Trust Will

Description

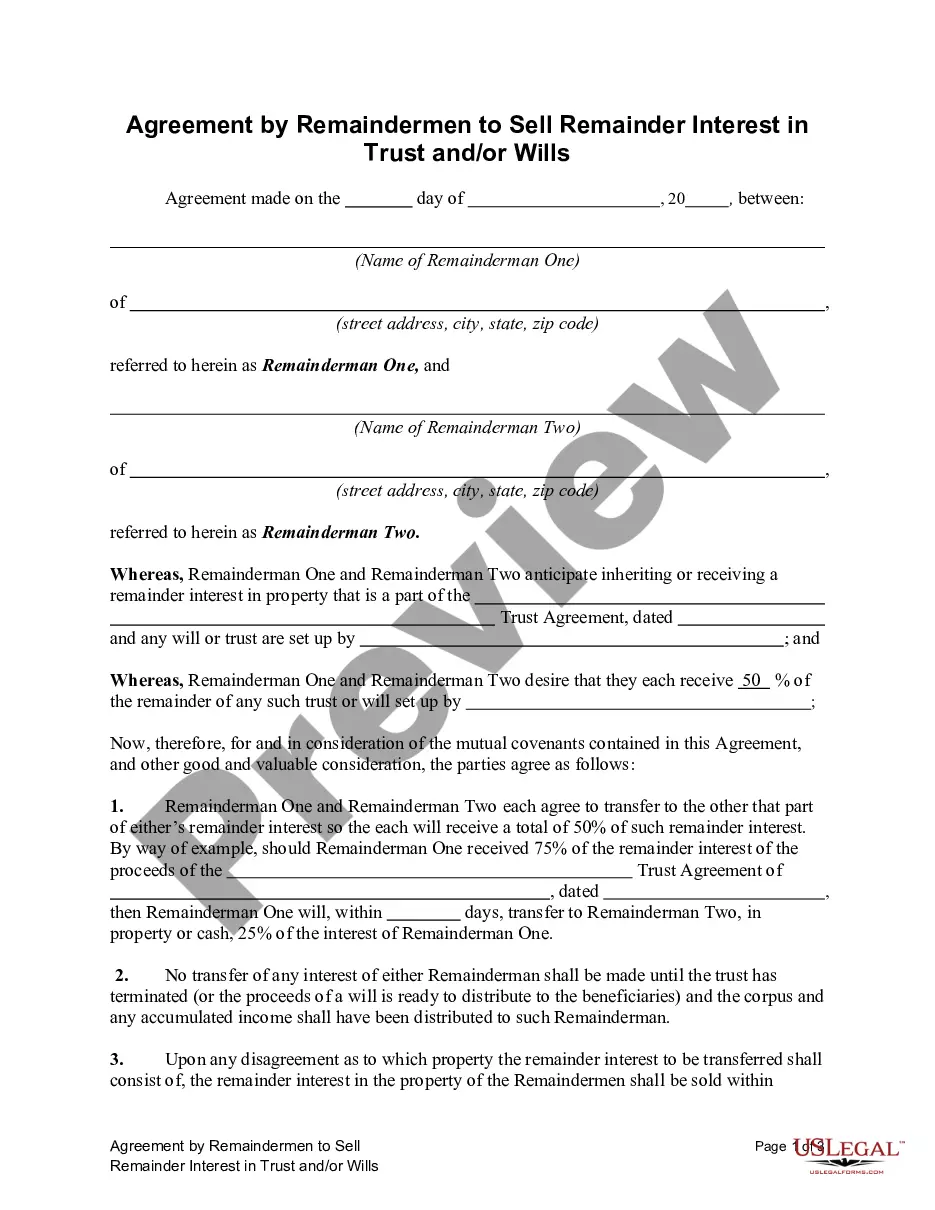

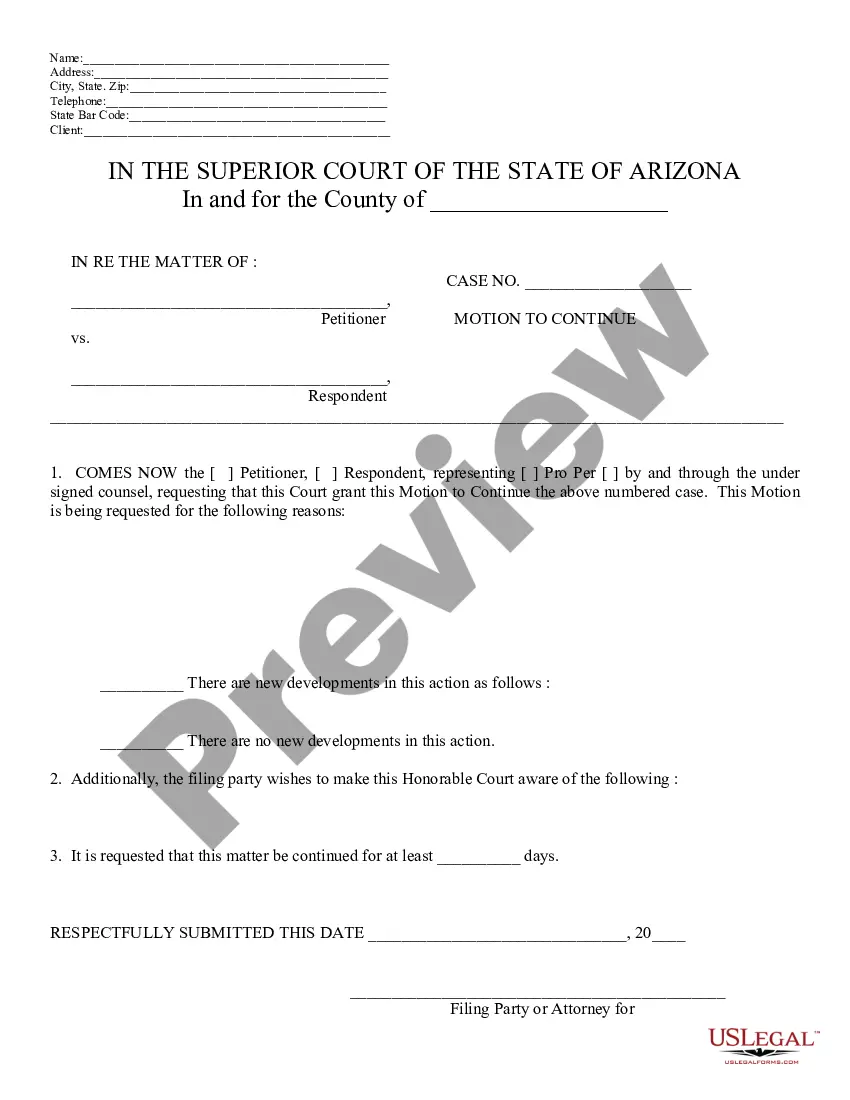

How to fill out Washington Agreement By Remainderman To Sell Remainder Interest In Trust And/or Wills?

- Log in to your existing account and verify your subscription status. If it's expired, consider renewing it based on your payment plan.

- Preview the form description to confirm it suits your needs and complies with your jurisdiction requirements.

- Utilize the Search tab if the form doesn’t meet your requirements, and explore the extensive library for alternatives.

- Proceed to purchase the desired document by selecting the 'Buy Now' option and choosing your preferred subscription plan.

- Complete the transaction by entering your payment details through credit card or PayPal.

- Download the form directly to your device and access it anytime through the 'My Forms' section of your account.

By following these steps, you ensure that your legal form process is seamless and efficient, backed by the extensive resources of US Legal Forms.

Take control of your legal documents today—trust in US Legal Forms for a hassle-free experience!

Form popularity

FAQ

Generally, a trust does not have to be filed with the IRS as a standalone document. However, if the trust generates income, you may need to file a tax return on behalf of the trust. This is an important consideration when setting up your trust will, as it affects your beneficiaries' future tax responsibilities. Consulting uslegalforms can ensure you meet IRS requirements accurately.

In California, a trust does not have to be filed with the court like a will. However, certain types of trusts may require court involvement under specific circumstances. It’s important to understand the legal nuances, especially if you have a trust will that includes complex assets. Using uslegalforms can help you navigate the requirements more easily.

Yes, a trust can indeed be created within a will, often referred to as a testamentary trust. This type of trust will become effective upon the death of the person who created it. It allows for the estate's assets to be managed in accordance with your specific wishes, providing protection for your beneficiaries. Utilizing uslegalforms can simplify the process of establishing a testamentary trust within your trust will.

Many parents overlook the importance of choosing the right trustee when setting up a trust will. Selecting someone who lacks financial knowledge, or who may act against your wishes, can lead to complications. It's essential to choose a responsible trustee who aligns with your long-term vision. Consider using uslegalforms to help create a clear and effective trust will.

