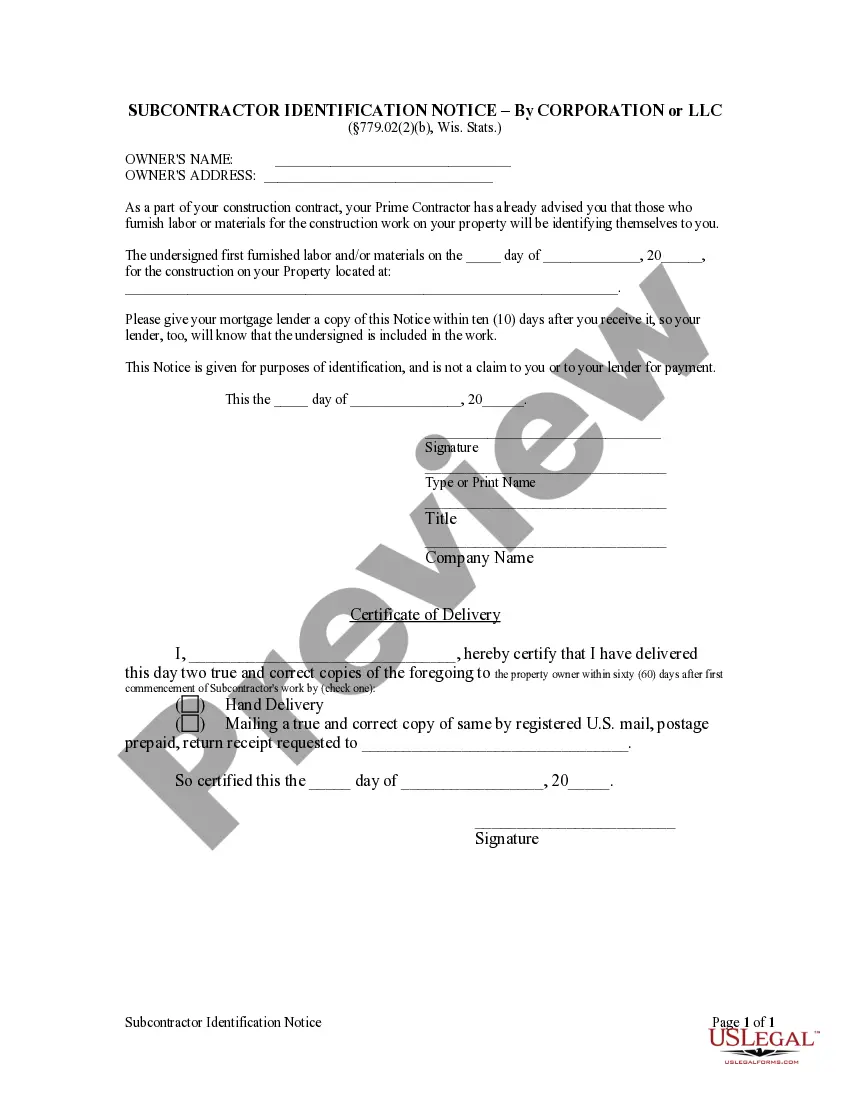

The Subcontractor's Identification Notice - Corporation is a form used by the subcontractor to provide notice for the furnishing of labor and materials. Every person other than a prime contractor who furnishes labor or materials for an improvement shall have the lien and remedy under this subchapter only if within 60 days after furnishing the first labor or materials the person gives notice in writing, in 2 signed copies, to the owner either by personal service on the owner or authorized agent or by registered mail with return receipt requested to the owner or authorized agent at the last-known post-office address. The owner or agent shall provide a copy of the notice received, within 10 days after receipt, to any mortgage lender who is furnishing or is to furnish funds for construction of the improvement to which the notice relates.

Corporation Identification Form

Description

How to fill out Corporation Identification Form?

Bureaucracy demands exactness and accuracy.

