Small Estate Affidavit Form Michigan

Description

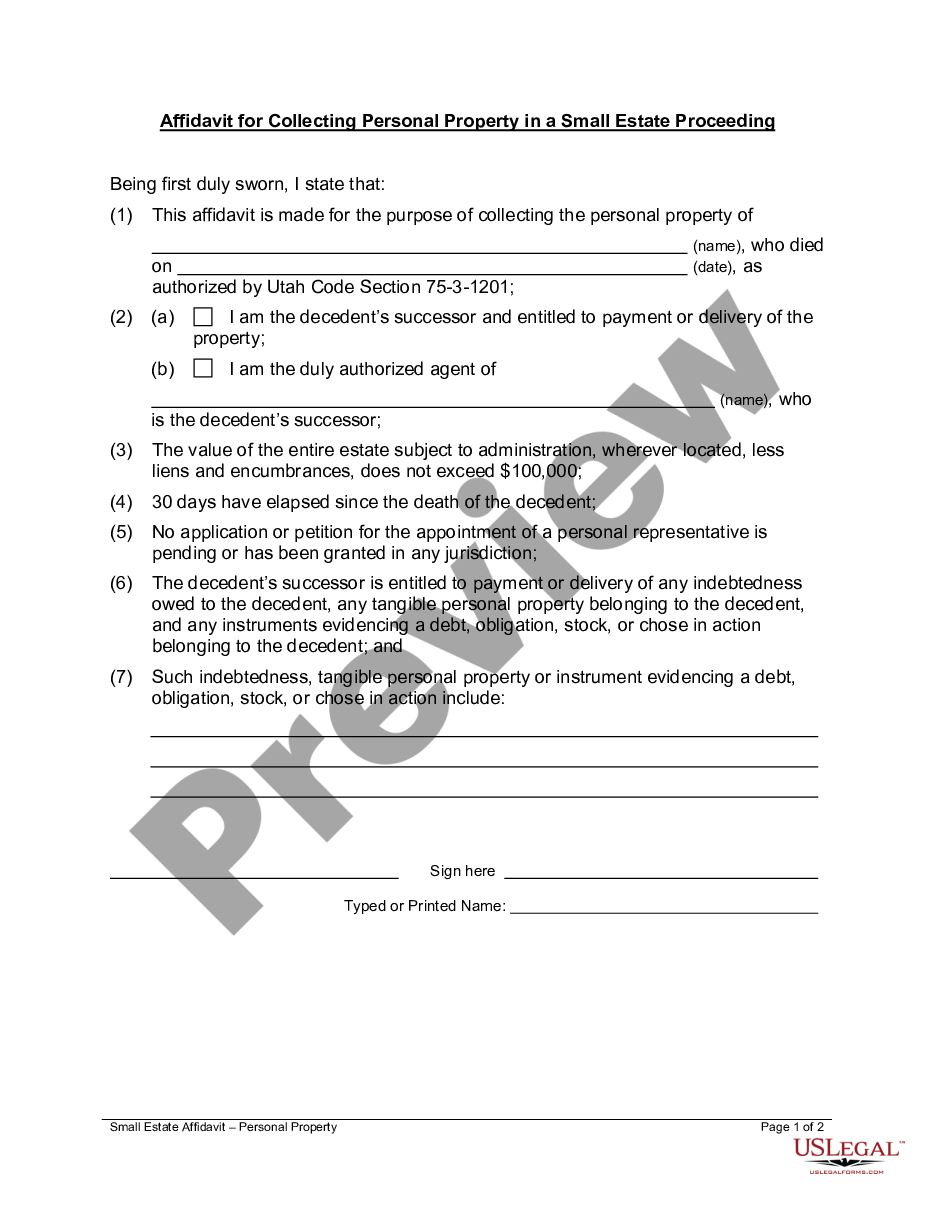

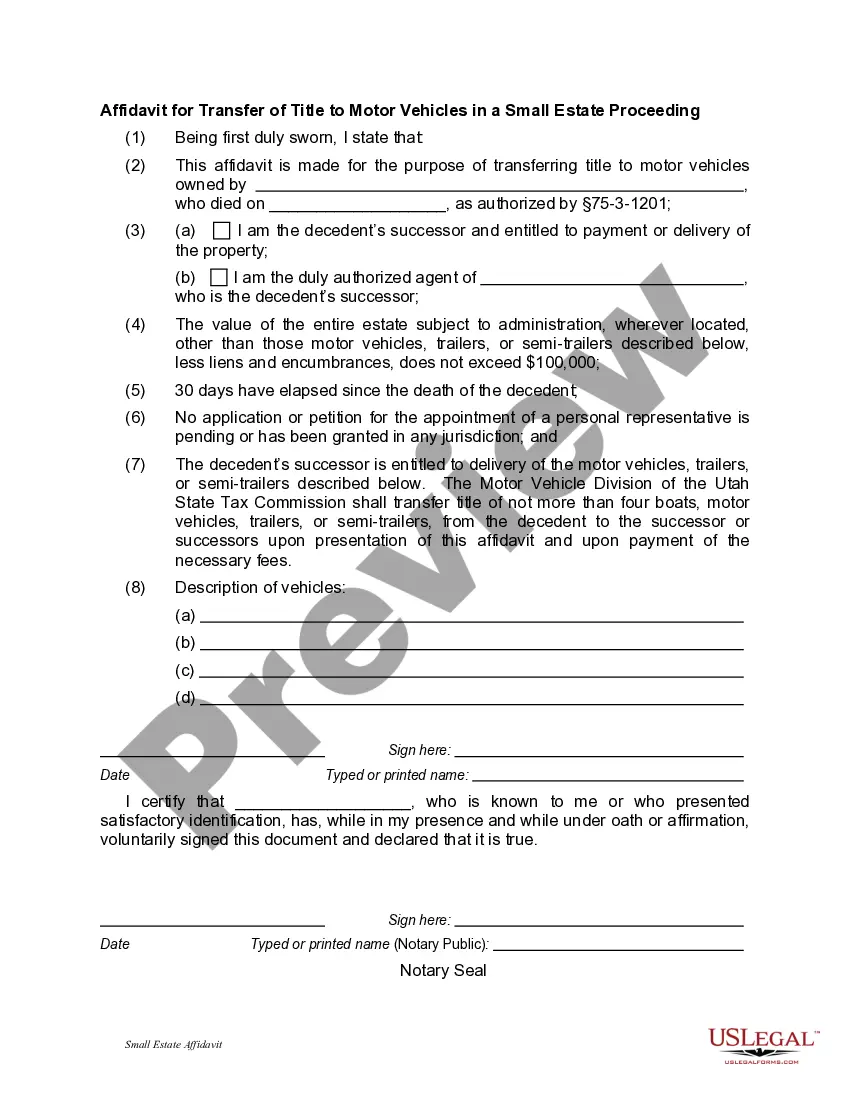

How to fill out Utah Small Estate Heirship Affidavit For Estates Under 100,000?

- Log into your US Legal Forms account to access your saved documents and start your order.

- If you're using the service for the first time, preview the form descriptions to ensure you select the proper Small estate affidavit form for Michigan that meets your needs.

- In case the desired form is not available, utilize the search feature to explore other templates pertinent to your specific requirements.

- Purchase the selected document by clicking the 'Buy Now' button and choosing the subscription plan that suits you best.

- Complete your transaction by entering your credit card details or linking your PayPal account for payment.

- Once the payment is confirmed, download your completed form directly to your device for easy access and future use.

In conclusion, US Legal Forms streamlines the entire process, offering a vast library of over 85,000 legal forms that ensure users can find exactly what they need without hassle. With the added benefit of expert support, you can be confident that your documents are accurate and legally binding.

Start your hassle-free experience today and access the Small estate affidavit form Michigan with US Legal Forms!

Form popularity

FAQ

If probate is not filed, the estate may face significant complications, potentially leading to legal disputes among heirs. Assets could remain unaccounted for, and rightful heirs may not receive their inheritance. Engaging with efficient solutions, such as the Small estate affidavit form Michigan, can prevent these issues by allowing a straightforward transfer of assets without formal probate.

Those who inherit from the estate usually bear the costs associated with probate in Michigan. This includes court fees, attorney expenses, and any other administrative costs. In some cases, estate funds cover these expenses before distribution. When dealing with a small estate, the Small estate affidavit form Michigan can help minimize costs and simplify the process.

Yes, Michigan law imposes a time limit for initiating probate, typically 5 years post-death. Although you can technically wait until the end of this period, delays often create complications in estate management. If a decedent's estate qualifies, you can utilize the Small estate affidavit form Michigan to bypass the standard probate timeline and expedite the settlement.

