Estate Questionnaire With

Description

How to fill out Estate Planning Questionnaire?

The Estate Questionnaire seen on this page is a versatile legal template crafted by expert attorneys in accordance with federal and state laws.

For over 25 years, US Legal Forms has supplied individuals, businesses, and legal practitioners with more than 85,000 authenticated, state-specific documents for any business and personal requirement. It’s the quickest, easiest, and most reliable method to acquire the forms you need, as the service promises the highest degree of data protection and malware defense.

Subscribe to US Legal Forms to have verified legal templates for all of life's situations readily available.

- Search for the document you require and examine it.

- Browse through the example you searched for and preview it or read the form description to ensure it meets your requirements. If it doesn’t, utilize the search feature to find the correct one. Click Buy Now when you have located the template you need.

- Sign up and Log In.

- Select the subscription plan that fits you and sign up for an account. Utilize PayPal or a credit card for a swift payment. If you possess an existing account, Log In and verify your subscription to proceed.

- Obtain the fillable template.

- Select the format you desire for your Estate Questionnaire (PDF, Word, RTF) and save the document onto your device.

- Complete and sign the form.

- Print the template to fill it out by hand. Alternatively, use an online multifunctional PDF editor to quickly and accurately complete and sign your document with a legally-binding electronic signature.

- Download your paperwork again.

- Reuse the same document whenever necessary. Access the My documents section in your profile to redownload any previously saved templates.

