Trust Wills Explained

Description

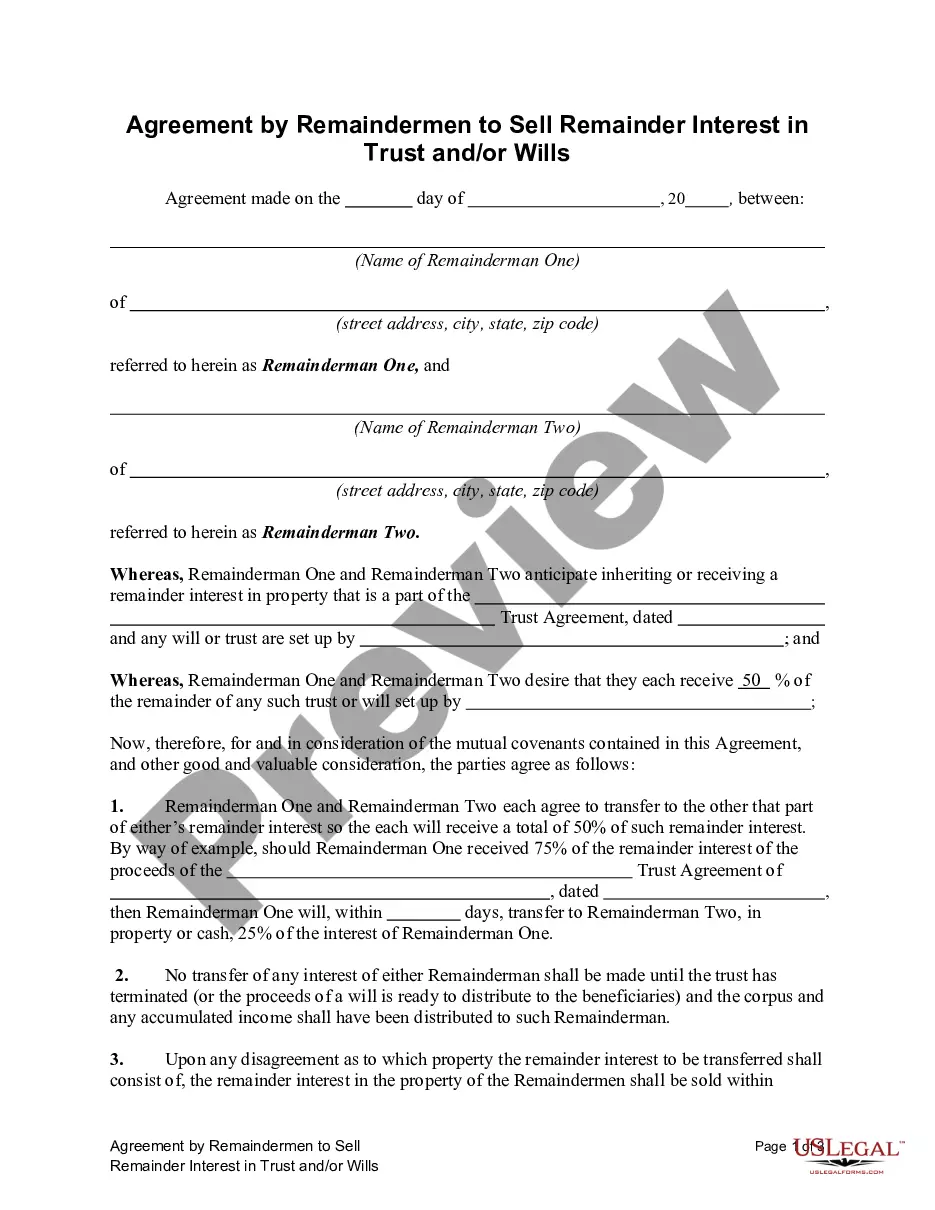

How to fill out Washington Agreement By Remainderman To Sell Remainder Interest In Trust And/or Wills?

