Estate Questionnaire With Answers

Description

How to fill out Estate Planning Questionnaire?

The Estate Survey With Responses presented on this page is a reusable official format created by experienced attorneys in compliance with national and local regulations.

For over 25 years, US Legal Forms has supplied individuals, organizations, and legal practitioners with more than 85,000 validated, state-specific documents for any business and personal situation.

Register with US Legal Forms to have validated legal templates for all of life's circumstances at your fingertips.

- Search for the document you require and assess it.

- Browse through the file you searched and preview it or check the form description to confirm it meets your requirements. If it doesn't, use the search feature to locate the suitable one. Click 'Buy Now' once you have identified the template you need.

- Register and Log In.

- Select the pricing option that fits you and create an account. Utilize PayPal or a credit card for a swift payment. If you already have an account, Log In and verify your subscription to continue.

- Obtain the editable template.

- Choose the format you desire for your Estate Survey With Responses (PDF, Word, RTF) and download the sample to your device.

- Fill out and sign the document.

- Print the template to fill it out manually. Alternatively, employ an online versatile PDF editor to quickly and accurately complete and sign your form with a valid signature.

- Download your documents again.

- Make use of the same document again whenever necessary. Access the My documents tab in your account to redownload any forms you have previously downloaded.

Form popularity

FAQ

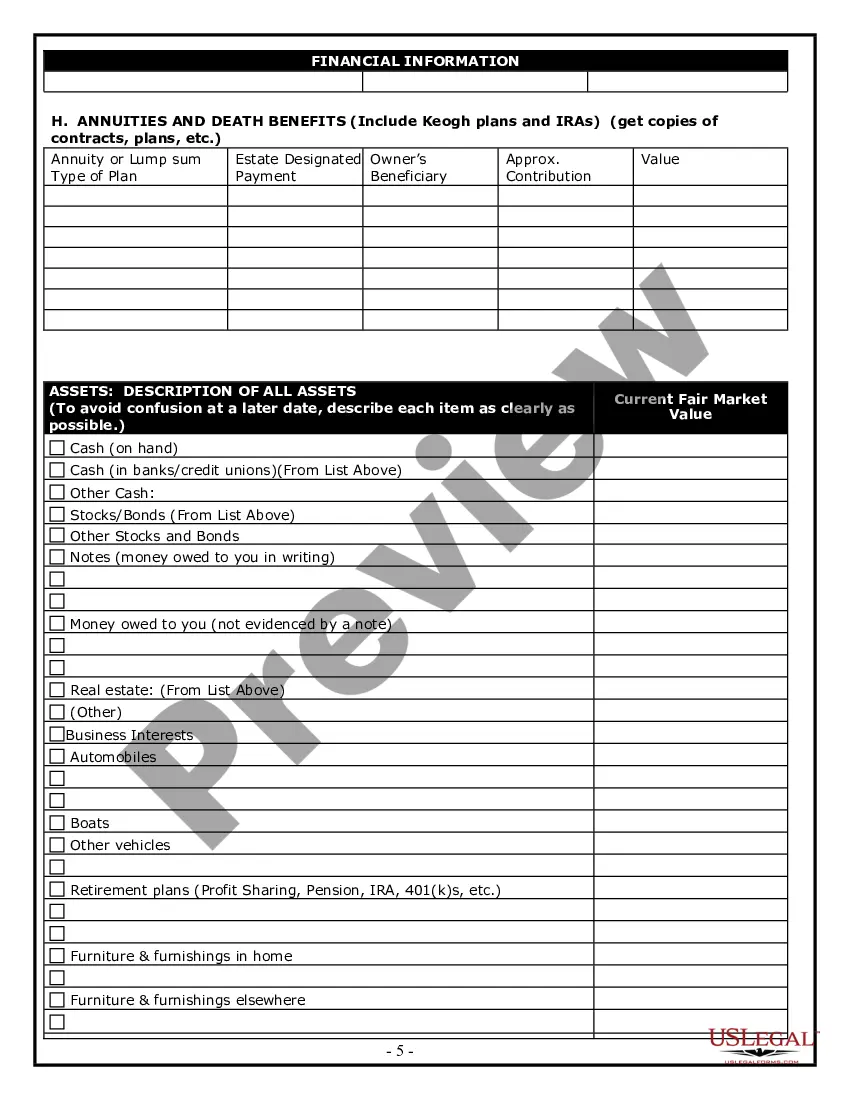

To determine the value of household items for an estate, start by researching similar items online through auction sites or local classifieds. You can also consult with appraisers who specialize in estate sales, as they can provide professional insights on value. Using an estate questionnaire with answers can help you catalog these items and their estimated worth systematically. This process ensures you understand the overall value of the estate, making it easier to manage and distribute assets.

