Va Attorney Real Estate With Chesapeake

Description

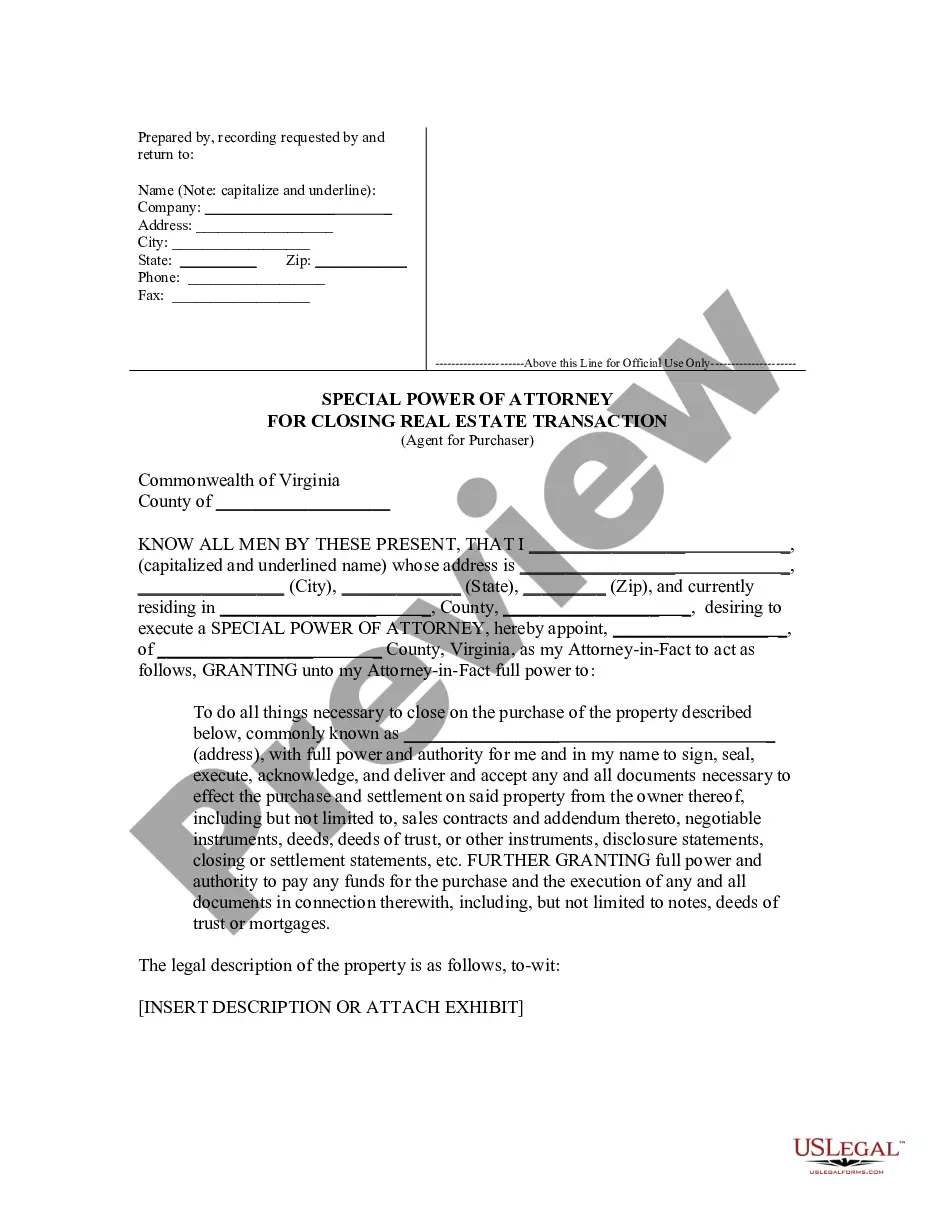

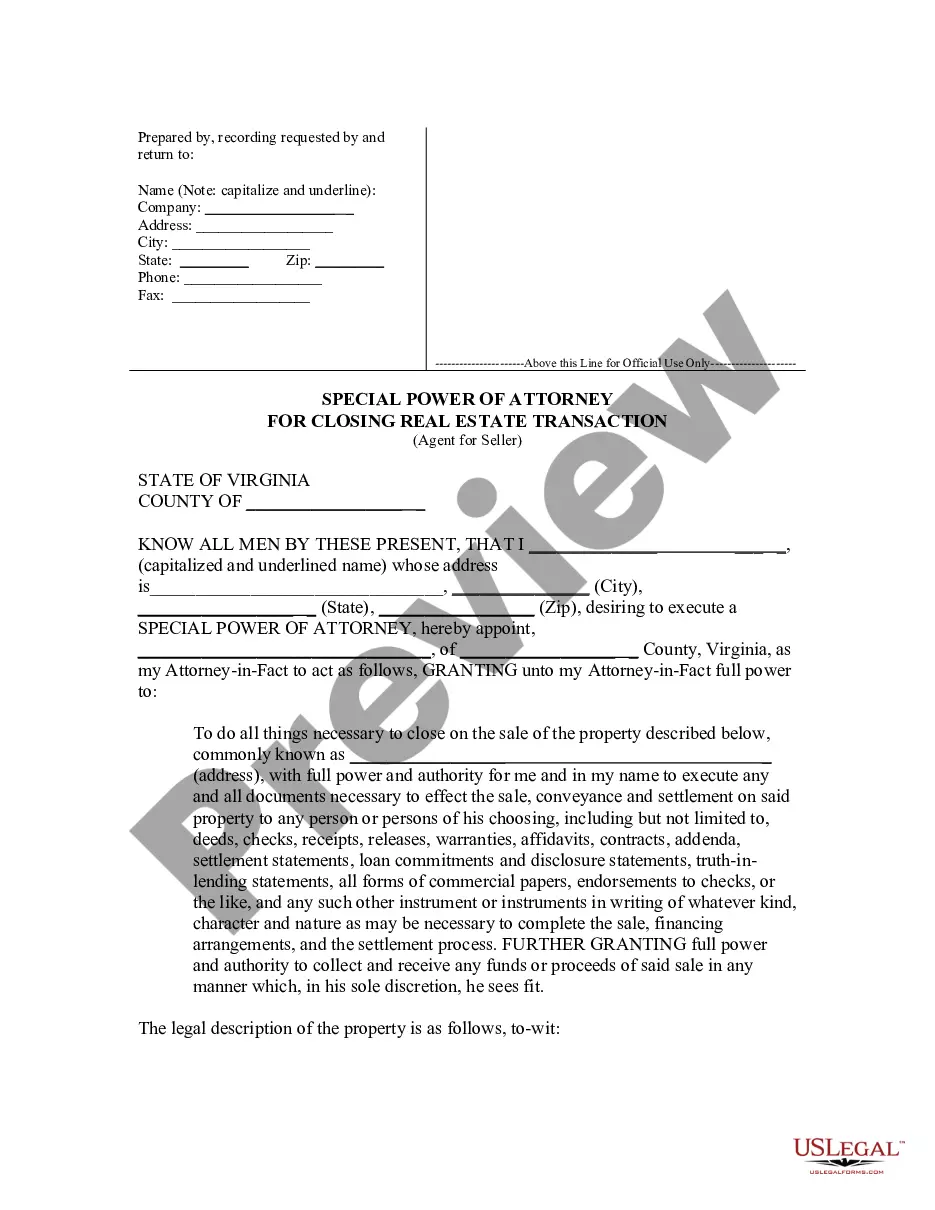

How to fill out Virginia Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser?

Legal management can be daunting, even for skilled experts.

When you seek a Virginia Attorney for Real Estate in Chesapeake and lack the time to dedicate to finding the appropriate and updated version, the procedures can be challenging.

US Legal Forms addresses any requirements you may encounter, from personal to business documentation, all in one location.

Leverage sophisticated tools to complete and oversee your Virginia Attorney for Real Estate in Chesapeake.

Here are the steps to follow after downloading the document you desire: Validate that this is the correct document by previewing it and reviewing its details.

- Tap into a valuable resource library of articles, guides, and materials pertinent to your circumstances and requirements.

- Save time and effort in searching for the forms you need; utilize US Legal Forms' advanced search and Preview tool to find Virginia Attorney for Real Estate in Chesapeake and obtain it.

- If you hold a monthly subscription, Log Into your US Legal Forms account, seek out the document, and secure it.

- Visit the My documents section to review the documents you've previously downloaded and organize your files as you see fit.

- If you are new to US Legal Forms, create a complimentary account and gain unlimited access to all platform advantages.

- Utilize a robust web form catalog to revolutionize how you handle these situations.

- US Legal Forms stands as a frontrunner in web legal forms, boasting over 85,000 state-specific legal documents available to you at all times.

- Access state- or county-specific legal and business documents.

