Legal Will Not Withhold

Description

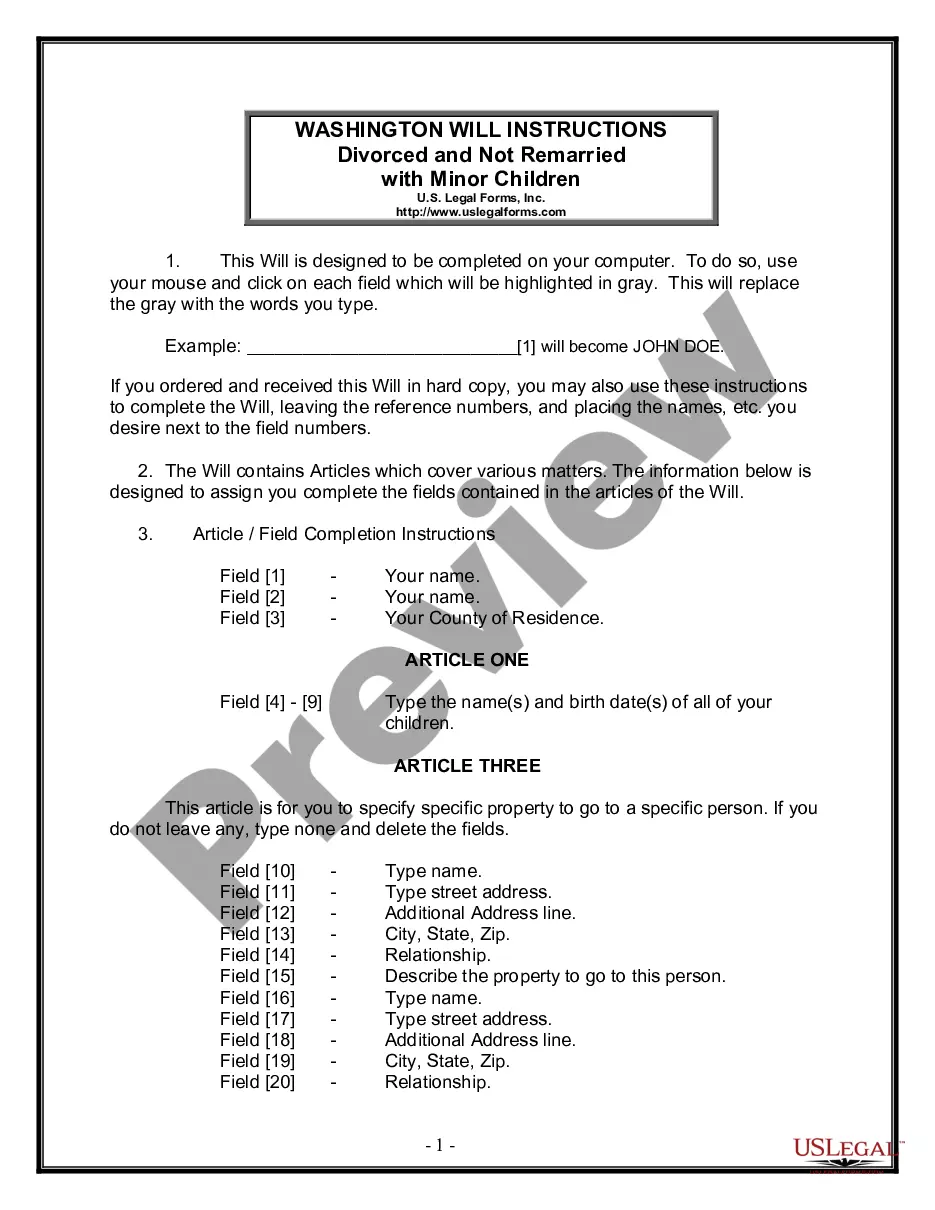

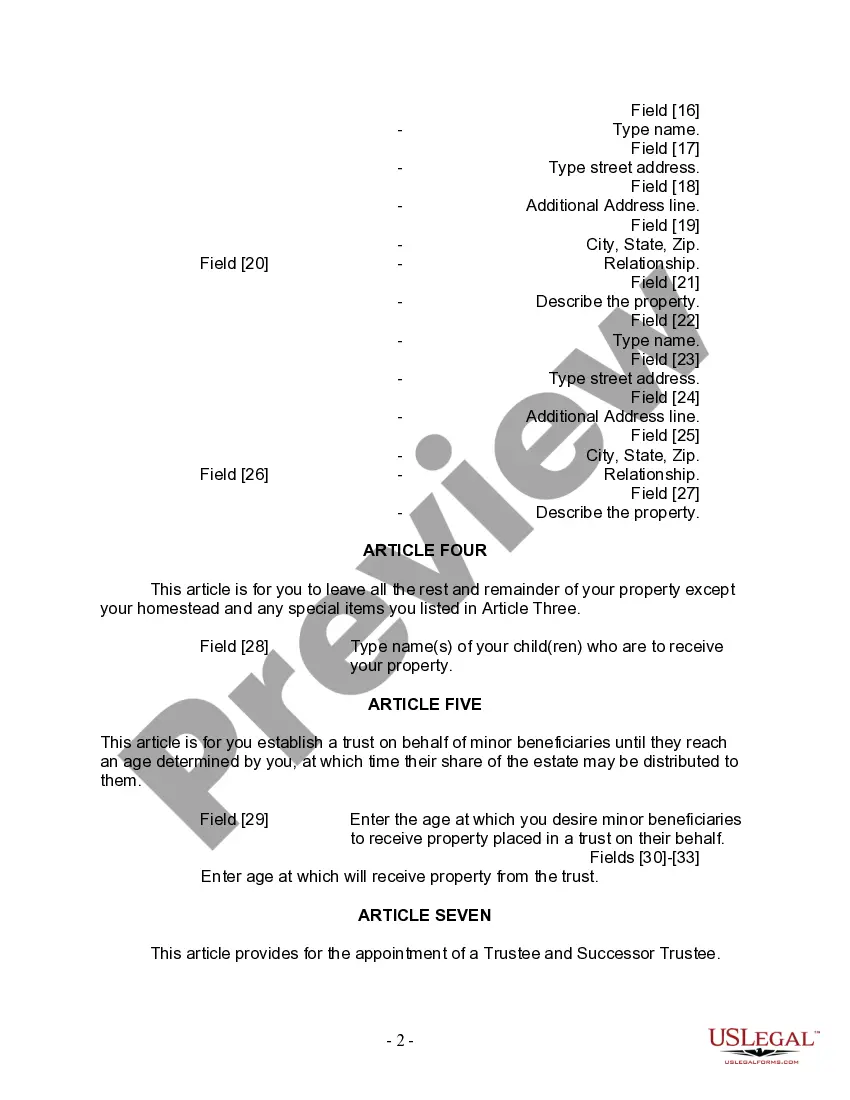

How to fill out Washington Last Will And Testament For Divorced Person Not Remarried With Minor Children?

Whether for professional objectives or for personal matters, everyone must handle legal circumstances at some stage in their existence.

Completing legal documentation requires meticulous focus, starting from selecting the appropriate form template. For instance, if you select an incorrect version of a Legal Will Not Withhold, it will be rejected once you submit it. Thus, it is crucial to obtain a trustworthy resource for legal documents like US Legal Forms.

With a comprehensive US Legal Forms catalog available, you will never need to waste time searching for the correct template online. Utilize the library's straightforward navigation to find the appropriate form for any situation.

- Locate the template you require by using the search feature or catalog browsing.

- Review the form's details to confirm it aligns with your situation, state, and locality.

- Click on the form's preview to examine it.

- If it is the wrong document, return to the search function to find the Legal Will Not Withhold template you need.

- Acquire the template when it satisfies your requirements.

- If you possess a US Legal Forms account, simply click Log in to retrieve previously stored documents in My documents.

- If you don't have an account yet, you can download the document by clicking Buy now.

- Choose the correct pricing option.

- Complete the profile registration form.

- Select your payment method: use a credit card or PayPal account.

- Pick the document format you prefer and download the Legal Will Not Withhold.

- Once saved, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

'Which will not be unreasonably withheld' refers to a promise that parties will act fairly when it comes to granting approvals and permissions. It encourages collaboration while safeguarding against arbitrary decisions. This concept plays a vital role in maintaining trust in business relationships. Therefore, it's important to recognize how this applies to your agreements.

