This form is a Transfer on Death Deed where the Grantors are two individuals, or husband and wife, and the Grantees are two individuals or husband and wife. This transfer is revocable by Grantors until death and effective only upon the death of the last Grantor. This deed complies with all state statutory laws.

Life Estate Deed Vermont Withholding

Description

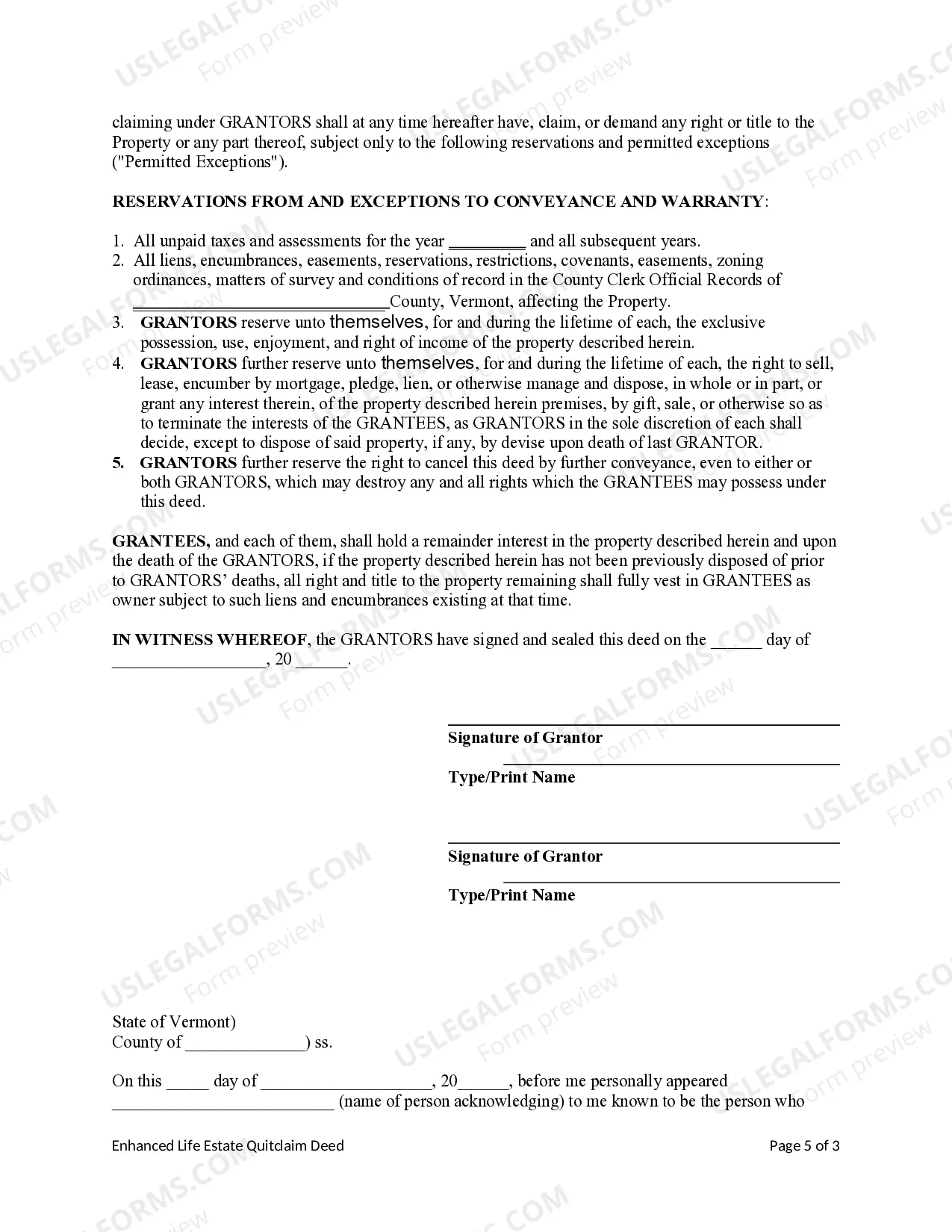

How to fill out Vermont Enhanced Life Estate Deed (a.k.a. Lady Bird Deed) From Two Individuals / Husband And Wife To Two Individuals / Husband And Wife.?

Accessing legal document samples that meet the federal and local regulations is crucial, and the internet offers numerous options to pick from. But what’s the point in wasting time searching for the appropriate Life Estate Deed Vermont Withholding sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the biggest online legal library with over 85,000 fillable templates drafted by lawyers for any business and personal case. They are simple to browse with all documents arranged by state and purpose of use. Our specialists stay up with legislative updates, so you can always be confident your paperwork is up to date and compliant when obtaining a Life Estate Deed Vermont Withholding from our website.

Obtaining a Life Estate Deed Vermont Withholding is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you require in the preferred format. If you are new to our website, follow the instructions below:

- Take a look at the template using the Preview feature or through the text description to make certain it meets your needs.

- Locate a different sample using the search tool at the top of the page if needed.

- Click Buy Now when you’ve located the suitable form and opt for a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Choose the right format for your Life Estate Deed Vermont Withholding and download it.

All templates you locate through US Legal Forms are reusable. To re-download and complete previously saved forms, open the My Forms tab in your profile. Enjoy the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

To properly convey a deed the deed must be signed in front of a notary and recorded in the county clerks office. If a survey is referenced in the deed, that survey should also be recorded. If a deed divides a parcel a survey should be recorded with the deed.

When a home purchase closes, the home buyer is required to pay, among other closing costs, the Vermont Property Transfer Tax. The buyer is taxed is at a rate of 0.5% of the first $100,000 of the home's value and 1.45% of the remaining portion of the value.

When a transfer is made by deed, the buyer or transferee is liable for the transfer tax.

A primary residence in Vermont pays at a varying rate ? 0.5% on the first $100,000 in value and then 1.45% (really 1.25% transfer tax and 0.2% clean water fee) on the remaining value. Properties other than a primary residence pay the 1.45% on all value.

When real estate is sold in Vermont, state income tax is due on the gain from the sale, whether the seller is a resident, part-year resident, or nonresident. If the seller is a nonresident, the buyer is required to withhold 2.5% of the sale price and remit it to the Vermont Department of Taxes.