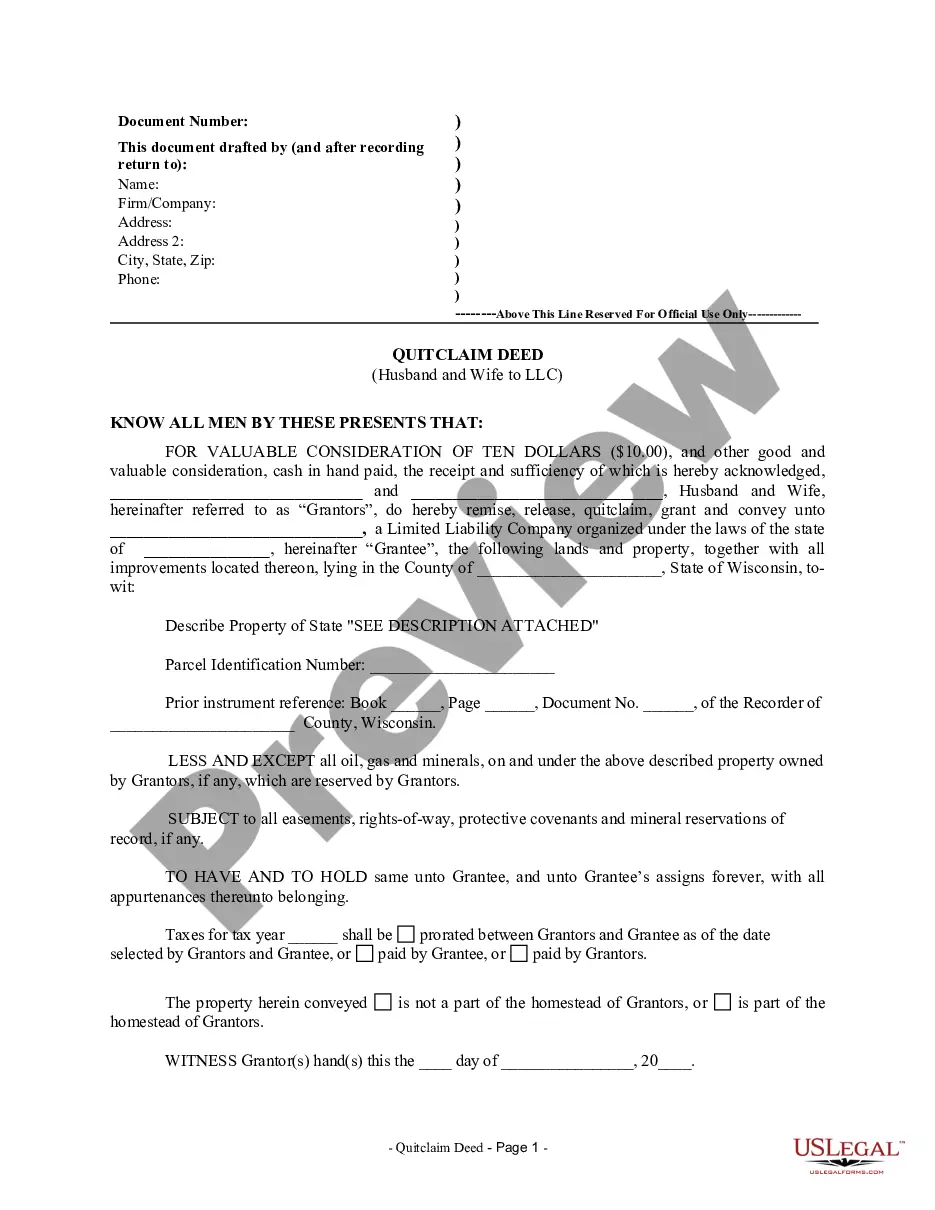

Quit Claim Deed Form Wisconsin For Property

Description

How to fill out Wisconsin Quitclaim Deed From Husband And Wife To LLC?

Whether for business purposes or for personal matters, everyone has to deal with legal situations at some point in their life. Completing legal documents requires careful attention, beginning from choosing the appropriate form template. For example, if you pick a wrong edition of the Quit Claim Deed Form Wisconsin For Property, it will be declined when you submit it. It is therefore crucial to have a dependable source of legal documents like US Legal Forms.

