Gift Deed Format For Nri

Description

How to fill out Virginia Deed Of Gift - Husband And Wife Or Two Individuals To Indvidual?

The Gift Deed Template For Nri you find on this webpage is a reusable official format created by expert attorneys in accordance with national and local laws.

For over 25 years, US Legal Forms has supplied individuals, companies, and legal professionals with more than 85,000 authenticated, state-specific documents for any commercial and personal event. It is the fastest, most uncomplicated, and most reliable method to acquire the paperwork you require, as the service assures bank-level data security and anti-malware safeguards.

Select the format you desire for your Gift Deed Template For Nri (PDF, Word, RTF) and download the sample onto your device.

- Explore the document you require and examine it.

- Search through the example you looked for and preview it or check the form description to ensure it meets your requirements. If it does not, utilize the search bar to find the appropriate one. Click Buy Now when you have found the template you need.

- Register and Log In.

- Choose the payment plan that fits you and create an account. Use PayPal or a credit card for a swift payment. If you already possess an account, Log In and verify your subscription to proceed.

- Acquire the editable template.

Form popularity

FAQ

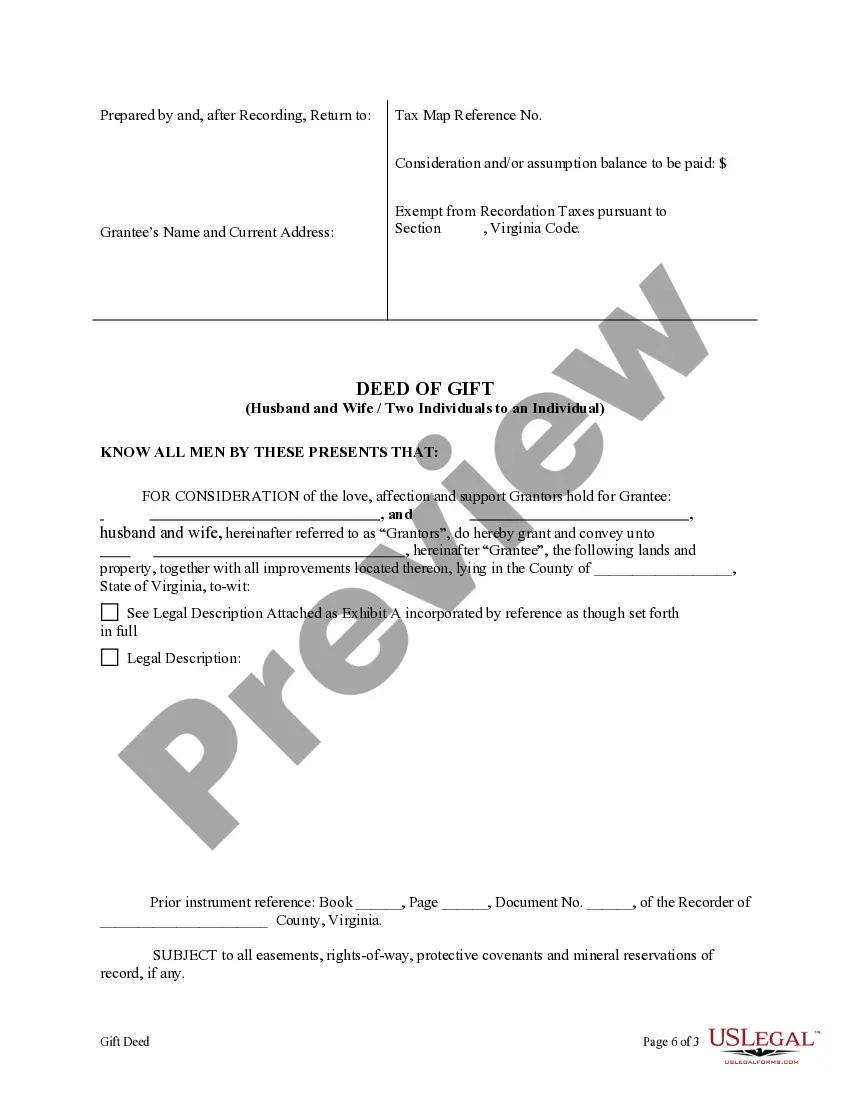

The format of a gift deed typically includes sections for the title, details of the donor and recipient, a description of the property, and declarations of intent. It should also outline any terms and conditions associated with the gift. Utilizing a reliable platform like USLegalForms can provide you with a comprehensive gift deed format for NRI, simplifying the documentation process.

