Limited Liability Company For Dummies

Description

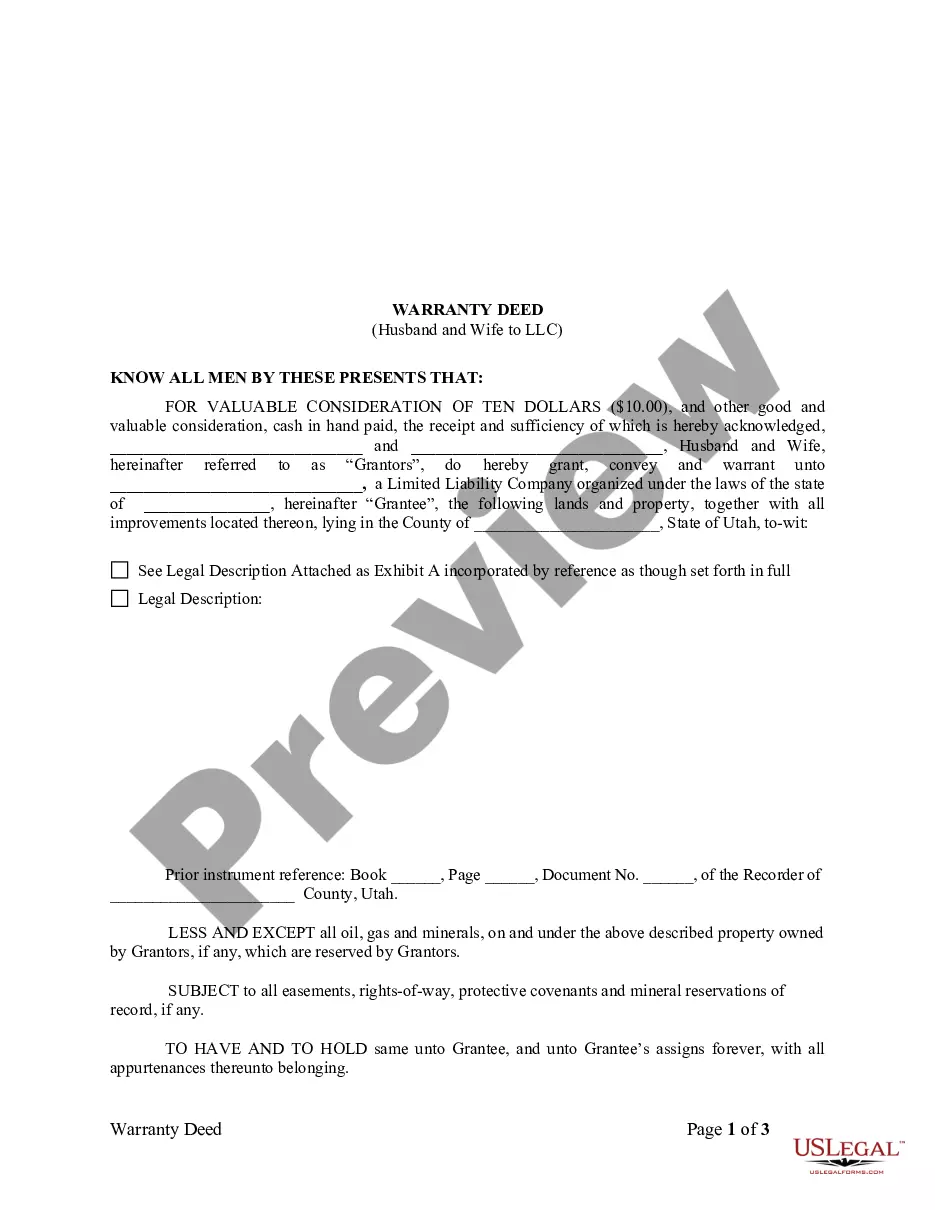

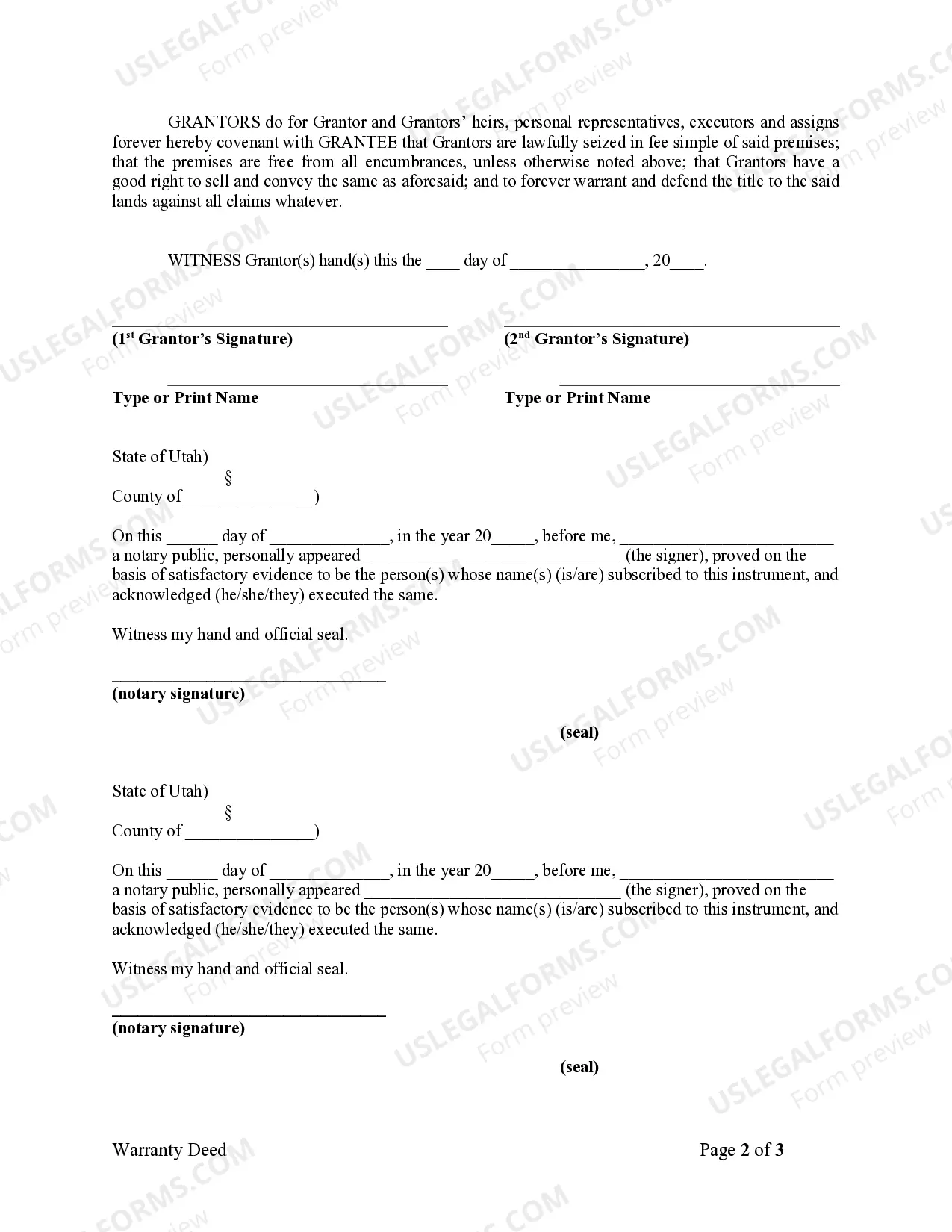

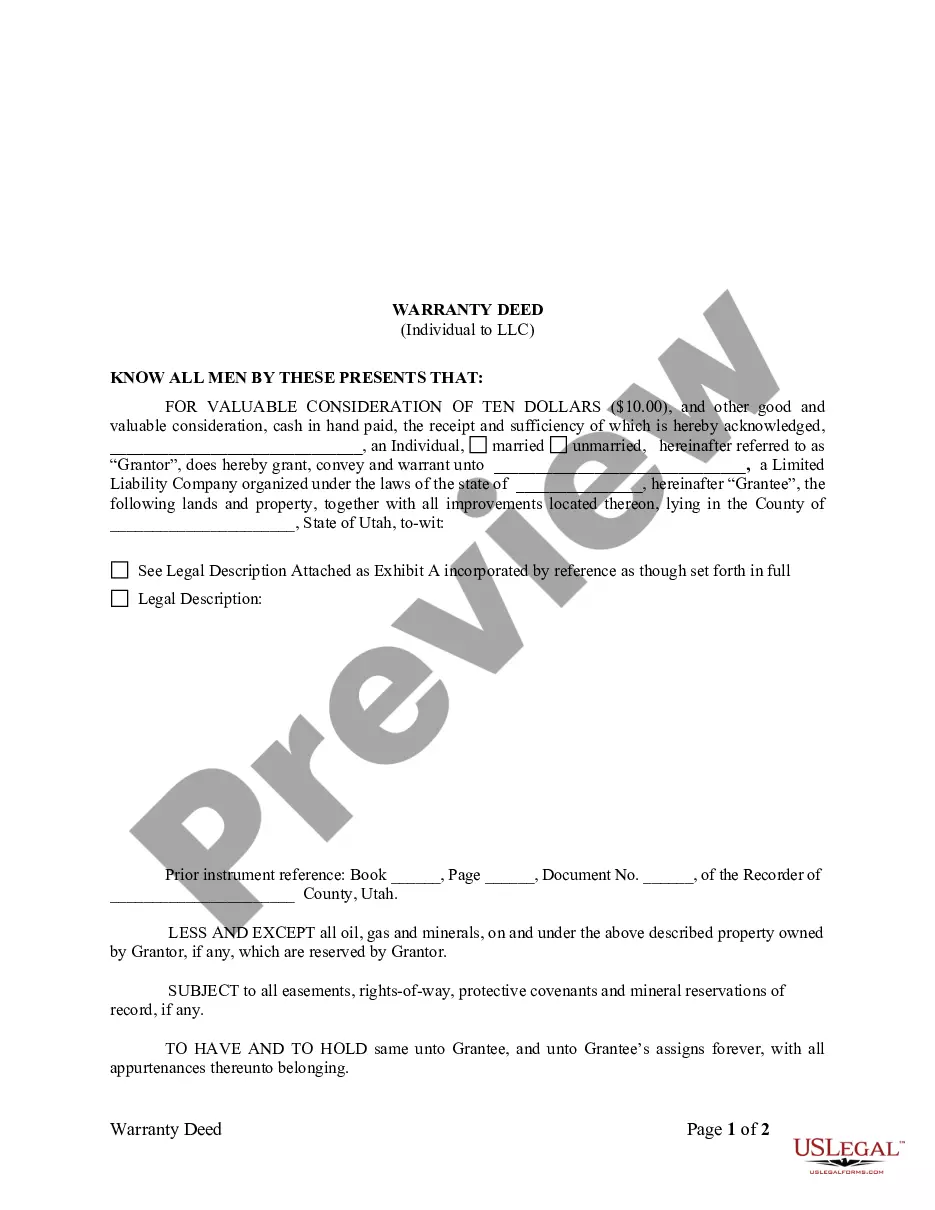

How to fill out Utah Warranty Deed From Husband And Wife To LLC?

- Log in to your US Legal Forms account if you've used the service before. If not, create a new account and select the appropriate subscription plan.

- Browse the extensive form collection and check the preview mode to identify the template that matches your specific requirements and jurisdiction.

- If needed, utilize the search feature to find alternative templates until you locate the correct one.

- Proceed by clicking the 'Buy Now' button, choose your preferred subscription, and register your account for access.

- Complete your purchase securely using your credit card or PayPal account.

- Download the finalized document onto your device, and find it later in the 'My Forms' section for easy access when necessary.

With US Legal Forms, you have the advantage of accessing over 85,000 fillable legal documents paired with expert assistance to ensure your forms are accurately completed.

Ready to kickstart your LLC journey? Explore US Legal Forms today and take the first step toward your business success!

Form popularity

FAQ

Yes, you can file your LLC by yourself without the assistance of an attorney. Most states allow easy online submission of the necessary forms, such as the articles of organization. However, be aware of specific state requirements and fees that you must meet. If you prefer a streamlined process, consider using US Legal Forms for guidance and to avoid potential pitfalls.

