This form is a Transfer on Death Deed where the Grantors are two individuals, or husband and wife, and the Grantees are two individuals or husband and wife. This transfer is revocable by Grantors until death and effective only upon the death of the last Grantor. This deed complies with all state statutory laws.

Vermont Enhanced Life Estate Deed Statute

Description

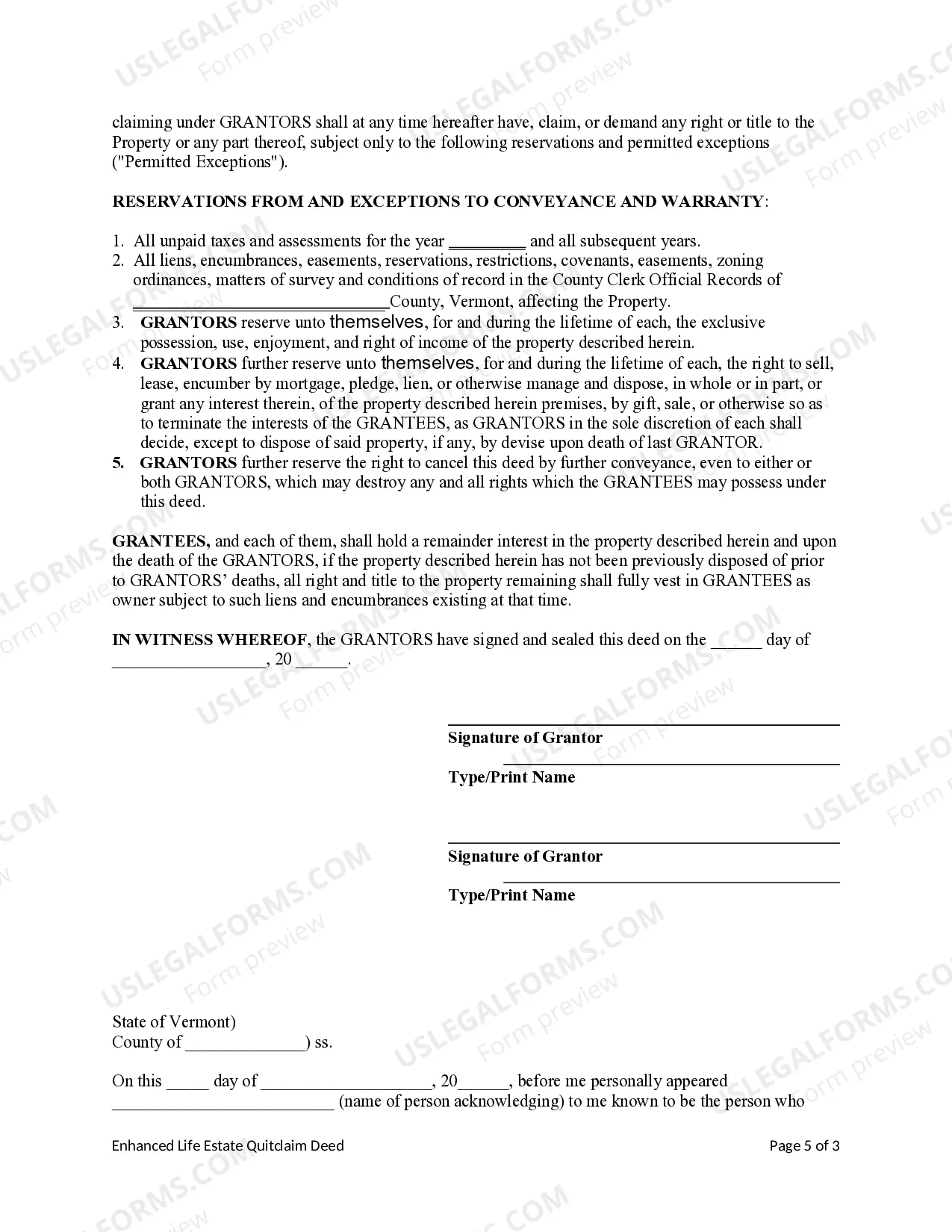

How to fill out Vermont Enhanced Life Estate Deed (a.k.a. Lady Bird Deed) From Two Individuals / Husband And Wife To Two Individuals / Husband And Wife.?

