Exemption Virginia Homestead Fort Worth

Description

How to fill out Virginia Homestead Deed For Single - Home?

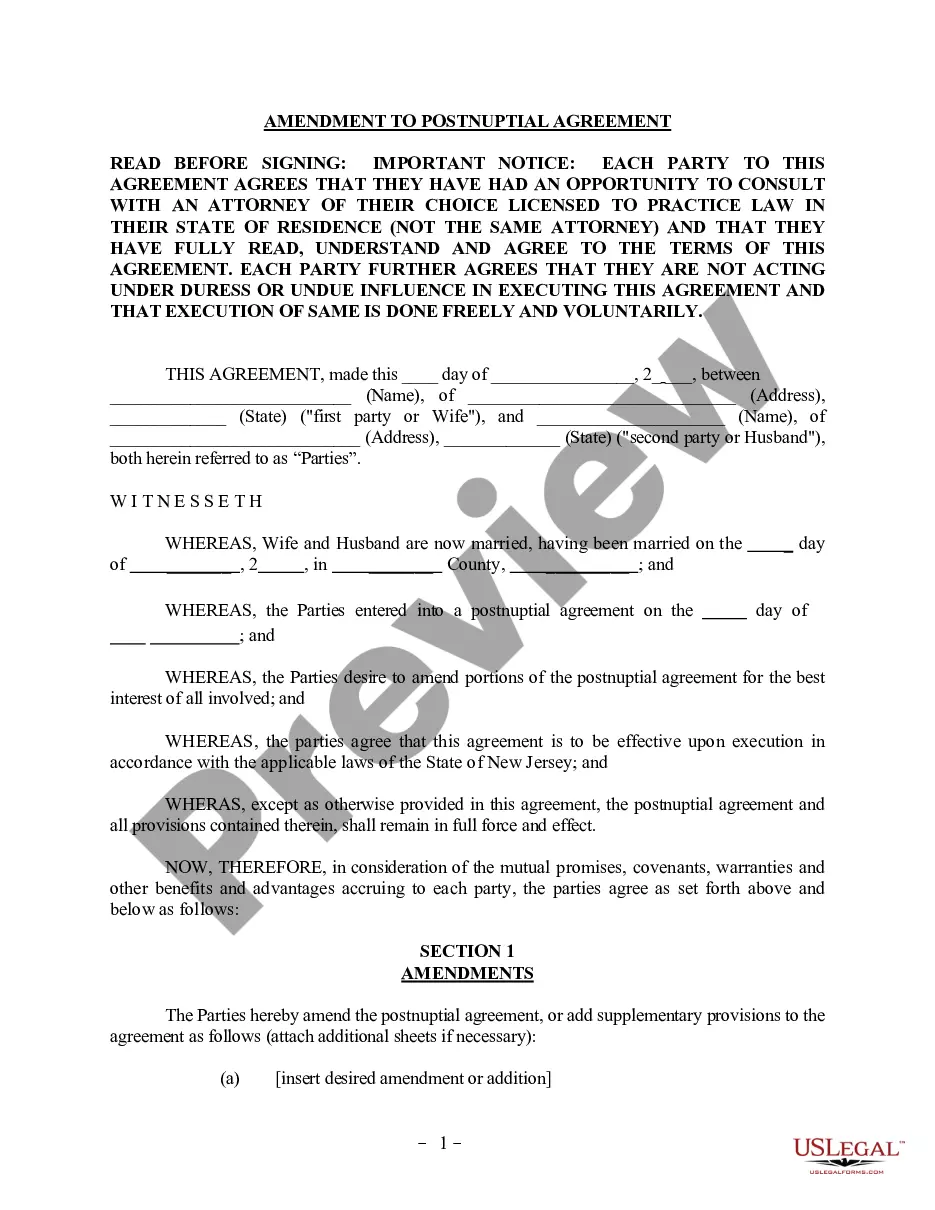

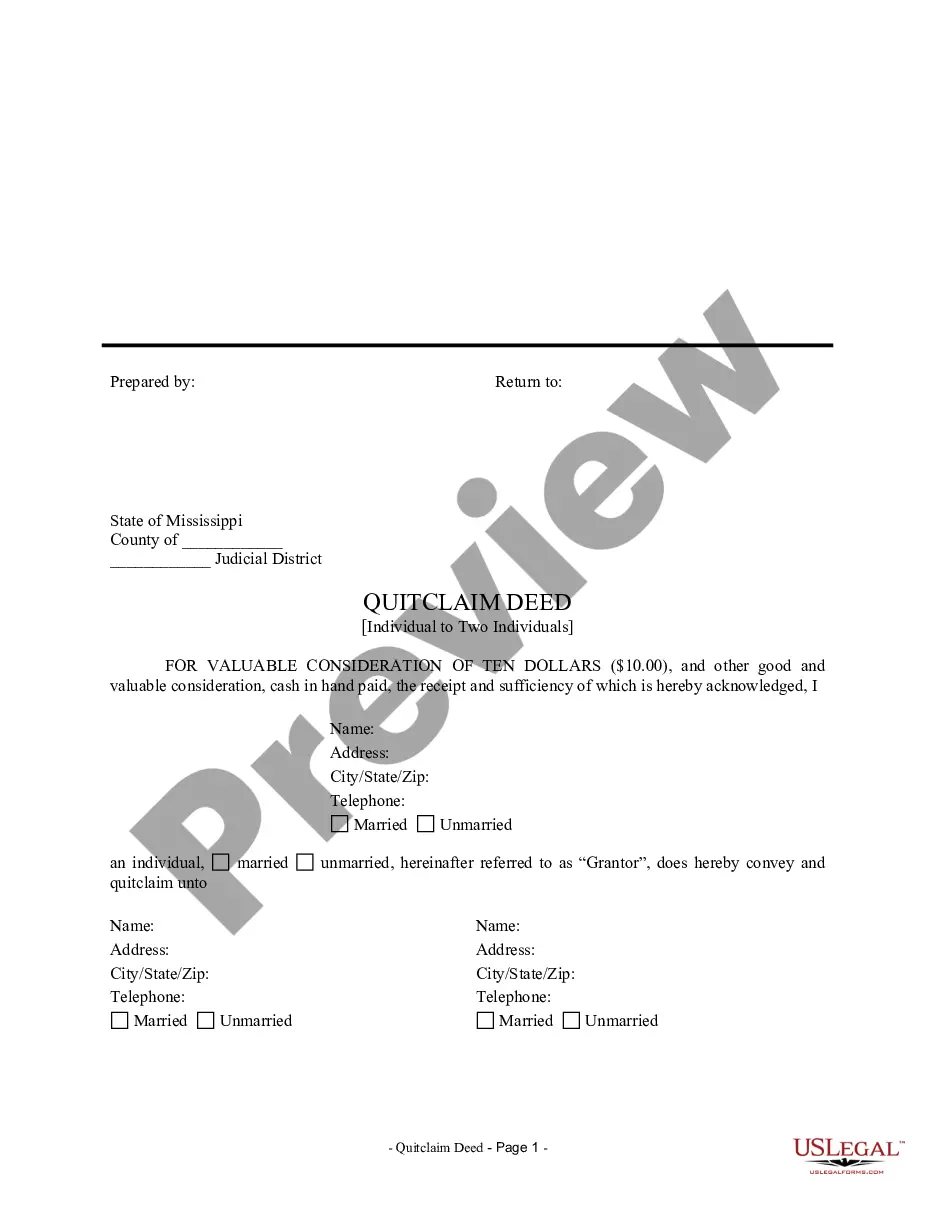

The Exemption Virginia Homestead Fort Worth displayed on this page is a versatile official template created by expert attorneys in accordance with federal and local regulations. For over 25 years, US Legal Forms has furnished individuals, enterprises, and legal practitioners with more than 85,000 validated, state-specific documents for any commercial and personal circumstance. It’s the quickest, simplest, and most reliable method to acquire the forms you require, as the service ensures bank-grade data protection and anti-malware safeguards.

Acquiring this Exemption Virginia Homestead Fort Worth will require just a few straightforward steps.

Register with US Legal Forms to have authenticated legal templates for all of life's situations at your fingertips.

- Search for the document you need and examine it. Browse through the sample you looked for and preview it or check the form description to confirm it meets your needs. If it doesn't, use the search feature to locate the correct one. Click Buy Now once you have identified the template you want.

- Register and Log In. Choose the pricing option that fits you and create an account. Use PayPal or a credit card to make a quick payment. If you already possess an account, Log In and verify your subscription to proceed.

- Acquire the fillable template. Select the format you prefer for your Exemption Virginia Homestead Fort Worth (PDF, DOCX, RTF) and save the document on your device.

