Foundation Construction Utah Withholding

Description

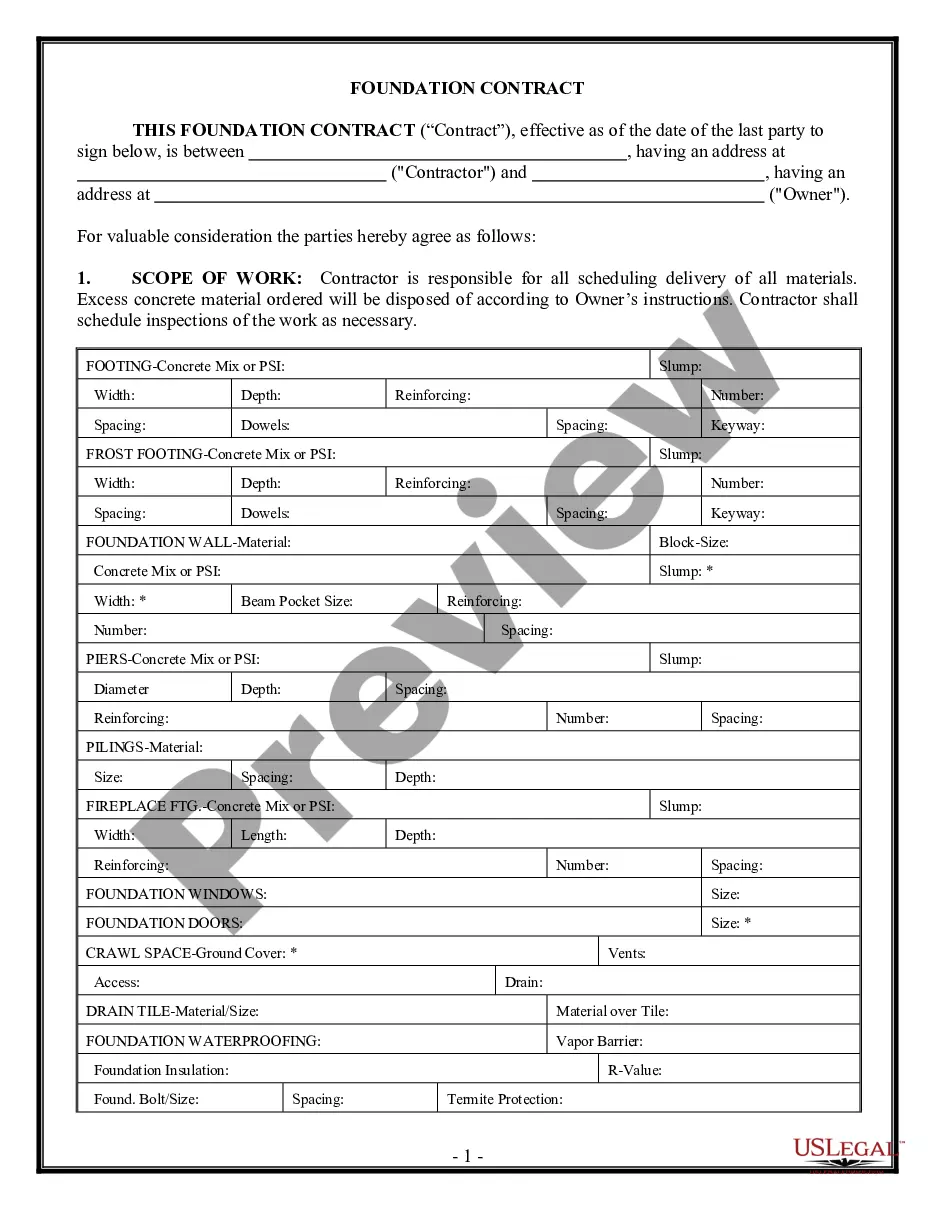

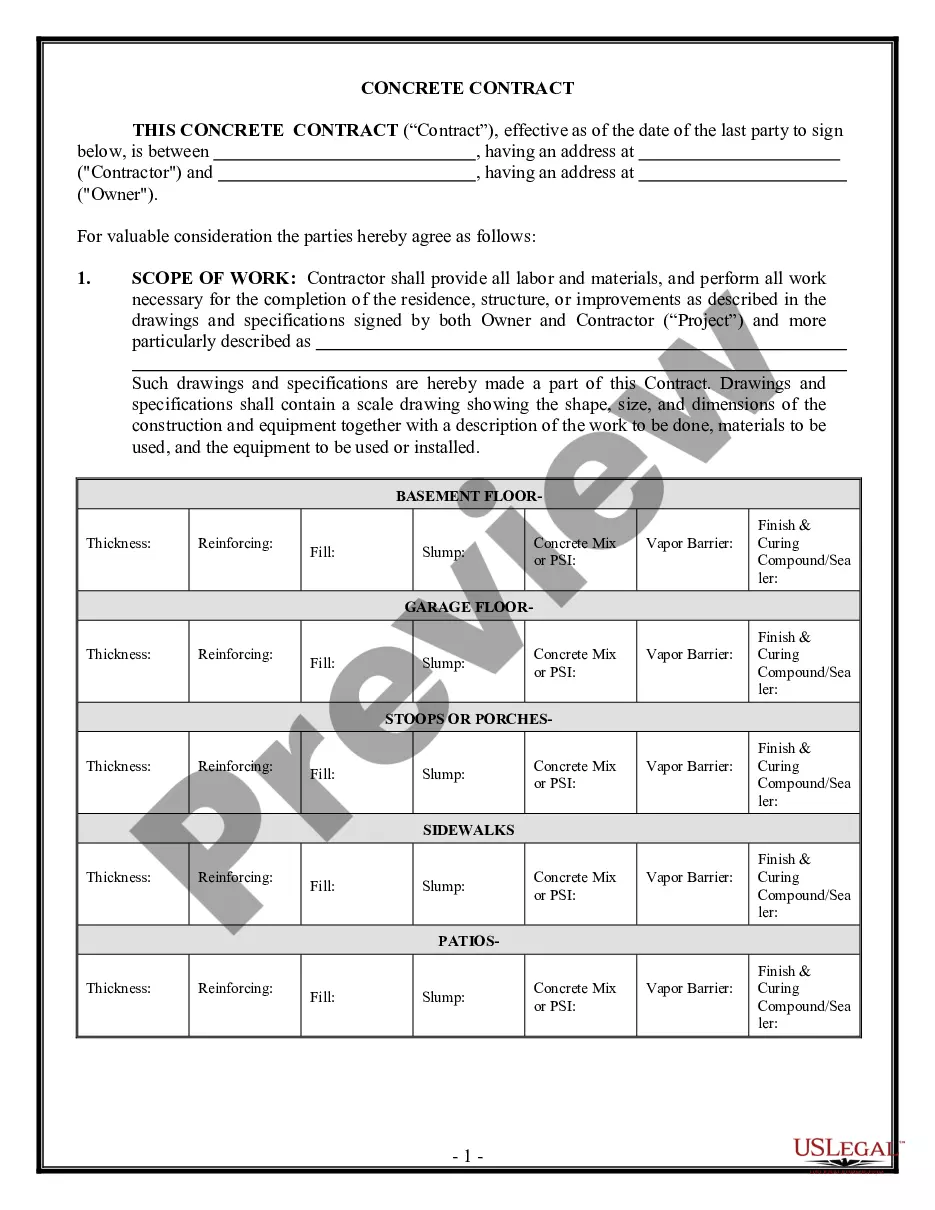

How to fill out Utah Foundation Contract For Contractor?

How to acquire professional legal documents that comply with your state regulations and prepare the Foundation Construction Utah Withholding without consulting a lawyer.

Numerous online services provide templates to address various legal situations and formal requirements. However, it might require some time to determine which of the accessible examples meet both your intended use and legal standards.

