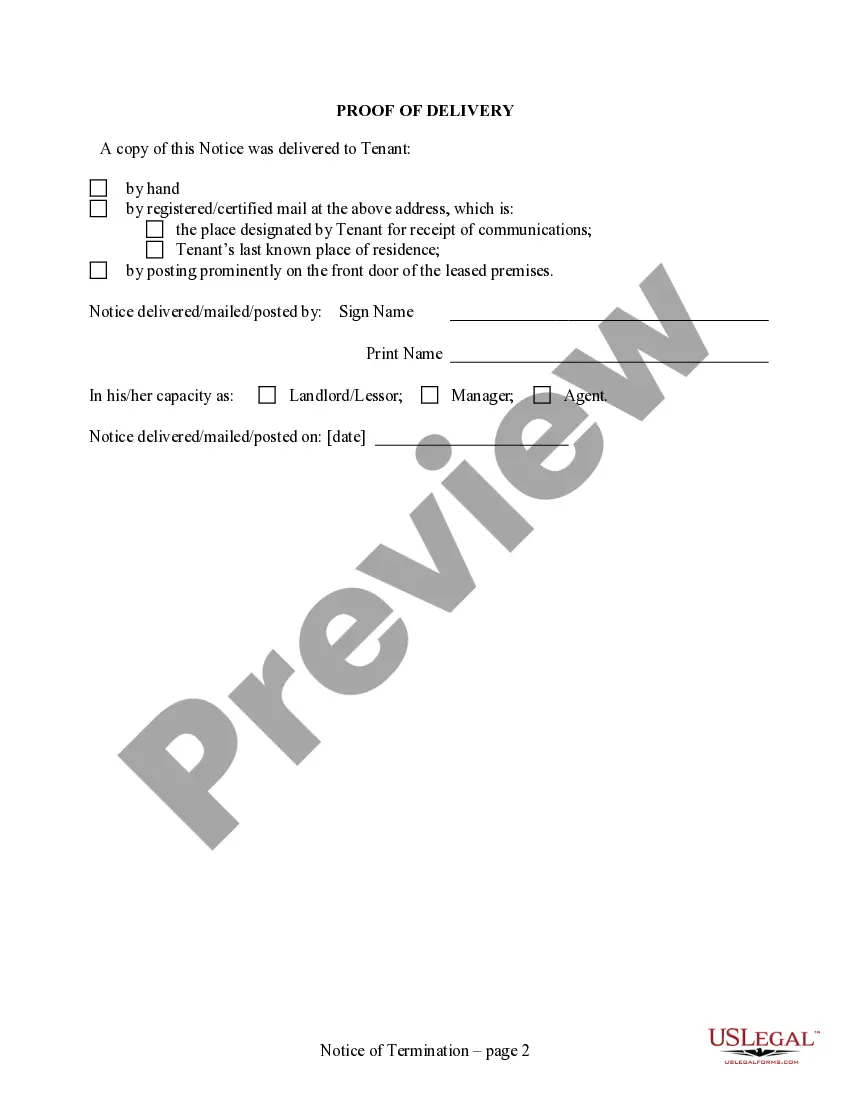

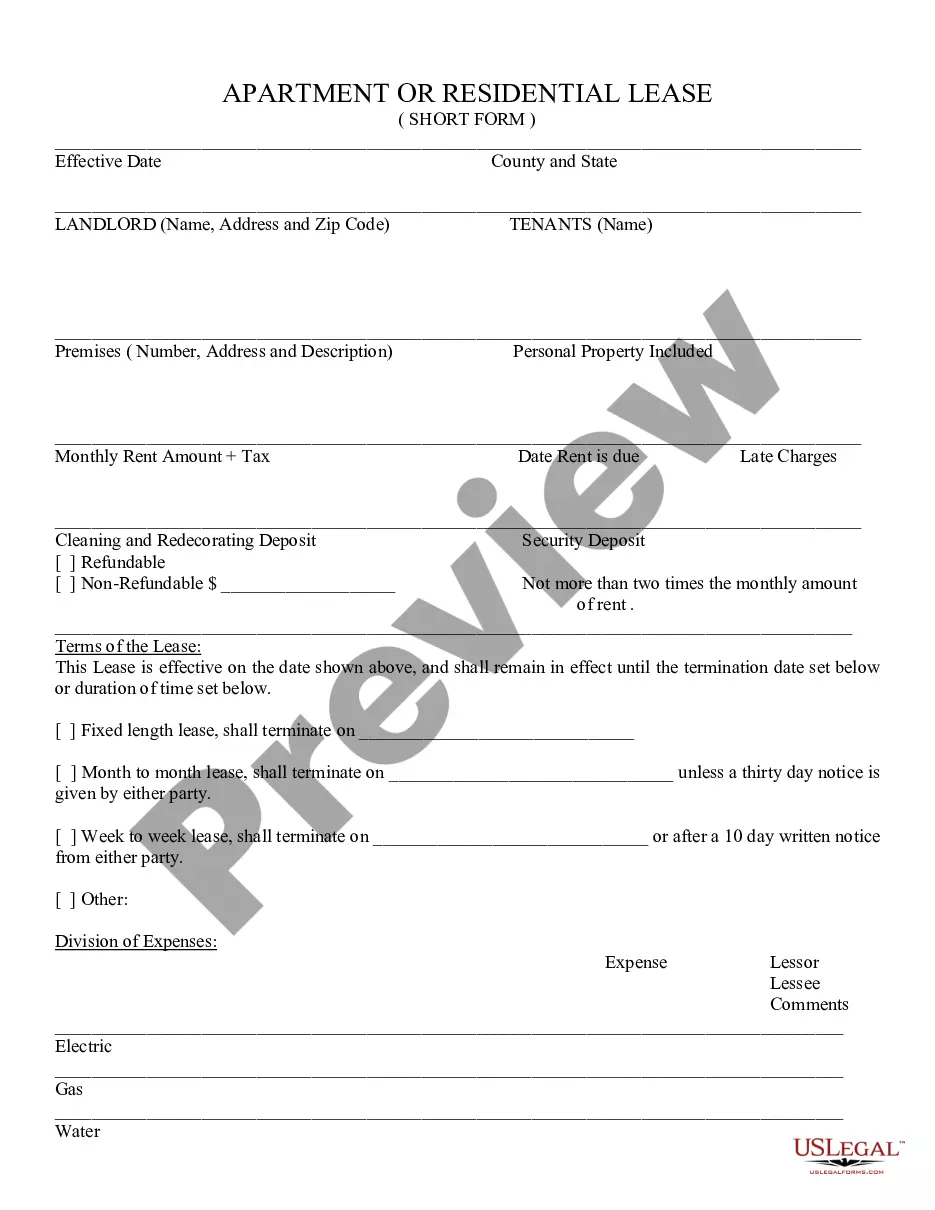

This 28 Day Notice to Terminate Month to Month Lease - No Right to Cure form is for use by a Landlord to terminate a month-to-month residential lease. "Residential" includes a house, apartment or condo. Unless a written agreement provides otherwise, the Landlord does not have to have a reason for terminating the Lease in this manner, other than a desire to end the lease. A month-to-month lease is one which continues from month-to-month unless either party chooses to terminate. Unless a written agreement provides for a longer notice, 28 days notice is required prior to termination in this state. The notice must be given to the Tenant within at least 28 days prior to the termination date. The form indicates that the Landlord has chosen to terminate the lease, and states the deadline date by which the Tenant must vacate the premises. For additional information, see the Law Summary link.

Expiring Twenty Deadline For Tax Purposes

Description

How to fill out Wisconsin 28 Day Notice To Terminate Month To Month Lease - No Right To Cure - Residential?

- If you have previous experience, log in to your account and download the required form template directly by clicking the Download button. Check for subscription validity and renew if necessary.

- For first-time users, start by reviewing the Preview mode and form descriptions. Make sure you've selected the correct document that fulfills your requirements and adheres to local regulations.

- If the right template is not found, use the Search tab to find an appropriate form that meets your needs before proceeding.

- Select the document you wish to purchase by clicking the Buy Now button. Choose a subscription plan that fits your needs and create an account for full access.

- Complete your purchase by entering your credit card details or utilizing your PayPal account to finalize the subscription.

- Finally, download the form to save it on your device, allowing you to fill it out later. Access it anytime in the My Forms section of your profile.

With US Legal Forms, you gain access to an extensive and affordable library of legal forms.

Don't wait until the last minute—start your legal form process today and ensure your compliance with the upcoming deadline!

Form popularity

FAQ

If you do not file your taxes for three years, you may face severe penalties, including fines and interest on unpaid taxes. The IRS can initiate collection efforts, and your financial record may be negatively impacted. Keeping track of the expiring twenty deadline for tax purposes can prevent these harsh outcomes.

Skipping a year of filing taxes is not advisable and could lead to significant repercussions. The IRS expects you to file each year, regardless of your income level or changes in financial circumstances. Understanding the implications of the expiring twenty deadline for tax purposes can help inform your decisions.