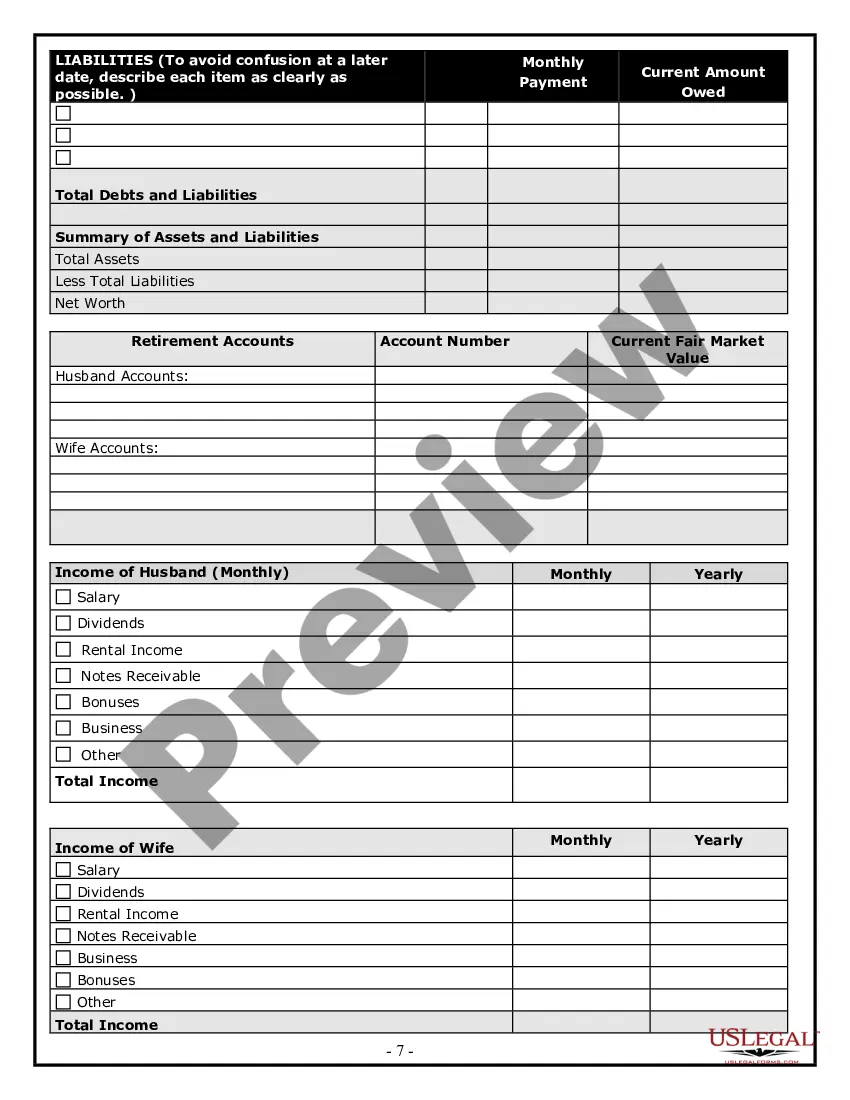

The estate planning process typically involves seven key steps: assessing your assets, determining your goals, choosing beneficiaries, selecting an executor, drafting necessary documents, reviewing and updating your plan, and communicating your wishes. Each step is crucial for a successful estate plan. An estate questionnaire with answers can guide you through these steps, ensuring that you cover all aspects comprehensively. For added assistance, consider using uslegalforms to access helpful tools and resources.

