Affidavit Of Child Support Withholding Limits

Description

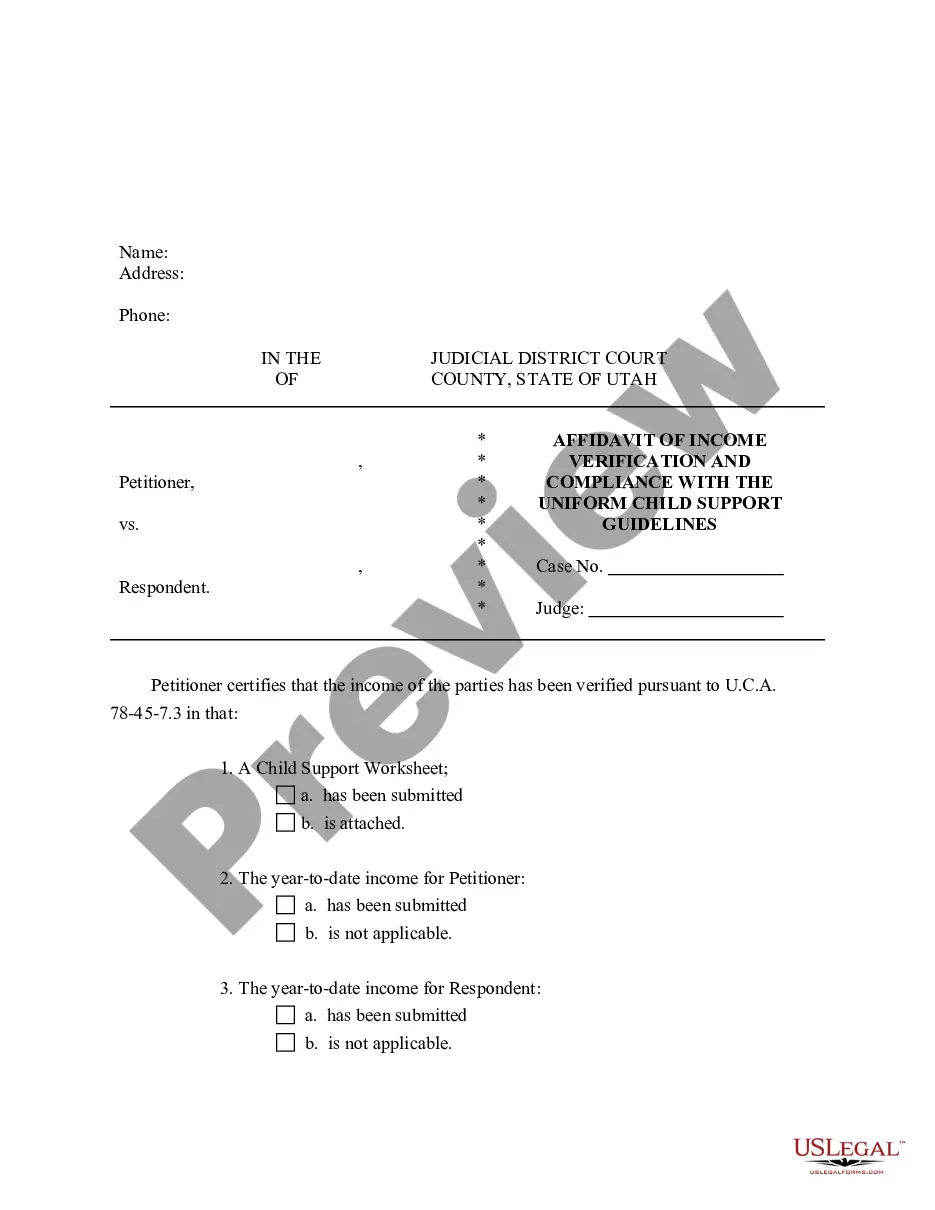

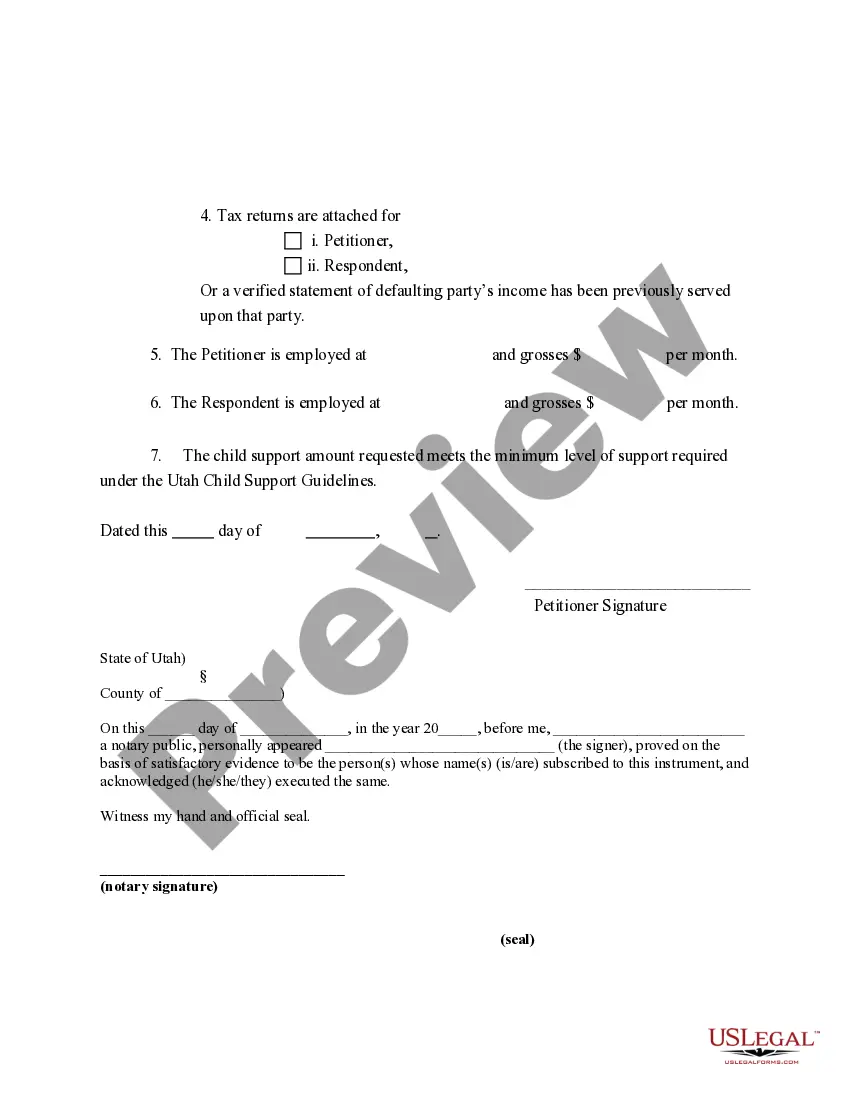

How to fill out Utah Affidavit Of Income Verification And Compliance With Child Support Guidelines?

There’s no longer a necessity to squander hours hunting for legal documents to meet your local state regulations.

US Legal Forms has gathered all of them in one location and enhanced their availability.

Our platform provides over 85,000 templates for any business and personal legal situations categorized by state and purpose.

Leverage the Search field above to find another template if the current one does not meet your needs.

- All forms are expertly crafted and verified for authenticity, so you can be confident in acquiring a current Affidavit Of Child Support Withholding Limits.

- If you are acquainted with our service and already possess an account, ensure your subscription is active before obtaining any templates.

- Click Log In to your account, select the document, and hit Download.

- You can also revisit all stored documents at any time by accessing the My documents tab in your profile.

- If you haven’t utilized our service before, the process will involve a few additional steps to complete.

- Here’s how new users can access the Affidavit Of Child Support Withholding Limits from our library.

