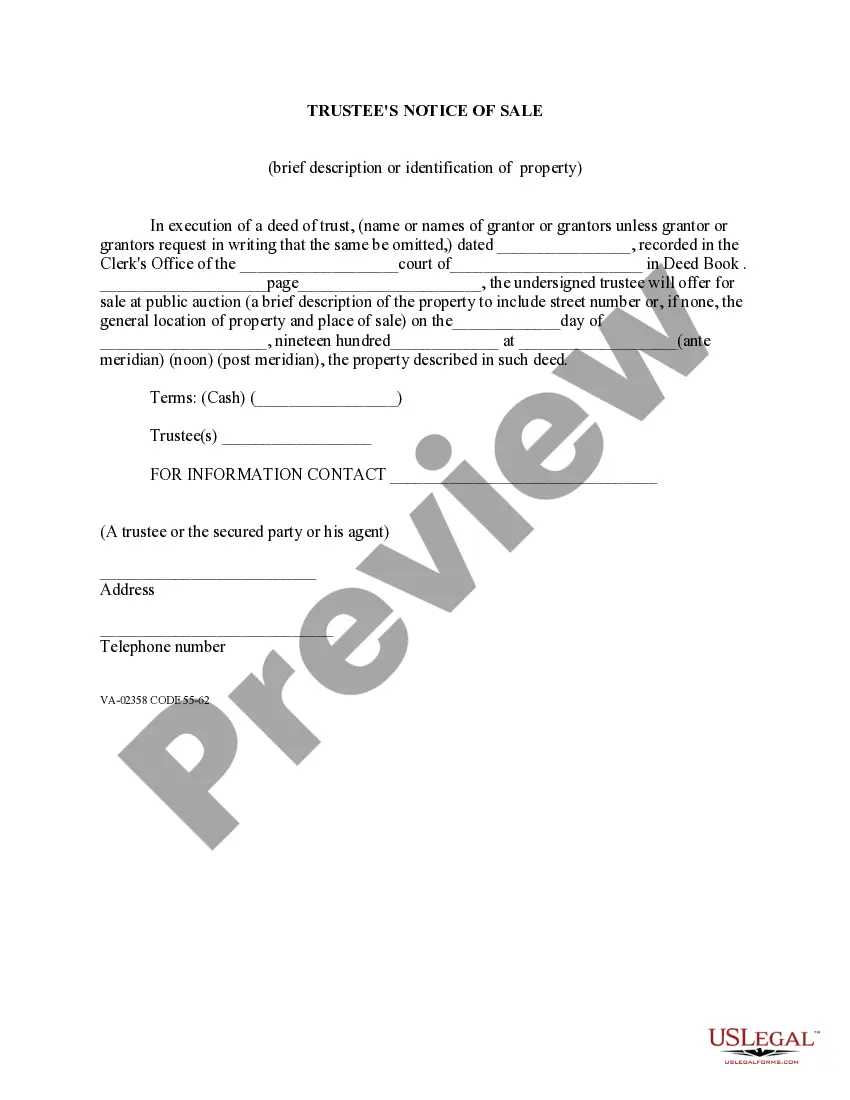

This is a sample form for use in Virginia property matters, a Permissible Form for Notice of Sale under Deed of Trust. Available in Word, Word Perfect and Rich Text formats.

Notice Deed Trust Without Consideration

Description

How to fill out Notice Deed Trust Without Consideration?

Bureaucracy demands meticulousness and correctness. If handling documentation like Notice Deed Trust Without Consideration is not part of your daily routine, it might lead to some confusion.

Selecting the appropriate sample from the outset will guarantee that your form submission proceeds seamlessly, avoiding any hassles of resubmitting a document or starting the entire process from the beginning. The correct sample for your paperwork can always be sourced from US Legal Forms.

