Maneuvering through the red tape of traditional documents and templates can be challenging, particularly if one does not engage in this professionally.

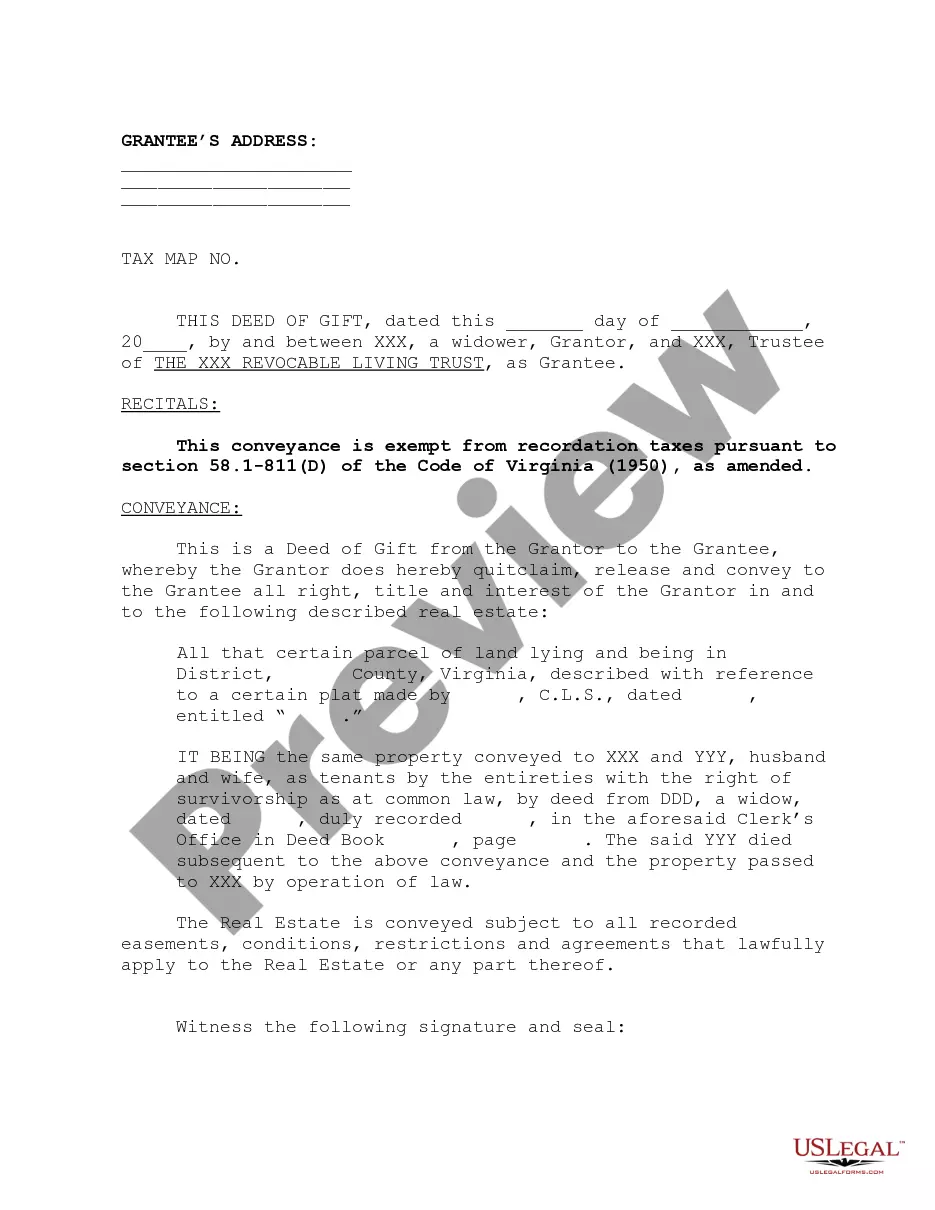

Selecting the appropriate template for a Deed Of Gift To Trust Without Crummey Powers can also be labor-intensive, as it must remain valid and precise to the final detail.

Nevertheless, you will need to spend considerably less time selecting a suitable template from a trusted source.

Acquire the correct form in a few simple steps: Enter the document name in the search field. Locate the appropriate Deed Of Gift To Trust Without Crummey Powers from the result list. Review the outline of the sample or view its preview. If the template meets your requirements, click Buy Now. Choose your subscription plan. Use your email and set up a password to register for an account at US Legal Forms. Select a credit card or PayPal payment method. Download the template file to your device in your preferred format. US Legal Forms can save you time and effort in determining whether the form you found online suits your needs. Create an account and gain unlimited access to all the templates you need.

- US Legal Forms is a service that streamlines the process of finding the right forms online.

- US Legal Forms serves as a single source to acquire the most recent examples of documents, verify their utilization, and download these examples for completion.

- This collection comprises over 85K forms applicable in numerous fields.

- When searching for a Deed Of Gift To Trust Without Crummey Powers, you can be assured of its validity as all forms are confirmed.

- Having an account on US Legal Forms guarantees that all essential documents are readily accessible.

- You can save them in your history or add them to the My documents repository.

- Access your saved documents from any device by simply clicking Log In at the library website.

- If you do not yet have an account, you can always initiate a new search for the template you require.

Where a grantor trust has been established, generally no gift tax would be due on property contributed. Grantor may act as investment advisor if it would not cause estate tax inclusion under IRC § 2036(b).− Irrevocable trust, completed gift. For the remainder interest, the gift is complete. Minimize the gift tax consequences of creating the trust. The trustee holds legal title to designated property in trust. Crummey holder the right annually to withdraw the full amount of the addition to the trust.