US Legal Forms is a trusted platform that assists you in locating official documents drafted in accordance with the latest updates in state laws, enabling you to save money on legal services.

If you do not possess an account with US Legal Forms, follow the steps outlined below: Review the opened webpage and verify if the form meets your requirements. Utilize the form description and preview options if provided. If necessary, search for another sample in the header indicating your state. When you locate the appropriate document, click the Buy Now button. Choose the most suitable pricing plan, then Log In or preregister for an account. Select the payment method (via credit card or PayPal). Choose the file format for your Foundation Construction Utah Withholding and click Download. The acquired documents are yours to keep; you can always access them later in the My documents section of your profile. Register for our library and create legal documents independently like a seasoned legal professional!

- US Legal Forms is not merely a conventional online library.

- It is a repository of over 85,000 verified templates for different business and personal situations.

- All documents are categorized by state and area to enhance your search efficiency and convenience.

- Additionally, it incorporates robust tools for PDF editing and electronic signatures, allowing users with a Premium subscription to efficiently complete their forms online.

- It requires minimal time and effort to obtain the needed documents.

- If you already possess an account, Log In and confirm your subscription status.

- Download the Foundation Construction Utah Withholding using the relevant button beside the document name.

Form popularity

FAQ

To apply for a Utah withholding account, you need to complete the necessary registration forms available on the state’s tax website. This step is vital for those involved in foundation construction, as it ensures that you manage your withholding responsibilities efficiently. You can also use platforms like US Legal Forms to access the required documents and guidance, simplifying your application process. Make sure you have all necessary information ready to streamline your application for a Utah withholding account.

Yes, Utah does require withholding for certain payments related to foundation construction. Contractors and subcontractors engaged in foundation construction must understand their withholding obligations to comply with state laws. Ensuring proper withholding helps avoid penalties and facilitates smoother operations in your construction projects. Familiarizing yourself with Utah withholding requirements is crucial for a successful foundation construction endeavor.

The withholding rate in Utah is generally a flat rate, which currently stands at 4.95%. This rate applies to most taxable income, making it straightforward to calculate your withholding. As you navigate the specifics of foundation construction Utah withholding, understanding this rate can support accurate budgeting and financial planning.

To determine your appropriate tax withholding, consider using the IRS withholding calculator available online. This tool helps you estimate your tax liability and suggests how many allowances to claim. Keeping in mind the specific context of foundation construction Utah withholding can further guide your decision, ensuring that your withholding aligns with your financial needs.

In Utah, the withholding allowance is determined based on personal circumstances, such as dependents and filing status. Generally, you can claim one allowance for yourself and additional allowances for dependents, which ultimately affect your withholding amount. For accurate calculations regarding foundation construction Utah withholding, you may want to assess your financial situation and future tax obligations.

The 3% sales tax in Utah applies to most sales of tangible personal property and certain services. For businesses involved in foundation construction Utah withholding, understanding how this sales tax interacts with your contracts is essential. Keeping track of these obligations will help you stay compliant and avoid unexpected costs.

In Utah, maintenance contracts are typically taxable unless they fall under specific exemptions. If your maintenance services are related to foundation construction, you must consider the implications on Utah withholding. Review your contract details or seek professional advice to ensure that you handle taxes correctly.

The tax rate for independent contractors in Utah is generally 4.85% on their taxable income. However, it's crucial for these contractors to manage their foundation construction Utah withholding properly to ensure that they meet their tax obligations. Consult with a tax professional to optimize your returns and ensure compliance.

The TC 75 form is used for reporting nonresident withholding tax in Utah. It is especially important for contractors involved in foundation construction Utah withholding. Ensure that you complete this form accurately to avoid penalties and to stay compliant with state tax laws.

Yes, construction services are generally taxable in Utah. This includes most aspects of foundation construction, which also involves withholding for tax purposes. However, certain construction activities may have exemptions, so it’s essential to review the specifics applicable to your situation.