Va Closing Transaction For This Vehicle

Description

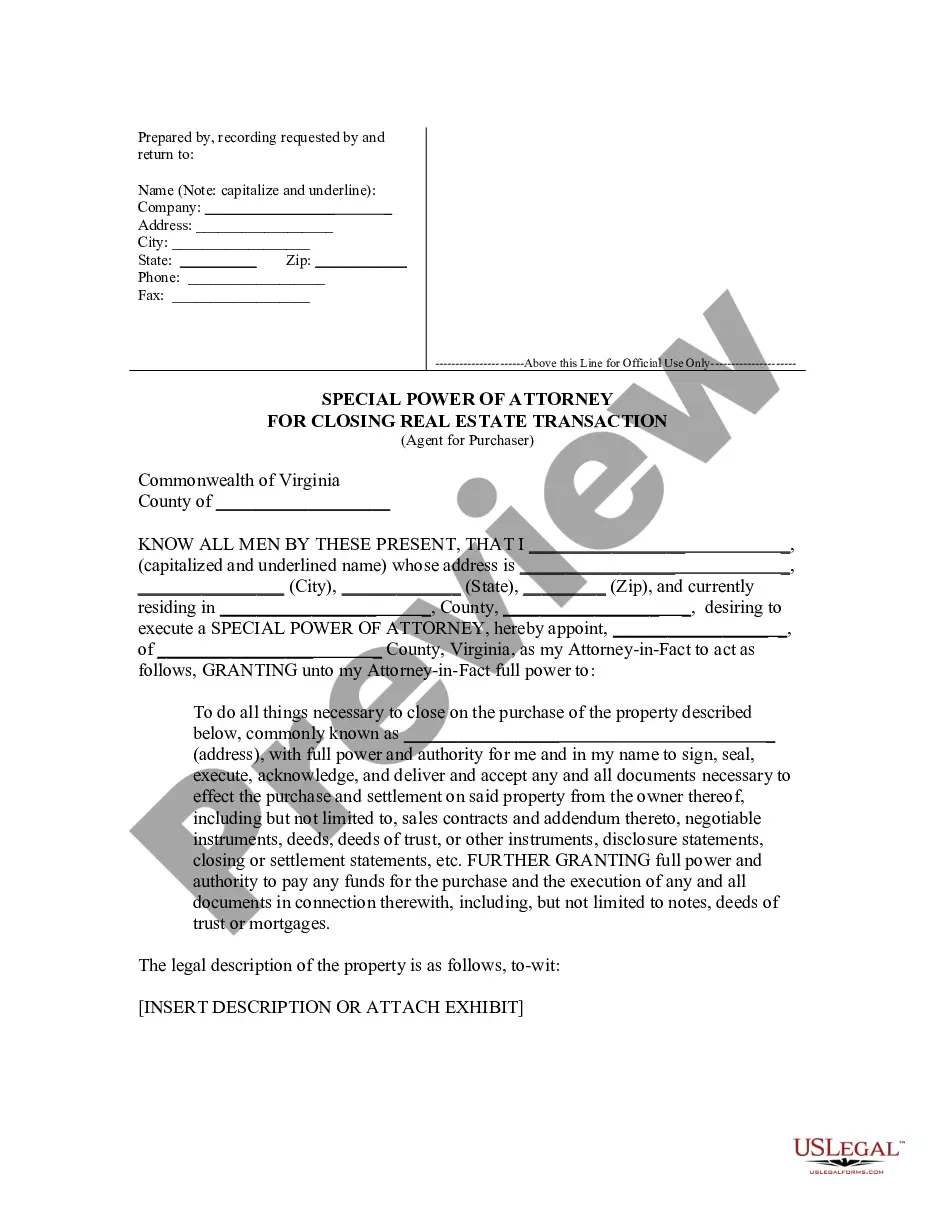

How to fill out Virginia Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser?

Obtaining legal templates that comply with federal and local regulations is essential, and the internet provides numerous options to select from.

However, what’s the benefit of wasting time hunting for the appropriate Va Closing Transaction For This Vehicle sample online when the US Legal Forms online repository already possesses such templates gathered in one location.

US Legal Forms is the largest online legal directory featuring over 85,000 fillable templates created by attorneys for any business and personal situation. They are straightforward to navigate with all documents categorized by state and intended use. Our experts keep current with legal updates, ensuring you can always be assured your form is up to date and compliant when obtaining a Va Closing Transaction For This Vehicle from our site.

