Gift Deed Format For Cash

Description

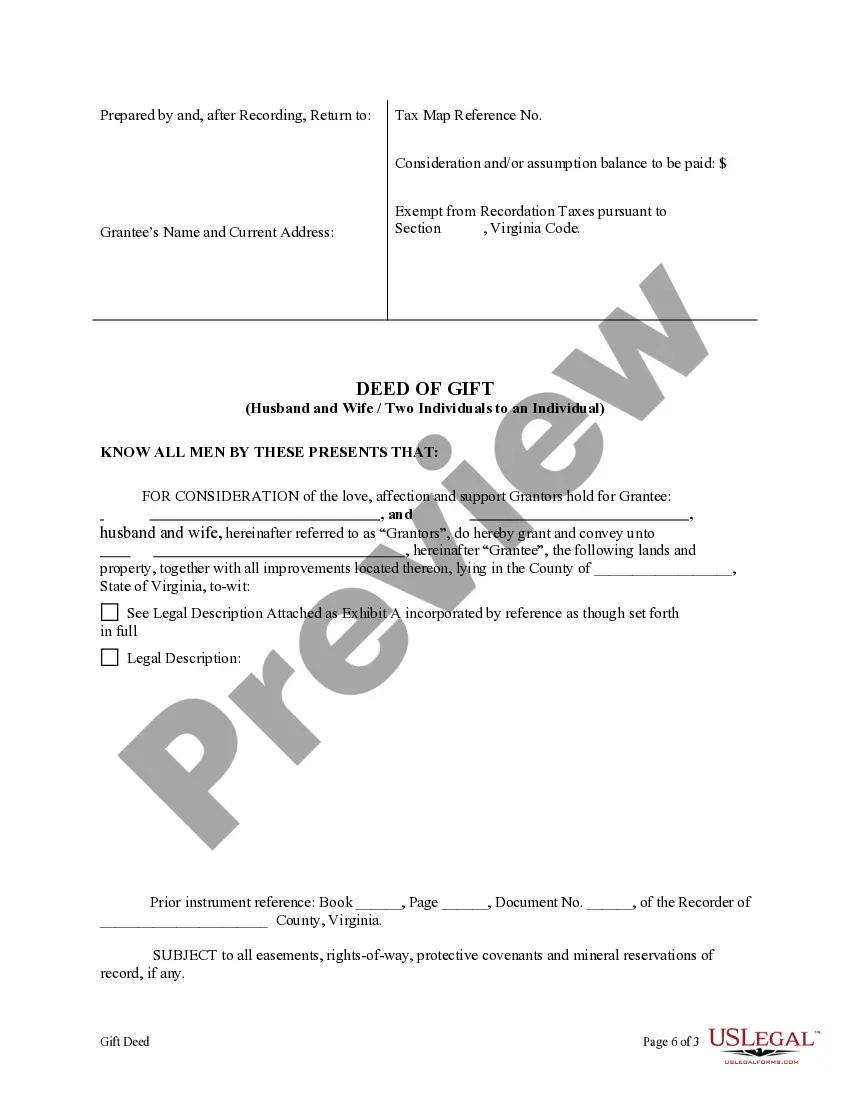

How to fill out Virginia Deed Of Gift - Husband And Wife Or Two Individuals To Indvidual?

It’s well-known that you cannot instantly become a legal authority, nor can you swiftly learn how to draft a Gift Deed Format For Cash without possessing a specific skill set.

Producing legal documents is a lengthy endeavor that necessitates particular education and abilities. So why not entrust the development of the Gift Deed Format For Cash to the professionals.

With US Legal Forms, one of the most extensive repositories of legal templates, you can locate everything from court documents to formats for internal corporate communication.

Begin your search anew if you require a different template.

Establish a free account and choose a subscription plan to obtain the template. Click Buy now. Once the payment is completed, you can download the Gift Deed Format For Cash, complete it, print it, and send or mail it to the relevant individuals or entities.

- We understand the significance of compliance and adherence to federal and local laws and regulations.

- That’s why, on our platform, all forms are geographically specific and current.

- Here’s how you can initiate your experience with our website and acquire the document you need in just a few minutes.

- Find the form you require using the search bar located at the top of the page.

- Preview it (if this option is available) and review the accompanying description to ascertain if the Gift Deed Format For Cash meets your needs.

Form popularity

FAQ

To display cash as a gift, consider using a gift deed format for cash, which adds a formal touch to your present. You can present the cash within a card or a decorative envelope, alongside the deed. This way, the recipient understands the intent behind the gift, and it adds a personal touch. For creating a stylish and accurate gift deed, US Legal Forms offers templates that simplify the process.

