Wisconsin Quitclaim Deed With Right Of Survivorship

Description

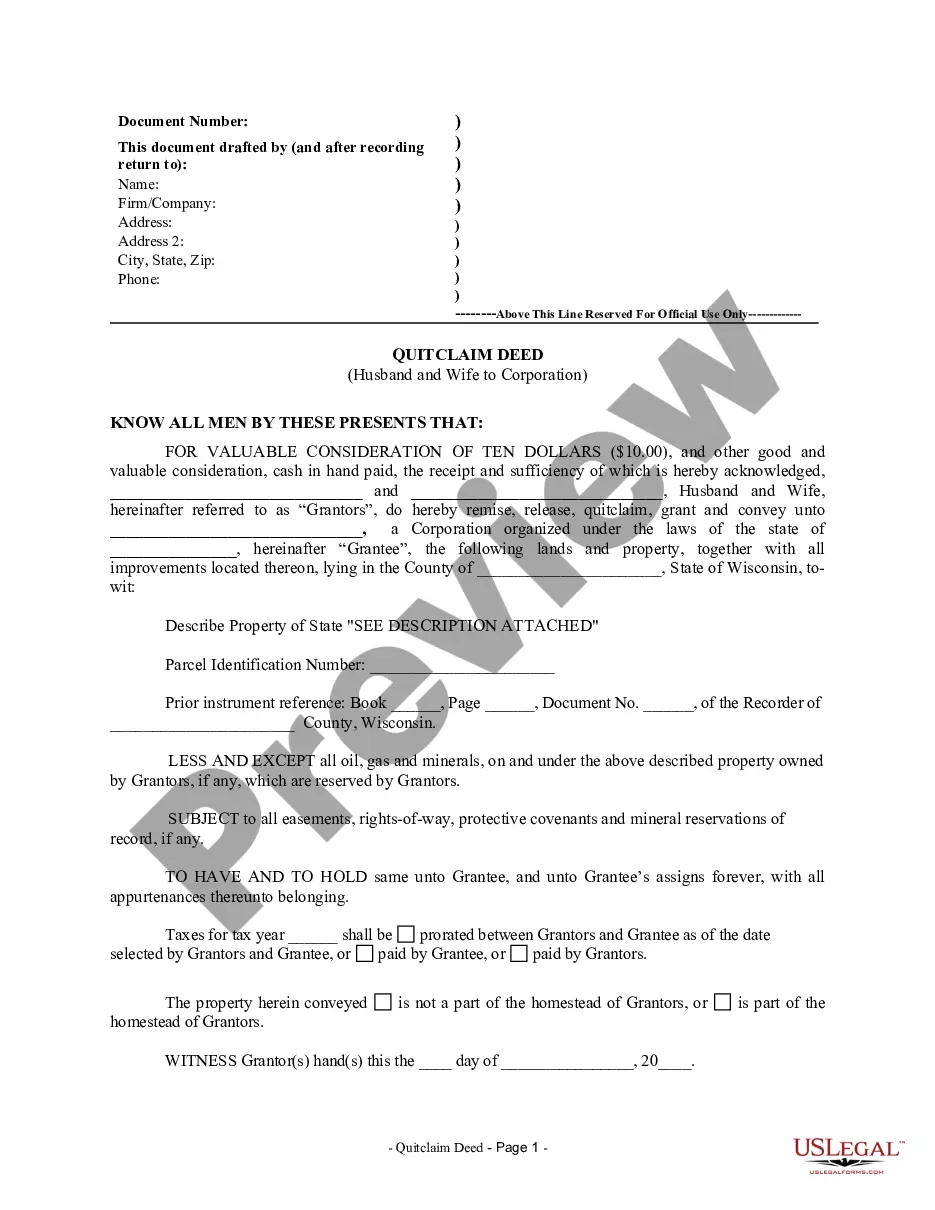

How to fill out Wisconsin Quitclaim Deed From Husband And Wife To Corporation?

There's no longer a reason to waste time looking for legal documents to adhere to your local state laws.

US Legal Forms has gathered all of them in one location and made them easier to access.

Our site offers over 85k templates for various business and personal legal matters organized by state and area of use.

Utilize the search field above to look for another template if the current one doesn't suit your needs.

- All forms are properly drafted and validated for authenticity, so you can feel secure in obtaining a current Wisconsin Quitclaim Deed With Right Of Survivorship.

- If you're familiar with our platform and already possess an account, ensure your subscription is active before retrieving any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all obtained documents whenever necessary by accessing the My documents tab in your profile.

- For first-time users of our platform, additional steps are required to complete the process.

- Here's how new users can access the Wisconsin Quitclaim Deed With Right Of Survivorship from our library.

- Carefully review the page content to ensure it includes the sample you need.

- To assist in this, utilize the form description and preview options if available.