Yes, the IRS can pursue you for unpaid taxes beyond five years. They can take action to collect debts through garnishing wages or seizing assets. Paying attention to the expiring twenty deadline for tax purposes becomes vital in preventing long-term consequences.

Missing the April 18th deadline can result in penalties and interest on any owed taxes. The IRS may impose fines based on how long you delay filing. Being aware of the expiring twenty deadline for tax purposes allows you to act diligently and avoid unnecessary stress.

For your tax year end date, you should enter December 31 of the year you are reporting. This date reflects the end of the fiscal year for most taxpayers. Understanding your obligations regarding the expiring twenty deadline for tax purposes ensures you fill out your tax return accurately.

Going without filing taxes for more than three years usually leads to trouble with the IRS, including potential audits or penalties. Once the three-year mark hits, the IRS can take immediate action, including levying fines. Staying informed about the expiring twenty deadline for tax purposes can help you avoid these issues.

You can typically go three years without filing taxes before facing legal consequences related to unpaid taxes. However, the IRS may find you, and penalties may accrue. It's crucial to understand that there's a limit to how long the IRS will wait for your tax return. Addressing the expiring twenty deadline for tax purposes is essential to maintain your financial health.

The 3-year rule for the IRS establishes that the agency typically has three years to audit your tax returns after they have been filed. Additionally, this rule applies to the collection of taxes owed, making it crucial to adhere to the expiring twenty deadline for tax purposes. If you filed your return on time and accurately, your exposure to future audits or collections is significantly reduced. Use resources like US Legal Forms to help you file correctly and stay informed.

The IRS can generally go back three years to collect unpaid taxes if you have filed your returns. However, if there are signs of fraud or if you haven’t filed, they can look back further, potentially as far as six years or longer. Being aware of the expiring twenty deadline for tax purposes helps ensure that you file properly and avoid complications. Keeping accurate records can help set you on a clear path.

Missing the October 15 tax deadline typically results in penalties and interest on any unpaid balance. This situation can complicate your finances and should be handled without delay, as the expiring twenty deadline for tax purposes is there to protect your interests. Filing as soon as possible can reduce the penalties, but understanding the ramifications is essential. US Legal Forms can offer resources to help you get back on track swiftly.