- Fill out and sign the document. Print the template to fill it out manually. Alternatively, use an online versatile PDF editor to swiftly and accurately complete and sign your form with a legally-binding electronic signature.

- Download your paperwork once again. Access the same document again whenever necessary. Open the My documents tab in your profile to redownload any forms previously purchased.

Form popularity

FAQ

The first optional homestead exemption commissioners approved excludes 10% of a home's appraised value from taxation by the county. That means residents will see an average decrease of about $68 in the property taxes they owe to the county.

The Virginia homestead exemption also allows individuals to deduct an additional $5,000 in real or personal property (including cash), or $10,000 if the debtor is 65 or older. This exemption type is often called a "wildcard" exemption.

Virginia homestead laws allow residents to designate up to $5,000 worth of real estate (including mobile homes) as a homestead, plus $500 for each dependent. If a resident is sixty-five years of age or older, or a married couples files for an exemption together, up to $10,000 may be exempted under the homestead laws.

A homestead exemption is available to any homeowner who qualifies. An exemption is also available for those who are age 65 or older. Others who qualify for an exemption are homeowners with disabilities, disabled veterans or the survivors of disabled veterans or veterans who were killed while on active duty. ...

The Virginia homestead exemption allows you to protect a small amount of equity in your home if you file for bankruptcy.