Form popularity

FAQ

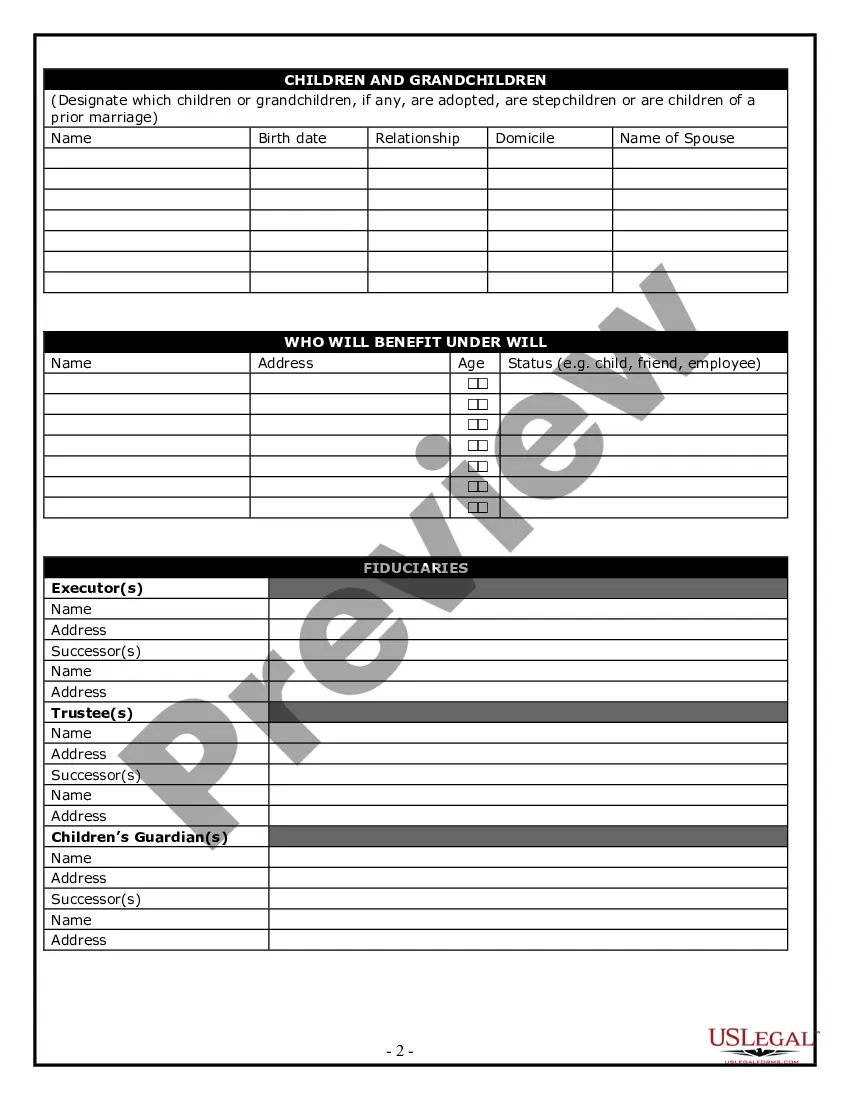

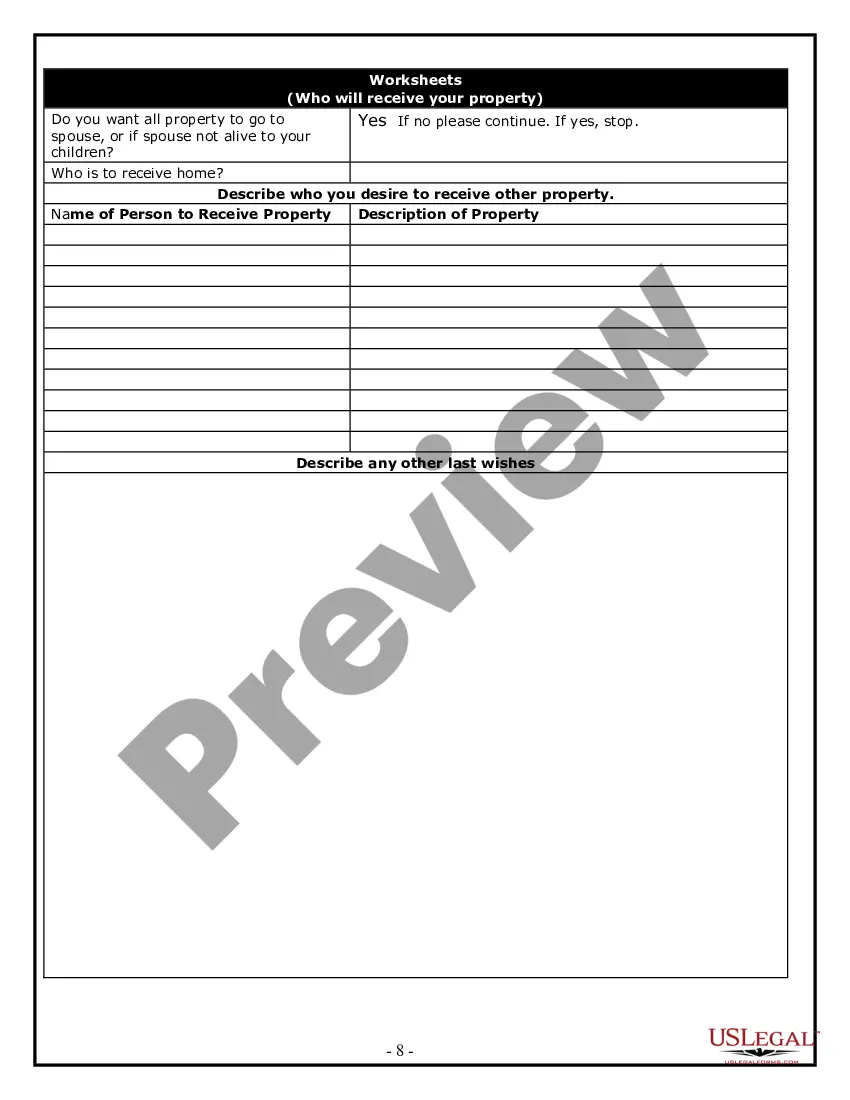

To fill out an estate planning questionnaire, start by collecting personal information about your family, assets, and financial accounts. Answer questions honestly and thoroughly, as this will help create a comprehensive plan. Using an estate questionnaire with structured sections can simplify this process, making it easier to outline your wishes and ensure nothing is overlooked. Once completed, review your responses to verify accuracy.