- If you have a US Legal Forms account, log in and ensure your subscription is active before downloading forms.

- In case you're new to the service, start by reviewing the Preview mode and form descriptions to select a template that fits your needs and adheres to your local jurisdiction.

- Use the Search tab to look for other templates if you don't find the suitable one on the first try.

- Once you find the right document, click the Buy Now button and choose a suitable subscription plan; don’t forget to create an account for full access.

- Complete your purchase by entering your credit card information or using PayPal.

- After payment, download the form and save it to your device. Access it later through the My Forms section in your profile.

With US Legal Forms, you gain access to an extensive collection of over 85,000 legal forms, ensuring that you find exactly what you need without hassle.

Experience the ease and reliability of legal document management. Start your journey with US Legal Forms today!

Form popularity

FAQ

Someone might choose a trust for its flexibility and long-term management of assets. Unlike a will, which only takes effect after you pass away, a trust can be active during your lifetime, allowing you to manage your assets more effectively. This feature can be particularly beneficial if you have complex financial situations or specific wishes. By exploring trust wills explained, you can see how a trust can meet your individual needs.

Choosing a trust allows for greater control over how and when your assets are distributed. For example, with a trust, you can specify that your children receive their inheritance at a certain age, rather than immediately upon your passing. Trusts can also offer protection from creditors and may reduce estate taxes. By understanding trust wills explained, you can better appreciate the advantages they offer over traditional wills.

You should consider using a trust when you want to avoid probate, which can be time-consuming and costly. Trusts often provide more privacy than wills because they do not go through the public probate process. Additionally, if you have minor children or specific wishes for your assets, a trust allows you to set clear instructions for your beneficiaries. In this context, trust wills explained can help you make informed decisions.

The biggest mistake people make with wills is not updating them as circumstances change, such as marriage, birth, or death of beneficiaries. Failing to address these changes can lead to unintended distributions and family conflict. Regularly reviewing your will ensures that it reflects your current wishes accurately. Trust wills explained often highlights this critical aspect of estate planning.

The 5 by 5 rule for trusts allows beneficiaries to access up to five percent of the trust's total amount each year without losing their rights to the remaining funds. This means that beneficiaries have the flexibility to withdraw small amounts while keeping the trust intact for future needs. Understanding this rule is essential for effectively managing a trust's resources. When trust wills are explained, this rule is a common topic.

Trusts are legal arrangements where one party holds assets for the benefit of another. Essentially, a grantor creates a trust, appoints a trustee to manage it, and designates beneficiaries who will receive the assets. Trusts provide a structure for asset management, often avoiding probate and helping with tax benefits. Trust wills explained can simplify this concept in easy terms.

Recent changes from the IRS emphasize stricter reporting requirements for certain trusts, particularly those with foreign assets. These new rules aim to improve transparency regarding trust income and tax obligations. Failing to comply can lead to hefty penalties, underscoring the need for proper guidance. When trust wills are explained, it's crucial to be aware of these regulations.

The 5 by 5 rule is a provision often found in trusts that allows beneficiaries to withdraw up to five percent of the trust's value each year. This rule provides flexibility and access to funds without fully distributing the trust. Understanding the 5 by 5 rule can help you maintain some level of control while still offering certain financial benefits. When trust wills are explained, this rule often comes up.

The biggest mistake parents often make when setting up a trust fund is failing to communicate their intentions clearly with their children. Many assume that their heirs will understand the purpose and details of the trust without guidance. This lack of communication can lead to confusion and disputes later on. Trust wills explained often include the importance of discussions about expectations.

To avoid inheritance tax with a trust, you need to establish a trust that qualifies for specific tax exemptions. For instance, certain irrevocable trusts can remove assets from your estate, thus reducing taxable inheritance. Additionally, using a trust allows proper asset distribution to beneficiaries, often in a way that keeps them exempt from tax. Understanding these strategies could clarify how trust wills are explained.