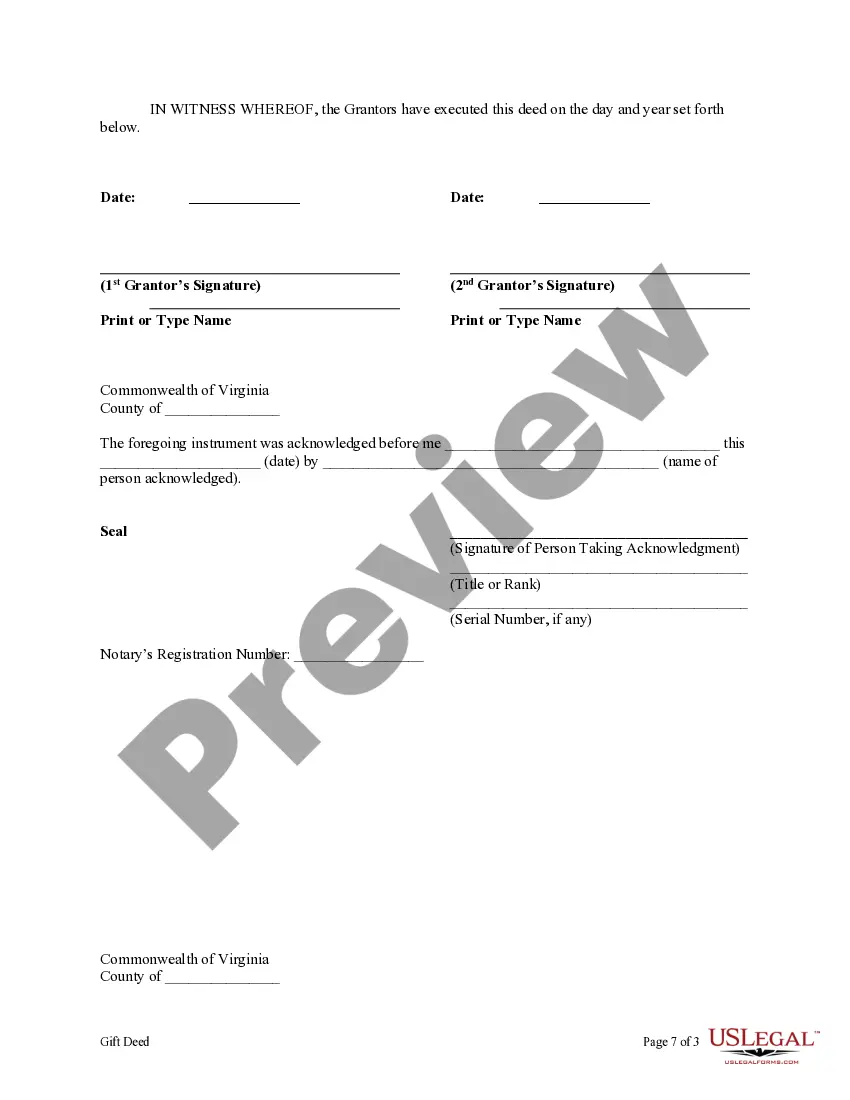

Common mistakes in gift deeds include insufficient detail and lack of signatures. It is crucial to include all relevant information like the amount, date, and full names of both parties. Additionally, failing to notarize the document can lead to issues later. To avoid these pitfalls, consider utilizing the gift deed format for cash available on US Legal Forms, ensuring all requirements are met.

To document a cash gift, you should create a gift deed format for cash. This document should clearly state the details of the transaction, including the names of the giver and recipient, the amount given, and the date. Additionally, both parties should sign the deed to validate the transaction. Using a reliable platform like US Legal Forms can help you generate a professional gift deed format for cash efficiently.

To declare cash gifts from parents, you should document the gift using a formal written agreement. Utilizing a gift deed format for cash can simplify this process, ensuring all necessary details are included. It’s also important to report these gifts on your tax returns, as the IRS has specific thresholds for gift tax exemptions. This proactive approach will help you avoid any future complications.

Yes, in many cases, a stamp paper is required for a cash gift deed to ensure it holds legal standing. The gift deed format for cash should be executed on the appropriate value of stamp paper as per your state’s laws. This requirement helps in validating the transaction and providing legal protection to both parties involved. Always verify your local regulations to ensure compliance.

The documentation for a cash gift typically includes a written agreement detailing the specifics of the transaction. A gift deed format for cash should include the giver’s and receiver’s names, gift amount, and the date of the gift. Additionally, you may want to include a statement indicating that the gift is made without any expectation of repayment. Keeping this documentation organized will help you manage any potential tax implications.

Documenting a cash gift involves creating a written record that clearly outlines the details of the gift. You can use a gift deed format for cash to specify the amount, date, and the relationship between the giver and receiver. It's also wise to keep a copy for your records, along with any relevant correspondence. This documentation can be useful for tax purposes and in case of future disputes.

In many states, using stamp paper for a gift deed is necessary to comply with legal requirements. The gift deed format for cash may need to be printed on a specific value of stamp paper to be considered valid. It's crucial to check your state's regulations, as the requirements can vary. Using the right stamp paper will help ensure that your gift deed is legally enforceable.

Yes, recording a deed of gift can be beneficial, especially if it involves real property. By recording the gift deed format for cash, you establish a public record that protects the rights of both the donor and the recipient. This can prevent disputes over ownership in the future. Additionally, some states may require recording to ensure legal validity.