Washington Annual File With Secretary Of State

Description

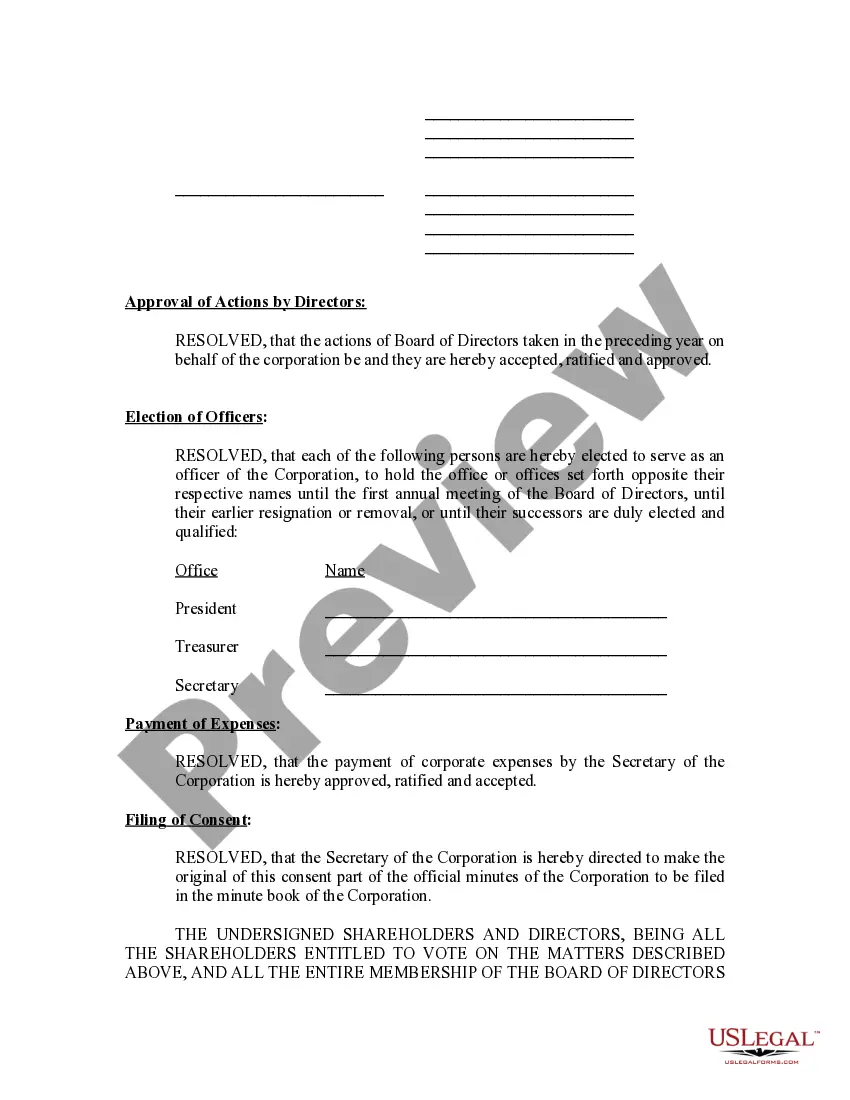

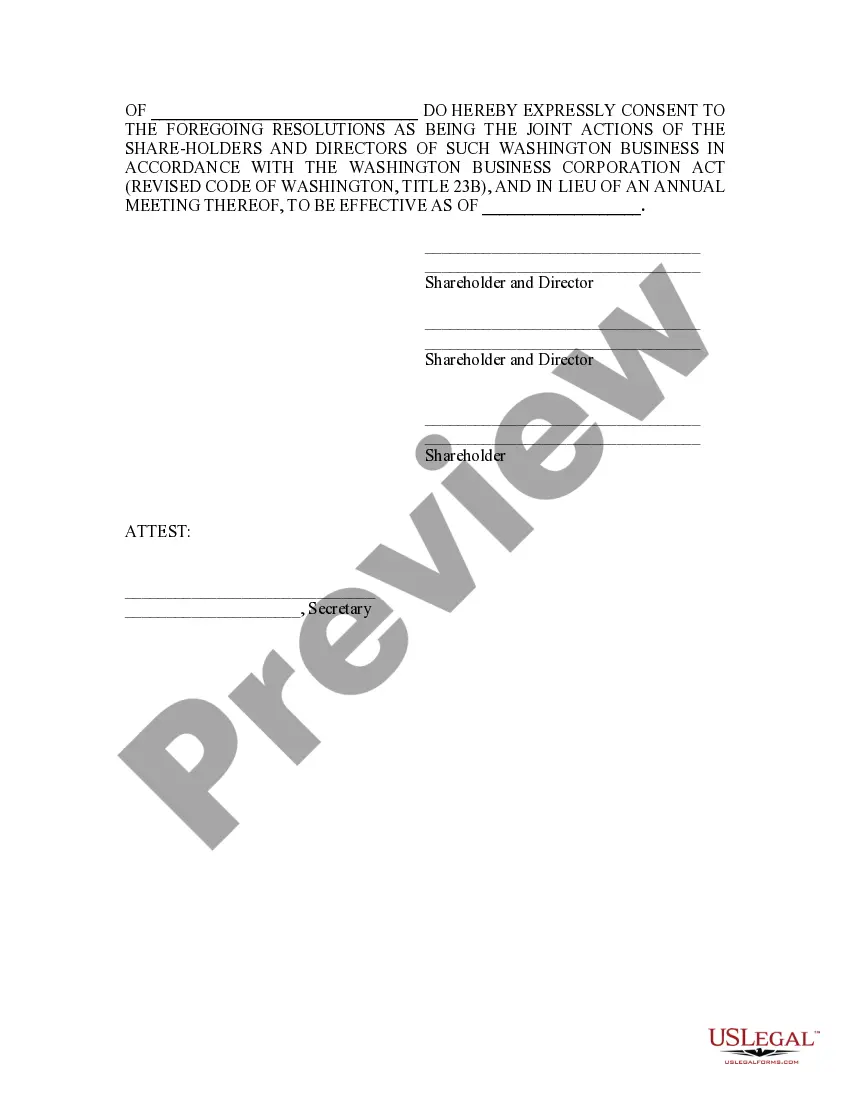

How to fill out Washington Annual Minutes?

Obtaining legal forms that comply with federal and local regulations is essential, and the web provides numerous alternatives to choose from.

However, what is the benefit of spending time searching for the appropriate Washington Annual File With Secretary Of State template online when the US Legal Forms digital library already consolidates such resources in one location.

US Legal Forms is the largest online legal resource with more than 85,000 printable templates created by attorneys for various professional and personal situations.

Review the template using the Preview option or via the text description to confirm it fulfills your needs.

- They are simple to navigate with all documents categorized by state and intended use.

- Our specialists stay updated with legal shifts, ensuring you can always trust that your form is current and adheres to regulations when acquiring a Washington Annual File With Secretary Of State from our platform.

- Securing a Washington Annual File With Secretary Of State is quick and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and save the document you need in the appropriate format.

- If you are a newcomer to our website, adhere to the instructions below.

Form popularity

FAQ

Corporations and limited liability companies, both foreign and domestic, must pay a $60 filing fee to submit their annual report to the Washington Secretary of State. Washington requires nonprofit organizations to pay $10 when filing their reports.

If you have a Washington LLC or corporation, you are required to file a Washington Annual Renewal each year with the Business Licensing Service. Both LLCs and corporations must pay the same Annual Renewal fee of $71. You can file a Washington Annual Renewal online, which is the recommended approach.

An Annual Report may be filed within 180 days before the expiration date. Visit our Corporations and Charities Filing System landing page and log in to your account. Once logged in, select ?Business Maintenance Filings? from the navigation bar on the left side, then select ?Annual Report?.

In addition to filing the $10 initial report, an annual report must be submitted at the end of your LLC's first year. This report is due on the last day of your LLC's anniversary month and costs $60. If you're late for the filing deadline, the Corporations and Charities Division will charge an additional $25 late fee.

Every year, foreign and domestic businesses are required to file an annual report to keep their UBI active and remain in good standing. The Annual Report is due by the last day of the month in which the business was originally formed.