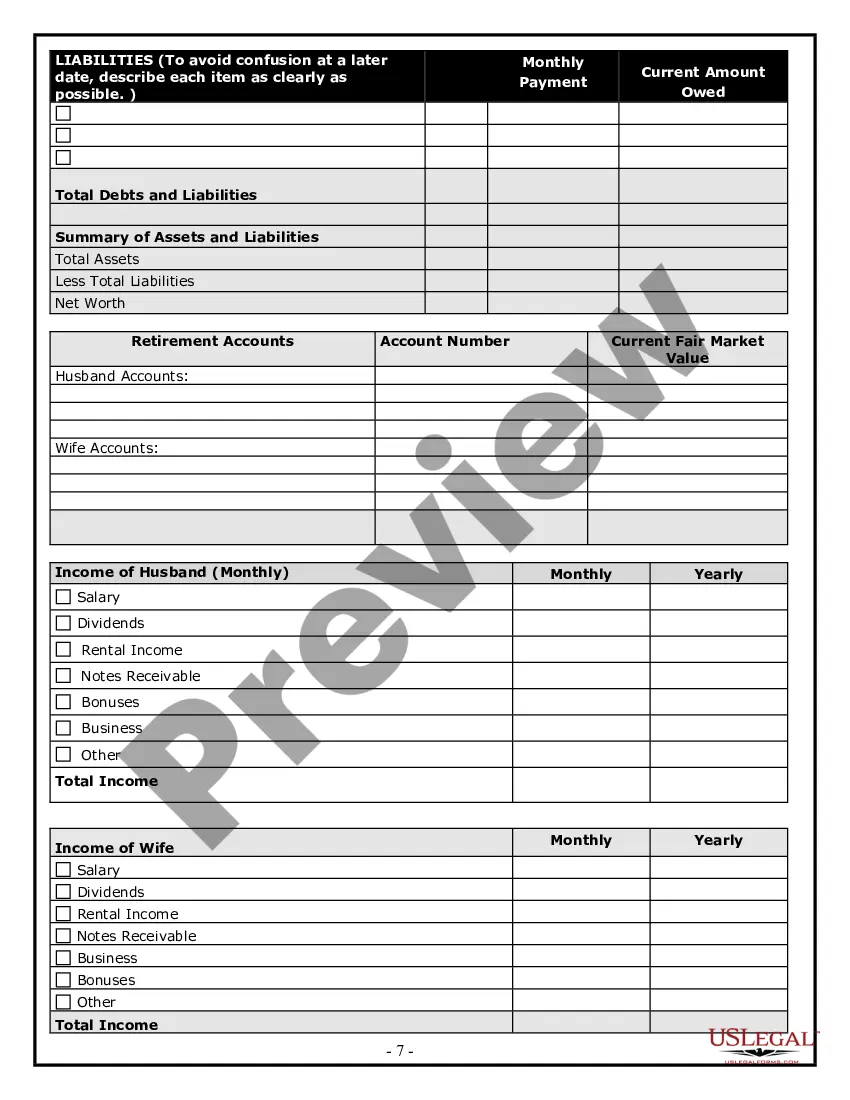

The estate planning process typically involves seven key steps: assessing your assets, determining your goals, choosing beneficiaries, selecting an executor, creating essential documents like wills and trusts, reviewing your plan regularly, and addressing any tax implications. Starting with an estate questionnaire can help clarify your goals and gather the necessary information. Each step is crucial in ensuring that your wishes are fulfilled and your loved ones are protected.