As a beneficiary you are entitled to information regarding the trust assets and the status of the trust administration from the trustee. You are entitled to bank statements, receipts, invoices and any other information related to the trust.

If a beneficiary requests access to financial institution statements and the executor refuses to provide them, the beneficiary can take legal action. They can follow the court for an order compelling the executor to reveal the requested information.

Executors are bound by fiduciary duties and must act in the best interests of the beneficiaries. They cannot alter beneficiary allocations to favor one over another. Any such actions would breach the will's terms and the executor's fiduciary responsibilities, potentially leading to legal consequences.

Include a self-proving clause in your will. A self-proving clause is a statement by the witnesses that you (the testator) had the capacity and intent to create the will and there appears to be no undue influence being exercised to force the person to sign the will.

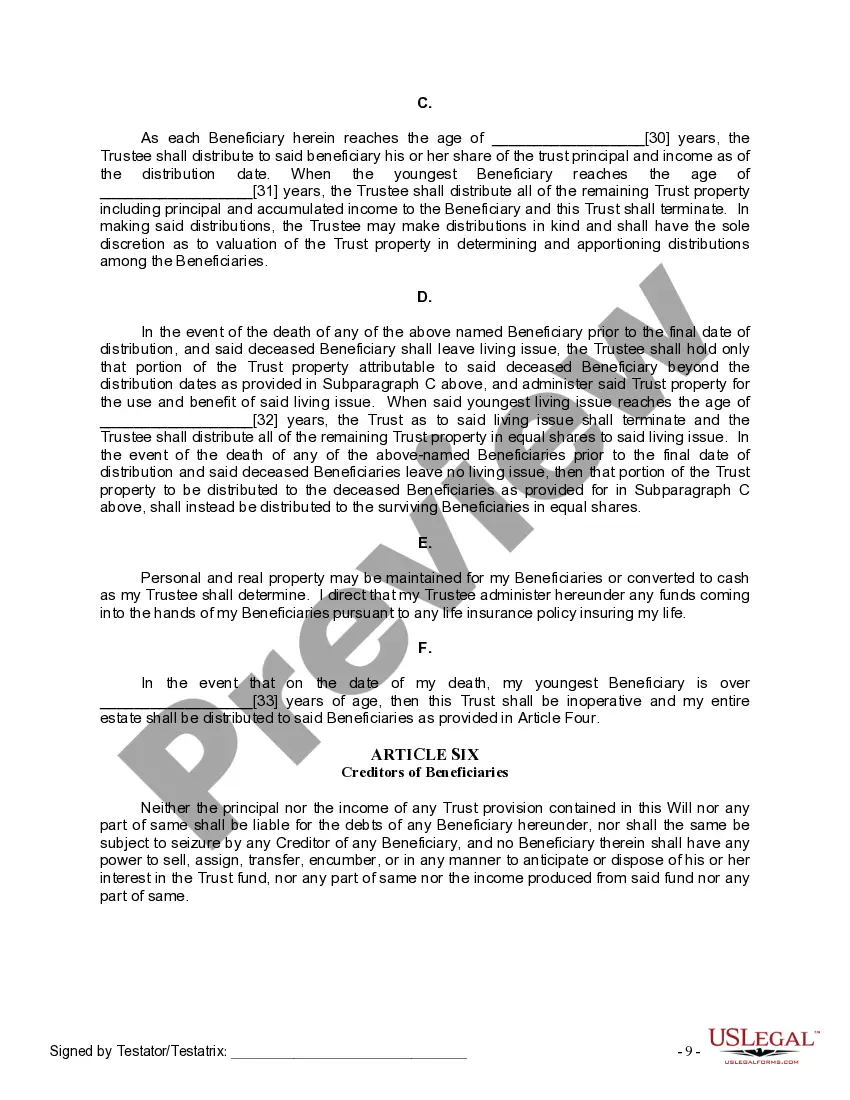

Whether or not the trustee can withhold funds from you depends on the terms of the trust itself. If the trust requires withholding distributions under certain circumstances, such as the beneficiary reaching a specific age, the trustee must follow those stipulations.