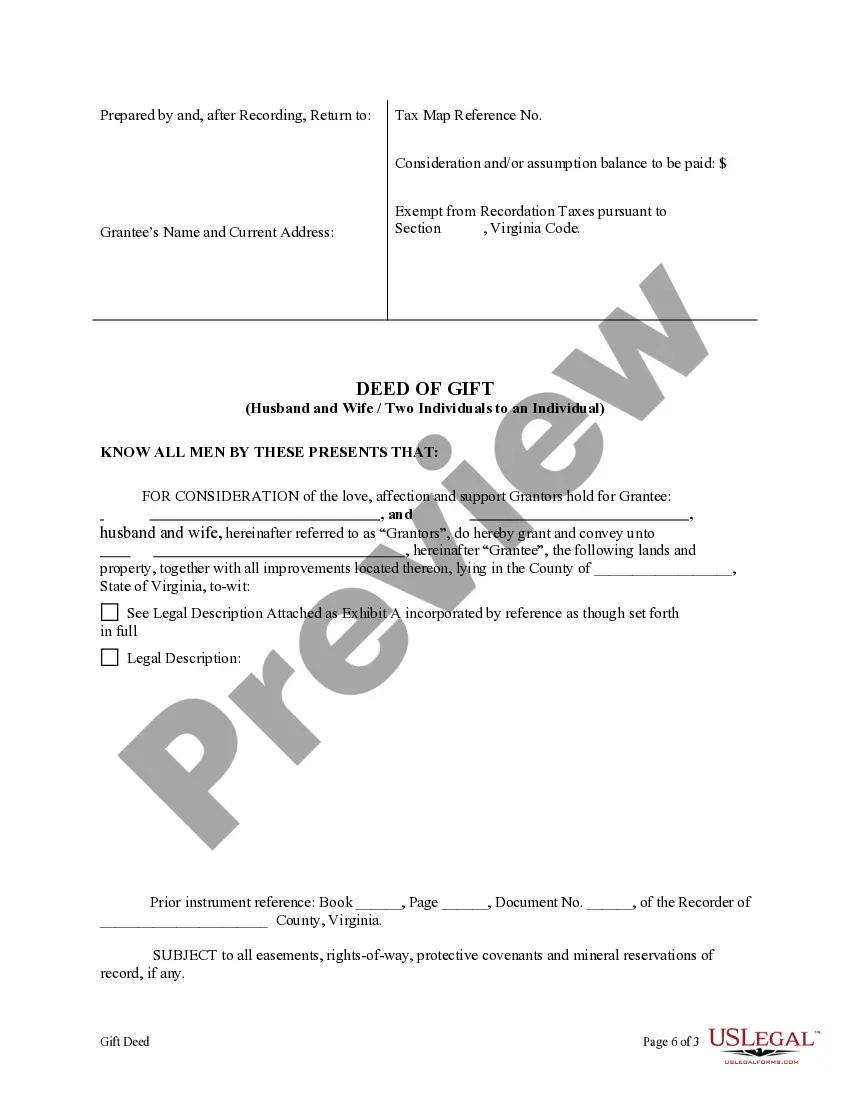

Gift Deed Format For Immovable Property

Description

How to fill out Virginia Deed Of Gift - Husband And Wife Or Two Individuals To Indvidual?

The Donation Agreement Format For Real Estate you observe on this page is a versatile official template created by expert attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has supplied individuals, entities, and legal practitioners with over 85,000 confirmed, state-specific documents for any commercial and personal situation. It’s the quickest, easiest, and most reliable method to acquire the documentation you require, as the service ensures the utmost level of data protection and anti-malware safeguards.

Subscribe to US Legal Forms to have authenticated legal templates for all of life’s situations at your fingertips.

- Search for the document you need and examine it.

- Browse through the file you searched and preview it or evaluate the form description to confirm it meets your needs. If it doesn’t, utilize the search bar to locate the correct one. Click Buy Now once you have discovered the template you require.

- Subscribe and Log In.

- Select the pricing plan that best fits you and create an account. Use PayPal or a credit card for swift payment. If you already possess an account, Log In and review your subscription to continue.

- Obtain the editable template.

- Choose the format you desire for your Donation Agreement Format For Real Estate (PDF, DOCX, RTF) and download the sample to your device.

- Fill out and sign the documentation.

- Print the template to complete it by hand. Alternatively, utilize an online multi-functional PDF editor to quickly and accurately fill out and sign your form with an electronic signature.

- Download your documents again.

- Use the same document again whenever necessary. Access the My documents tab in your profile to re-download any previously acquired forms.

Form popularity

FAQ

A gift deed of immovable property is a legal document that facilitates the transfer of ownership of real estate as a gift, without any payment involved. This type of deed specifies the property being transferred and outlines the intentions of the donor. It is essential to use the correct gift deed format for immovable property to ensure the transaction is legally binding and recognized. To avoid complications, consider using US Legal Forms for access to templates and expert advice on drafting your gift deed.

