Wisconsin Transfer Death Deed With Power Of Attorney

Description

How to fill out Wisconsin Transfer On Death Deed Or TOD - Beneficiary Deed From Two Individuals To An Individual?

Identifying a reliable source to obtain the latest and suitable legal templates is a significant part of navigating bureaucracy. Securing the correct legal documents requires accuracy and meticulousness, which is why it is crucial to source samples of the Wisconsin Transfer Death Deed With Power Of Attorney only from trustworthy providers, such as US Legal Forms. An incorrect template can squander your time and impede your current situation. With US Legal Forms, you have minimal concerns. You can access and verify all the details regarding the document’s application and appropriateness for your circumstances and in your jurisdiction.

Follow these steps to complete your Wisconsin Transfer Death Deed With Power Of Attorney.

Eliminate the hassle associated with your legal paperwork. Browse the comprehensive US Legal Forms library to discover legal samples, verify their applicability to your circumstances, and download them instantly.

- Utilize the catalog navigation or search bar to find your template.

- Examine the form’s details to ensure it meets the criteria of your state and locality.

- Review the form preview, if available, to confirm it is the document you need.

- Return to the search and locate the correct document if the Wisconsin Transfer Death Deed With Power Of Attorney does not match your needs.

- If you are confident about the form’s suitability, download it.

- As an authorized user, click Log in to verify and access your selected templates in My documents.

- If you do not have an account yet, click Buy now to acquire the form.

- Choose the pricing option that aligns with your needs.

- Proceed to registration to complete your transaction.

- Conclude your purchase by selecting a payment method (credit card or PayPal).

- Select the file format for downloading the Wisconsin Transfer Death Deed With Power Of Attorney.

- Once you have the form on your device, you can edit it with the editor or print it out and fill it in manually.

Form popularity

FAQ

Yes, you can transfer a deed with a power of attorney in Wisconsin. The appointed agent can execute a Wisconsin transfer death deed with power of attorney on behalf of the property owner. It is crucial to ensure that the power of attorney document explicitly grants the authority to handle real estate transactions. For your convenience, USLegalForms offers resources to help navigate these requirements.

While hiring a lawyer to file a Wisconsin transfer death deed with power of attorney is not mandatory, it can be beneficial. A legal professional can help ensure that all details are correctly addressed and that the deed complies with state laws. If you prefer a more straightforward approach, USLegalForms provides the necessary templates and guidance to assist you in the process without legal representation.

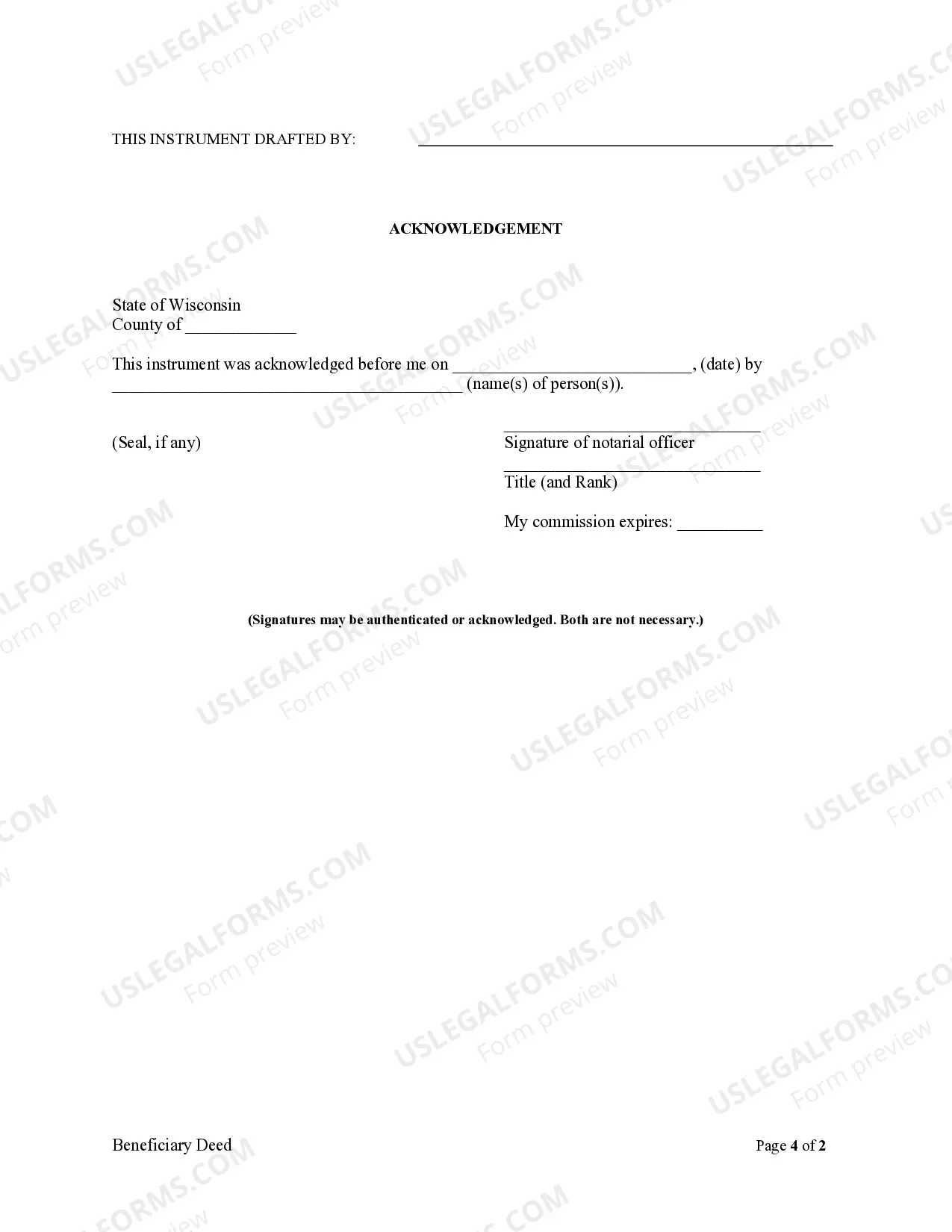

To obtain a Wisconsin transfer death deed with power of attorney, start by filling out the appropriate deed form. You can access these forms through a legal resource like USLegalForms, which offers easy-to-use templates. After completing the deed, you must have it signed in front of a notary public. Finally, file the signed deed with your local county register of deeds to ensure it is legally recorded.

