This security agreement is for use in a bridge financing with the form of a secured demand note or form of secured promissory note available on this site. This form provides as an option the use of a collateral agent through whom the secured lenders would coordinate their actions.This security agreement does not contain extensive company representations or warranties, nor does it contain extensive covenants of the company other than those related to the collateral. Some secured lenders prefer to have financial or operational covenants, which are not included in this form of security agreement.

Bridge Financing Agreement For Home Purchase

Description

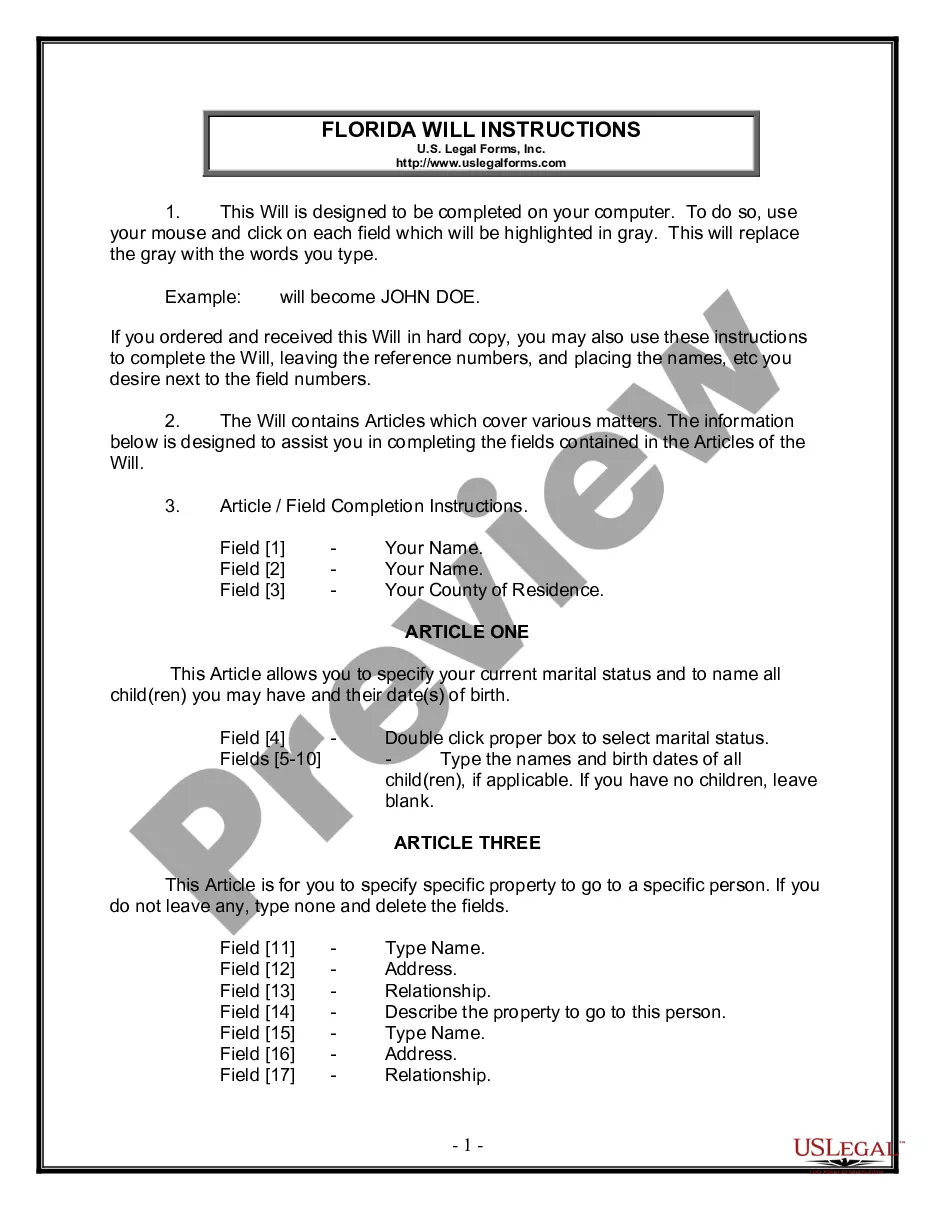

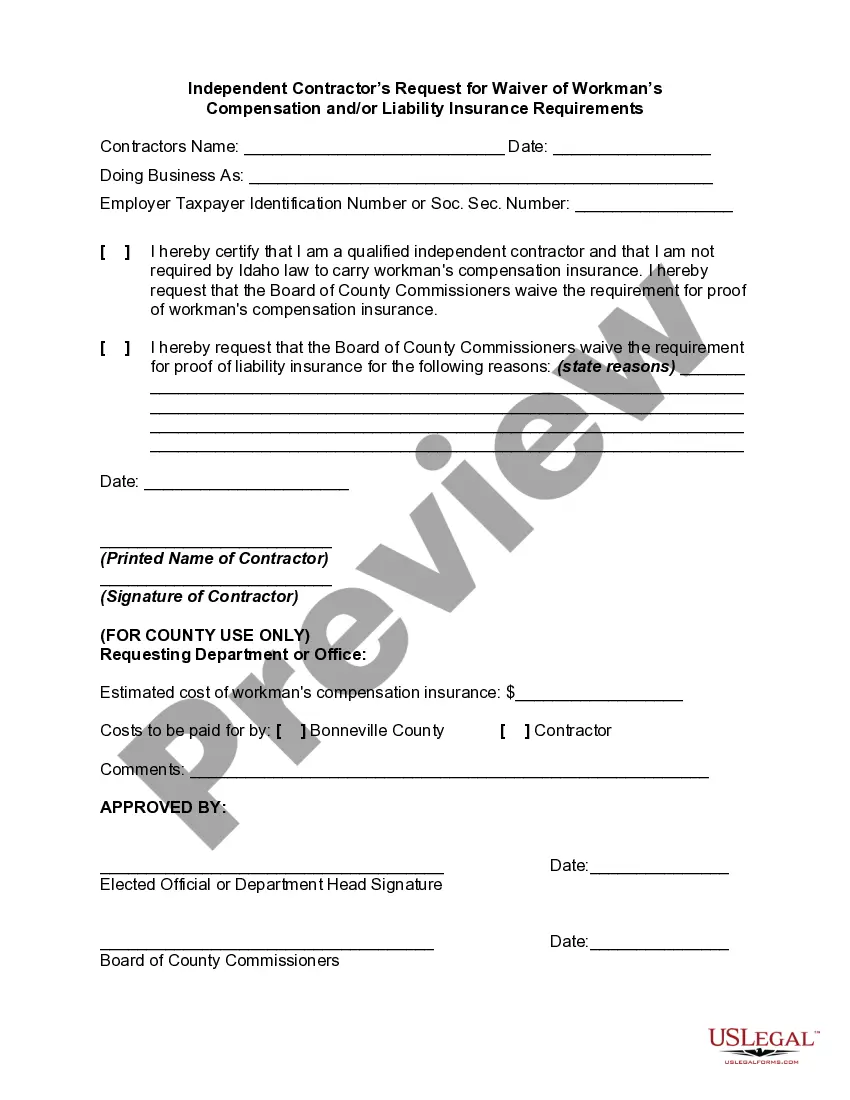

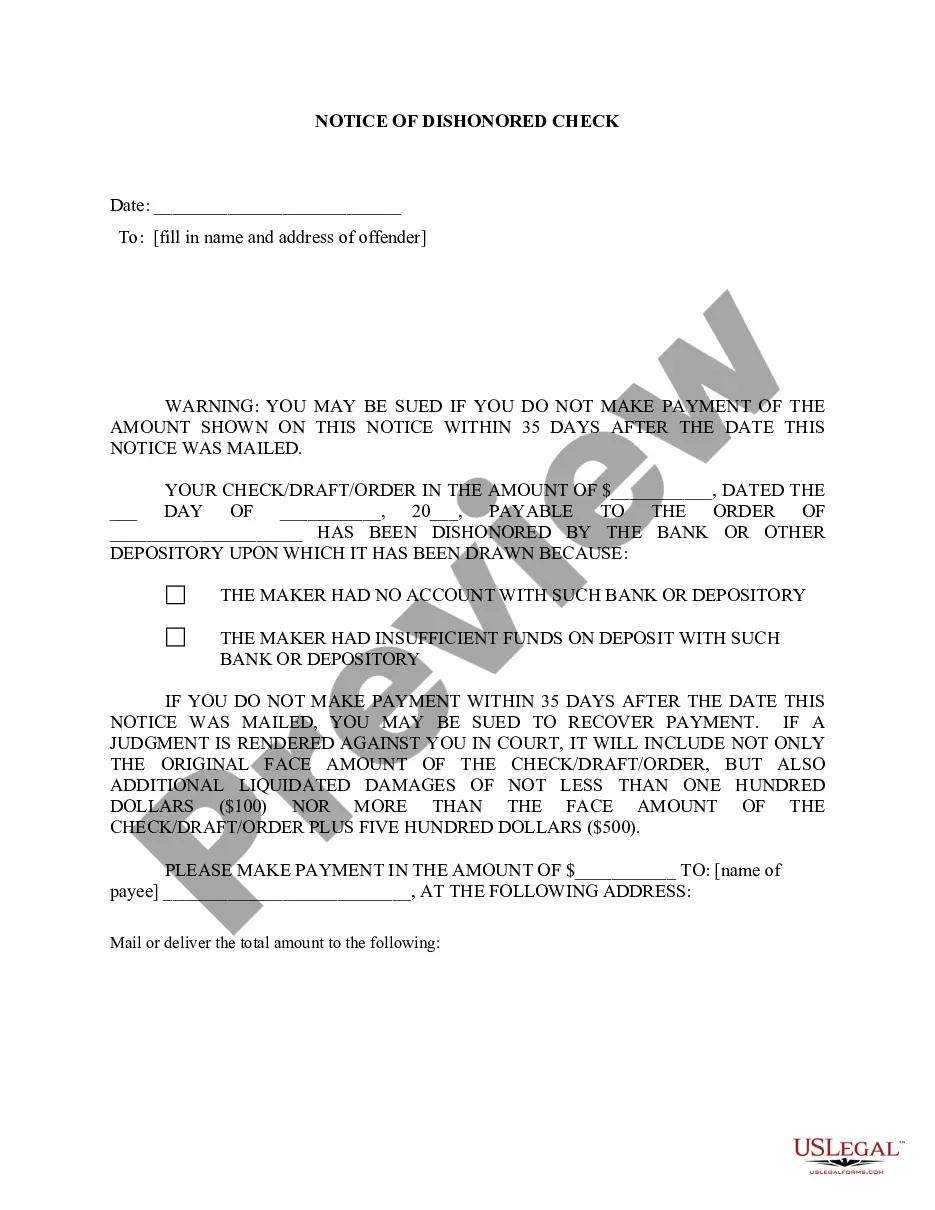

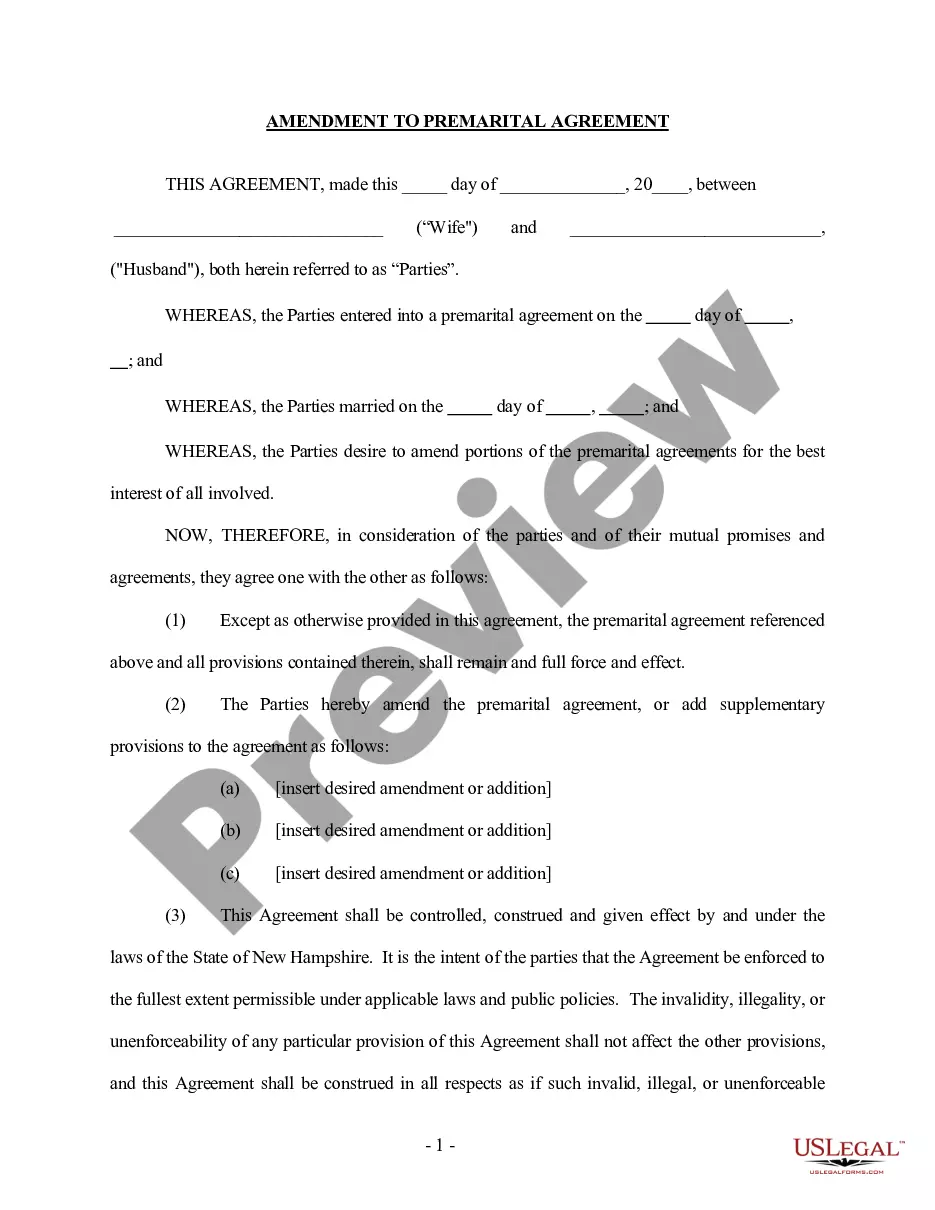

