Trust Will

Description

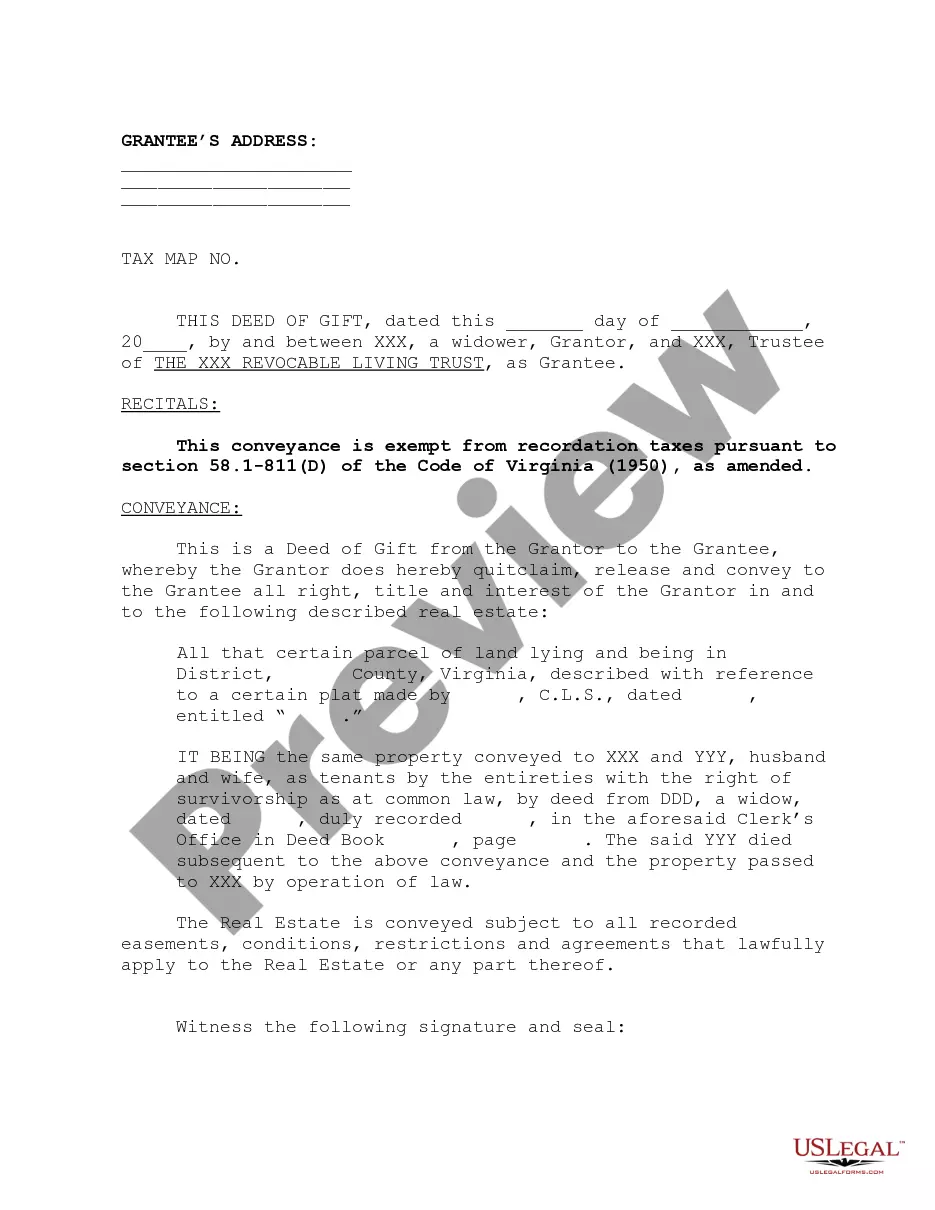

How to fill out Virginia Deed Of Gift To Trust Of Property Left By Previous Will?

- Log in to your existing account at US Legal Forms. Verify your subscription status and renew if necessary to ensure uninterrupted access.

- Explore the Preview mode and form descriptions. Confirm that you select the correct form, tailored to your needs and compliant with your local regulations.

- If you cannot find the desired document, utilize the Search feature to efficiently locate the appropriate template.

- Proceed to purchase the chosen document by clicking 'Buy Now'. Select a subscription plan that best suits your requirements and create an account for full access.

- Complete your purchase using your preferred payment method, either credit card or PayPal.

- Download your legal form directly to your device and retrieve it from the 'My Forms' section of your profile whenever needed.

By following these steps, you can trust that you are obtaining the right legal documents while enjoying the extensive resources that US Legal Forms offers.

Start your journey today to streamline your legal needs and ensure you’re always prepared. Trust will lead you to the solutions and support necessary for effective documentation.

Form popularity

FAQ

A trust will serves as a combination of both a will and a trust, allowing you to outline your wishes for asset distribution while also providing for the creation of a trust upon your death. This type of trust is particularly useful for those who want to minimize probate and ensure a smooth transition of assets. By utilizing a trust will, you can address the management of your estate more comprehensively, offering peace of mind for you and your beneficiaries.

While trusts offer many benefits, they also have some drawbacks compared to wills. For instance, trusts typically require more maintenance, such as ongoing management and potential tax filings. Furthermore, if a person does not fund the trust correctly, it may not provide the intended protections. It’s important to weigh these negatives when deciding between a trust will and a traditional will, considering your personal situation.

A trust provides several key advantages compared to a will. First, a trust allows for the management of your assets during your lifetime and beyond, while a will only comes into effect after your passing. Second, trusts can help avoid probate, which can save time and costs for your beneficiaries. Lastly, a trust offers more flexibility in how assets are distributed, providing you with greater control over your estate's future.

You should avoid putting joint assets, like jointly owned property, or assets with designated beneficiaries in your will. Additionally, avoid specific funeral arrangements and any gifts that may not be appropriate, as these can create complications. Remember, a well-thought-out trust will encompass these considerations and help clarify your wishes.

Whether a trust is better than a will depends on your specific situation. Trusts provide advantages such as avoiding probate and maintaining privacy regarding your estate. Ultimately, a well-structured trust will offer more control over your assets compared to a will, making it an appealing option for many.

The biggest mistake with wills often involves failing to communicate with family about your intentions. Open discussions can help prevent confusion and conflicts after your passing. Additionally, ensuring your trust will accurately reflect your wishes and is regularly updated can prevent significant issues in the future.

While it's possible to create a trust without an attorney in Florida, having one can significantly simplify the process. An attorney can help ensure that your trust will comply with state laws and can address any unique considerations you may have. If budget is a concern, online resources like US Legal Forms can also assist in creating a legally sound trust.

The golden rule when making a will is to be as clear and specific as possible. Clear instructions help reduce the likelihood of disputes among heirs and ensure that your wishes are honored. A well-defined trust will guide your loved ones in carrying out your plans effectively.

Common mistakes with wills include not updating them after major life events, like marriage or the birth of a child. Another frequent error involves failing to clearly outline specific bequests, which can lead to confusion and disputes among heirs. Paying attention to these details ensures that your trust will reflect your true intentions.

Yes, a trust can be created within a will, which is often referred to as a testamentary trust. This type of trust becomes effective only after your death, allowing you to dictate how your assets are distributed. This approach can provide additional benefits, such as protecting your beneficiaries and managing their inheritance responsibly.