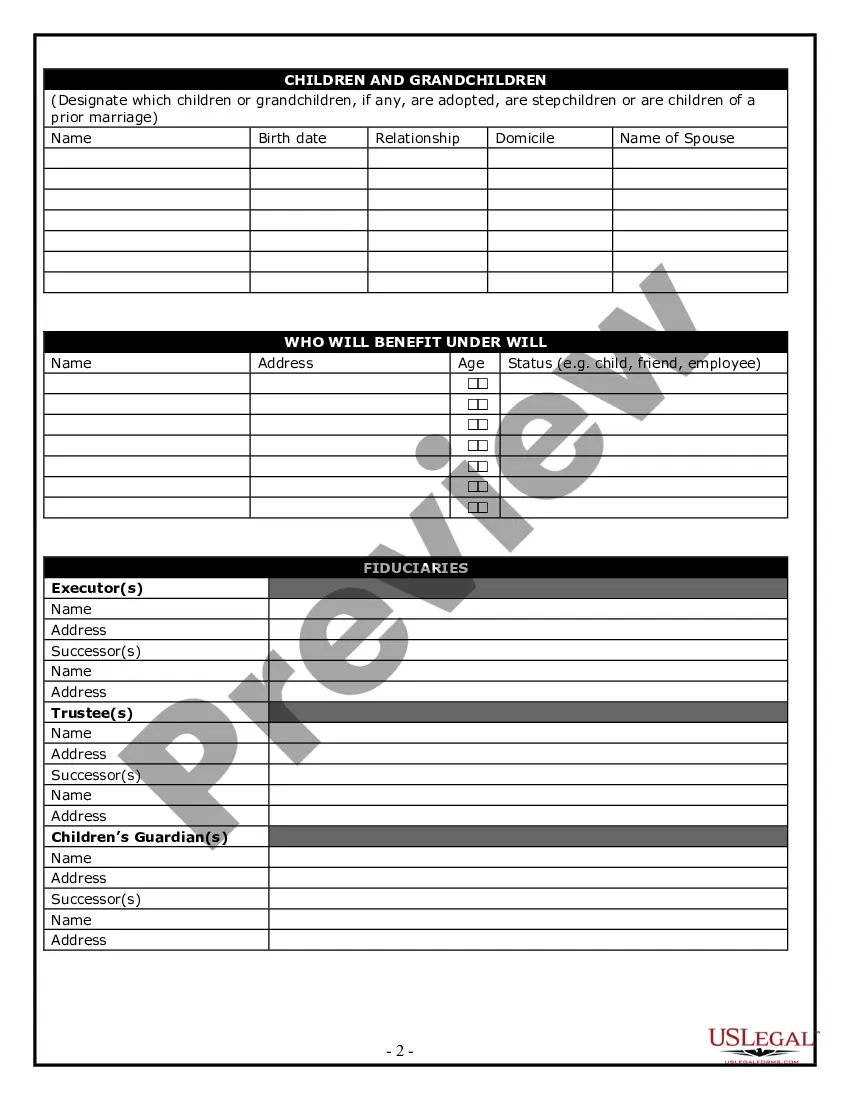

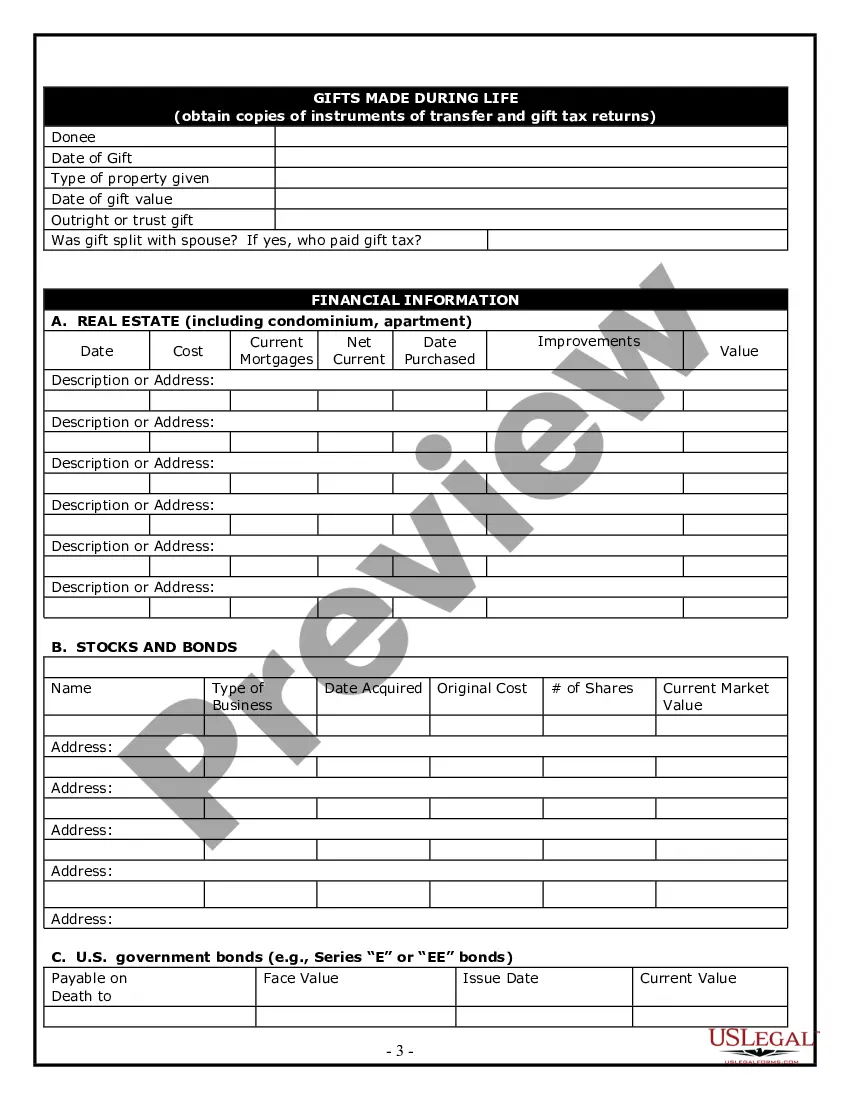

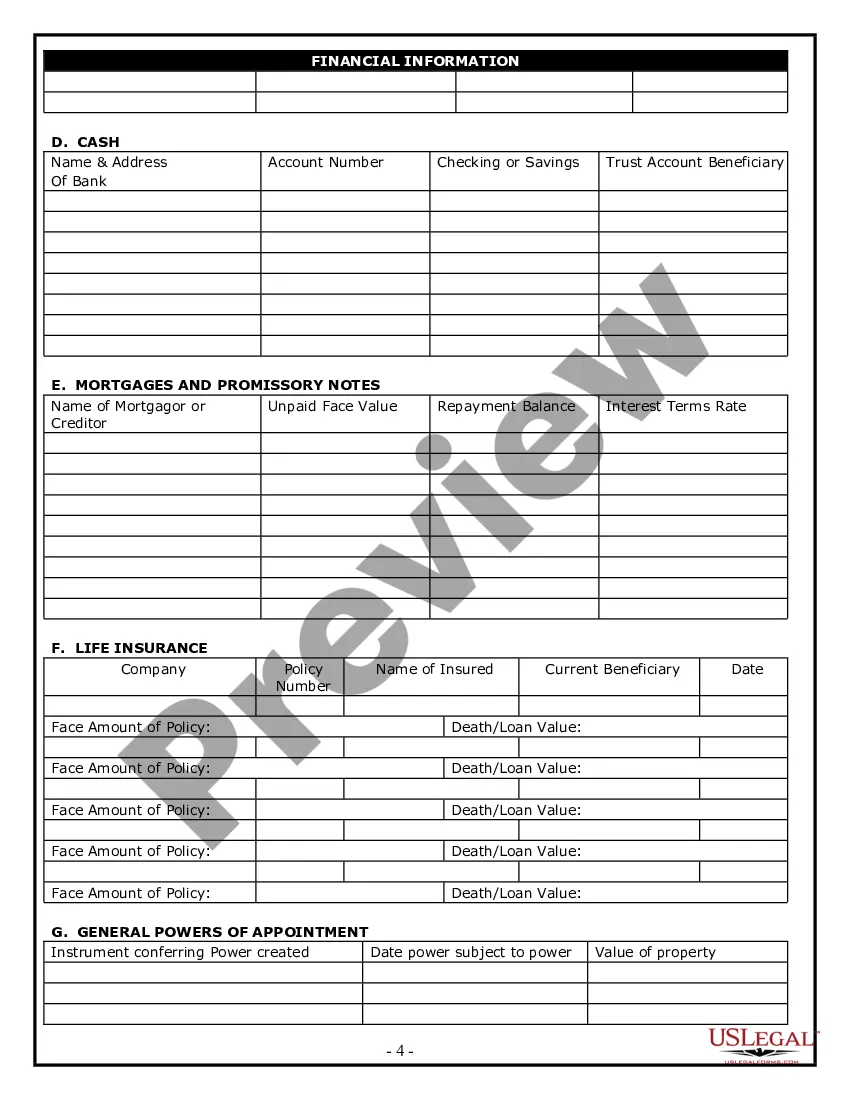

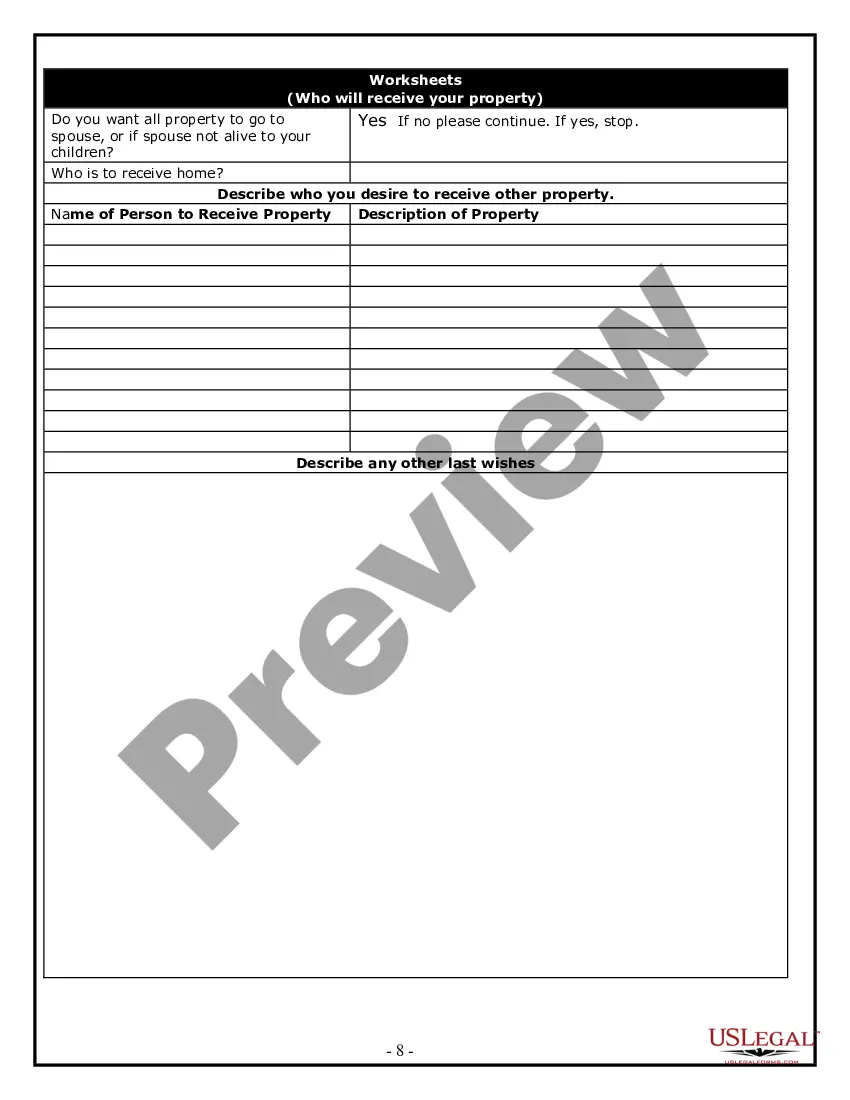

To fill out an estate questionnaire, begin by collecting information about your assets, liabilities, and beneficiaries. Answer each question as thoroughly as possible; this creates a clear picture for your estate planning. Utilizing an estate questionnaire with answers can help facilitate this process, ensuring you don't overlook any important details. If you encounter challenges, resources like uslegalforms can offer valuable support.

Filling out estate paperwork requires careful attention to detail and understanding of your assets and beneficiaries. Start by gathering all necessary documents, such as wills, trusts, and financial statements. An estate questionnaire with answers can streamline this process, guiding you through each step and ensuring you provide all required information. If you need assistance, consider using platforms like uslegalforms to simplify your experience.

