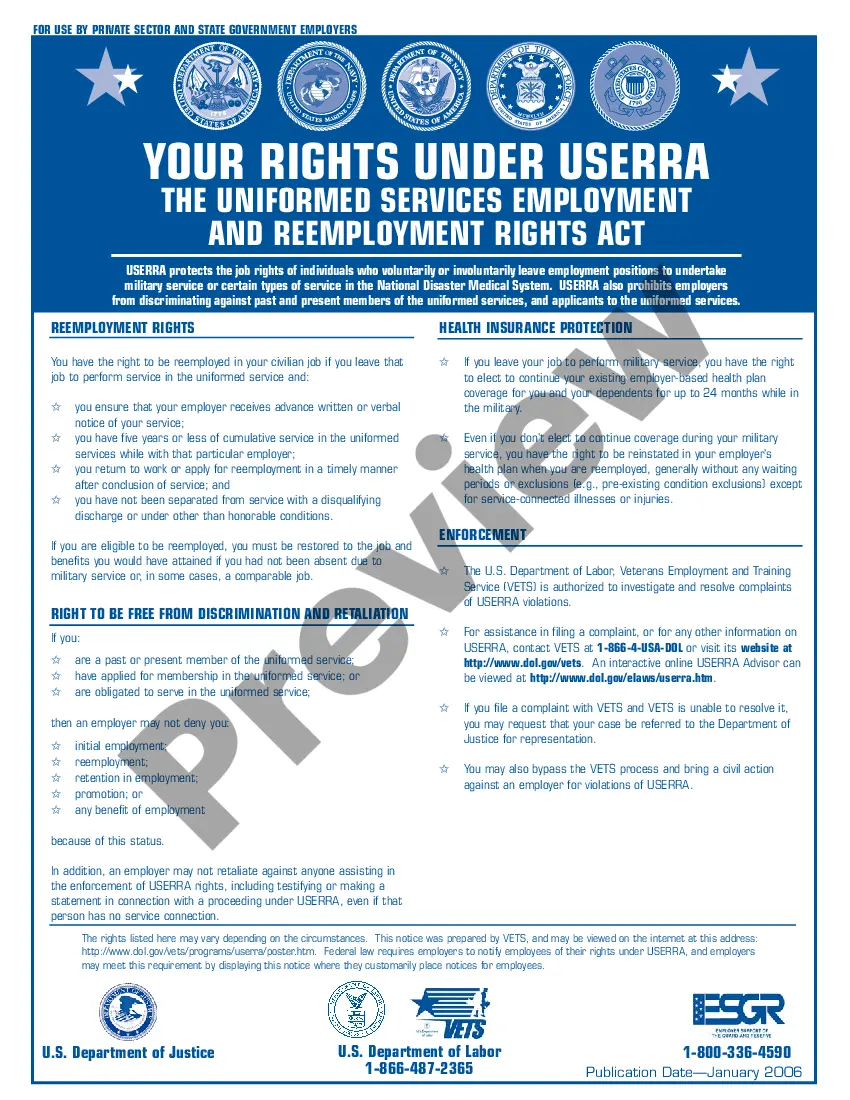

An approved copy of the Uniformed Services Employment and Reemployment Rights Act is made available for informational purposes or for employers to use as posters.

Employee Rights Act Mauritius Withholding Tax

Description

Form popularity

FAQ

Yes, Mauritius taxes foreign income, although there are provisions for tax credits under the Employee Rights Act Mauritius withholding tax. Residents are subject to tax on their worldwide income, while non-residents may be taxed on Mauritian-sourced income. It's important to evaluate your tax situation and potentially seek guidance from a tax advisor for accurate reporting. This understanding can help prevent any unexpected tax liabilities.

Mauritius imposes several types of taxes, including income tax and withholding tax as defined by the Employee Rights Act Mauritius withholding tax. The country follows a progressive tax rate system, where individuals’ tax rates increase with higher income levels. Understanding these tax obligations is critical for financial planning and compliance. Furthermore, the tax framework is designed to foster transparency and economic development.

Certain individuals may be exempt from withholding tax under the Employee Rights Act Mauritius withholding tax framework. Usually, exemptions apply to specific categories such as foreign diplomats, non-resident taxpayers, or certain pensioners. It's essential to review the criteria outlined in the law or consult a tax professional for clarity on eligibility. Understanding these exemptions can help you plan your finances effectively.

Exemptions for the Mauritius Revenue Authority (MRA) can vary based on specific circumstances and types of income. Generally, certain allowances and incomes might be exempt from taxation under the Employee Rights Act Mauritius withholding tax provisions. Reviewing the details of these exemptions can benefit both employers and employees. Staying informed can help you make the most of your financial situation.

To retrieve your EDF, or Employee Data Form, you need to visit the Mauritius Revenue Authority (MRA) website or office. The process generally includes filling in necessary forms and providing required documentation. Properly managing your Employee Rights Act Mauritius withholding tax documentation can streamline this process. For more detailed guidance, consider using platforms like UsLegalForms.

The unemployment allowance in Mauritius varies and is dependent on several factors, including prior earnings and contributions. It provides essential support to those who find themselves without work. Being aware of how the allowance connects with the Employee Rights Act Mauritius withholding tax can ensure you manage your finances effectively during unemployment. Always check for updates to avoid surprises.

In 2024, the pension amount in Mauritius is expected to be subject to regular reviews. Currently, pension benefits provide a basic income for retirees. Understanding how pension contributions relate to the Employee Rights Act Mauritius withholding tax can help you plan better for retirement. You should consult local regulations for the latest updates on pension amounts and eligibility.

The CSG Allowance in Mauritius is a financial support aimed at assisting individuals, especially low-income earners. This allowance serves as a relief measure to help these individuals during financial hardships. Awareness of the CSG Allowance is important, particularly in light of the Employee Rights Act Mauritius withholding tax, as it can impact your net income. Make sure to check your eligibility.

The CSG, or Contribution Sociale Généralisée, is a mandatory social security contribution in Mauritius. It funds various social services, including health care and retirement benefits. Both employers and employees contribute to the CSG, and it is essential to understand how these contributions interact with the Employee Rights Act Mauritius withholding tax to ensure compliance. By being informed, you can better navigate your obligations.

Yes, withholding tax is applicable in Mauritius. It is a deduction made at the source on various types of income, including salaries, dividends, and interest. Under the Employee Rights Act Mauritius withholding tax framework, employers play a critical role in ensuring that taxes are correctly withheld from employee salaries. Understanding this process helps both employers and employees maintain compliance with tax regulations.