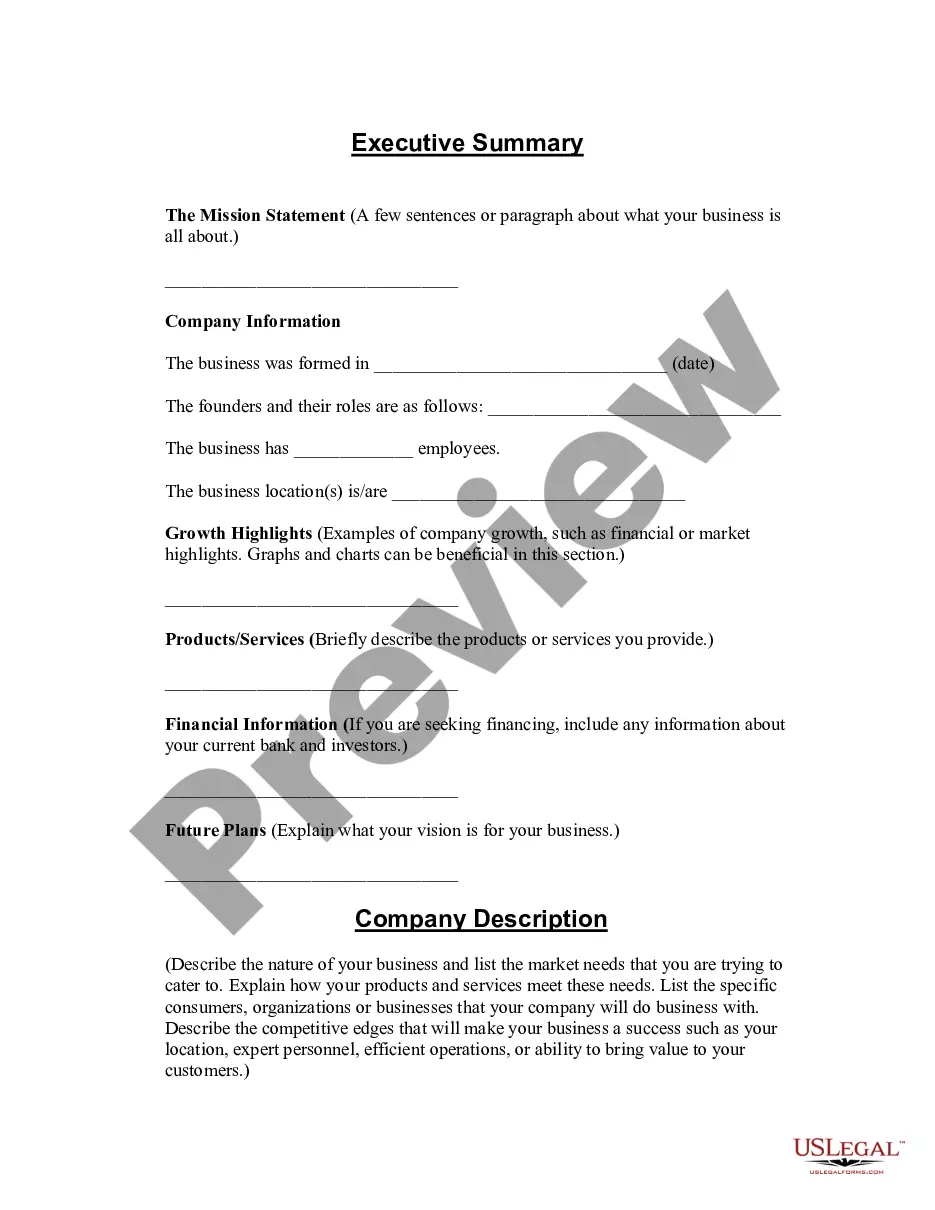

Business Plan Template For Loan

Description

How to fill out Sample Business Plan Template?

Engaging with legal documents and tasks can be a lengthy addition to the day.

Business Plan Template For Loan and similar forms typically necessitate you to locate them and comprehend the most effective way to fill them out accurately.

Thus, if you are managing financial, legal, or personal affairs, having a comprehensive and accessible online directory of forms readily available will be immensely beneficial.

US Legal Forms is the premier online resource for legal templates, featuring over 85,000 state-specific documents and various tools that will aid you in completing your paperwork seamlessly.

Simply Log In to your account, locate Business Plan Template For Loan, and download it immediately from the My documents section. You can also retrieve forms you have downloaded previously.

- Explore the collection of relevant documents available to you with just one click.

- US Legal Forms provides you with state- and county-specific documents accessible anytime for download.

- Protect your document management tasks using a high-quality service that enables you to create any form in a matter of minutes without any extra or hidden fees.

Form popularity

FAQ

A first offense is punishable by fines ranging from $50 to $500 and as much as thirty days in jail. Repeat offenders may face fines as much as $2,000 and anywhere from 30 days to 10 years in jail.

Generally, if your bank credited your account, it can later reverse the funds if the check is found to be fraudulent. You should check your deposit account agreement for information on the bank's policies regarding fraudulent checks. Fraudulent checks may be part of an overpayment/money order scam.

§34-11-60 concerns the drawing and uttering of fraudulent checks. The following elements are necessary for a check to be considered fraudulent: 1. That the accused did make, draw, utter, issue, or deliver a check, draft, or order.

To criminally prosecute a bad check, South Carolina law states a check must be deposited within 10 days of receipt, the check cannot be postdated, that there was no agreement to hold the check, and a warrant must be obtained within 180 days from the date the check was received.

Prima facie evidence of fraudulent intent in drawing check, draft or other written order, reasonable and probable cause for prosecution.

To criminally prosecute a bad check, South Carolina law requires that the check must have been deposited within ten days of receipt, and was not postdated; there was no agreement to hold the check between the check writer and the merchant; and a warrant must have been obtained within 180 days from the date the check ...

If you try to cash or deposit a check and it comes back as bad, your first step is to reach out to the person who wrote the check and try to resolve the situation. Get payment for the check amount, as well as any fees you were charged, if possible. You can also call the bank.