Third Party Financing Addendum For Credit Approval

Description

How to fill out UCC1-AD Financing Statement Addendum?

Creating legal documents from the ground up can occasionally feel quite daunting. Certain situations may require extensive research and significant financial investment.

If you desire a simpler and more cost-effective method of producing the Third Party Financing Addendum For Credit Approval or any other documents without unnecessary complications, US Legal Forms is here to assist you.

Our online collection of over 85,000 current legal documents encompasses nearly every facet of your financial, legal, and personal matters. With just a few clicks, you can swiftly obtain state- and county-compliant forms meticulously prepared by our legal experts.

Visit our website whenever you need dependable services that allow you to easily locate and download the Third Party Financing Addendum For Credit Approval. If you're a returning user and have set up an account with us, simply Log In to your account, choose the form, and download it or re-download it later from the My documents section.

US Legal Forms boasts an impeccable reputation and over 25 years of experience. Join us today and simplify the process of document completion!

- Verify the document preview and descriptions to confirm you have located the correct form.

- Ensure the form you select adheres to the laws and regulations of your state and county.

- Select the appropriate subscription plan to purchase the Third Party Financing Addendum For Credit Approval.

- Download the form, then complete, certify, and print it.

Form popularity

FAQ

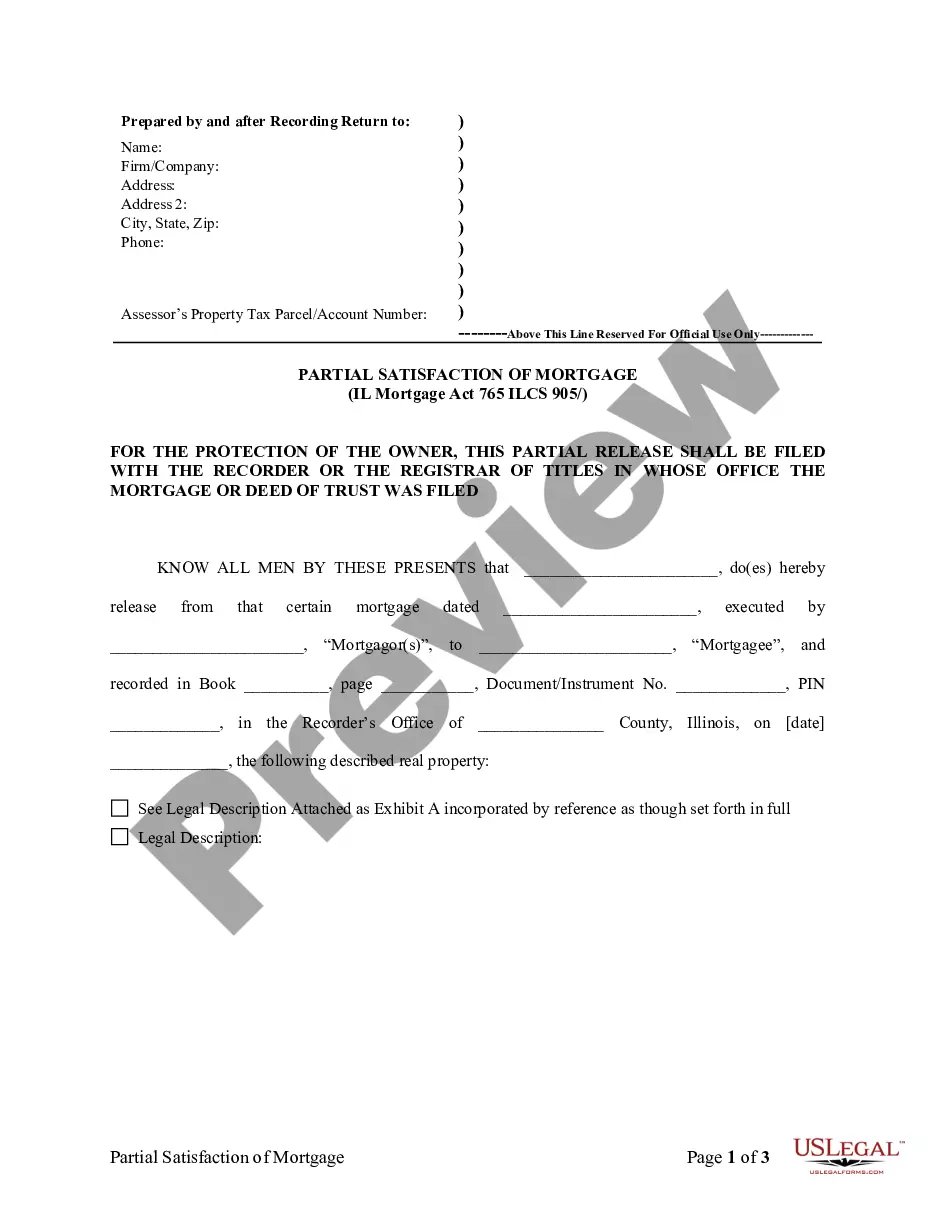

A financing addendum is a legal document that outlines the terms and conditions related to third party financing for a real estate transaction. This addendum is essential for buyers seeking credit approval, as it clarifies the financing process and requirements. By including a third party financing addendum for credit approval, you can protect your interests and ensure that all parties understand their responsibilities. UsLegalForms provides a straightforward solution to create this addendum, making your transaction more efficient.

A third party financing addendum is not always required, but it is highly recommended when buyers seek external financing. This addendum provides clarity on the financing process and protects both parties involved in the transaction. Using a platform like US Legal Forms can help buyers create a comprehensive third party financing addendum for credit approval, ensuring all necessary details are included.

If the buyer cannot secure approval under the third party financing addendum, they typically have the option to back out of the contract without penalty. This provision protects buyers by allowing them to terminate the agreement if they cannot obtain the necessary financing. It's important for buyers to communicate with the seller promptly to avoid misunderstandings and ensure a smooth transaction.

In paragraph 2b of the third party financing addendum, property approval refers to the requirement for the lender to evaluate and approve the property as part of the financing process. This step is essential for obtaining the necessary credit approval, as the lender must ensure the property meets their criteria for lending. By understanding this section, buyers can better prepare for the financing process.

The third party financing addendum is a legal document that outlines the terms and conditions under which a buyer can secure financing from an outside lender. This addendum helps ensure that both the buyer and seller understand the financing process and its implications on the property transaction. It is a crucial part of real estate deals, especially for buyers relying on loans for credit approval.

Description: This Addendum is used when any type of financing for all or part of the purchase price will be provided by a third-party (not the Seller or Buyer).

What happens if buyer's credit is not approved under the TREC Third Party Financing Addendum, and the buyer gives timely notice to the seller? The contract will terminate and the buyer will get the earnest money.

A seller financing addendum outlines the terms under which the seller of a property agrees to loan money to the buyer in order to purchase their property.

Which of the following is NOT a form of financing listed on the Third Party Financing Addendum? The answer is seller financing.