If you need to get a Quit Claim Deed Form Wisconsin For Property template, stick to these simple steps:

- Get the sample you need using the search field or catalog navigation.

- Look through the form’s information to ensure it suits your situation, state, and county.

- Click on the form’s preview to see it.

- If it is the incorrect form, go back to the search function to locate the Quit Claim Deed Form Wisconsin For Property sample you require.

- Download the file when it meets your requirements.

- If you have a US Legal Forms profile, just click Log in to gain access to previously saved files in My Forms.

- If you don’t have an account yet, you may obtain the form by clicking Buy now.

- Select the appropriate pricing option.

- Finish the profile registration form.

- Choose your payment method: you can use a credit card or PayPal account.

- Select the document format you want and download the Quit Claim Deed Form Wisconsin For Property.

- When it is saved, you can fill out the form by using editing software or print it and complete it manually.

With a large US Legal Forms catalog at hand, you do not have to spend time searching for the appropriate sample across the web. Take advantage of the library’s easy navigation to get the proper form for any occasion.

Form popularity

FAQ

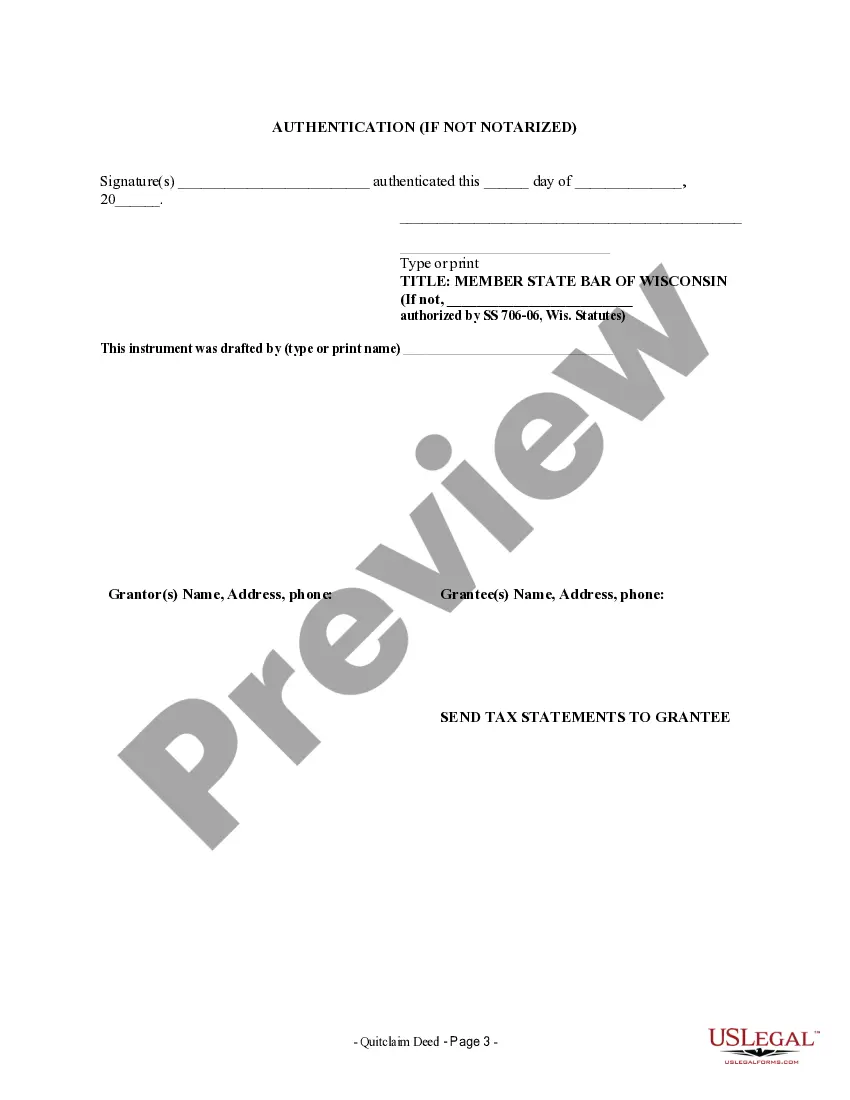

A $30 filing fee is typically required.

