Uniform Commercial Code Statement With Case Laws

Description

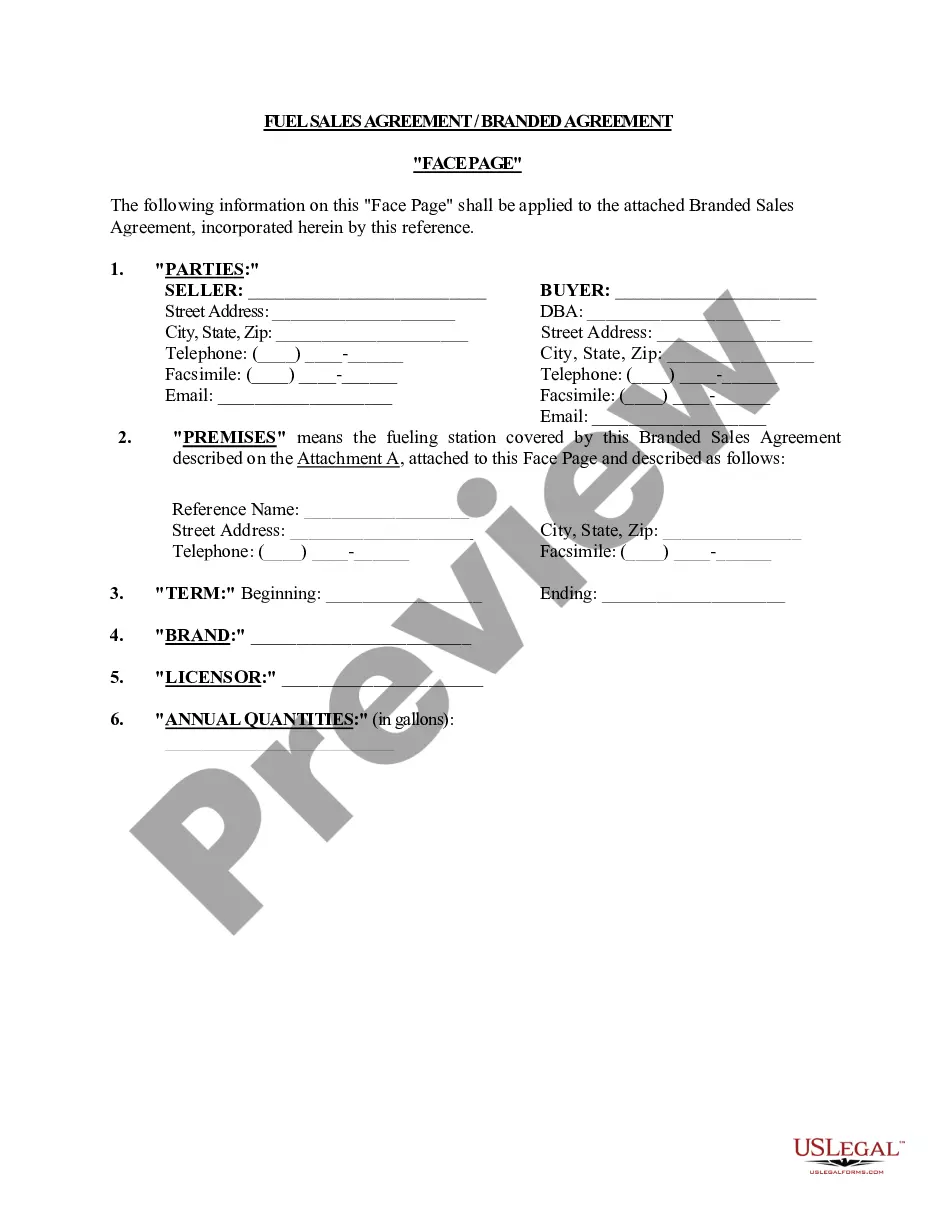

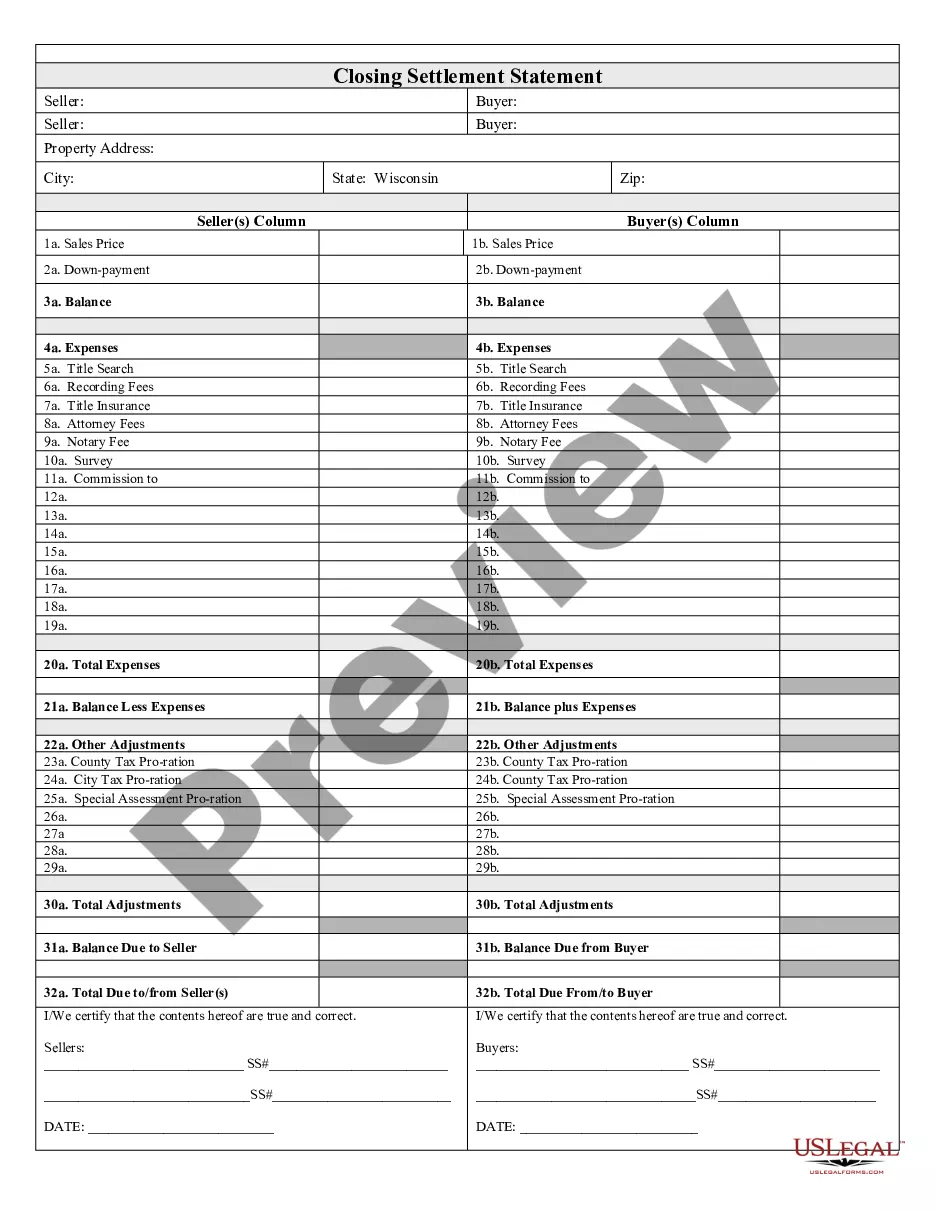

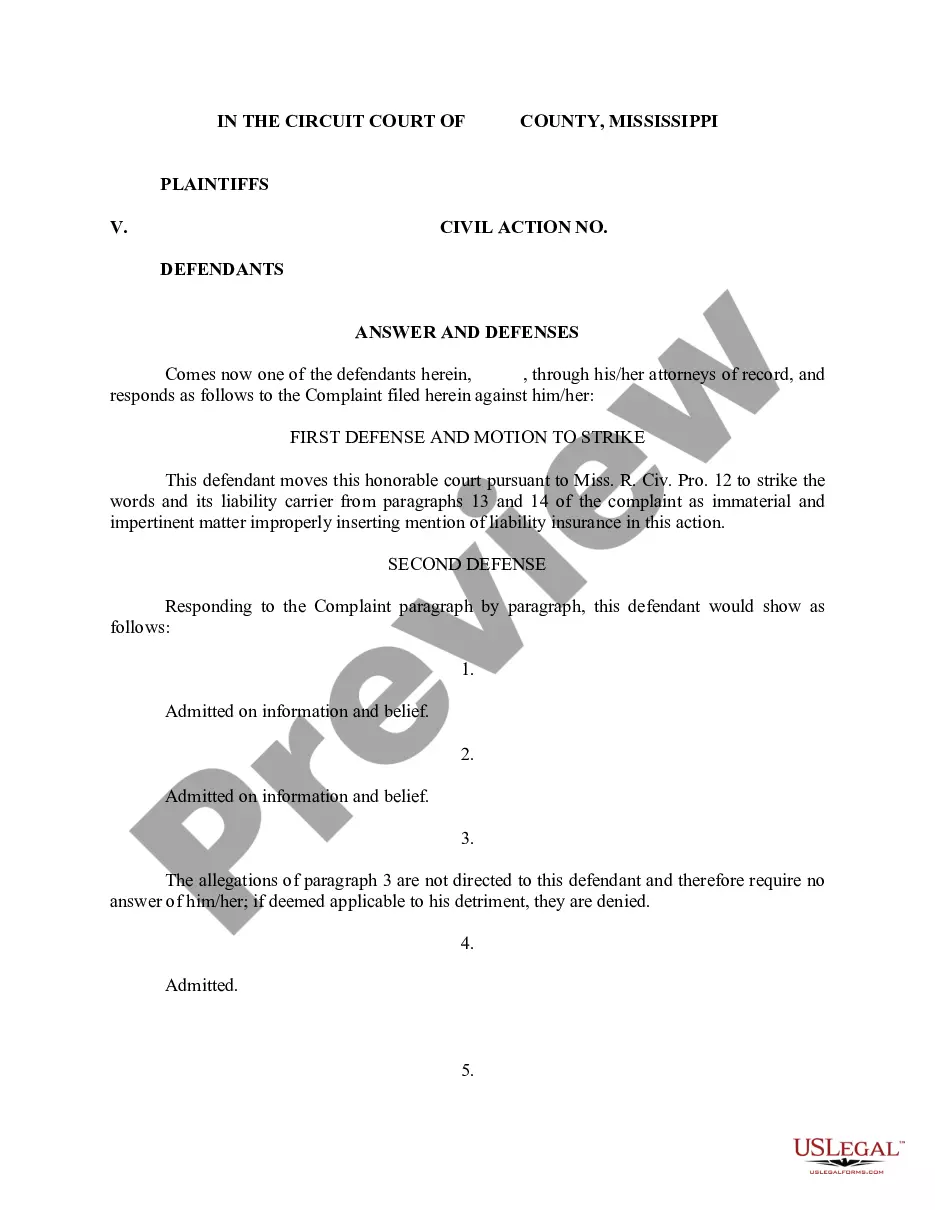

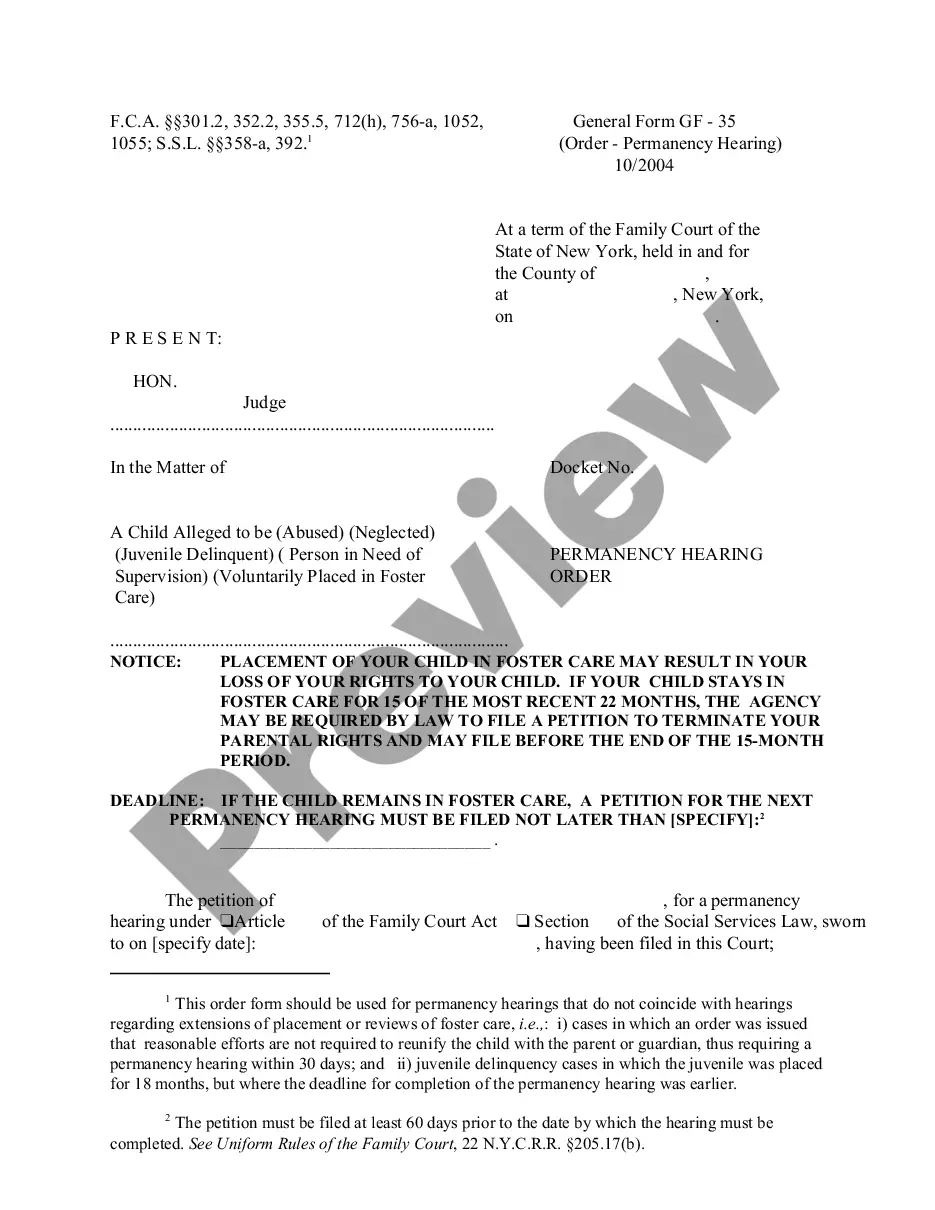

How to fill out UCC1-AD Financing Statement Addendum?

Gaining access to legal documents that comply with federal and local regulations is essential, and the web provides numerous alternatives to consider.

However, why spend time searching for the ideal Uniform Commercial Code Statement With Case Laws example online when the US Legal Forms online repository already has these templates gathered in one location.

US Legal Forms is the premier online legal archive featuring over 85,000 customizable templates created by legal professionals for various professional and personal situations.

Review the template using the Preview option or via the text description to ensure it meets your requirements. Search for another sample using the search feature at the top of the page if necessary. Once you