Form popularity

FAQ

Yes, it is typically necessary to remove a deceased spouse from joint bank accounts. This helps prevent any complications in the future regarding access to funds and account management. If the account was set up with a right of survivorship, you will likely retain access to the funds, but updating the account information ensures clarity. Contact your bank for guidance on their specific procedures after a spouse's passing.

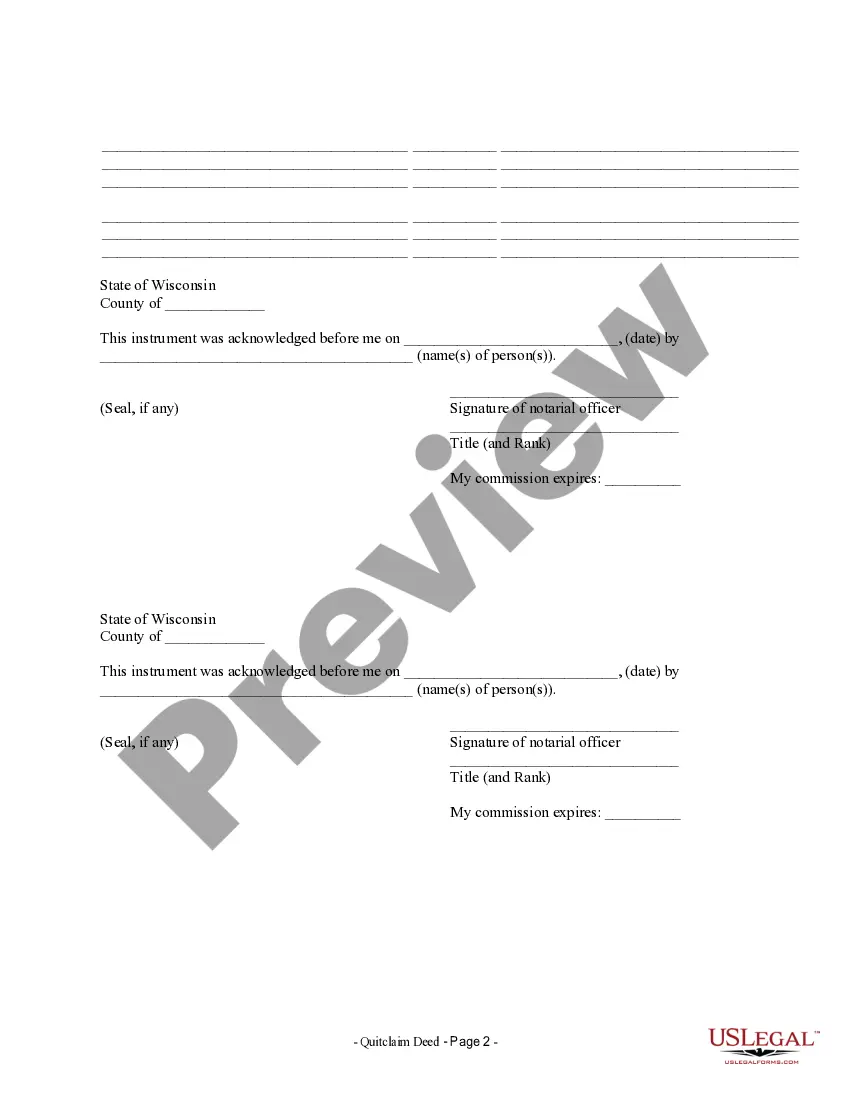

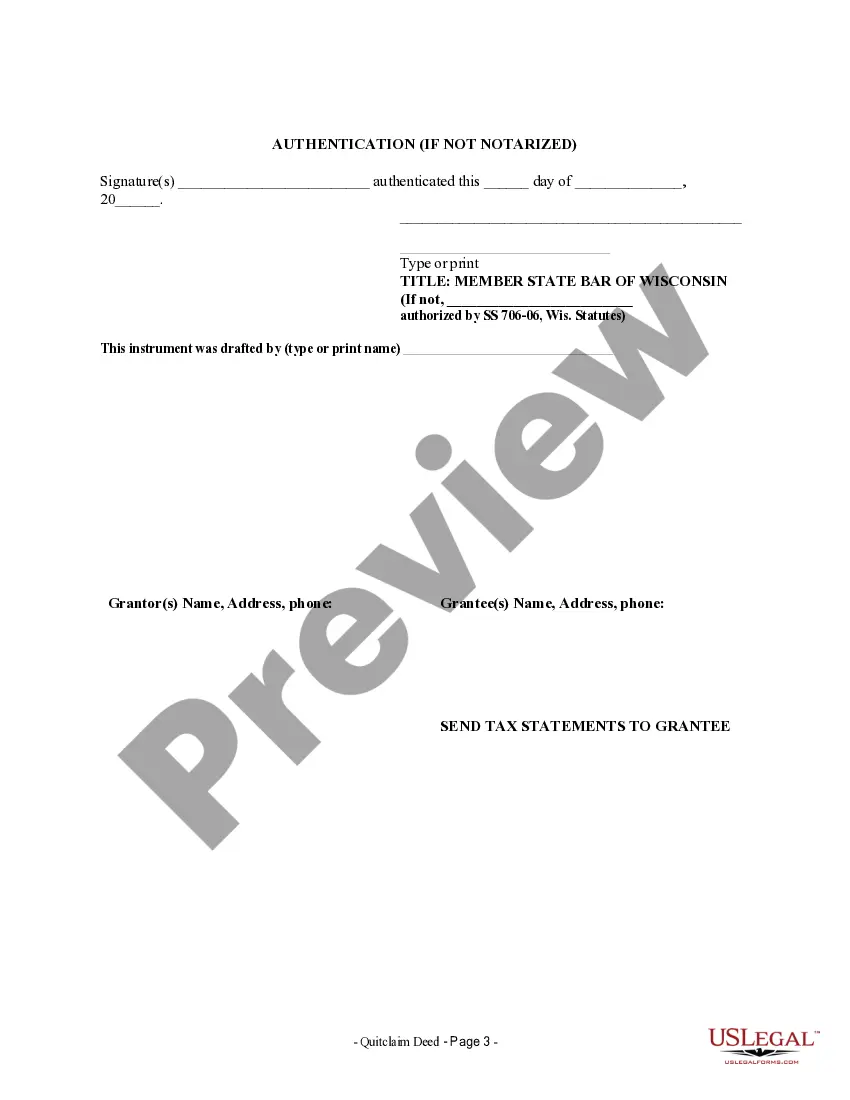

Filling out a Wisconsin quitclaim deed is straightforward with the right information. You need to include the names of the grantor and grantee, a description of the property, and the language to indicate the right of survivorship. Online platforms like US Legal Forms can provide templates and guidance to ensure you complete this process correctly. After filling it out, remember to sign and submit it to your county's register of deeds for proper recording.

The right of survivorship allows a property co-owner to inherit the deceased co-owner's share of the property automatically. For instance, if you and your spouse own a house together and one of you passes away, the other automatically becomes the sole owner due to the Wisconsin quitclaim deed with right of survivorship. This feature helps streamline the transfer of ownership and avoids lengthy probate processes. Understanding this right can safeguard your interests in shared property.

After the death of a spouse, it is important to take steps to manage their estate and assets. If you shared property, using a Wisconsin quitclaim deed with right of survivorship allows you to claim ownership easily. You should also review joint financial accounts, update insurance policies, and contact relevant agencies to ensure everything is handled properly. It may be beneficial to consult an attorney for a clear understanding of your rights and responsibilities.

To transfer a house title after death in Wisconsin, you typically use a Wisconsin quitclaim deed with right of survivorship. This document allows the surviving spouse to take full ownership of the property without going through probate. First, you must obtain the death certificate and any necessary information about the property. Then, complete and file the quitclaim deed with your county's register of deeds.

