Seller Financing For Real Estate

Description

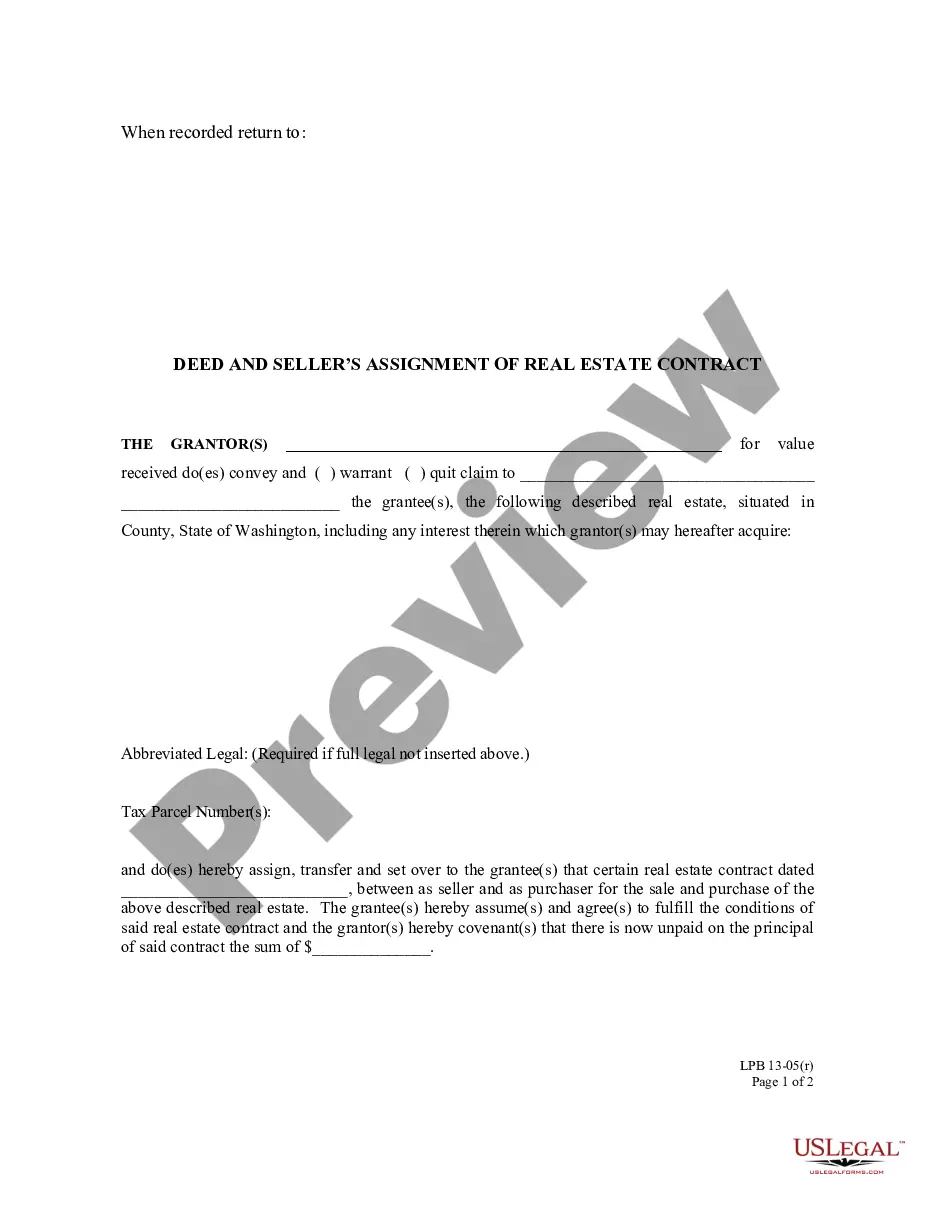

How to fill out Washington Deed And Seller's Assignment Of Real Estate Contract - With Representative Acknowledgment?