have located the appropriate form, click Buy Now and choose a subscription plan. Create an account or Log In and complete your payment via PayPal or credit card. Select the format for your Uniform Commercial Code Statement With Case Laws and download it.

- They are user-friendly, with all documents organized by state and intended purpose.

- Our experts keep abreast of legal modifications, ensuring you can always trust that your form is current and compliant when acquiring a Uniform Commercial Code Statement With Case Laws from our site.

- Obtaining a Uniform Commercial Code Statement With Case Laws is quick and easy for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document sample you need in the appropriate format.

- If you are a first-time visitor to our site, follow the steps outlined below.

Form popularity

FAQ

To record a UCC, you must complete the UCC form accurately and submit it to the designated state office, usually the Secretary of State. Ensure that you include all pertinent details about the debtor and the secured party to avoid any issues with your filing. Recording your Uniform Commercial Code statement with case laws helps to protect your security interest and establishes a public record. For assistance in preparing and filing your documents, explore the services offered by USLegalForms.

In New York, you should file your UCC Financing Statement with the Department of State, Division of Corporations. This office manages all UCC filings, ensuring they are registered appropriately. Filing at this location helps establish priority for your Uniform Commercial Code statement with case laws in New York. For a seamless process, consider utilizing USLegalForms to navigate the requirements efficiently.

Credit Score Home buyers who have high credit scores get access to the largest selection of loan types and the lowest interest rates. You'll need to have a qualifying FICO® Score of at least 620 points to qualify for most types of loans.

Requirements 3% minimum down payment. 620 minimum credit score. Income cannot exceed 80% of the Area Median Income (AMI) for your county. Contribute at least 1% of the loan amount or $1,000 (whichever is less). ... Must attend an approved homebuyer education course (in-person if credit score is below 680)

The amount of money that you'll need to put down in PA will vary depending on your loan program. Most buyers will need a down payment of at least 3% or 3.5%, as these are the minimums for Conventional and FHA loans respectively.

Before you head off to the bank, you will need to have certain documents for a mortgage pre-approval in Pennsylvania. Proof of Income and Employment. ... Records of Assets. ... List of Monthly Debt Payments. ... Records of Other Expenditures and Financial Events.

What Will You Need to Get Pre-approved for a Mortgage in Pennsylvania? Your two most recent pay stubs as proof of income received from your employment. Your two most recent W-2s to show your wage, salary and tax information. Two most recent bank statements to show that you have the stated down payment.