Disability: If your beneficiary has a disability or acquires one from an accident or illness before death. In that case, the POD and TOD funds could end up with the government or jeopardize their Medicaid and SSI.

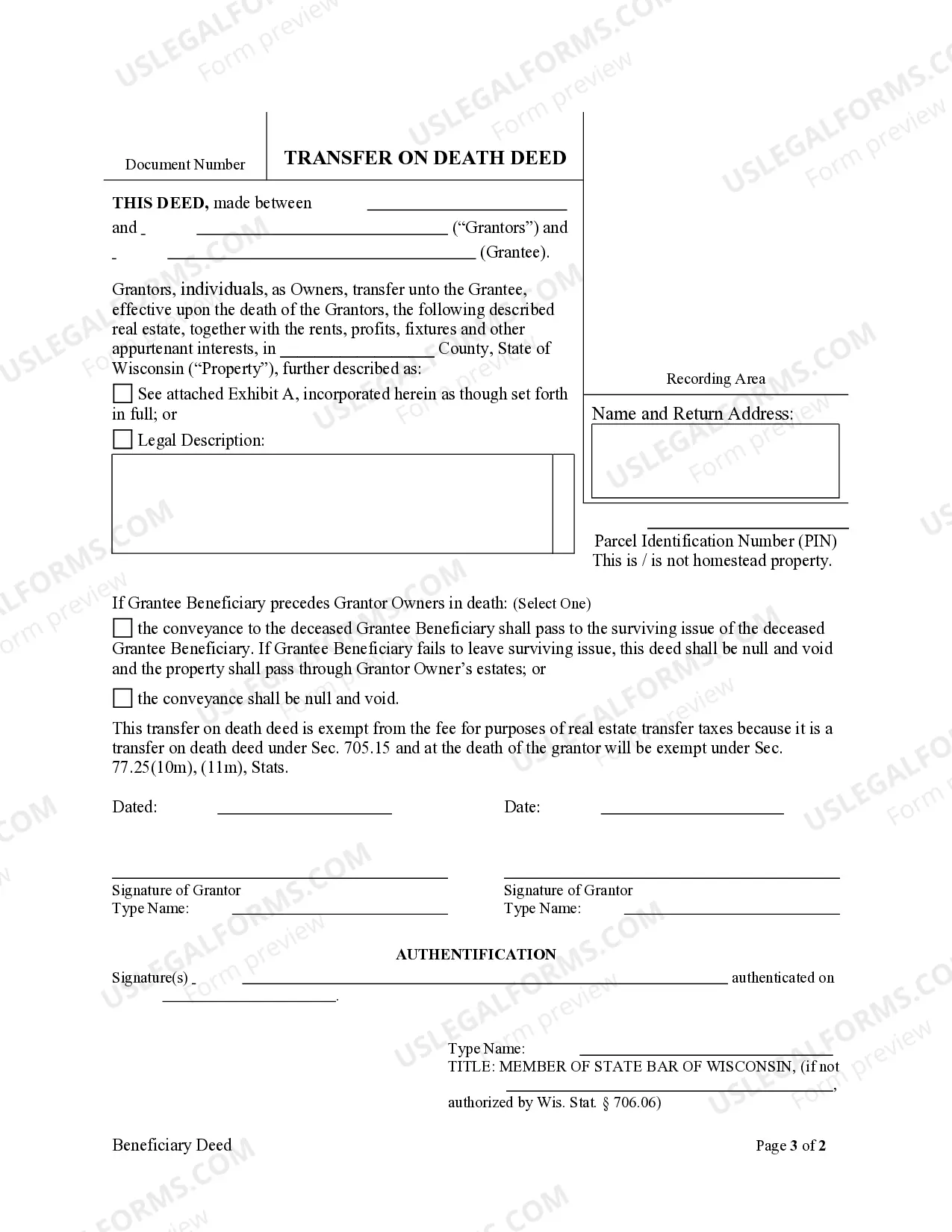

A Wisconsin transfer on death deed allows an owner of real property to designate one or more beneficiaries to receive their interest upon their death. Also known as ?pay on death? (?POD?) or ?TOD? for short, this document allows the transferor and beneficiary to skip the lengthy probate process.

A Wisconsin TOD deed must include: The name of the property owner or owners whose interest a TOD deed will transfer; The TOD beneficiary's name; and. A statement that the transfer only becomes effective upon the owner's death.

Pros and cons of a transfer on death deed Avoid probate. Property with a TOD deed typically does not have to pass through probate court to transfer to its beneficiaries. ... Avoid federal gift tax paperwork. ... Maintain Medicaid eligibility. ... It might prevent property from being used to repay Medicaid benefit costs.

The deed could get complicated, and its validity contested if it is not recorded correctly or if the legal criteria are not met. If there is no provision for a contingent beneficiary, the transfer on the death deed is rendered ineffective if the named beneficiary passes away before the property owner.