An example of writing an LLC involves choosing a unique name for your business and adding 'LLC' at the end. For instance, 'Tech Innovators, LLC' would indicate that it is a Limited Liability Company. This structure clarifies your business's legal form for customers and partners alike. Resources like US Legal Forms can assist you with examples and ensure you adhere to legal standards.

Filling out an LLC involves several steps, including completing articles of organization with your state’s business filing office. You'll need to provide essential details such as the business name, address, and the nature of the business. Additionally, you may need to state whether you have a registered agent. You can simplify this process by using US Legal Forms, which offers templates and guidance to help ensure you fill it out correctly.

An example of writing an LLC could be 'Smith and Sons Landscaping, LLC' where 'Smith and Sons Landscaping' is the business name followed by 'LLC' to indicate its structure. This example clearly identifies your business and its legal standing. It's important to check for name availability and comply with your state’s naming rules. Using platforms like US Legal Forms can help you ensure your example meets all requirements.

In layman's terms, a Limited Liability Company, or LLC, is a type of business structure that combines the personal asset protection of a corporation with the tax benefits of a partnership. This means owners, known as members, are generally not personally responsible for business debts. Essentially, it protects your personal assets while allowing you the flexibility of a partnership. Understanding this can make forming your business simpler and safer.

To write LLC correctly, you should include the specific designation 'Limited Liability Company' or the abbreviation 'LLC' at the end of your business name. Ensure that the name is unique and not already used by another entity. This practice helps to clarify the legal structure and demonstrates your choice of protection for personal assets. Using a tool like US Legal Forms can guide you through proper naming and registration.

LLCs may fail for various reasons, including poor management, lack of planning, or insufficient funding. Also, members might not adhere to the formalities required to maintain the LLC status. Understanding potential pitfalls through resources like 'Limited liability company for dummies' can help you recognize and avoid these issues, putting you on a more successful path.

Although an LLC has many advantages, it may not always be beneficial. For instance, certain businesses might face higher costs and ongoing fees related to maintaining an LLC. Additionally, if you don't intend to raise capital through investors, an LLC may not offer significant benefits compared to other business structures. Consulting 'Limited liability company for dummies' can provide further clarity on this matter.

Filing taxes as an LLC can be straightforward, but it varies depending on the number of members. Single-member LLCs generally file taxes like sole proprietorships, while multi-member LLCs file as partnerships. Resources like 'Limited liability company for dummies' provide clear insights on tax obligations and forms, helping you navigate your tax responsibilities accurately.

The best way to file for an LLC typically involves choosing a name, designating a registered agent, and then filing the necessary paperwork with your state. Many people find that using a platform like uslegalforms simplifies this process significantly. It is also helpful to read guides like 'Limited liability company for dummies' for clear steps and insights. This ensures you meet all legal requirements efficiently.