Washington Annual File With State

Description

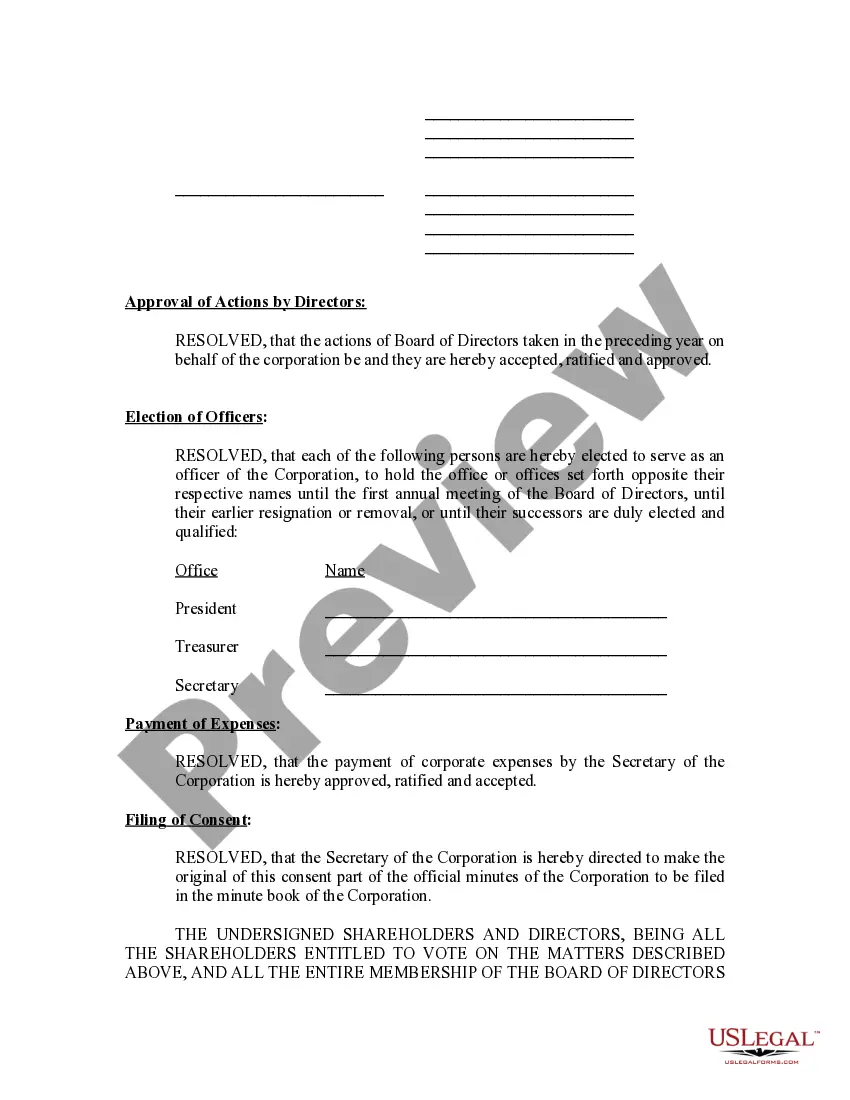

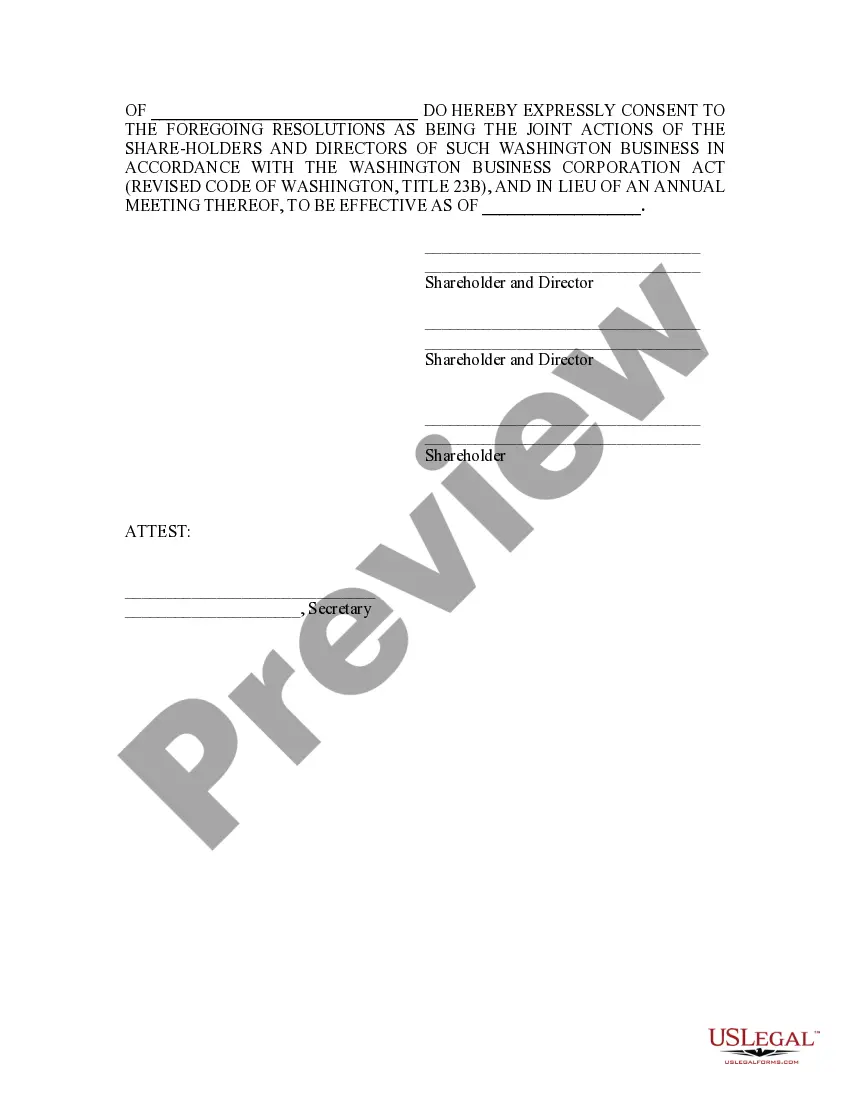

How to fill out Washington Annual Minutes?

Finding a reliable source for the most up-to-date and suitable legal templates is a significant part of navigating bureaucracy.

Identifying the correct legal documents requires accuracy and meticulousness, which is why sourcing samples of the Washington Annual File With State from credible providers, like US Legal Forms, is essential.

Once the form is on your device, you can edit it using the editor or print it out and fill it out manually. Eliminate the hassle associated with your legal paperwork. Browse the extensive US Legal Forms library to discover legal templates, assess their applicability to your situation, and download them right away.

- Use the catalog navigation or search bar to identify your template.

- Access the form’s details to verify if it meets the requirements of your state and locality.

- View the form preview, if available, to confirm that it is indeed the document you need.

- Return to the search and find an appropriate document if the Washington Annual File With State does not fit your needs.

- If you are certain about the form’s relevance, proceed to download it.

- As an authorized user, click Log in to verify your identity and access your selected templates in My documents.

- If you do not have an account yet, click Buy now to acquire the template.

- Choose the pricing plan that fits your requirements.

- Continue with the registration process to finalize your purchase.

- Complete your transaction by selecting a payment method (credit card or PayPal).

- Choose the file format for downloading the Washington Annual File With State.

Form popularity

FAQ

Yes, Washington state generally requires you to file a state return based on your business activity. In addition to your Washington annual file with state, you may need to account for specific taxes or additional forms. It's important to understand your obligations to avoid issues with state authorities.

Yes, renewing your LLC annually is mandatory in Washington state. This includes submitting the Washington annual file with state authorities, which keeps your LLC active and compliant. Without renewal, your business may face legal complications.

Failure to file your annual report can lead to penalties, including fines or dissolution of your LLC. Your Washington annual file with state is crucial for compliance, so neglecting this task can jeopardize your business. Stay proactive to keep your LLC in good standing.

