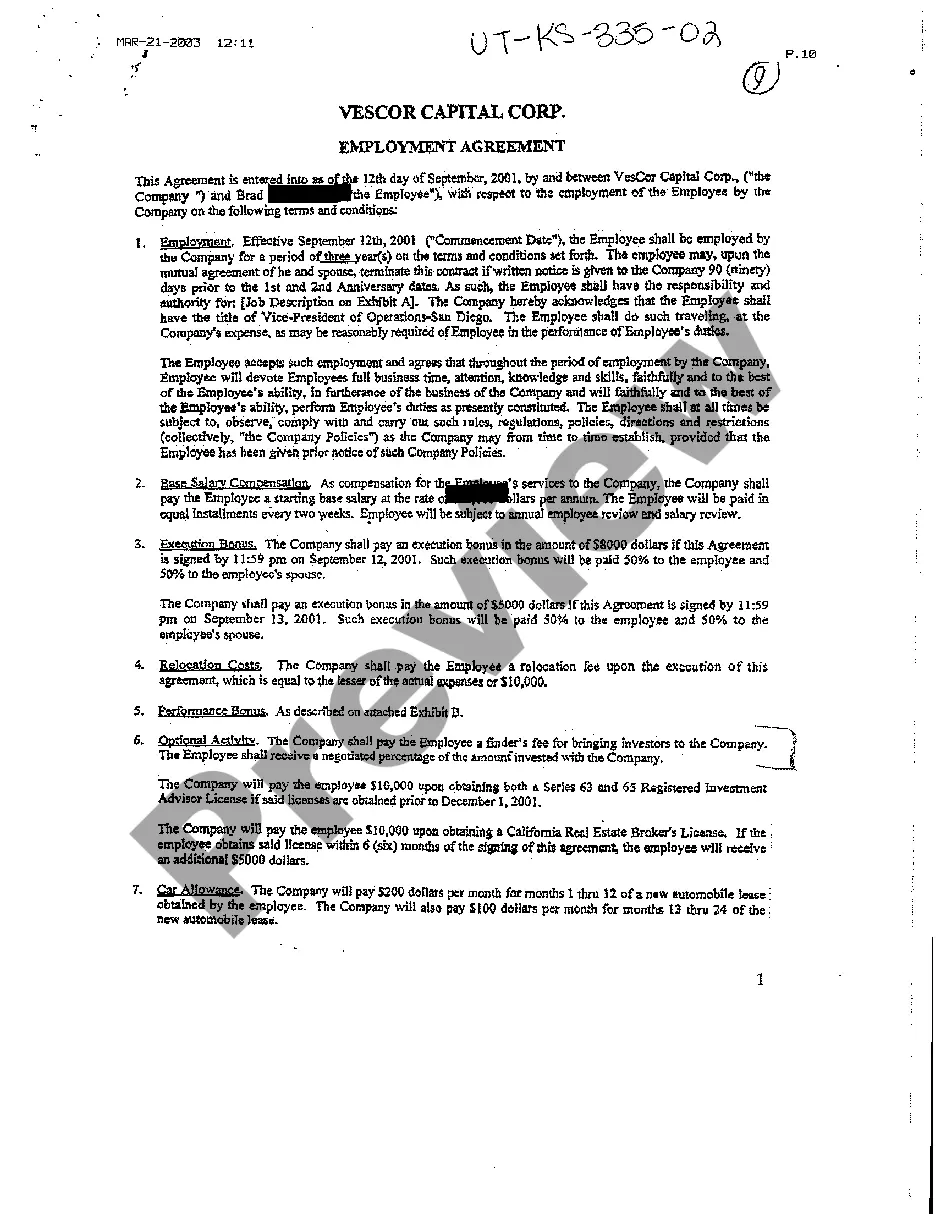

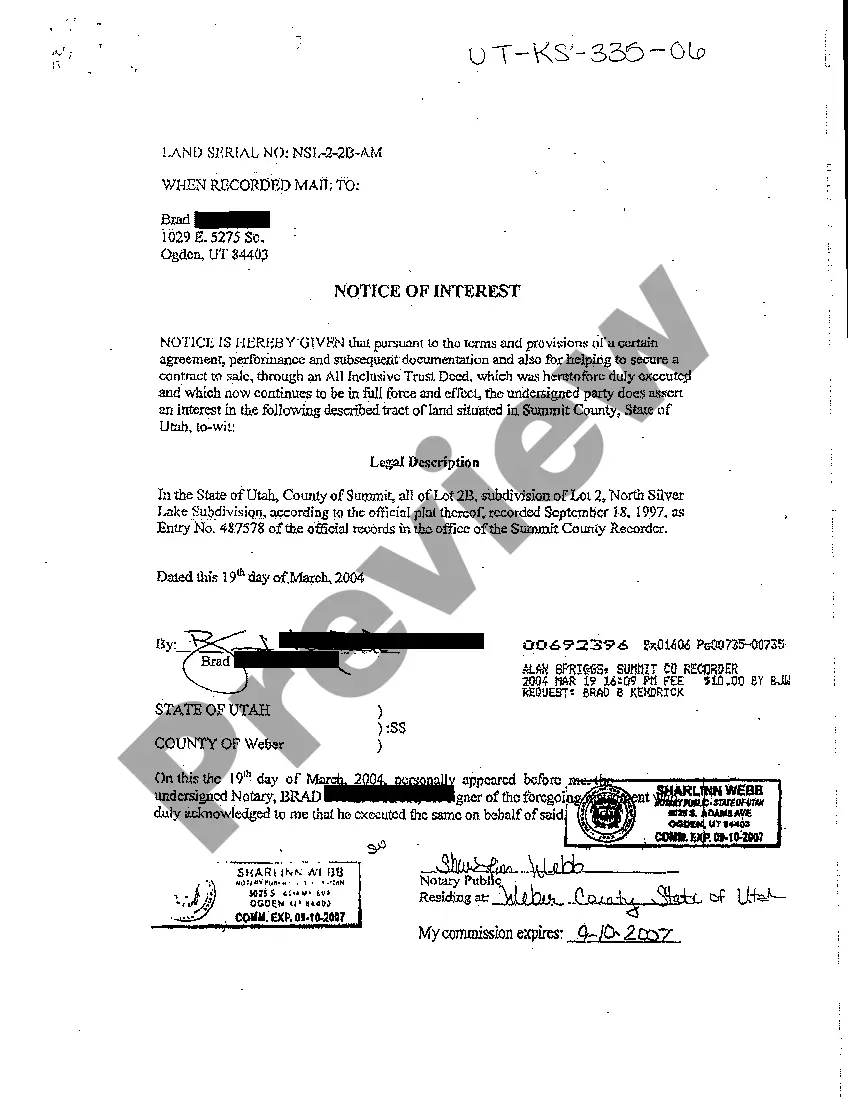

Notice Of Interest Within 30 Days

Description

How to fill out Utah Notice Of Interest In Property By Respondent?

Managing legal matters can be maddening, even for the most seasoned professionals.

When you are seeking a Notice of Interest Within 30 Days and lack the time to dedicate to finding the accurate and current version, the procedures can become overwhelming.

Access a repository of articles, guides, and resources related to your situation and needs.

Save time and energy searching for the documents you require, and use US Legal Forms’ advanced search and Preview tool to find Notice of Interest Within 30 Days and download it.

Leverage the US Legal Forms web library, supported by 25 years of experience and reliability. Streamline your daily document management into a simple and intuitive process today.

- If you have a monthly subscription, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to see the documents you have previously downloaded and to manage your folders as you wish.

- If it's your first time using US Legal Forms, create an account and enjoy unlimited access to all the advantages of the library.

- Here are the steps to take once you have the form you need.

- Ensure this is the correct form by previewing it and reviewing its details.

- Confirm that the sample is valid in your state or county.

- Select Buy Now when you are prepared.

- Choose a monthly subscription plan.

- Select your desired file format and Download, complete, sign, print, and submit your document.

- Access state- or county-specific legal and organizational forms.

