Llc Ltda

Description

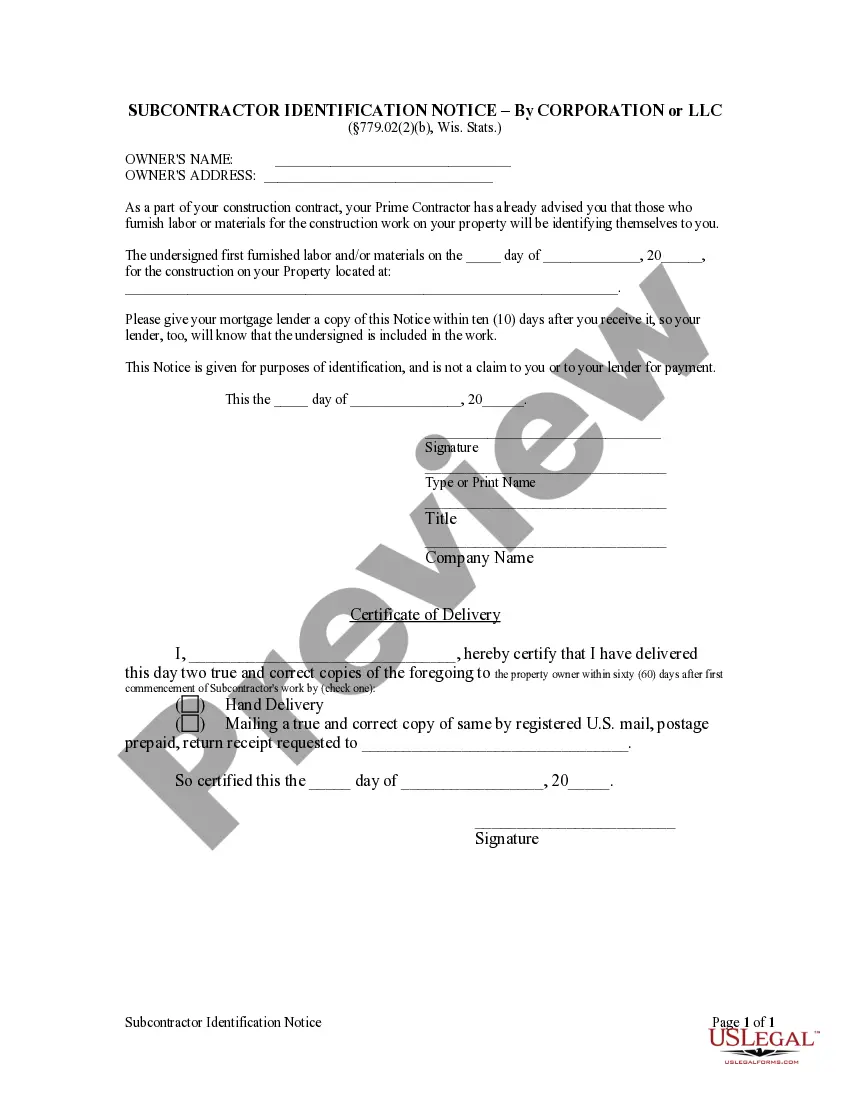

How to fill out Wisconsin Subcontractor's Identification Notice By Corporation?

- If you're a returning user, log in to your account and ensure your subscription is active. Then, simply download the necessary form template using the Download button.

- For first-time users, begin by reviewing the form description and preview in order to confirm you’ve selected the correct LLC LTDA document that matches your jurisdiction's requirements.

- Should you find inconsistencies in your chosen form, leverage the Search tab to explore other templates until you find the right match.

- Proceed to purchase the document by clicking the Buy Now button and selecting your preferred subscription plan. Creating an account is necessary to access the full library.

- Complete your purchase by entering your credit card information or using a PayPal account to finalize the subscription.

- Once payment is confirmed, download your completed form and store it on your device. You can always access it later in the My Forms section of your profile.

In conclusion, US Legal Forms provides a user-friendly experience for obtaining legal documents, particularly for LLC LTDA registrations. With a vast library of forms and access to expert assistance, you can ensure that your documents are accurate and legally compliant.

Start your journey with US Legal Forms today and streamline your legal paperwork process!

Form popularity

FAQ

Yes, if your LLC ltda has income from services rendered, you may receive a 1099 form from clients or customers. This form reports the income to the IRS. It is important to keep your records organized, as you'll need this information for tax reporting and compliance.

Yes, you can file your LLC ltda separately for tax purposes. If you elect to be treated as a corporation, your LLC can file its tax returns independently. This option may offer certain tax benefits, so consider consulting with a tax professional to explore your choices.

In Texas, the approval process for your LLC ltda typically takes between 3 to 5 business days if you file online. If you choose to file using a paper application, it may take a bit longer. It is always wise to check the Texas Secretary of State's website for current processing times.

You can certainly have an LLC ltda and choose not to actively engage in business. However, it is essential to maintain compliance by adhering to state requirements, such as annual reports and minimal tax obligations. Even inactive LLCs require some level of attention to avoid unnecessary penalties.

Failing to file taxes for your LLC ltda can lead to penalties and interest, impacting your financial health. The IRS may impose fines for late filings, and it could jeopardize your LLC's status. It is crucial to maintain compliance and avoid these risks by filing your taxes on time.

A single owner LLC typically files taxes as a sole proprietorship. This means you report your business income and expenses on your personal tax return using Schedule C. By doing this, your LLC ltda remains simple and straightforward, allowing for easier tracking of your finances.

The easiest way to get an LLC, or LLC ltda, is to use a reliable online service like US Legal Forms. This platform streamlines the process by providing clear instructions and essential documents needed to form your LLC. You simply fill out the required information, and they handle the paperwork for you. This approach saves time and ensures that you meet all the legal requirements.

An Ltd company, or Limited Company, is recognized as a separate legal entity, providing its owners with limited liability protection. This means owners are not personally responsible for the company's debts, similar to an Llc ltda. Such entities are typically seen as reliable and credible in the business world. By choosing to form an Llc ltda or an Ltd company, entrepreneurs can present a strong professional image while safeguarding their personal assets.

Environmental business consultants can be structured as various types of entities, including an LLC or Ltda, depending on the region. These companies provide specialized services focused on sustainability and environmental management. By being an Llc ltda, they can ensure that their owners are protected from personal liability while still addressing crucial environmental issues. This business type is invaluable in today’s economy, where green practices are increasingly important.

A Ltda is a type of limited liability company common in various regions, particularly in Latin America. This structure protects its owners by limiting their financial liability to their investment in the business. In many aspects, an Llc ltda functions similarly to a U.S. LLC, offering both operational flexibility and personal asset protection. Choosing the right legal structure like an Llc ltda can enhance business success.