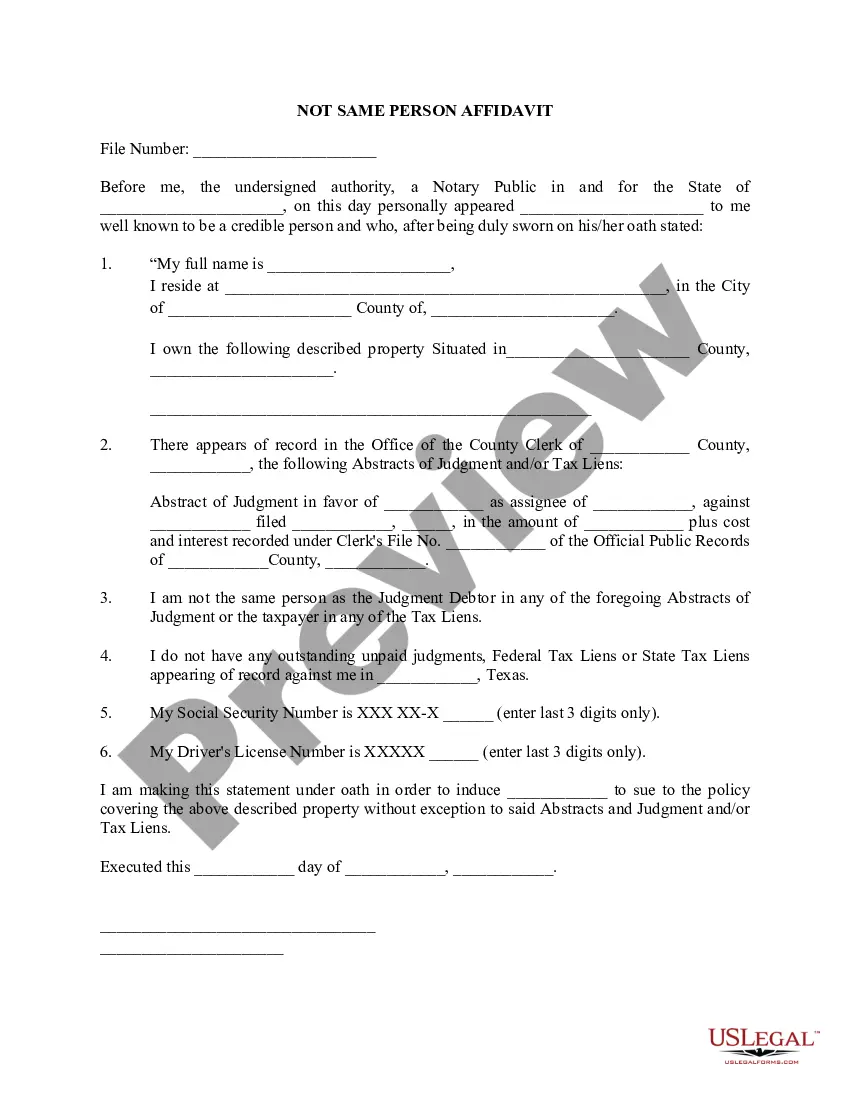

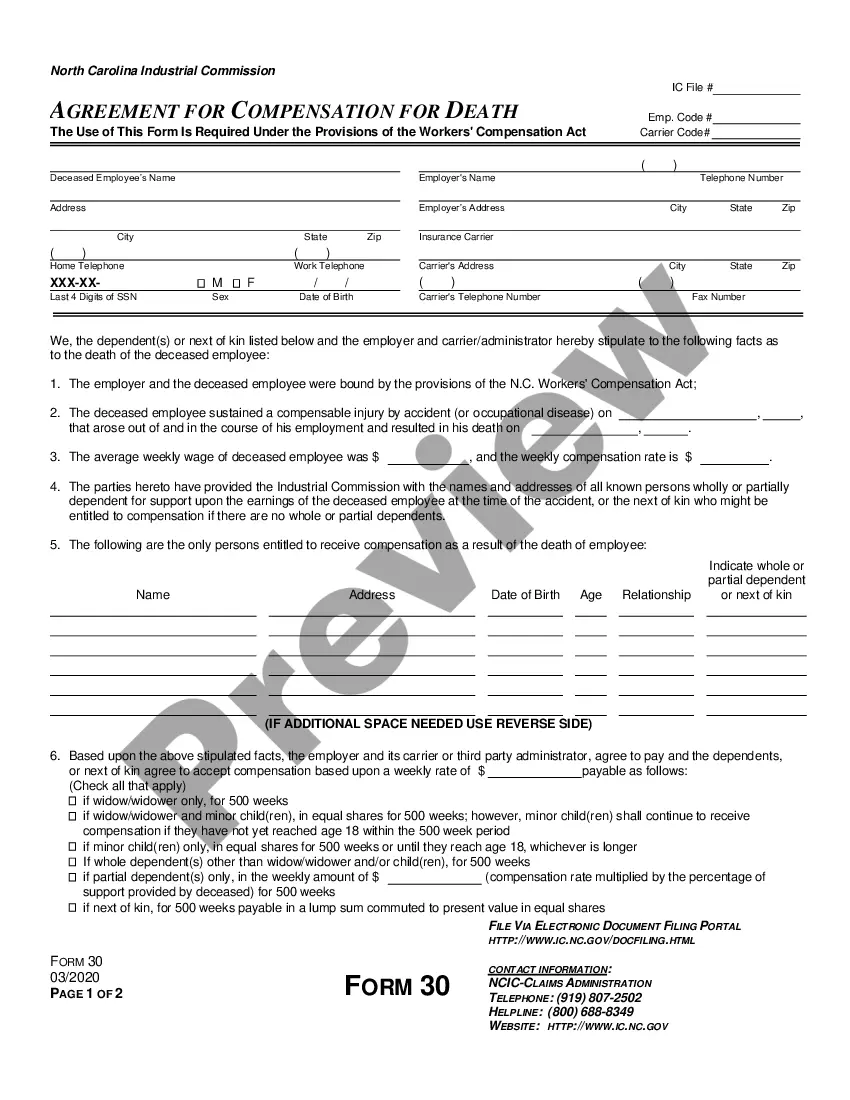

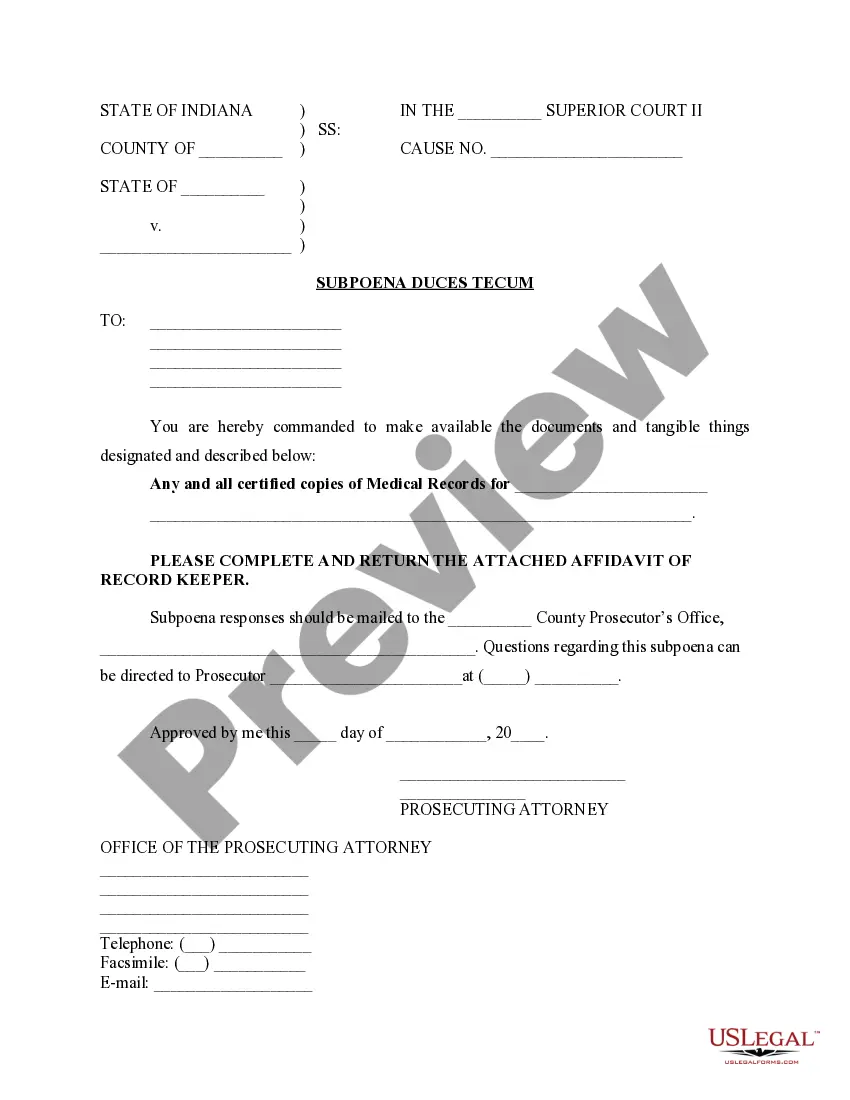

- Examine the page content closely to verify it holds the sample you need.

- To accomplish this, use the form description and preview options if available.

Form popularity

FAQ

If the employee is single, the maximum withholding amount is 60% of the employee's disposable income. If the employee is behind by more than 12 weeks on child-support payments, add an additional 5% to the maximum withholding amount (i.e., 55% for second family, 65% for single).

The maximum amount that may be withheld is 50 percent of the lump sum after taxes or the total amount of arrears, whichever is less.

Allowable disposable income is the most a worker's wages may be garnished. The amount that can be garnished is dependent on disposable income and the Consumer Credit Protection Act (CCPA) percentage limit. This in effect sets a maximum limit on the percentage that may be garnished in a pay period.

Up to 50% of your disposable earnings may be garnished to pay child support if you're currently supporting a spouse or a child who isn't the subject of the order. If you aren't supporting a spouse or child, up to 60% of your earnings may be taken. An additional 5% may be taken if you're more than 12 weeks in arrears.

Turn in your completed Petition to Terminate Withholding for Child Support form at the district clerk's office in the county where your current order was made. Get a copy for both you and the other party. The clerk will file-stamp your forms with the date and time and return the copies to you.