Washington Limited Liability Company With Multiple Owners

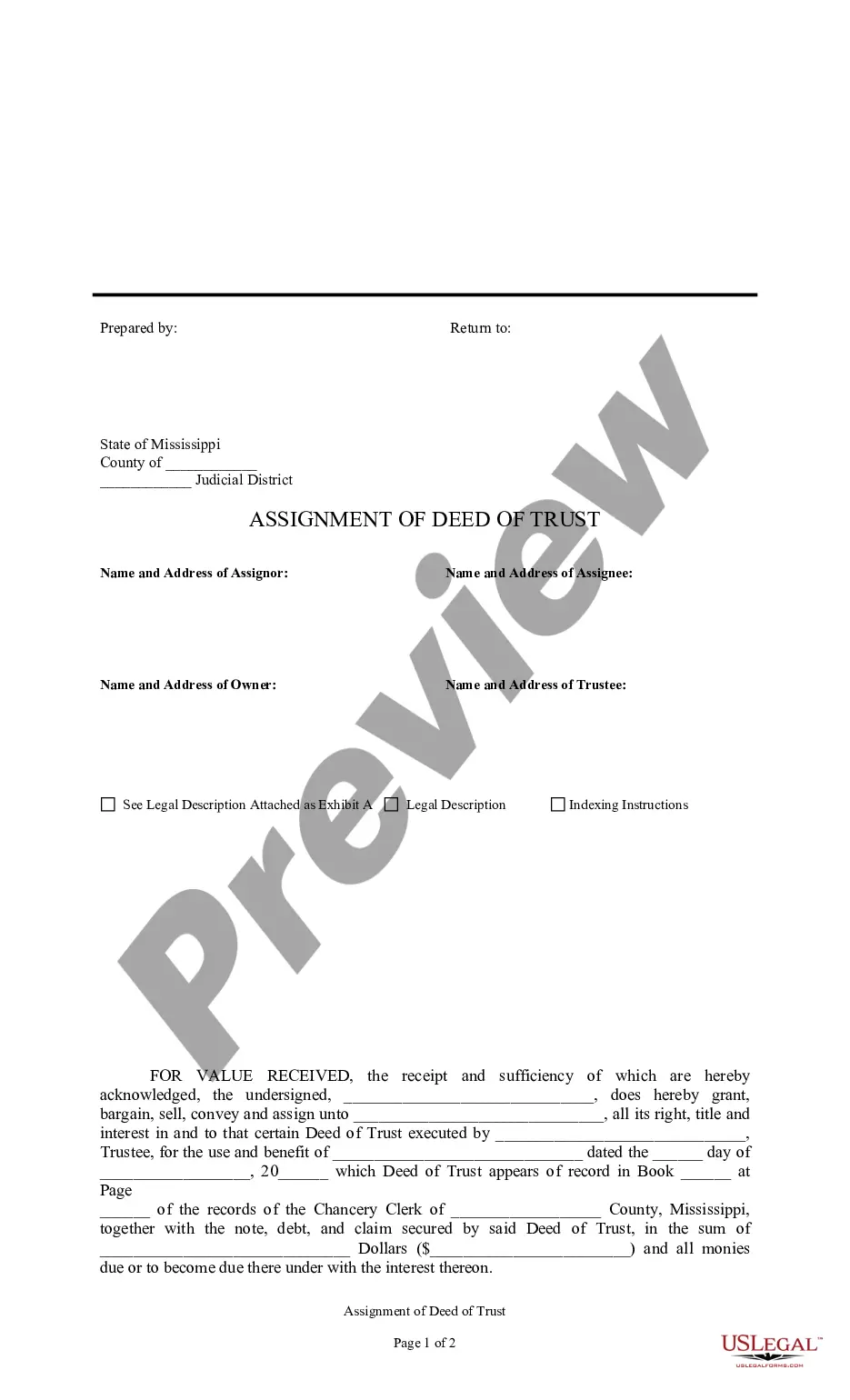

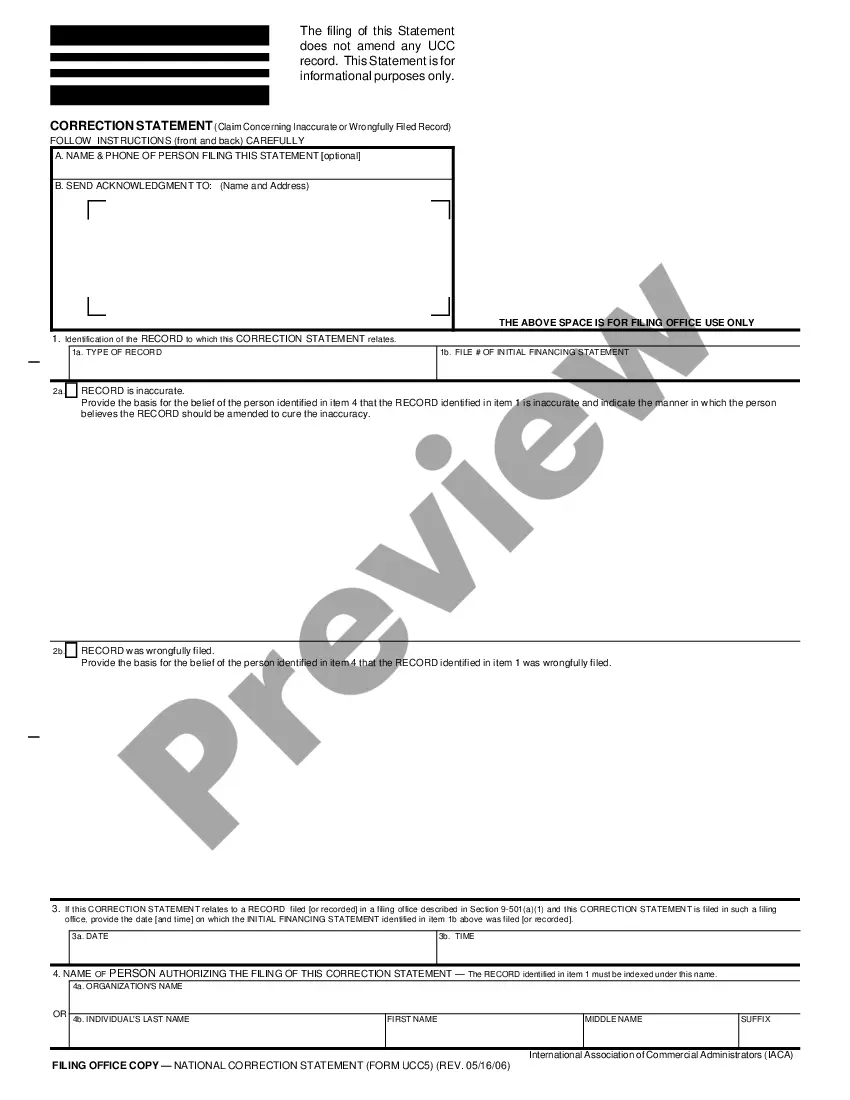

Description

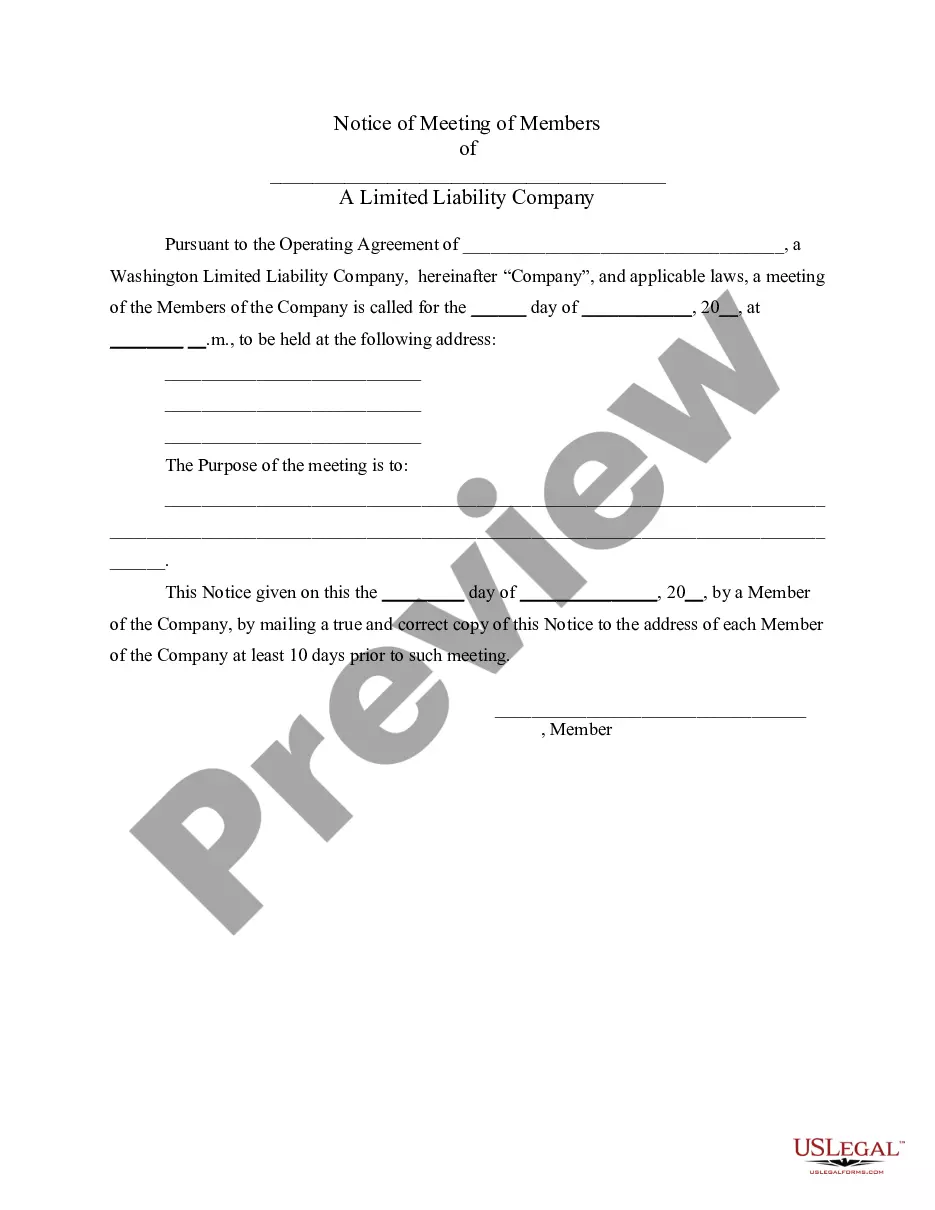

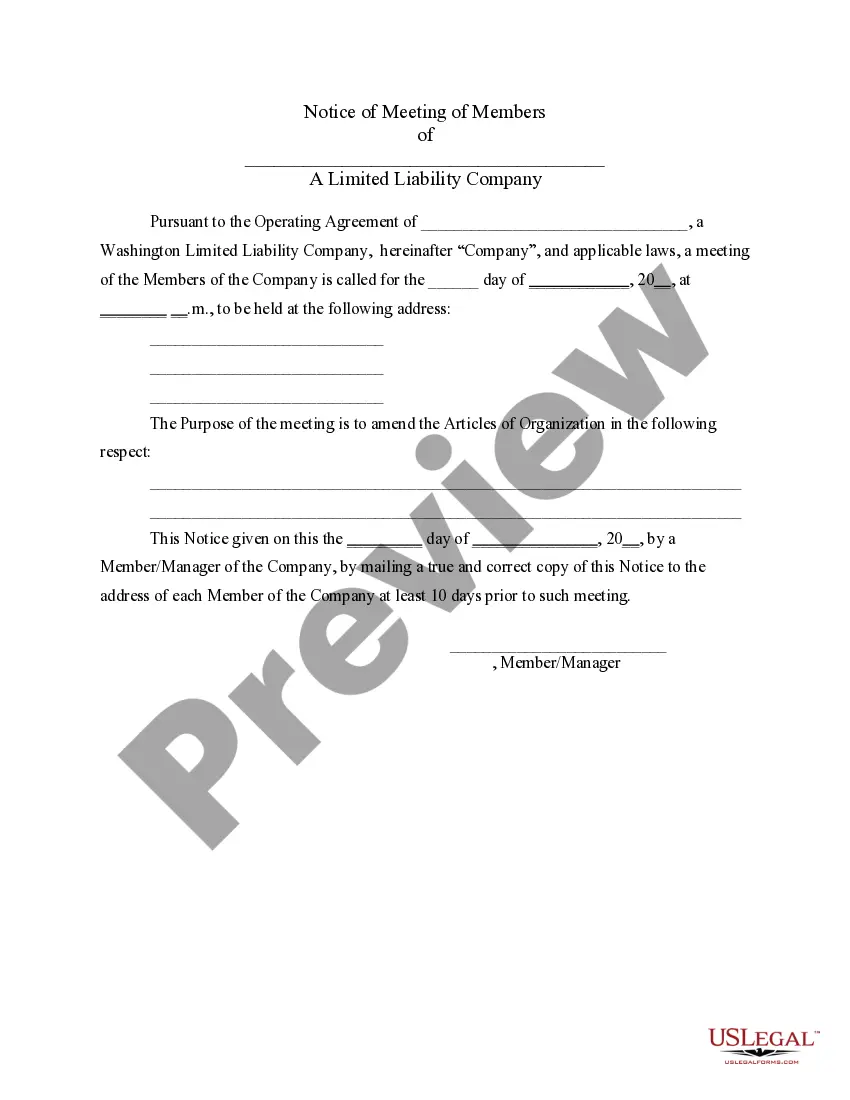

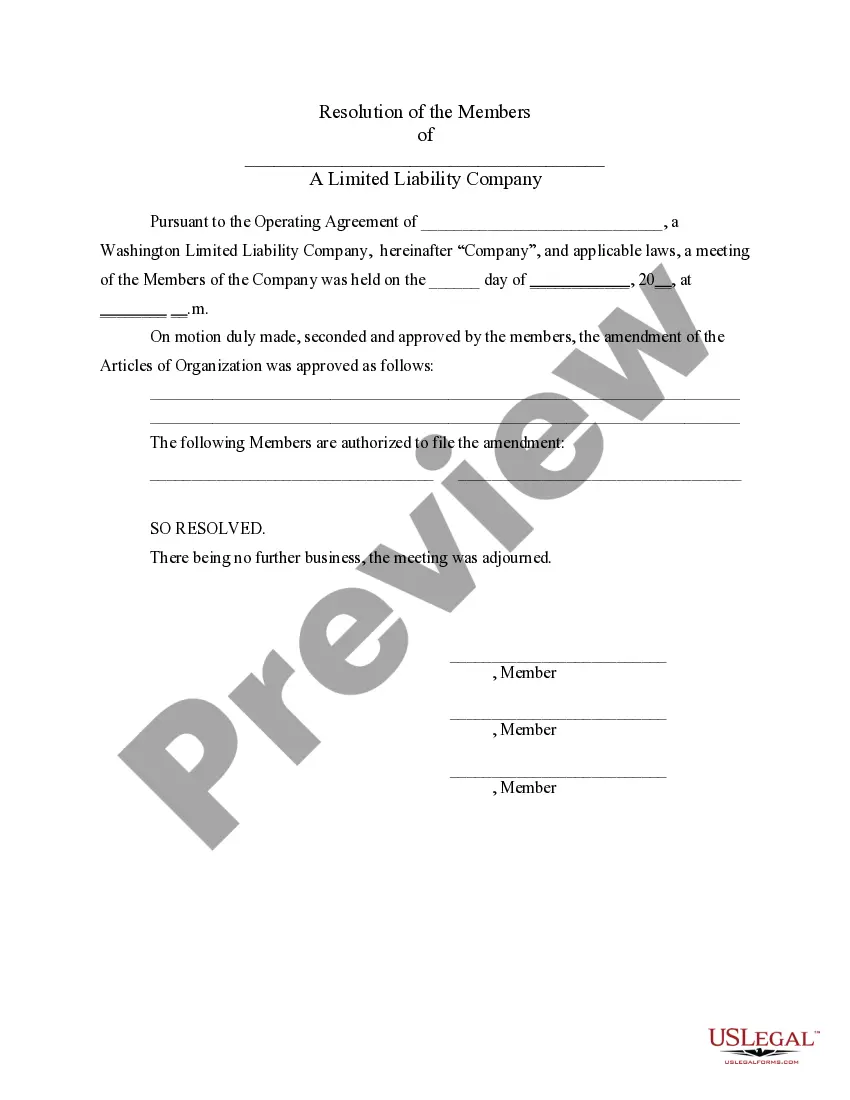

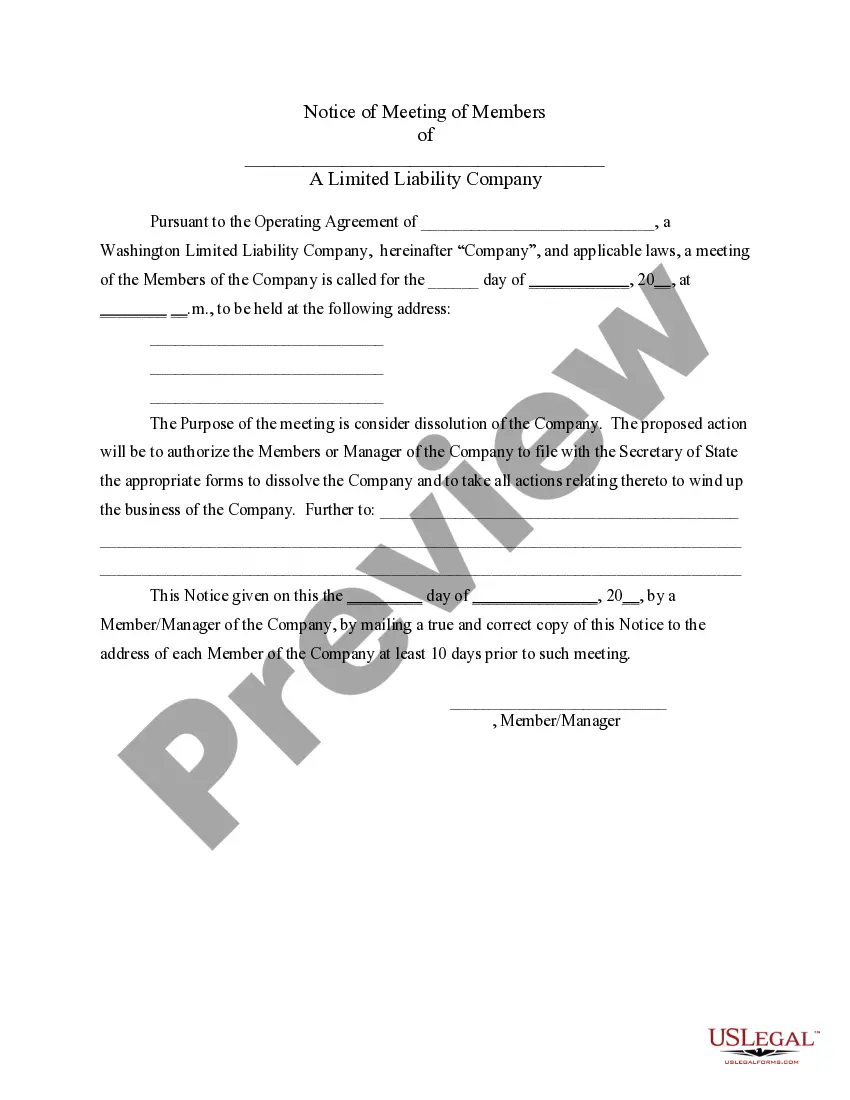

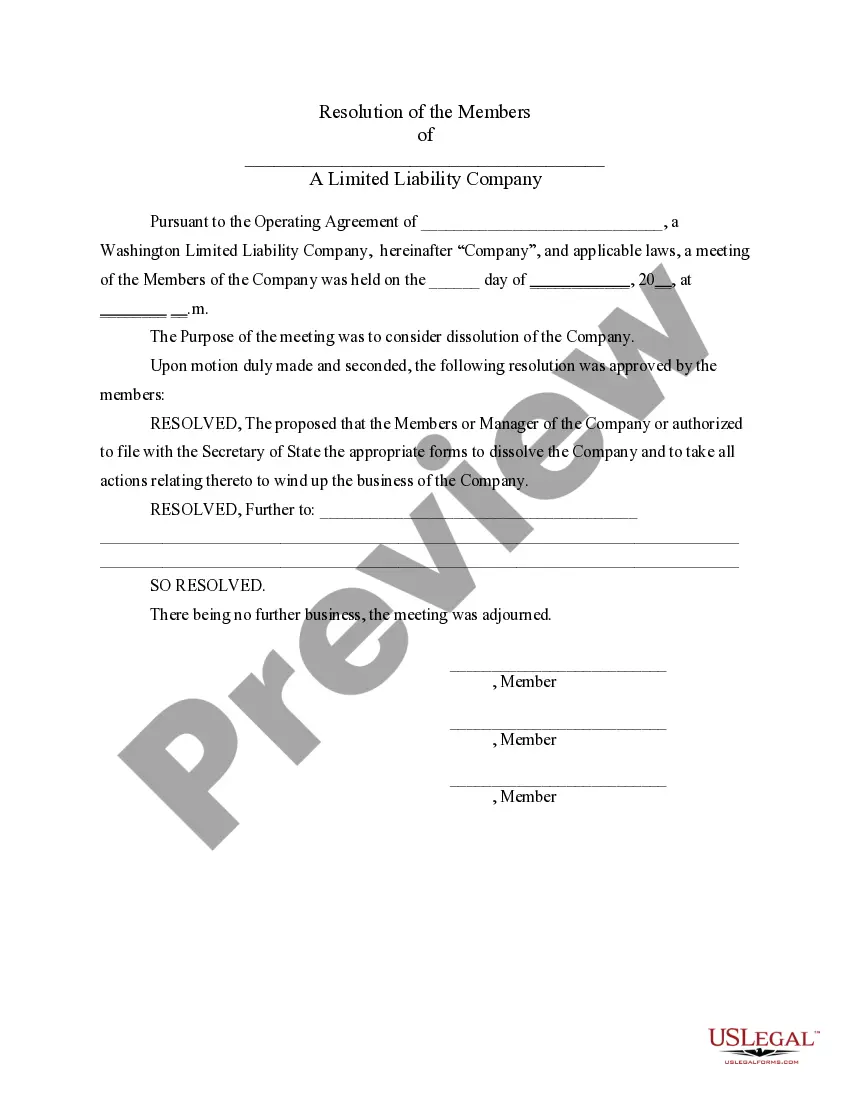

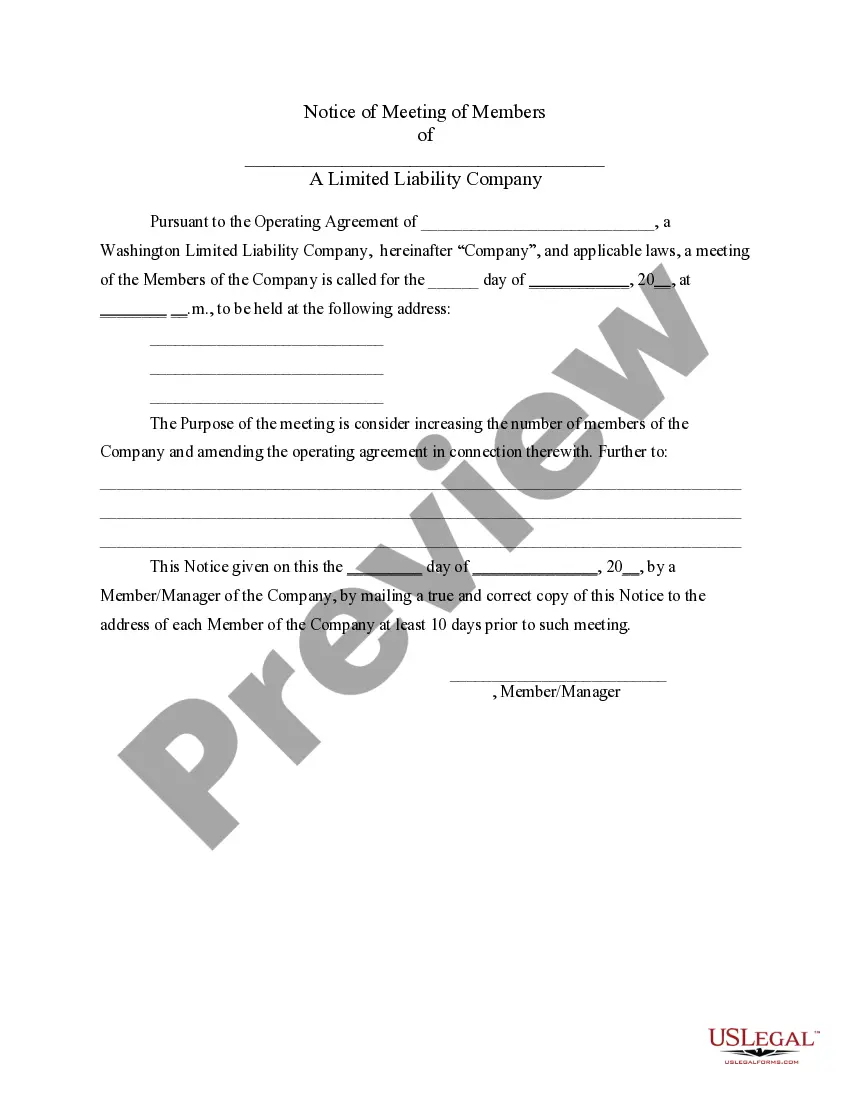

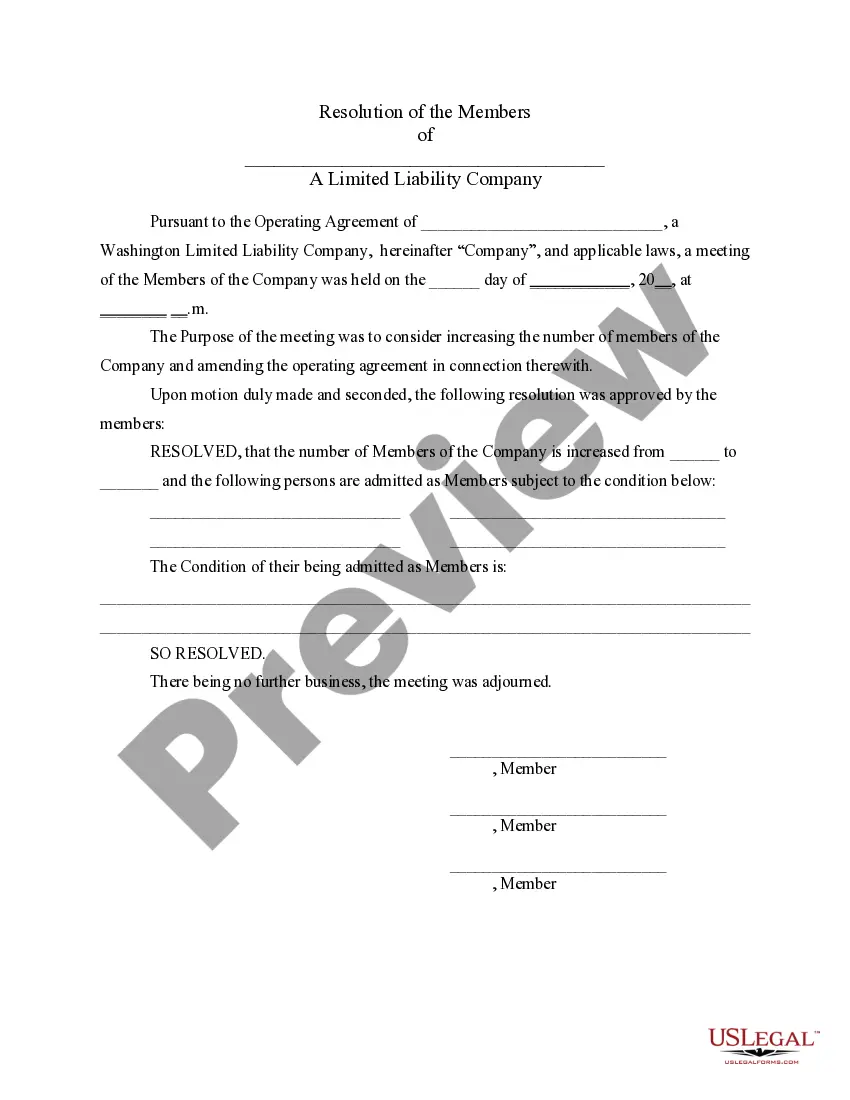

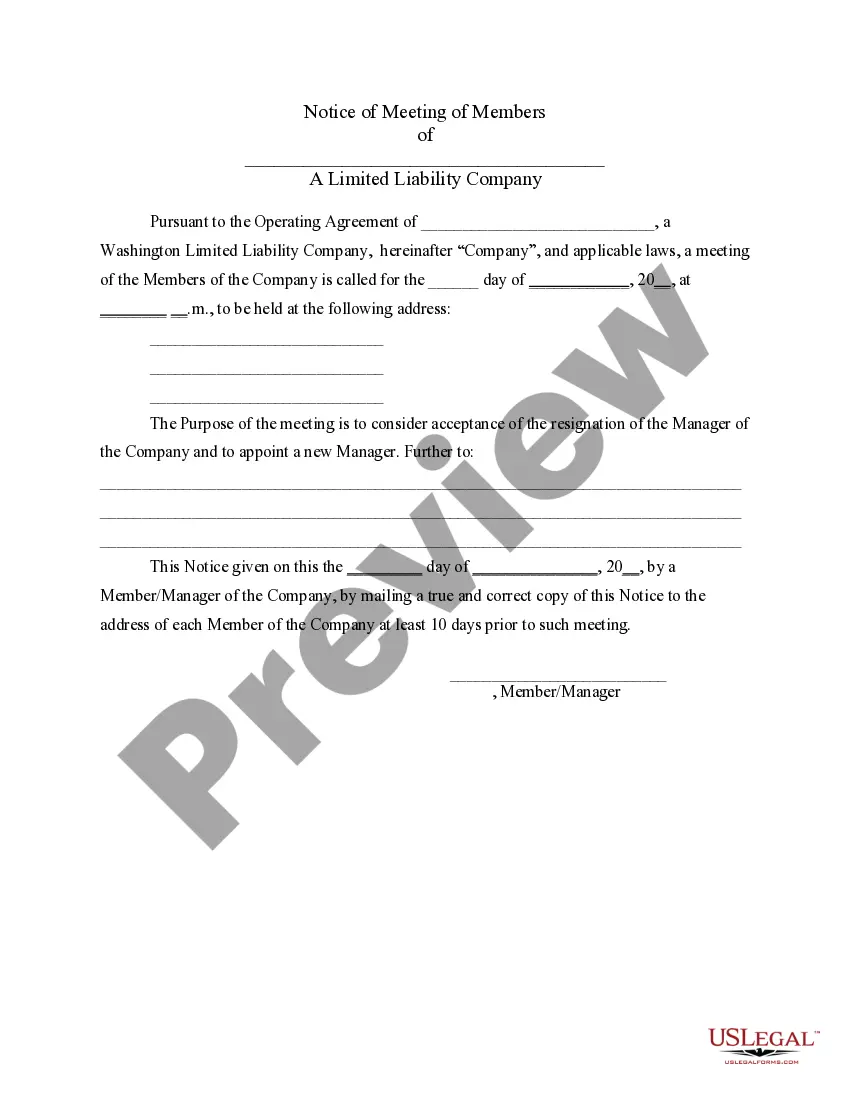