The format of a gift deed typically includes essential details such as the donor's and recipient's names, property description, and the statement of intent to gift. It is crucial to follow a specific gift deed format for immovable property to ensure validity and compliance with local laws. Additionally, the deed should be signed by both parties and ideally witnessed to prevent any future disputes. To simplify this process, you can find reliable templates on US Legal Forms that guide you through the necessary steps.

To transfer a property to a family member, using a gift deed is often the most effective approach. This legal document allows you to transfer ownership without a sale, ensuring that the property remains within the family. When drafting the gift deed, you should follow the proper gift deed format for immovable property to ensure it meets legal requirements. Consider using platforms like US Legal Forms to access templates and guidance, making the process quicker and easier.

There is no set gift deed format in Pakistan. Generally, when someone bequeaths their property to a loved one, the deed mentions that the gift was made voluntarily and without any coercion. It also clarifies the donor is not bankrupt and won't ever ask for the gift to be returned.

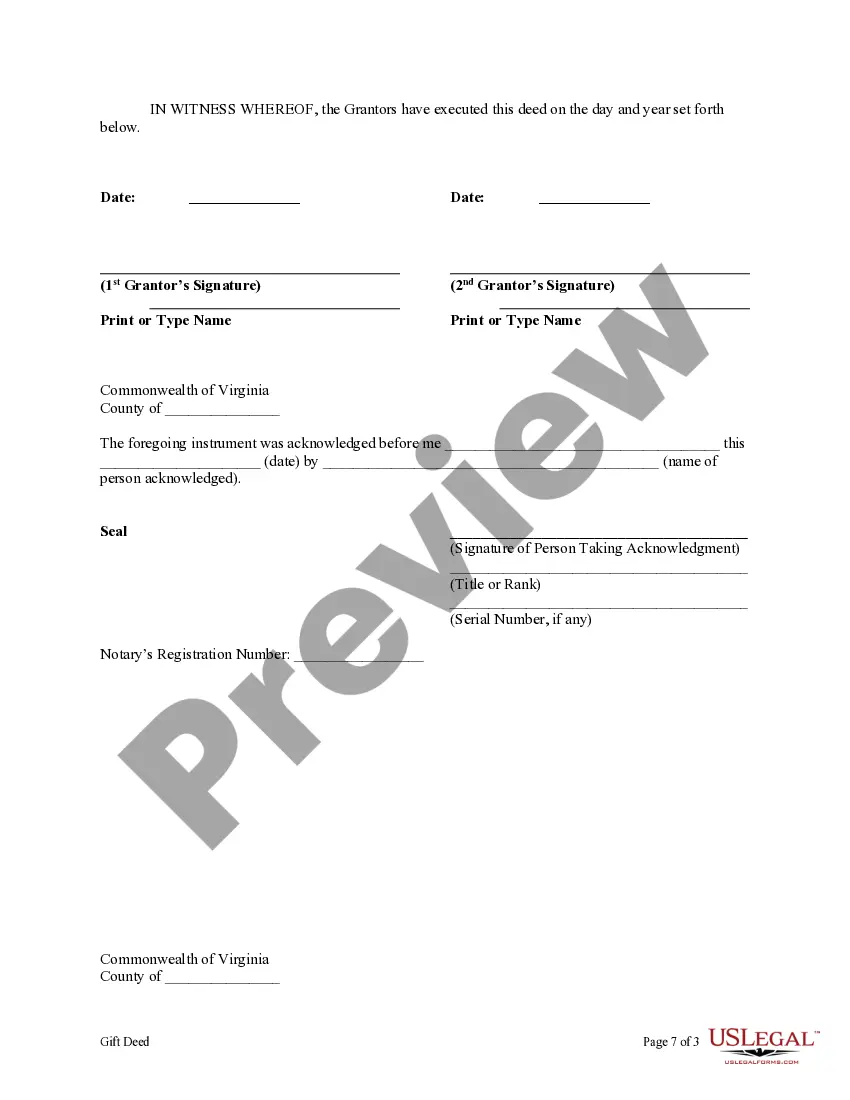

Transfers of real property must be in writing and notarized. Deeds should be recorded in the county where the property is located. To ensure a legal change to the property title, you'll want the services of an attorney. A qualified attorney will prepare and file the real estate transfer deed.

Gift deeds in Texas are valid; however, there are strict requirements for gift deeds in Texas. Therefore, if you have a document that might be a gift deed or if someone is claiming they have a gift deed to a property that should be yours, you should contact an attorney as soon as possible.

The Gift Deed needs to be in writing. It must include the full name of the current owner and the full name, mailing address and vesting of the new owner. The property needs to be properly described.

However, Texas does not impose a gift tax on transfers of real estate between family members nor is there a capital gains tax in Texas, so you may only be liable for federal taxes. When transferring a house after death through a will or trust, estate taxes may come into play.