Transferring property title to a family member in Wisconsin typically involves executing a quitclaim deed. This deed must clearly state the grantor and grantee information, along with the property details. By using a Wisconsin quitclaim deed with right of survivorship, you ensure that the property automatically passes to the family member upon your death. You can find user-friendly templates and step-by-step guidance on USLegalForms to make this process simple and efficient.

To add someone to your deed in Wisconsin, you must execute a quitclaim deed that includes the new owner's name and the existing property description. This type of deed allows for the transfer of ownership without many formalities. Utilizing a Wisconsin quitclaim deed with right of survivorship guarantees that the newly added owner can inherit the property automatically upon your passing. Platforms like USLegalForms can help streamline this process with their tailored templates.

In Wisconsin, anyone can prepare a quitclaim deed, including property owners. However, it's advisable to use a legal professional to ensure accuracy and compliance with state laws. Using a Wisconsin quitclaim deed with right of survivorship can help you add significant legal protections. Consider platforms like USLegalForms, where you can find templates and guidance tailored to your needs.

To change the deed on a house after the death of a spouse in Wisconsin, you will need to execute a new Wisconsin quitclaim deed with right of survivorship. This involves filling out the necessary forms to transfer the deceased spouse's interest in the property to you. It is essential to have an official death certificate and to record the new deed with the appropriate county office. Using services like US Legal Forms can simplify this process by providing the required forms and instructions.

Yes, you can prepare your own Wisconsin quitclaim deed with right of survivorship. The process typically involves completing a legal form that outlines the details of the property and the parties involved. However, you should ensure that the deed complies with Wisconsin state laws to avoid any complications. Using platforms like US Legal Forms can provide you with templates and guidance to create a legally sound quitclaim deed.