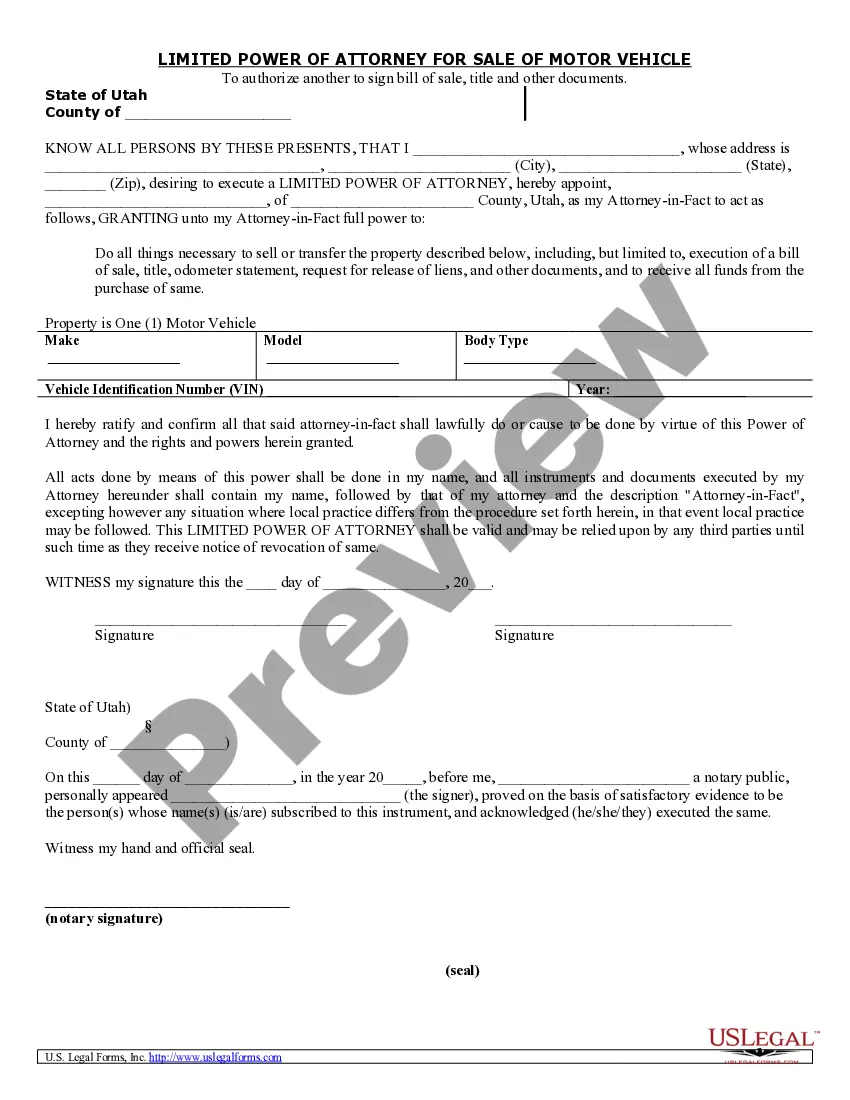

This is a limited power of attorney authorizing your agent to execute a bill of sale, title and other documents in connection with the sale of a motor vehicle. This form contains a state specific acknowledgment. This form allows your agent to do all things necessary to sell or transfer property, including the execution of a bill of sale, title, odometer statement, request for release of liens and other documents and to receive all funds from the purchase of the same.

Utah Poa For Vehicle Withholding

Description

Form popularity

FAQ

To get a power of attorney in Utah, you need to fill out a specific form that meets state requirements. This form allows you to appoint someone to manage your vehicle's withholding matters on your behalf. It is important to ensure that the form is properly signed and notarized to be valid. You can use USLegalForms as a reliable resource to find the necessary documents for creating a Utah POA for vehicle withholding.

To obtain a Utah withholding number, you must register with the Utah State Tax Commission. You have the option to apply online, by mail, or in person. During the registration process, you will provide necessary details about your business and its employees. Once registered, you can easily access forms related to your Utah POA for vehicle withholding needs.

Any corporation doing business in Utah must file a corporate tax return, regardless of whether they are based in the state. This requirement helps ensure proper tax compliance for all entities. If your corporation manages vehicles or utilizes the Utah poa for vehicle withholding, accurate reporting becomes even more vital. Uslegalforms can provide the necessary forms and instructions to ensure your filing is seamless.

The Utah sales tax exemption certificate allows certain purchases to be exempt from sales tax. Typically, this applies to specific entities like non-profits or businesses engaged in resale activities. If you're considering how this relates to the Utah poa for vehicle withholding, be sure to check applicable exemption rules to maximize your savings. Resources on uslegalforms can offer clarity on how to properly fill out these certificates.

Yes, Utah usually requires estimated tax payments if you expect to owe more than a certain amount after withholding. This requirement can apply to self-employed individuals or those with additional income streams. Understanding your obligations, especially in relation to the Utah poa for vehicle withholding, is crucial to avoid penalties. Platforms like uslegalforms can assist with the forms and calculations needed.

In Utah, you generally cannot register a car to a PO box. The registration process requires a physical address for verification purposes. However, if you are using the Utah poa for vehicle withholding, consider maintaining updated records to facilitate any correspondence related to the vehicle. For comprehensive guidance, check out uslegalforms.

Gifting a vehicle in Utah involves completing a few simple steps. First, you need to ensure the title is signed over to the recipient. Additionally, when providing the Utah poa for vehicle withholding to manage the vehicle's title transfer, you may need to file paperwork with the Department of Motor Vehicles. Utilize uslegalforms for templates that help navigate the gifting process smoothly.

The tax amendment form for Utah is typically required when you need to correct a previously filed tax return. This form allows you to amend your income tax details to reflect accurate information. When filling out your amendment, consider how the Utah poa for vehicle withholding may impact your tax situation. Using platforms like uslegalforms can guide you through the process with the necessary forms.

To obtain a Utah state withholding number, you must register your business with the Utah State Tax Commission. This process usually involves filling out the appropriate forms and providing details about your business. If you need assistance, US Legal Forms can be a valuable resource, especially when addressing the nuances of Utah poa for vehicle withholding.

The Utah state tax withholding rate varies based on income levels and specific circumstances. Generally, the state offers a sliding scale for withholding to accommodate different income brackets. For clarity on your individual situation, especially related to Utah poa for vehicle withholding, consider consulting resources from US Legal Forms.