Whether a trust is better than a will largely depends on your personal circumstances and goals. A trust can provide benefits like asset protection, ongoing management of your wealth, and the ability to avoid probate. However, a will is often simpler and more straightforward, offering a clear outline of your final wishes. If you’re unsure, consulting with a knowledgeable resource like US Legal Forms can help you explore your options and choose the best solution for your estate planning needs.

A trust will serves to combine the benefits of a will and a trust, ensuring that your assets are managed according to your wishes after your passing. Essentially, it allows you to create a trust within your will, taking effect upon your death. This structure provides a means to manage your wealth, protect your beneficiaries, and potentially avoid probate. Using a trusty platform like US Legal Forms can streamline the creation of your trust will, making the process more simple and efficient.

One significant disadvantage of a trust is the complexity involved in its setup and management. Unlike a simple will, a trust requires careful planning and may necessitate the assistance of legal professionals, which can increase costs. Additionally, a trust may not provide the same level of flexibility as a will when it comes to changing beneficiaries or terms, especially if not properly structured. If you are considering a trust will, it's essential to weigh these factors against your estate planning needs.

You should avoid putting certain items in your trust will, such as funeral wishes or joint assets. Funeral wishes can be better served in a separate document that your loved ones can access easily. Moreover, joint assets, such as property owned with someone else, automatically transfer to the co-owner, making them unnecessary in your will. Focusing your will on unique assets ensures it serves its purpose effectively.

One common mistake people make with their trust wills is not updating them after major life events. Changes like marriage, divorce, or the birth of a child can significantly affect asset distribution. Additionally, failing to clearly identify beneficiaries or assets can lead to disputes. Regularly reviewing your trust will is vital for ensuring it reflects your current wishes.

The golden rule when making a trust will is to ensure clarity in your intentions. Clearly outline your assets and how you want them distributed. This prevents confusion and potential conflicts among your beneficiaries. Taking the time to be precise now can save loved ones from difficult decisions later.