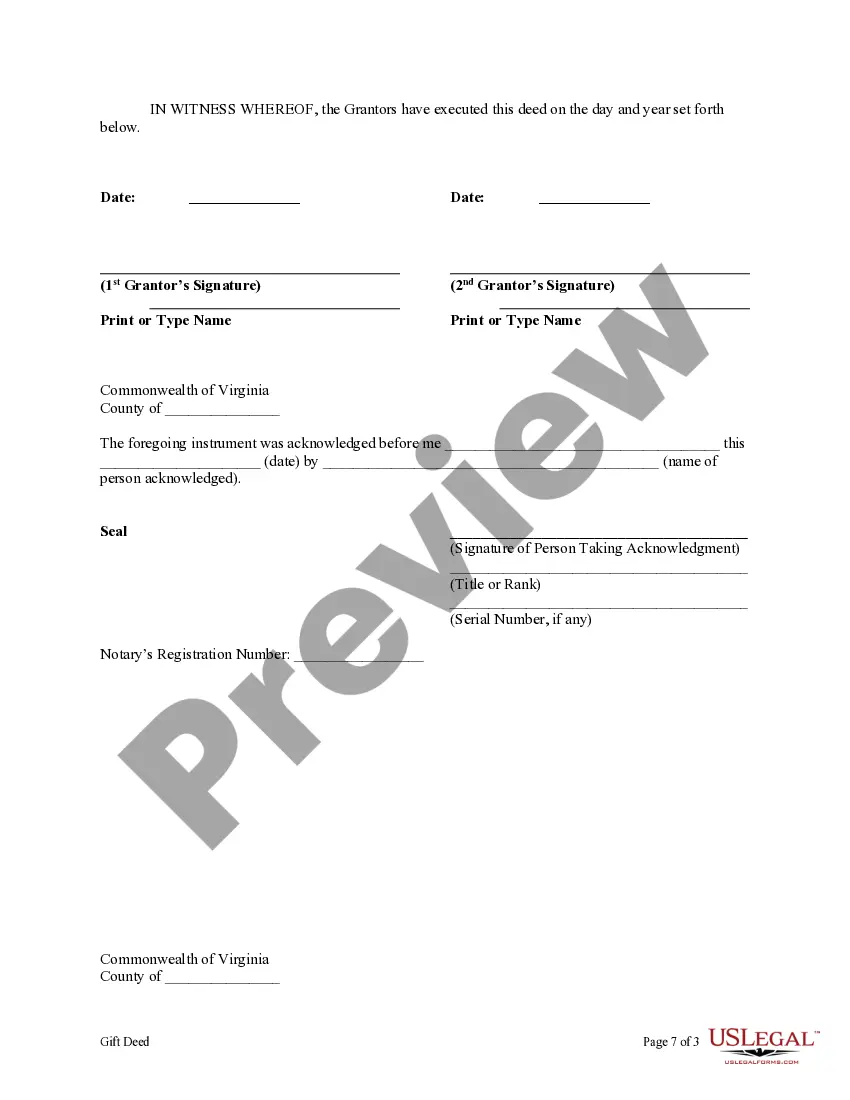

To create a gift deed for property in India, begin by drafting the document with clear details of the donor, recipient, and the property involved. Use a gift deed format for NRI to ensure that it meets legal standards and includes all essential elements, such as consideration and the intent to gift. After preparing the deed, it is crucial to have it signed by both parties in the presence of witnesses for legal validity.

Common mistakes in gift deeds include failing to mention the donor and recipient's details accurately and not specifying the property being gifted. Often, individuals overlook the need for witness signatures, which can invalidate the deed. Using a standardized gift deed format for NRI can help avoid these pitfalls by ensuring that all necessary information is included.

Yes, an Indian resident can give a gift to a Non-Resident Indian (NRI). However, it is essential to follow the legal requirements stipulated by Indian law. This includes using a proper gift deed format for NRI that documents the transaction clearly. It is advisable to consult legal experts to ensure compliance with all regulations.