Hit Buy Now once you’ve identified the correct form and select a subscription plan. Create an account or Log In and complete the payment via PayPal or a credit card. Select the appropriate format for your Va Closing Transaction For This Vehicle and download it. All templates you find through US Legal Forms are reusable. To re-download and complete previously acquired forms, visit the My documents section in your profile. Take advantage of the most comprehensive and user-friendly legal paperwork service!

- Acquiring a Va Closing Transaction For This Vehicle is quick and easy for both existing and new users.

- If you already have an account with a valid subscription, Log In and save the document sample you need in your chosen format.

- If you are new to our website, follow the steps below.

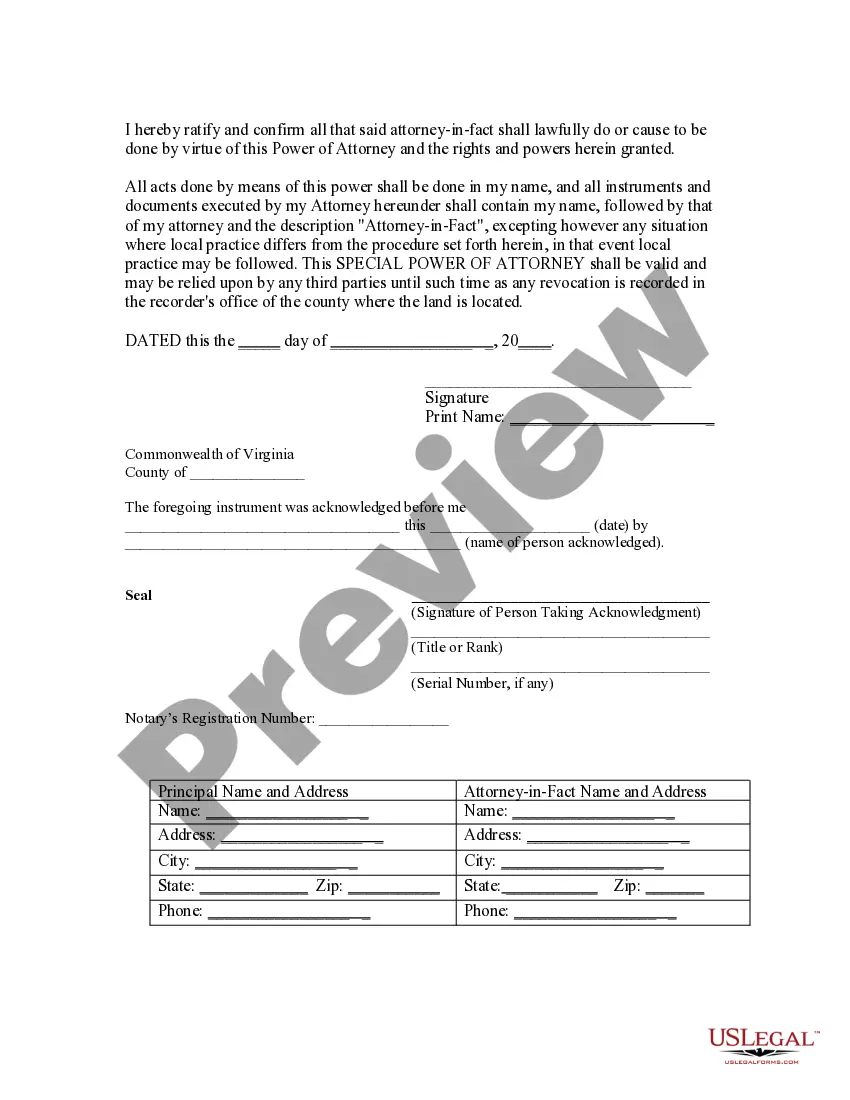

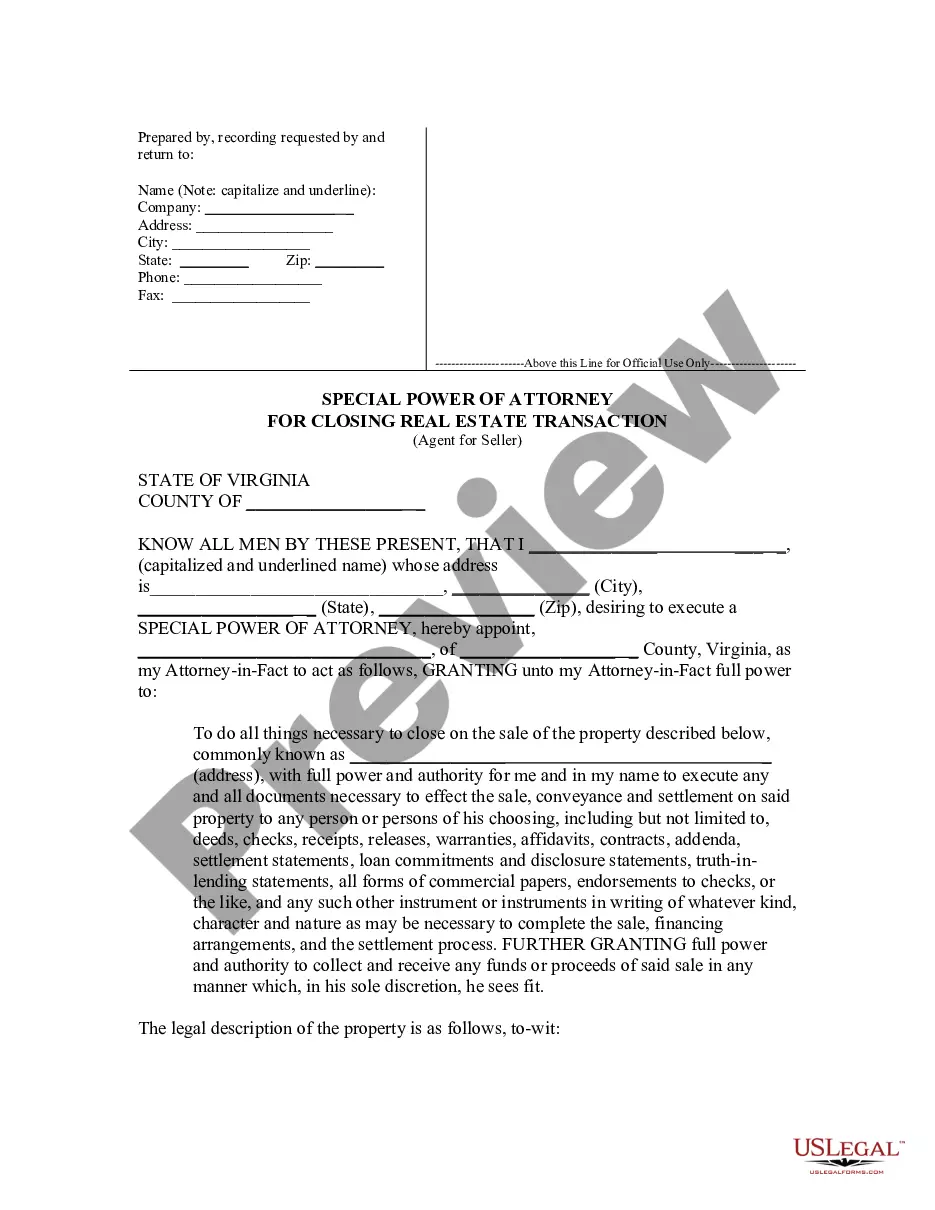

- Review the template using the Preview feature or through the text outline to verify it meets your requirements.

- Find another sample using the search tool at the top of the page if needed.

Form popularity

FAQ

Can VA loan closing costs get rolled into your loan? Although you can't include all of your closing costs in your mortgage, the VA does allow you to roll your VA funding fee into your total loan amount. By financing your funding fee with the rest of your loan, you'll instead repay the amount over time.

Every nonresident, including any foreign corporation, conducting business in the Commonwealth and owning and regularly operating in such business any motor vehicle, trailer, or semitrailer in the Commonwealth shall be required to register the vehicle and pay the same fees required for registration of similar vehicles ...

How to Register a Recently Purchased Vehicle Complete an Application for Registration (Form VSA 14) Gather proof of address and identification. Obtain your vehicle's emission certificate. Purchase auto insurance or pay the $500 uninsured motorist fee. Bring a credit card to pay for registration fees.

How to Sign Your Virginia Title Transfer - YouTube YouTube Start of suggested clip End of suggested clip This is where you're going to sign your name. Exactly how appears on the title. So if there's seniorMoreThis is where you're going to sign your name. Exactly how appears on the title. So if there's senior-junior. One two three however many there are that is where you're gonna sign.

In the sale information section on the title, do the following: Print and sign your name as seller(s) - all owners listed on the title must sign. Provide the name and address of the buyer/recipient. Fill out the odometer reading using the odometer reading from the vehicle (do not guess or estimate) Enter the date of sale.