How to fill out Security Agreement For Bridge Financing?

What is the most dependable service to obtain the Bridge Financing Agreement For Home Purchase and other latest iterations of legal documentation? US Legal Forms is the answer! It's the most comprehensive collection of legal forms for any purpose.

Every template is carefully drafted and validated for adherence to federal and regional regulations. They are categorized by area and jurisdiction, making it easy to find the one you require.

US Legal Forms is an ideal choice for anyone needing to handle legal documentation. Premium users can benefit even more by completing and approving previously saved files electronically at any time using the integrated PDF editing tool. Try it out today!

- Experienced users of the platform only need to Log In to the system, verify if their subscription is active, and click the Download button next to the Bridge Financing Agreement For Home Purchase to obtain it.

- Once saved, the template is accessible for future use within the My documents section of your profile.

- If you do not yet possess an account with our library, follow these steps to create one.

- Form compliance verification. Prior to acquiring any template, ensure it meets your usage requirements and complies with your state or county's regulations. Review the form description and utilize the Preview option if available.

Form popularity

FAQ

Bridge loans typically have interest rates between 8.5% and 10.5%, making them more expensive than traditional, long-term financing options. However, the application and underwriting process for bridge loans is generally faster than for traditional loans.

Sound finances: To be approved for a bridge loan typically requires strong credit and stable finances. Lenders may set minimum credit scores and debt-to-income ratios. Generally speaking, if your financial situation is shaky, it could be difficult to get a bridge loan.

However, bridge loans also come with higher interest rates than traditional mortgages and several fees, such as origination charges and a home appraisal.

Bridge loans are generally used in one of two ways:As a way to pay off your current mortgage, putting any excess toward your new down payment. As a second mortgage that becomes your down payment for the new house.

Since the sale of the current property will automatically pay off the bridge loan, the lender can be reasonably certain they will recoup the loan amount. A credit score of 650 and above should be easily approved by private money bridge lender.