US Legal Forms is the largest online repository of forms, housing over 85 thousand templates across various fields. To find the most recent and relevant version of the Notice Deed Trust Without Consideration, simply search on the website. Store, download, and manage templates within your profile, and review the descriptions to ensure you have the suitable one available.

Locating the correct and current samples for your documents is just a matter of minutes with a US Legal Forms account. Eliminate bureaucratic uncertainties and simplify your paperwork.

- With a US Legal Forms account, acquiring, consolidating, and navigating the templates you save can be done in just a few clicks.

- On the site, click the Log In button to Log In.

- Afterward, go to the My documents section, where your form history is maintained.

- Review the form descriptions and download those needed at any time.

- If you are not a subscribed user, locating the desired template will require a few additional steps.

- Find the template using the search function.

- Ensure that the Notice Deed Trust Without Consideration you found is suitable for your state or locality.

- View the preview or read the description with details on the template's usage.

- If the result corresponds with your search, click the Buy Now button.

- Select the right option from the offered pricing plans.

- Log Into your account or create a new one.

- Complete the transaction using a credit card or PayPal.

- Receive the form in your chosen format.

Form popularity

FAQ

Getting out of a trust deed involves a formal process, often requiring the consent of the beneficiaries or a court's approval. You might consider renegotiating terms or, in some cases, dissolving the trust altogether. If your situation involves a notice deed trust without consideration, seeking guidance from a legal professional can help you understand the best steps forward.

In the UK, not all heirs must agree to sell property, as the executor typically holds the authority to make that decision. However, if there are multiple heirs, disagreements can create challenges. If faced with a notice deed trust without consideration, it's crucial to navigate the sale process with due diligence and possibly seek professional advice to avoid disputes.

An executor can often sell property without unanimous approval from all beneficiaries in the UK, depending on the will's provisions. However, this may lead to conflicts among beneficiaries, especially if there are differing opinions about the sale. If you encounter a notice deed trust without consideration in this context, it can be beneficial to understand your rights and obligations.

In the UK, a trustee generally cannot remove a beneficiary from a trust without cause unless the trust document specifically grants that power. Removing a beneficiary can be complex and may require modifications to the trust itself. If you are dealing with a situation involving a notice deed trust without consideration, consulting a legal expert can provide clarity on your options.

To establish a valid trust deed, you typically need a clear intent to create the trust, properly identified beneficiaries, and a defined property. Documentation must be signed and, in many cases, legally recorded to assert its validity. It's worth noting how a notice deed trust without consideration can fit into these requirements, ensuring you meet all necessary criteria.

A deed of trust in California can be deemed invalid for various reasons, such as lack of a clear legal description of the property or the absence of essential signatures. Furthermore, if proper recording procedures are not followed, it can also be challenged. It's important to ensure compliance with all legal requirements to avoid issues, particularly if you have a notice deed trust without consideration.

One common mistake parents make when establishing a trust fund in the UK is not clearly defining the beneficiaries or purposes of the trust. This can lead to misunderstandings and potential legal disputes in the future. Additionally, failing to consider the implications of notice deed trust without consideration can create unnecessary complications down the line.

In the UK, a trustee may be able to sell property without the approval of all beneficiaries if the trust document allows for it. However, doing so could lead to disputes among beneficiaries, particularly if there is a disagreement about the sale. It's critical to review the terms of the trust to understand the limitations and requirements involved, especially if you have received a notice deed trust without consideration.

A notice deed trust without consideration typically requires certain conditions to be valid. These conditions include the intention of the grantor to convey the property, a clear description of the property, and the signature of the grantor. Additionally, the deed must be properly recorded to protect the interests of the parties involved. Understanding these requirements can help prevent future legal disputes.

A notice deed trust without consideration may still be valid, but it often depends on state laws. Generally, most states allow for deeds to be executed without consideration, meaning a property can be transferred as a gift. However, you must ensure that all legal requirements are met to avoid complications later. Consulting with a legal expert familiar with property law is advisable to understand your specific situation.