- Log in to your account on US Legal Forms if you're already a user, or create a new account to get started.

- Navigate to the form section and preview the seller financing documents. Ensure the selected form aligns with your requirements and adheres to local laws.

- If the form isn't suitable, use the search feature to find a different template that better fits your needs.

- Select the desired document and choose the appropriate subscription plan to access the forms.

- Complete your purchase using a credit card or PayPal to gain full access to US Legal Forms' extensive library.

- Download the form to your device and store it securely, ensuring you can easily access it later from your profile.

With US Legal Forms, you have access to a vast array of legal forms—more than any competitors—making the process of seller financing straightforward and efficient. Plus, you can consult with premium experts for personalized assistance.

Don't miss out on using these easy-to-fill forms for your seller financing journey. Start now and simplify your real estate transactions!

Form popularity

FAQ

Obtaining seller financing for real estate can be simpler than traditional financing, but it depends on the seller's willingness to offer terms. Buyers with good credit scores and a solid financial history can enhance their chances. Open communication and a good relationship with sellers play significant roles. Ensuring both parties are on the same page can facilitate the process and make obtaining financing more manageable.

A fair interest rate for seller financing in real estate often ranges from 5% to 10%, depending on various factors, including market conditions and buyer qualifications. It's crucial to conduct thorough research to ensure the rate is competitive yet fair for both the seller and buyer. Carefully considering local market trends can help establish an agreeable interest rate. Transparent discussions about rates build trust during the process.

Owner financing can be a favorable option for sellers looking to sell their property quickly while also receiving a steady income stream. It can attract buyers who may have difficulty securing traditional financing. By offering flexible terms, sellers can negotiate a better deal and potentially earn more through interest over time. This approach can turn a selling challenge into a profitable opportunity.

Typical terms for seller financing for real estate vary but generally include a down payment, interest rate, and repayment schedule. The down payment can range from 5% to 20%, depending on negotiation. Interest rates might be competitive compared to bank loans. The parties usually agree on payment lengths and when the full balance is due.

Seller financing for real estate can be a smart choice for both buyers and sellers. For buyers, it often means easier qualification and flexible terms. Sellers can enjoy a steady income stream and potentially higher sales prices. Ultimately, it depends on individual circumstances and goals.

To explain seller financing to a seller, start by outlining its benefits, including quicker sales and potential higher sale prices. Emphasize that they can earn interest income over time rather than receiving a lump sum upfront. Address any concerns by explaining the security an appropriate agreement provides, as it can protect their investment. Utilizing tools from US Legal Forms can help create confidence in the seller financing for real estate process by ensuring everything is documented properly.

Writing a seller financing contract requires a few key components. Include the property details, financing terms like down payment and interest rates, and payment schedule in the contract. Define default clauses, indicating what will happen if repayments are missed, and specify whether the seller retains any rights to the property until full payment is made. For assistance, consider using US Legal Forms to access templates that simplify creating your contract for seller financing for real estate.

In Texas, similar to seller financing, the seller retains the deed until the buyer fulfills their payment obligations. The buyer, however, gains equitable title, allowing them to use the property while making payments. This arrangement can be complex, which is why having proper legal documentation is essential. US Legal Forms can provide clarity and assistance in drafting agreements that meet Texas laws.

In seller financing, the seller retains ownership of the deed until the buyer pays off the mortgage. This means the seller has a vested interest in ensuring the buyer follows the payment schedule. The buyer receives equitable interest in the property, but the seller holds the legal title until full payment. For clarity on such arrangements, US Legal Forms can help you draft solid seller financing agreements.

To report seller financed interest income, you must typically use IRS Form 1098. This form allows you to report the interest you received from the buyer. Remember, accurately tracking and recording these payments is essential. For further assistance with documentation, consider using the US Legal Forms platform, which provides templates designed for seller financing for real estate.