A Wisconsin general warranty deed form?or just warranty deed?is a real estate deed under which the current owner contracts to warrant the transferred real estate's title. An owner who contracts to warrant a property's title conveys the real estate with a warranty of title.

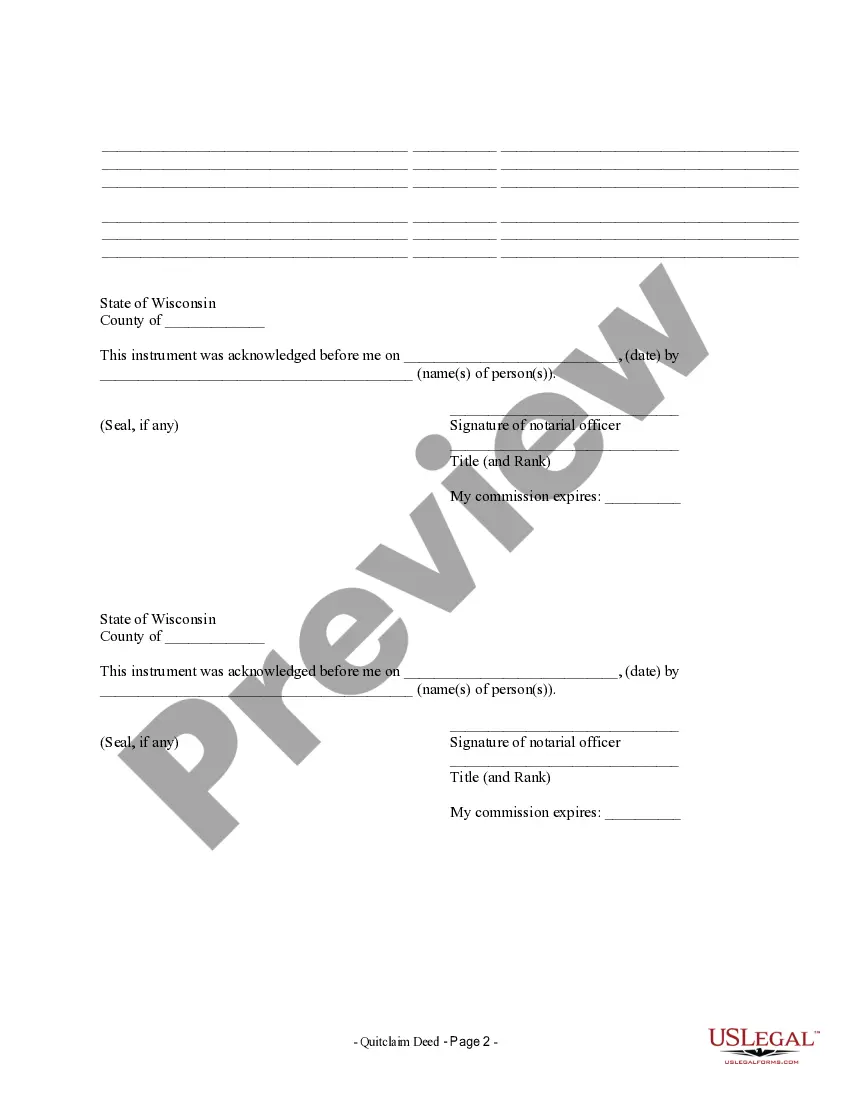

How do I make a change to property ownership (add, remove or change someone's name)? To change ownership of real estate, a new conveyance document (deed) must be drafted and submitted for recording along with an Electronic Real Estate Transfer Return Receipt (e-RETR) We do not carry blank forms in our office.

Legal instruments such as warranty deeds, quit claim deeds, etc., that convey title from one property owner to a new owner, are usually drafted by attorneys, or paralegals or legal secretaries under the supervision of an attorney.

A $30 filing fee is typically required. Transfer Tax: Yes: 30 cents for each $100 value or fraction of $100.