How to fill out Washington LLC Notices, Resolutions And Other Operations Forms Package?

Creating legal documents from the ground up can frequently be somewhat daunting.

Certain circumstances may require hours of investigation and substantial expenses.

If you’re searching for a simpler and more economical method of preparing Washington Limited Liability Company With Multiple Owners or any other forms without unnecessary complications, US Legal Forms is consistently available to assist you.

Our online repository of over 85,000 current legal forms covers almost every aspect of your financial, legal, and personal affairs.

However, before proceeding to download the Washington Limited Liability Company With Multiple Owners, consider these suggestions: Review the form preview and descriptions to confirm that you have located the correct document. Verify if the template you select meets your state and county requirements. Choose the appropriate subscription plan to acquire the Washington Limited Liability Company With Multiple Owners. Proceed to download the form, complete, certify, and print it. US Legal Forms boasts a strong reputation and more than 25 years of experience. Join us today and simplify the process of form execution!

- With just a few clicks, you can promptly obtain state- and county-compliant templates carefully arranged for you by our legal professionals.

- Utilize our service whenever you require trustworthy and dependable solutions to quickly find and download the Washington Limited Liability Company With Multiple Owners.

- If you’re already familiar with our site and have an account, simply Log In, select the template and download it, or re-download it anytime later from the My documents section.

- Not registered yet? No problem. It takes minimal time to sign up and explore the library.

Form popularity

FAQ

Registering an LLC for Multiple Members State laws generally allow the registration of LLCs with several members. To create an LLC owned by many people, the intended owners of the LLC are required to file articles of organization with any state agency in charge of registering such business entities.

A limited liability company (LLC) is a business entity type that can have more than one owner. These owners are referred to as ?members? and can include individuals, corporations, other LLCs, and foreign entities. Most states do not restrict LLC ownership, and there is generally no maximum number of members.

The process of adding a member to a Washington LLC may involve amending the company's articles of organization to include the new member. Depending on the terms in the agreement, current LLC members may need to vote on it for the amendment to pass.

Divide ownership of the LLC by calculating total cash investment by the members. Give each member an ownership stake equal to his cash investment. Four members contributing $25,000 apiece would each receive a 25 percent stake in the company.

You can take money out of your business account in any form you want?e.g., cash, paper or electronic checks, ACH payments, PayPal or Venmo. However you do it, you're responsible for applicable income and self-employment taxes on your business income. A payroll service can significantly simplify this process.