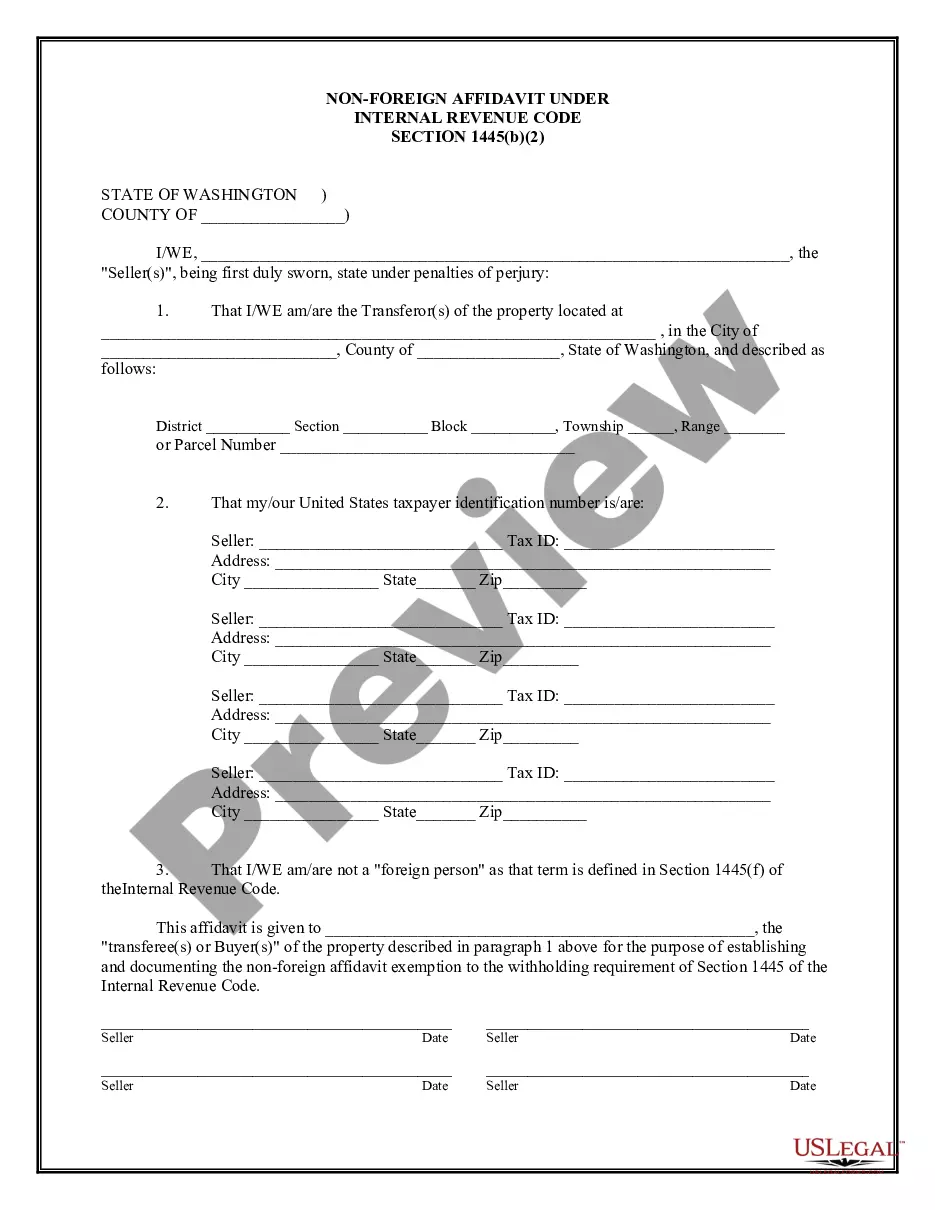

Affidavit Irc 1445 Foreign Person

Description

How to fill out Washington Non-Foreign Affidavit Under IRC 1445?

Well-crafted official documents are one of the essential assurances for preventing issues and legal disputes, but obtaining them without an attorney’s assistance may require time.

Whether you need to swiftly locate a current Affidavit Irc 1445 Foreign Person or any other forms for employment, family, or business situations, US Legal Forms is always available to assist.

The process is even more straightforward for current users of the US Legal Forms library. If your subscription is active, you simply need to Log In to your account and click the Download button next to the desired document. Furthermore, you can access the Affidavit Irc 1445 Foreign Person at any time later, as all documentation obtained on the platform remains accessible within the My documents tab of your profile. Save time and money on preparing official documents. Try US Legal Forms today!

- Verify that the form is appropriate for your situation and area by reviewing the description and preview.