Form popularity

FAQ

States that mandate the physical presence of an attorney, or restrict other types of closing duties to attorneys, include: Alabama, Connecticut, Delaware, District of Columbia, Florida, Georgia, Kansas, Kentucky, Maine, Maryland, Massachusetts, Mississippi, New Hampshire, New Jersey, New York, North Dakota, ...

The current tax rate is $1.04 per $100 of assessed value, with an additional levy of $0.01 for mosquito control. Fiscal Year 2022 to 2023 includes a $0.04 credit, which results in an effective tax rate of $1.01 per $100 of assessed value. 3. What should I do if I find an error in my property description?

Are You In An Attorney State? StateAttorney State?UtahNoVermont?Yes - Attorney StateVirginia?Yes - Attorney StateWashingtonNo47 more rows ?

Although The Code of Virginia allows ?non-lawyers,? such as title insurance companies, to close real estate transactions, there are many benefits to spending a little extra to have a licensed attorney on your side. Here are five reasons to hire a real estate attorney: 1.

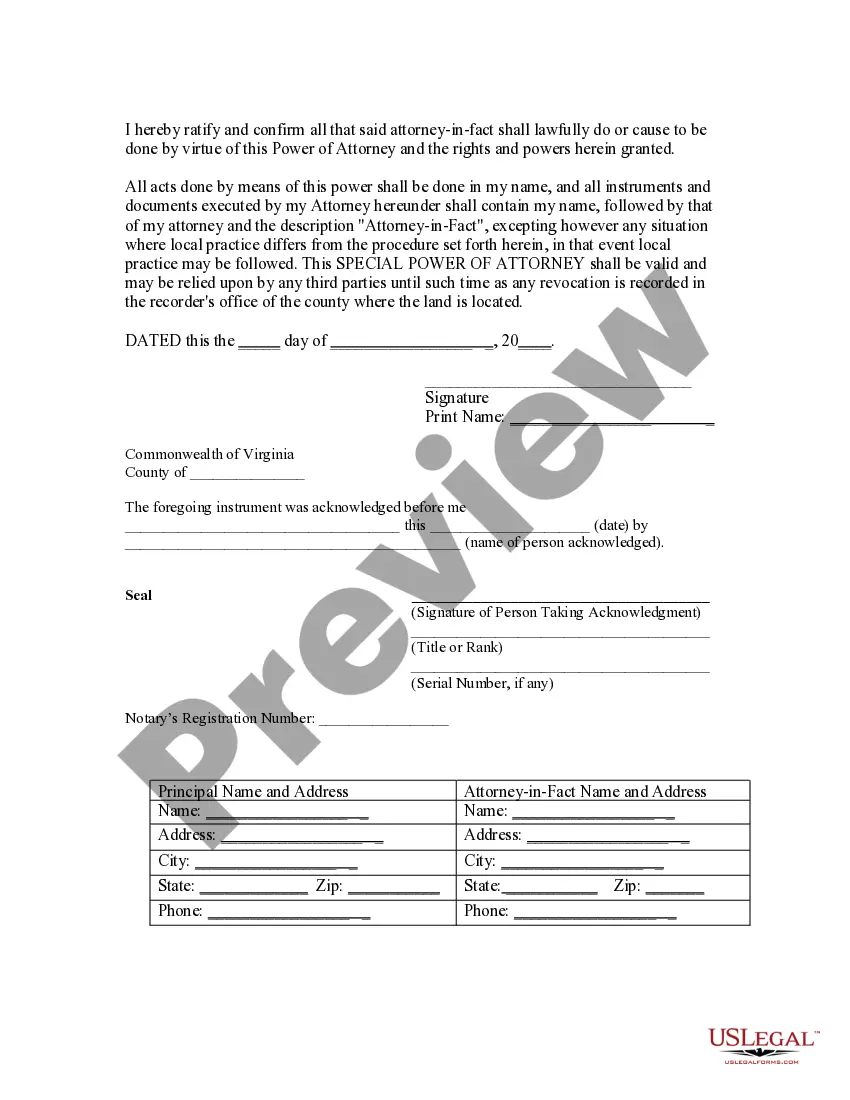

For your POA to be valid in Virginia, it must meet certain requirements. Mental Capacity for Creating a POA. ... Notarization Requirements. ... Create the POA Using Software or an Attorney. ... Sign the POA in the Presence of a Notary Public. ... Store the Original POA in a Safe Place. ... Give a Copy to Your Agent.