You have a maximum of 5 years from the date of death to open a probate case in Michigan. However, starting the process sooner is advisable to ensure a smooth administration. For smaller estates, you might consider the Small estate affidavit form Michigan, which streamlines proceedings and avoids lengthy court processes.

In Michigan, you generally have to file for probate within 3 to 4 months after a person’s death. Failing to do so can complicate the process and potentially confuse the distribution of the estate. While the law provides a timeframe, it’s important to act sooner rather than later. Using resources like the Small estate affidavit form Michigan can simplify handling smaller estates without full probate.

A small estate is typically defined as one valued below a specified amount—$24,000 in Michigan—allowing heirs to use a simplified affidavit process. In contrast, a probate estate consists of all assets that exceed this value and require formal probate proceedings. Understanding this distinction can help individuals make informed decisions and streamline the asset distribution process efficiently.

In Kansas, small estate affidavits do not need to be filed with the court if the total value of the estate is below a certain limit, which differs from Michigan laws. However, the small estate affidavit form Michigan has specific guidelines that may vary, so it’s important to check local regulations. For clarity and compliance, seeking resources like US Legal Forms can be beneficial.

Writing a small estate affidavit involves completing the specific form required by Michigan law, which includes details about the deceased and their assets. It’s advisable to provide accurate and honest information to ensure compliance, simplifying the process for validation. To assist you, US Legal Forms offers templates and guidance on how to fill out the small estate affidavit form Michigan.

The approval time for a small estate affidavit can vary but usually takes around a few days to a couple of weeks. Once the small estate affidavit form Michigan is completed and submitted, heirs can expect a relatively quick turnaround for approval. This efficiency can significantly reduce the stress of settling an estate.

In Michigan, if an estate is valued at more than $24,000, it typically must go through the probate process. This threshold means that estates below this value can utilize the small estate affidavit form Michigan to bypass the lengthy probate proceedings. Understanding this can save families time and expenses during a challenging period.