- US Legal Forms addresses any requirements you may have, from personal to business documents, all in a single location.

- Utilize sophisticated tools to complete and oversee your Notice of Interest Within 30 Days.

Form popularity

FAQ

How to Write a Penalty Abatement Request Letter Record Your Information and the Penalty Information. ... State an Explicit Request for an IRS Penalty Abatement and Appeal. ... Explain the Facts. ... Cite any Applicable Laws. ... Apply the Law to the Facts. ... Request for Next Action. ... Include Signature, Attestations, and Attachments.

If you receive a Form 1099-R and do not report the distribution on your tax return, the IRS will likely send you a CP2000, Underreported Income notice. This IRS notice will propose additional tax, penalties and interest on your distributions and any other unreported income.

To pay the penalties on CP162, you can use the IRS's EFTPS system or mail a check to the IRS address printed on the notice. If you pay the penalties, you can still request abatement. The IRS issues refunds when it abates penalties retroactively.

How do I complete abatement form 843? Line 1 is the tax year the abatement is for. Line 2 is the total fees/penalties you are asking the IRS to remove. Line 3 is generally going to be Income (tax). Line 4 is the Internal Revenue Code section. ... Line 5a is the reason you are requesting the abatement.

Examples of valid reasons for failing to file or pay on time may include: Fires, natural disasters or civil disturbances. Inability to get records. Death, serious illness or unavoidable absence of the taxpayer or immediate family.