Indeed, filing an annual report is essential in Washington. You must submit your Washington annual file with state to maintain good standing for your LLC. This reporting keeps your business information updated and helps avoid legal issues.

Yes, Washington state requires an annual report for LLCs. You will need to submit your Washington annual file with state authorities, typically by the due date each year. This requirement ensures that your business information is current and accessible.

Some states, like Delaware and Nevada, do not require an annual report for LLCs. However, this does not apply to Washington, where you must file your Washington annual file with state every year. Always check local regulations to ensure compliance and avoid penalties.

Yes, you need to renew your LLC every year in Washington state to stay compliant. This process often involves filing your Washington annual file with state authorities. Keeping your LLC active helps you maintain your business rights and protects your liability status.

Filing an Annual Report with the Washington Secretary of State is a straightforward process. Start by visiting the Washington Secretary of State's website to access the online filing system. You will need to provide details about your business, such as its name and registration number. To make this process even easier, you can utilize the USLegalForms platform, which provides guided assistance for your Washington annual file with state.

To complete your Washington state annual report, access the filing portal on the Secretary of State's website. You must provide updated details about your business, including ownership and contact information. Ensure that you accurately fill out the form to meet your Washington annual file with state requirements. US Legal Forms can assist you by providing templates and detailed guidance tailored to make your filing experience easier.

Filing a Washington state tax return involves determining your tax obligations and completing the necessary forms. While Washington does not have an income tax, other taxes may apply depending on your business activities. Be sure to include all relevant information to fulfill your Washington annual file with state obligations. Platforms like US Legal Forms offer resources and forms to simplify the tax filing process for business owners.