- Search for another template (if necessary) using the Search bar in the page header.

- Click Buy Now once you find the relevant template.

- Select the pricing plan, Log In to your account or create a new one.

- Choose your preferred payment method to purchase the subscription plan (via credit card or PayPal).

- Select PDF or DOCX file format for your Affidavit Irc 1445 Foreign Person.

- Click Download, then print the document to complete it or upload it to an online editor.

Form popularity

FAQ

The FIRPTA law says that if the seller is a foreign person, the transferee i.e. the buyer, is the Withholding Agent3 that is legally responsible for collecting the tax and forwarding it to the IRS.

The FIRPTA affidavit is for all those local sellers who are not foreigners. This form certifies that the seller of the real estate property is a local seller, and a non-resident alien to provide income tax to the Internal Revenue Service. This form can help your seller in avoiding the FIRPTA withholding.

AFFIDAVIT OF NON-FOREIGN STATUS. Section 1445 of the Internal Revenue Code provides that a buyer of a United States real property interest must withhold tax if the seller is a foreign person.

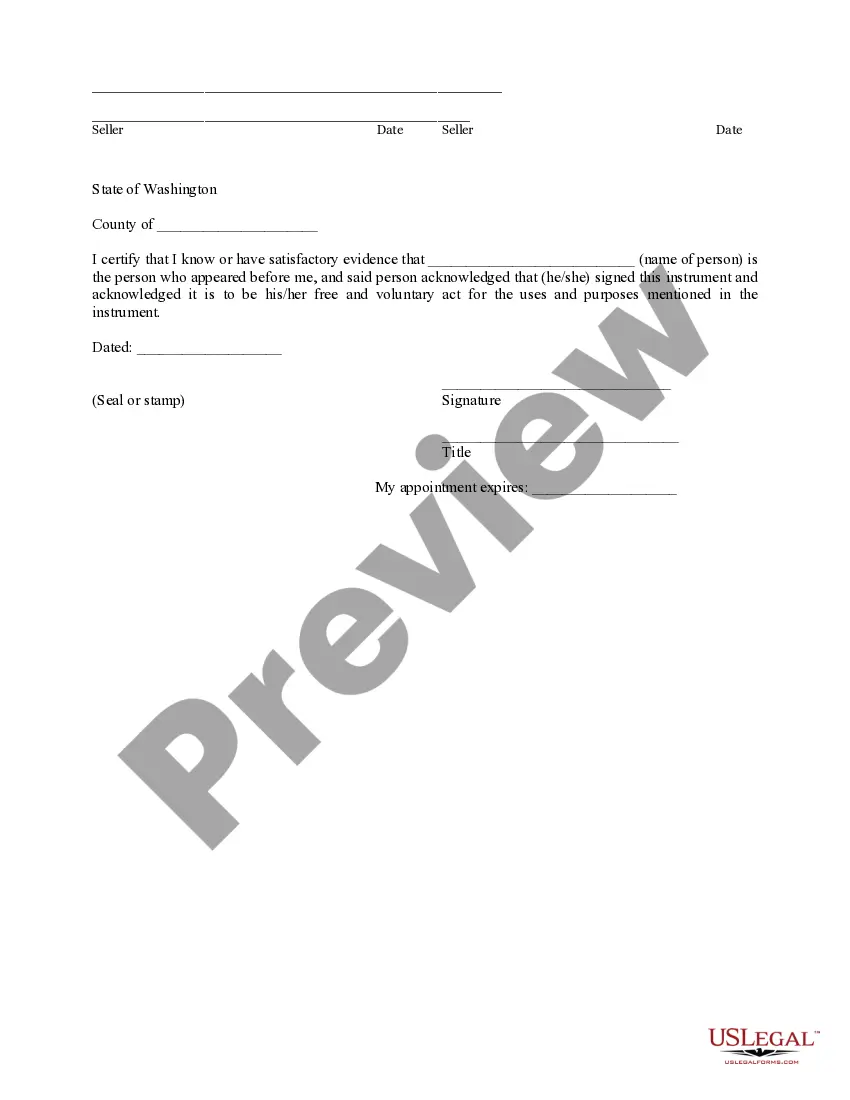

There are two different types of FIRPTA Certifications: one for individuals (natural persons) and another for entities (e.g., corporation, partnership, limited liability company, etc.). The FIRPTA Certification must be signed by all transferors (sellers).

FIRPTA stands for Foreign Investment In Real Property Tax Act (26 USC §1445). It is a tax law designed to ensure payment of tax to the Internal Revenue Service (IRS), as may be due, when US property is sold by any foreign person.