Affidavit Irc 1445 Withholding

Description

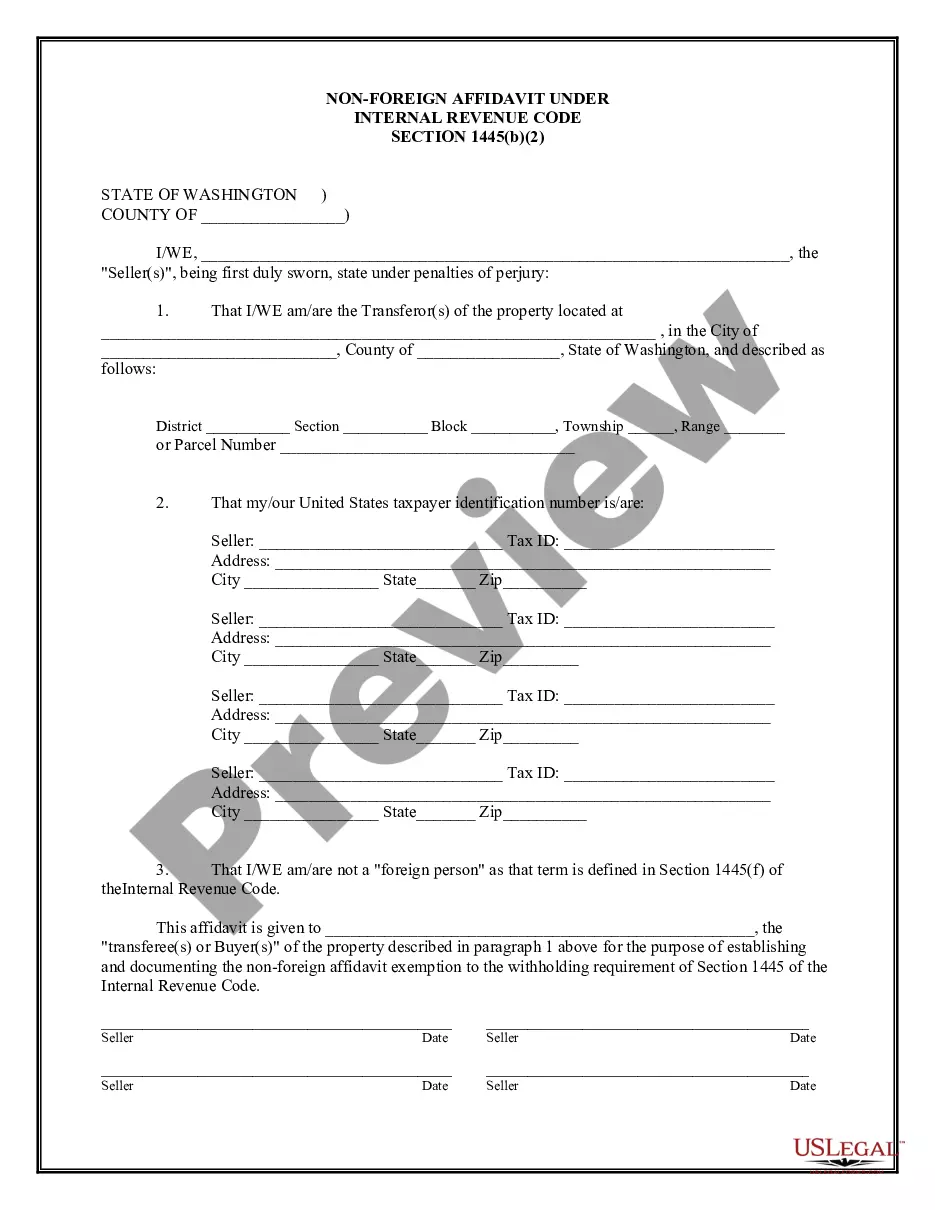

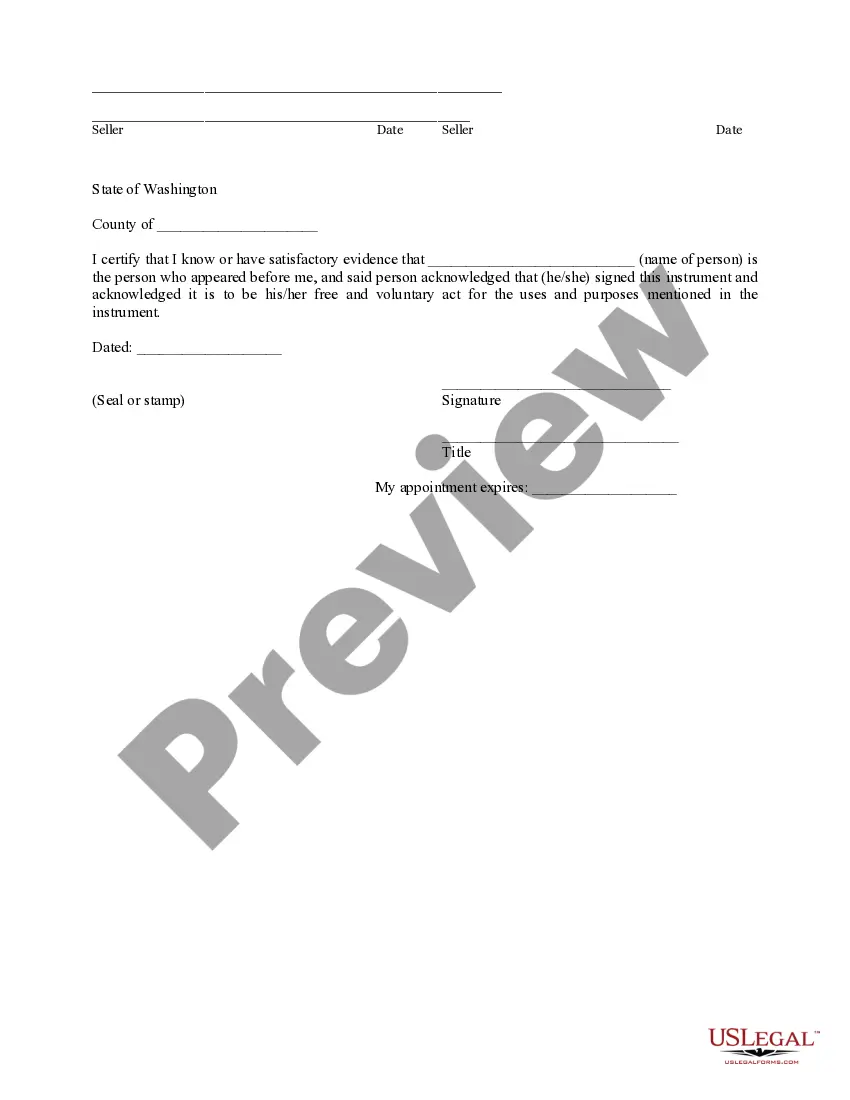

How to fill out Washington Non-Foreign Affidavit Under IRC 1445?

There is no longer any need to squander time looking for legal documents to fulfill your local state obligations. US Legal Forms has gathered all of them in one location and made them easy to access.

Our platform provides over 85k templates for any business and personal legal situations categorized by state and area of application. All forms are appropriately drafted and confirmed for authenticity, so you can be confident in receiving a current Affidavit Irc 1445 Withholding.

If you are acquainted with our platform and already possess an account, ensure your subscription is active prior to accessing any templates. Log In to your account, choose the document, and click Download. You may also return to all saved documents whenever needed by accessing the My documents tab in your profile.

You can print your form to fill it out manually or upload the sample if you prefer to work with an online editor. Preparing legal documentation in compliance with federal and state regulations is quick and simple with our platform. Try US Legal Forms today to keep your records organized!

- If you are new to our platform, the process will require additional steps to complete.

- Here's how new users can acquire the Affidavit Irc 1445 Withholding from our catalog.

- Examine the page content thoroughly to confirm it contains the sample you need.

- To do this, use the form description and preview options if available.

- Employ the Search bar above to search for another template if the previous one was not suitable.

- Press Buy Now next to the template title when you find the correct one.

- Choose the desired pricing plan and either create an account or Log In.

- Complete payment for your subscription using a credit card or PayPal to proceed.

- Select the file format for your Affidavit Irc 1445 Withholding and download it to your device.

Form popularity

FAQ

In general, IRC § 1445 requires the purchaser of a USRPI from a foreign person to withhold 10 percent (or more) of the amount realized on the disposition.

The disposition of a U.S. real property interest by a foreign person (the transferor) is subject to income tax withholding (IRC section 1445). The buyer (transferee) of the U.S. real property interest is the withholding agent. If you are the transferee, you must find out if the transferor is a foreign person.

FIRPTA withholding is required to be submitted to the IRS within 20 days of the closing together with IRS Form 8288, U.S. Withholding Tax Return for Disposition by Foreign Persons of U.S. Real Property Interests, and Form 8288-A, Statement of Withholding on Dispositions by Foreign Persons of U.S. Real Property

AFFIDAVIT OF NON-FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a buyer of a United States real property interest must withhold tax if the seller is a foreign person.