If you do not regularly handle documents like the Corporation Identification Form, it can lead to some misunderstandings.

Selecting the appropriate sample from the outset will ensure that your document submission is processed smoothly and avert any issues related to re-submitting a document or starting the same task completely anew.

If you're not a registered user, finding the necessary sample will require a few extra steps: 1. Search for the template using the search field. 2. Confirm that the Corporation Identification Form you've found is applicable to your state or county. 3. Open the preview or check the description that provides details on the usage of the template. 4. If the result meets your requirements, click the Buy Now button. 5. Select the best option from the suggested subscription plans. 6. Log In to your account or create a new one. 7. Complete the purchase using a credit card or PayPal. 8. Save the form in your preferred file format. Finding the correct and current samples for your paperwork takes only a few minutes with an account at US Legal Forms. Eliminate bureaucratic concerns and simplify your document management.

- You can always find the correct sample for your paperwork at US Legal Forms.

- US Legal Forms is the largest online repository of forms, holding over 85 thousand samples across various sectors.

- You can obtain the most current and suitable version of the Corporation Identification Form simply by searching it on the site.

- Find, store, and save templates in your account or refer to the description to verify that you have the right one available.

- With an account at US Legal Forms, it's simple to acquire, store in one location, and browse through the templates you've saved for easy access.

- Once on the site, click the Log In button to sign in.

- Next, go to the My documents page, where your form history is kept.

- Review the descriptions of the forms and save the ones you need at any time.

Form popularity

FAQ

To obtain a company ID number, you will need to officially register your business with the appropriate state authorities. This process usually involves submitting an application, along with the necessary formation documents. Once your business is registered, you can complete the corporation identification form using your newly assigned company ID number.

You can find your corporate ID in the formation documents your business received upon incorporation or registration. If those documents are unavailable, visit your state's corporate search portal online for easy access. Remember, this corporate ID is a key component when completing the corporation identification form.

To locate your Business ID, start by checking paperwork associated with your business, such as tax filings or bank statements. If you can’t find the documents, visit your local government or business registry website. Your Business ID is often needed on the corporation identification form, serving as an official recognition of your company.

You can find your corporate ID by reviewing your business’s registration documents or by looking it up through your state’s online business database. If these methods do not yield results, contact your state’s Secretary of State office for further guidance. This ID is crucial when filling out any corporation identification form.

Your corporate ID can typically be found on your formation documents or by checking your state’s corporate registry. If you cannot locate these resources, consider reaching out to your state’s business filing agency for assistance. Completing the corporation identification form will require this ID, so having it handy is very important.

To find your Employer Identification Number (EIN), you can start by checking any tax documents that your business filed. If you have lost these documents, you can contact the IRS directly or visit their website to retrieve your EIN securely. Additionally, the corporation identification form often requires your EIN, making it essential for proper identification.

An EIN is formatted as a nine-digit number, typically structured like this: 12-3456789. When filling out your corporation identification form, make sure to include the hyphen to ensure clarity and accuracy in your submission. Proper formatting is essential for the IRS to recognize your EIN correctly. This will help you avoid any future issues with your business identification.

Yes, the SS-4 form can be filed electronically, providing a quick and efficient way to obtain your EIN. When you file online through the IRS website, you can receive your EIN immediately upon approval. This electronic filing option streamlines the process, making it easier for you to complete your corporation identification form and set up your business without unnecessary delays.

Filing an EIN involves creating an SS-4 form, which acts as your corporation identification form. You can file this form online through the IRS website, by fax, or by mail. Ensure that you enter all the required information accurately, as mistakes can lead to processing delays. Once approved, you will receive your EIN, which is crucial for your business operations.

To file an EIN for a C Corporation, you need to complete the SS-4 form, which is a short corporation identification form. You can submit this either online or via mail. Once your application is approved, the IRS will send you your EIN, and you can start using it for business transactions and tax registration. Be sure to have all your business information ready before you begin the filing process.