- Log in to your US Legal Forms account if you're a returning user and select the desired form template to download.

- For new users, begin by checking the form preview and description to ensure it meets your needs and complies with local regulations.

- If the initial template doesn't suit your requirements, use the search function to find additional templates.

- Once you've identified the correct document, click the buy button and choose the subscription plan that fits your needs.

- Complete your purchase by entering your payment details, either via credit card or PayPal.

- After the transaction, download your form and save it on your device. You can access it anytime through the My Forms section of your account.

In conclusion, US Legal Forms simplifies the document preparation process for the Vermont enhanced life estate deed statute. With an extensive library and easy navigation, you can find the right forms quickly and efficiently.

Don't hesitate—visit US Legal Forms today to streamline your legal documentation process!

Form popularity

FAQ

An enhanced life estate is a type of property ownership that allows a person to retain rights to their property during their lifetime while designating it to pass automatically to a beneficiary upon their death. According to the Vermont enhanced life estate deed statute, this arrangement enables you to enjoy your property fully, yet ensures a seamless transfer of ownership without going through probate. This feature not only simplifies the estate planning process but also helps in avoiding unnecessary legal complications for your heirs. For those considering such options, US Legal Forms offers resources and templates to help you create an enhanced life estate deed that meets legal requirements.

The two main types of life estates are conventional life estates and enhanced life estates. A conventional life estate grants the right to use and occupy the property during the owner's lifetime, after which it passes to a designated remainder beneficiary. On the other hand, an enhanced life estate, as defined by the Vermont enhanced life estate deed statute, allows the owner to retain the right to sell or mortgage the property without needing the consent of the remainder beneficiary. This type of estate provides more flexibility and control for the owner.

Choosing between a lady bird deed and a trust depends on your individual circumstances and goals. A lady bird deed allows for direct transfer of property upon death without probate, while a trust offers broader benefits, including management of assets during your lifetime and after. Reviewing the Vermont enhanced life estate deed statute in conjunction with professional advice can help you determine which option better meets your needs and estate planning objectives.

Yes, you can draft your own lady bird deed, but it is crucial to ensure it meets all legal requirements specific to your state, including those outlined by the Vermont enhanced life estate deed statute. While many forms are available online, consulting a legal expert may help you avoid pitfalls and ensure the deed accurately reflects your intentions. Utilizing platforms like US Legal Forms can provide you with the necessary templates and guidance to create a valid, enforceable document.

One disadvantage of a lady bird deed is that it may not be recognized in every state, which can complicate matters for property owners who move or own properties across state lines. Additionally, while a lady bird deed facilitates avoiding probate, it can create tax implications that may not be present with other estate planning tools. Knowing the nuances outlined in the Vermont enhanced life estate deed statute is important for making informed decisions about property transfer.

The main difference between a life estate deed and an enhanced life estate deed lies in the control and flexibility they offer. An enhanced life estate deed allows the owner to sell, change beneficiaries, or mortgage the property without needing consent from the remaindermen. This distinction is significant, particularly under the Vermont enhanced life estate deed statute, as it provides greater autonomy to the property owner while still ensuring that the property will pass to the intended heirs.

A life estate deed in Vermont is a legal document that allows an individual to retain rights to a property during their lifetime while transferring remainder rights to another party. This means that the individual can live in, use, and control the property until their passing, at which point the property passes to the designated beneficiary. Understanding the Vermont enhanced life estate deed statute can help clarify the responsibilities and benefits associated with this type of deed.

While a life estate deed provides benefits, it has disadvantages to consider. For example, once a life estate is established, the original owner cannot sell or mortgage the property without consent from the beneficiaries, as stated in the Vermont enhanced life estate deed statute. Additionally, there may be tax implications or loss of control over the property, making it important to weigh your options carefully.

The enhanced life estate deed is often considered one of the best options for avoiding probate. As per the Vermont enhanced life estate deed statute, it allows property to transfer directly to designated beneficiaries without going through the probate process. This can save time and reduce legal complexities for your loved ones after your passing.

For instance, if Jane owns a house and executes an enhanced life estate deed, she can live in the house until her death. She can designate her children as beneficiaries, meaning they will automatically own the house once she passes, as outlined in the Vermont enhanced life estate deed statute. This example highlights how ownership can be structured to benefit both the current owner and the future recipients.