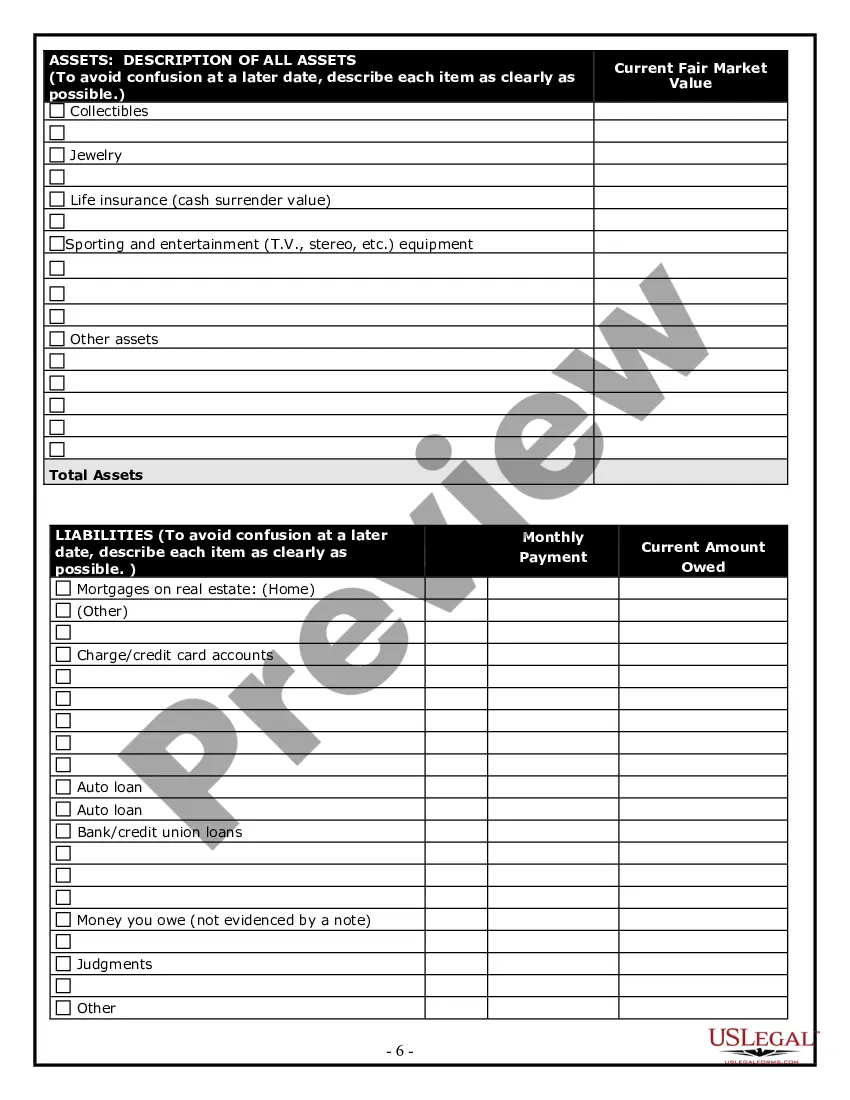

Your estate inventory should be as detailed as possible to ensure clarity in the estate planning process. Include all assets, such as real estate, bank accounts, investments, and personal belongings. The more comprehensive your estate questionnaire with answers, the easier it will be for your heirs to understand your wishes and manage your estate. Using a structured approach can help you capture every necessary detail.

Certain assets do not go through probate, making them easier to transfer after death. For instance, assets held in a living trust, life insurance policies with designated beneficiaries, and retirement accounts like IRAs or 401(k)s pass directly to named individuals. This means you can avoid the lengthy probate process for these assets. To understand your options better, consider using our Estate questionnaire with answers, which can guide you in organizing your estate efficiently.

The biggest mistake in a will often involves failing to designate a personal representative or executor. Without a clear choice, this can lead to confusion and conflict among your heirs. Another common error is neglecting to review and update the will regularly. Addressing these issues through an estate questionnaire with answers ensures that your will is comprehensive and reflects your true intentions.

Inheriting certain assets can lead to more trouble than they are worth. Common examples include properties requiring extensive repairs, timeshares with ongoing fees, or collectibles that are difficult to sell. Additionally, assets with significant tax burdens can create financial strain. Understanding the implications of these assets before inheriting can be crucial, and an estate questionnaire with answers can help clarify these concerns during the planning process.

Filling out an estate planning questionnaire involves gathering important information about your assets, debts, and beneficiaries. Start by listing all your assets, including real estate and bank accounts. Then, think about who you wish to inherit these assets and any specific conditions you might want to include. An estate questionnaire with answers simplifies this process by prompting you with essential questions to ensure nothing is overlooked.

The 5 by 5 rule in estate planning allows beneficiaries to withdraw up to $5,000 per year from a trust without affecting the overall trust assets. This rule provides flexibility and access to funds while preserving the trust's integrity. Understanding this rule can help you make informed decisions in your estate planning process. Utilizing an estate questionnaire with answers can guide you through these important considerations.