Financing Addendum Form With Bfl Stamp And Sign

Description

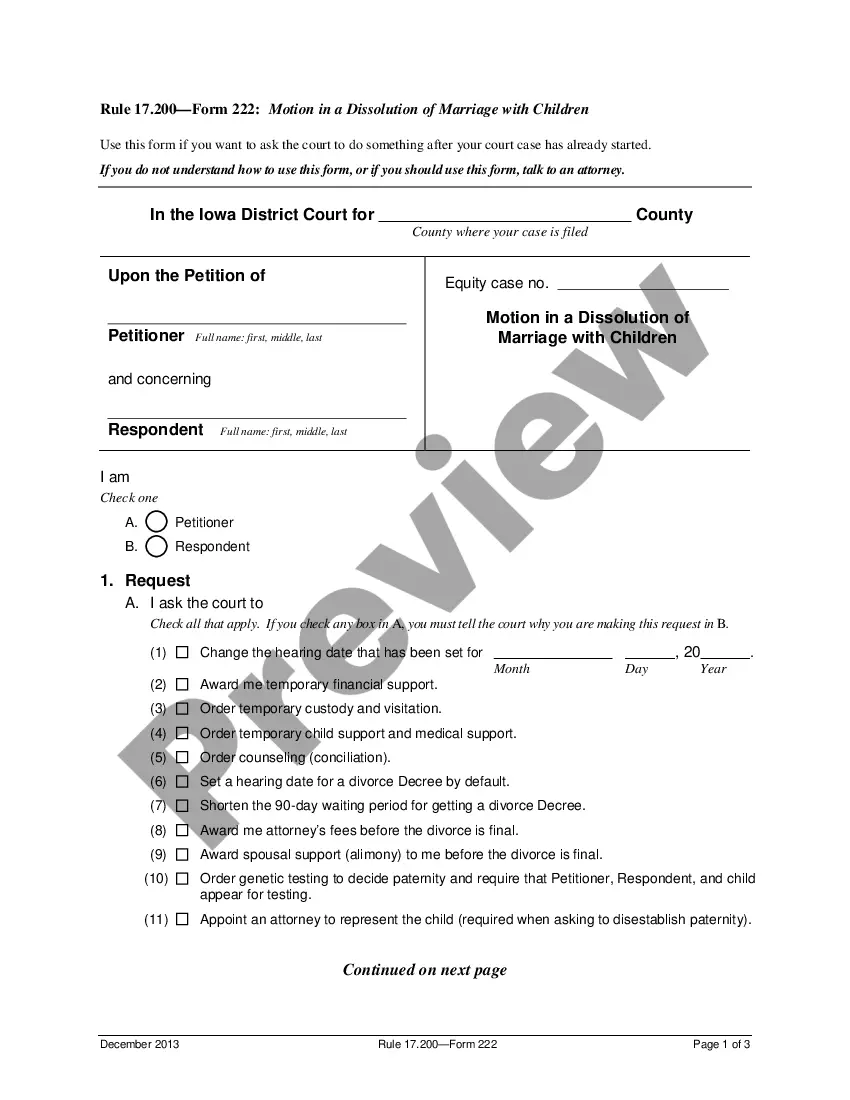

How to fill out UCC1-AD Financing Statement Addendum?

Dealing with legal documents and operations can be a time-consuming addition to your entire day. Financing Addendum Form With Bfl Stamp And Sign and forms like it usually require that you look for them and navigate how you can complete them appropriately. For that reason, regardless if you are taking care of economic, legal, or personal matters, having a thorough and hassle-free web library of forms close at hand will greatly assist.

US Legal Forms is the number one web platform of legal templates, featuring more than 85,000 state-specific forms and a number of tools to help you complete your documents effortlessly. Discover the library of relevant documents accessible to you with just a single click.

US Legal Forms provides you with state- and county-specific forms offered at any time for downloading. Protect your papers management processes having a high quality support that allows you to make any form within minutes without having additional or hidden cost. Just log in to the profile, locate Financing Addendum Form With Bfl Stamp And Sign and download it straight away within the My Forms tab. You may also gain access to previously downloaded forms.

Is it your first time making use of US Legal Forms? Register and set up your account in a few minutes and you will have access to the form library and Financing Addendum Form With Bfl Stamp And Sign. Then, stick to the steps below to complete your form:

- Make sure you have discovered the proper form by using the Preview feature and reading the form information.

- Pick Buy Now when ready, and select the subscription plan that suits you.

- Select Download then complete, eSign, and print out the form.

US Legal Forms has 25 years of experience supporting users manage their legal documents. Get the form you need right now and improve any process without having to break a sweat.

Form popularity

FAQ

What should be in a personal loan contract? Names and addresses of the lender and the borrower. Information about the loan co-borrower or cosigner, if it's a joint personal loan. Loan amount and the method for disbursement (lump sum, installments, etc.) Date the loan was provided. Expected repayment date.

Loan agreements generally include information about: The location. ... The lender and borrower. ... The loan amount. ... Interest and late fees. ... Repayment method. ... Collateral and insurance.

A loan agreement should be structured to include information about the borrower and the lender, the loan amount, and repayment terms, including interest charges and a timeline for repaying the loan. It should also spell out penalties for late payments or default and should be clear about expectations between parties.

A seller financing addendum outlines the terms under which the seller of a property agrees to loan money to the buyer in order to purchase their property.

What to include in your loan agreement? The amount of the loan, also known as the principal amount. The date of the creation of the loan agreement. The name, address, and contact information of the borrower. The name, address, and contact information of the lender.