Transfer Death Beneficiaries With A Will

Description

How to fill out Washington Transfer On Death Deed - Individual To Three Individuals - Does NOT Include Alternate Beneficiaries.?

- If you're a returning user, log in to your account and access the necessary form template. Ensure your subscription is current; renew it if required.

- For first-time users, begin by previewing the available forms. Confirm that the chosen form aligns with your needs and complies with local regulations.

- Should you find the initial form unsuitable, utilize the Search function to explore additional templates that may better serve your requirements.

- Once you've identified the right document, click the Buy Now button to select your preferred subscription plan. Make sure to create an account to unlock the full library.

- Complete your purchase by entering your credit card information or using PayPal for convenience.

- After your transaction, download the form and save it for completion, accessible anytime via the My Forms section.

With US Legal Forms, individuals and attorneys can navigate the legal landscape with ease, leveraging a vast library of over 85,000 forms. This empowers users to create legally sound documents swiftly and efficiently.

Start today to ensure your beneficiaries are properly designated in your will. Explore US Legal Forms for a seamless documentation process!

Form popularity

FAQ

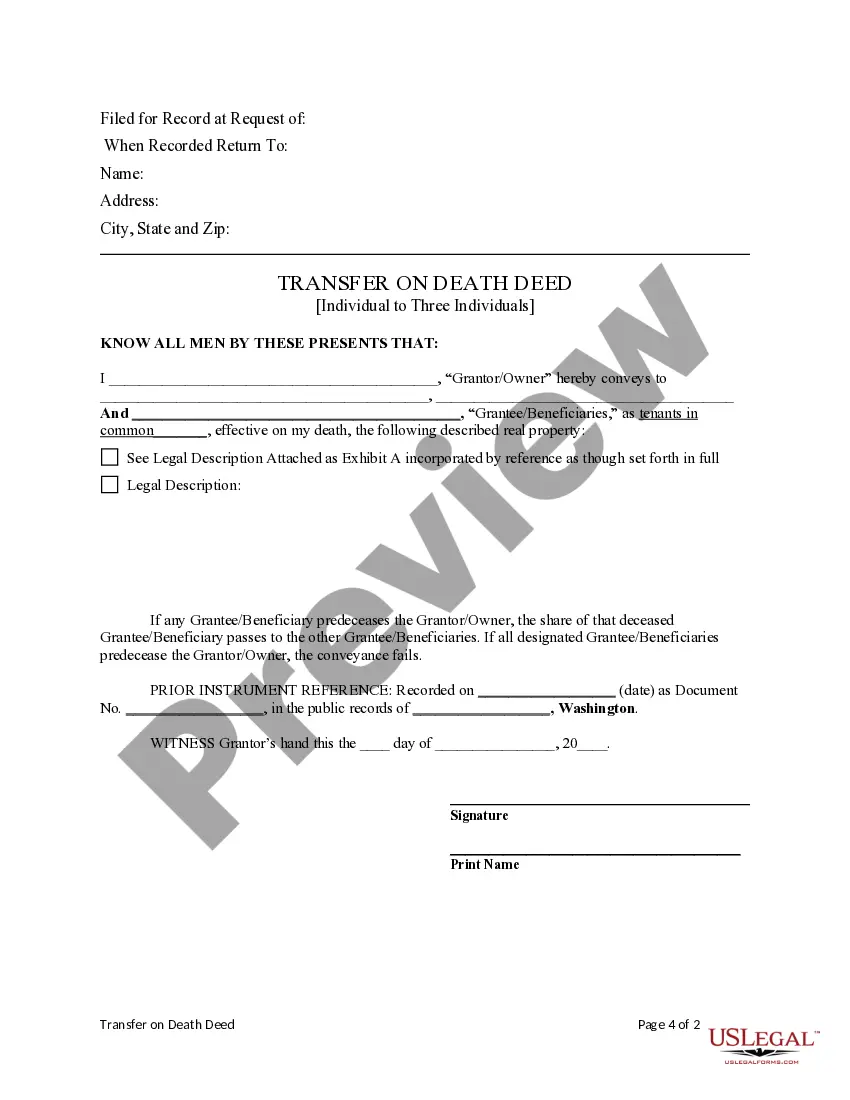

A transfer on death deed does not automatically avoid inheritance tax. While it may simplify the transfer of property, it could still subject your estate to taxes. It’s essential to understand how transfer death beneficiaries with a will can impact your overall tax situation. Consulting with a tax professional can provide valuable insights, and using platforms like US Legal Forms can guide you through the legal complexities.

Choosing between a transfer on death (TOD) designation and naming beneficiaries often depends on your circumstances. Transfer death beneficiaries with a will provide clear direction to your heirs, but a TOD may lead to complications if it contradicts your intentions. Evaluating the long-term implications is crucial. Consulting resources like US Legal Forms can help clarify your options and facilitate informed decisions.

If there is no will, you typically need to file for probate within a few weeks of the death, depending on your state's laws. This process can ensure that the estate is managed according to state guidelines. If you have questions about managing transfer death beneficiaries with a will or navigating probate, US Legal Forms offers resources to assist you. Timely action can help simplify the matters your loved ones face.

A transfer on death deed can be problematic as it may not reflect your latest wishes if you change your mind later. Unlike transfer death beneficiaries with a will, a deed does not allow for detail on asset distribution in complex scenarios. Furthermore, using a transfer on death deed can complicate estate planning, as it may not account for taxes or debts. It's important to assess all options before deciding.

The best way to leave property upon death is by having a will that clearly outlines your wishes. This allows you to specify transfer death beneficiaries with a will, ensuring your assets go to those you intend. A will also helps your loved ones avoid potential disputes over your estate. Having a well-documented plan can provide peace of mind during a difficult time.

Whether a transfer on death is better than a will depends on your specific circumstances. A TOD can expedite the transfer of certain assets, therefore providing immediate benefits to beneficiaries. However, a will covers a broader range of estate matters, including the management of any debts and disposition of assets that do not have a TOD. Balancing the two—transfer death beneficiaries with a will—can create a comprehensive and effective estate plan tailored to your needs.

Yes, accounts with a transfer on death designation can avoid probate altogether. When the account holder passes, the account transfers directly to the named beneficiaries without going through the lengthy probate process. This can streamline the transfer of assets, making it an attractive option when considering how to handle transfer death beneficiaries with a will. Using these strategies can provide peace of mind for you and your loved ones.

It’s not mandatory to have a lawyer for a transfer on death deed, but having one can simplify the process and ensure compliance with state laws. A lawyer can help clarify how transfer death beneficiaries with a will interact, guiding you in making the best decisions for your estate. If you are unsure about the specifics or your individual situation, seeking legal advice can be beneficial. US Legal Forms offers various resources that can assist you if you prefer a more self-guided approach.

Yes, in most cases, a transfer on death will take precedence over instructions laid out in a will. This means if a property has a TOD designation, it will be transferred to the beneficiary directly, bypassing the will's terms. This feature of transfer death beneficiaries with a will can expedite the process, but it also emphasizes the importance of coordinating these documents to avoid conflicts. A thorough review of your estate with tools from US Legal Forms can help clarify these interactions.

A potential downside of a transfer on death is the lack of flexibility once it is established; it can be difficult to change beneficiaries. Additionally, relying on a TOD may lead to complications if an asset isn’t explicitly covered. It's crucial to consider that a TOD may not consider your entire estate plan, making the coordination with your will vital. You might want to explore transfer death beneficiaries with a will to create a balanced estate plan.