The gift received is not taxable if the donee is a relative as defined in the income tax act, which includes a spouse, siblings, children, linear ascendants and descendants of the donee, etc.In case the shares are gifted to someone other than relatives as mentioned in the Income Tax Act, the same is tax-exempt if the ...

Draft of a gift deed must include the following details: Place and date on which the gift deed is to be executed. Relevant information on gift deed regarding the donor and the donee, such as their names, address, relationship, date of birth and signatures.

Gift From Father to daughter under Income Tax Act,1961 Gifts from the father to daughter are tax-free, regardless of the amount. A parent would be considered a ?relative,?; thus, a gift from a father to a daughter will not be taxed in his hands as income.

As per the Union Budget 2023-24, any monetary gift above ?50,000 received by a non-ordinarily resident from a resident Indian would be deemed to arise in India and taxable from April 1, 2024. Gifts from a Resident Indian to an NRI can only be sent to their NRO Account.

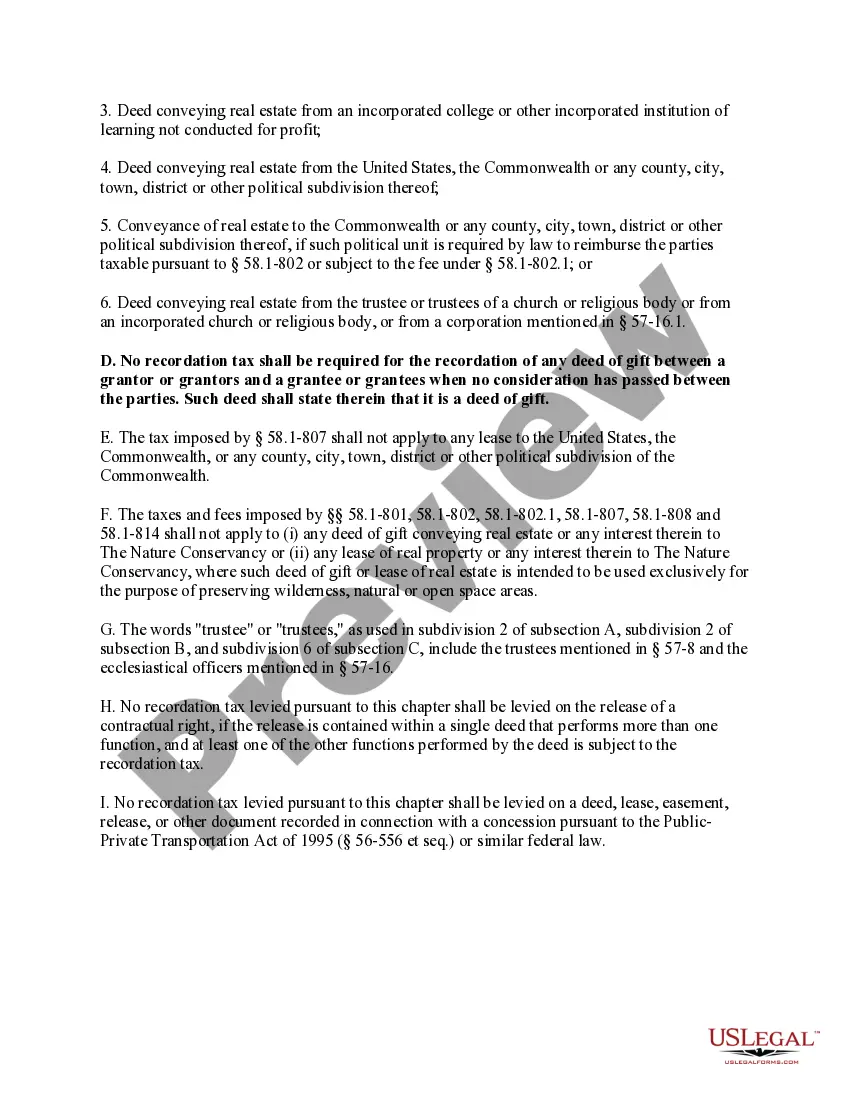

An NRI gift deed is a legal document required under Section 17 of the Registration Act of 1908. It is formulated when an NRI donor wants to give a gift to someone. The gift deed is a formal agreement between the donor and the receiver and must be printed on stamp paper.