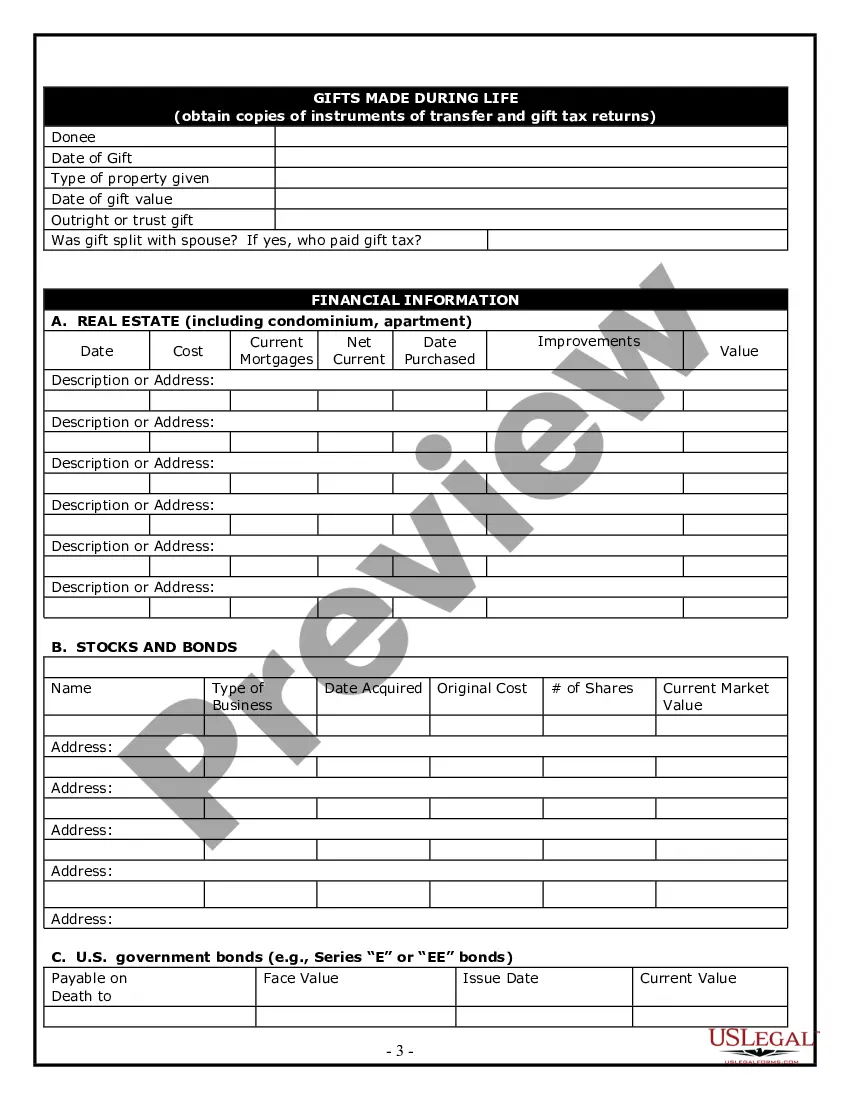

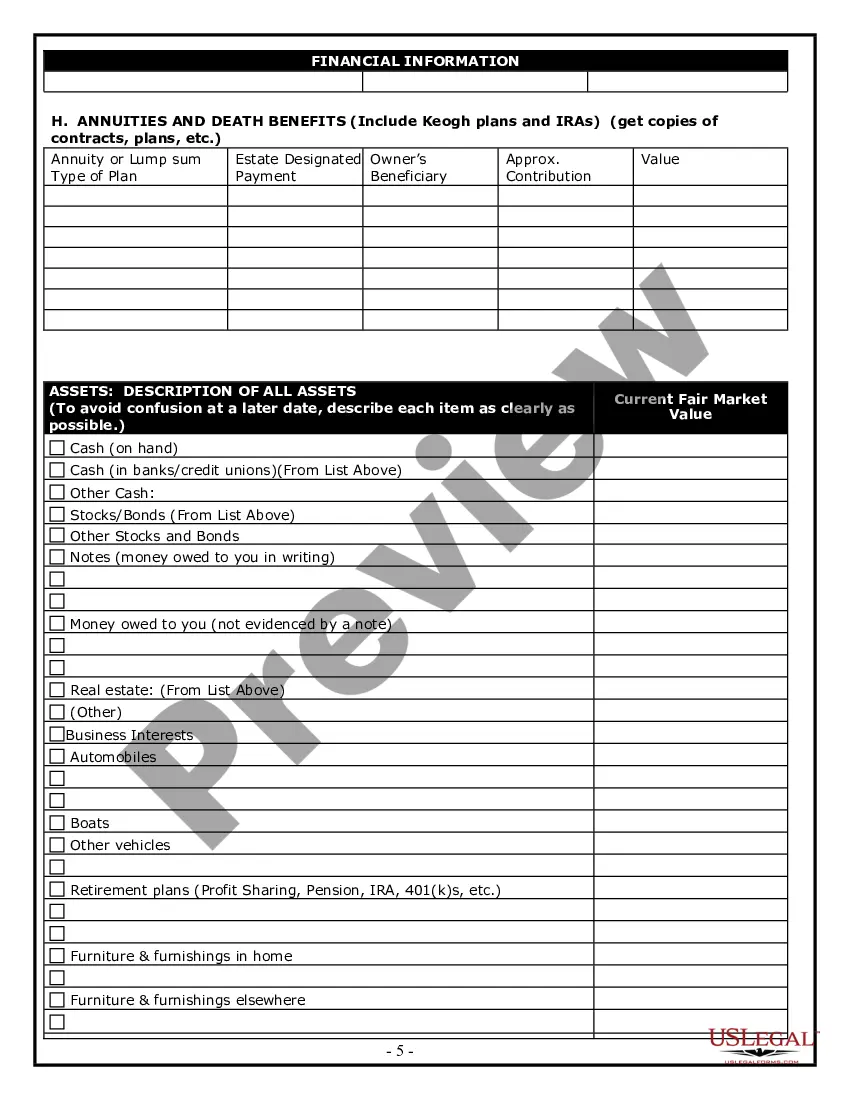

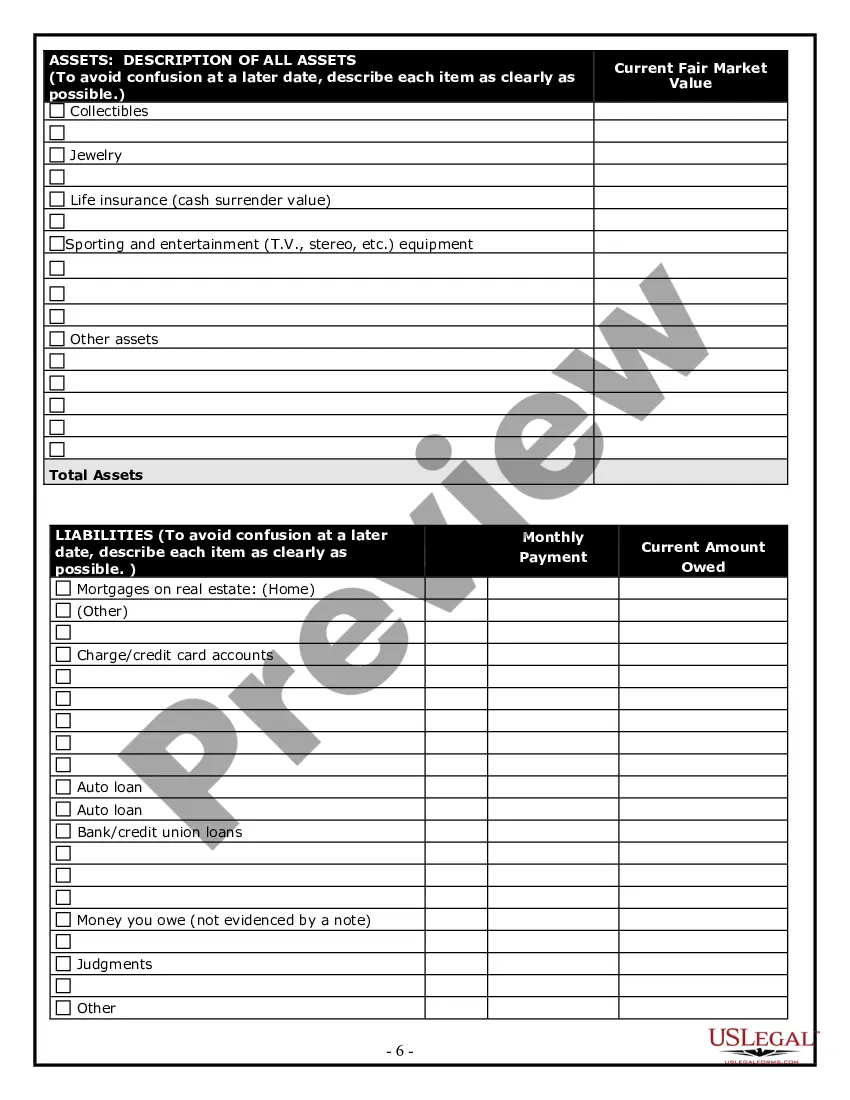

To determine the value of household items for an estate, start by researching similar items online to establish a fair market value. You may also consider hiring a professional appraiser for valuable or unique items. An estate questionnaire with valuation sections can guide you through this process and help document the value of each item effectively. Always keep receipts or appraisal records for future reference.

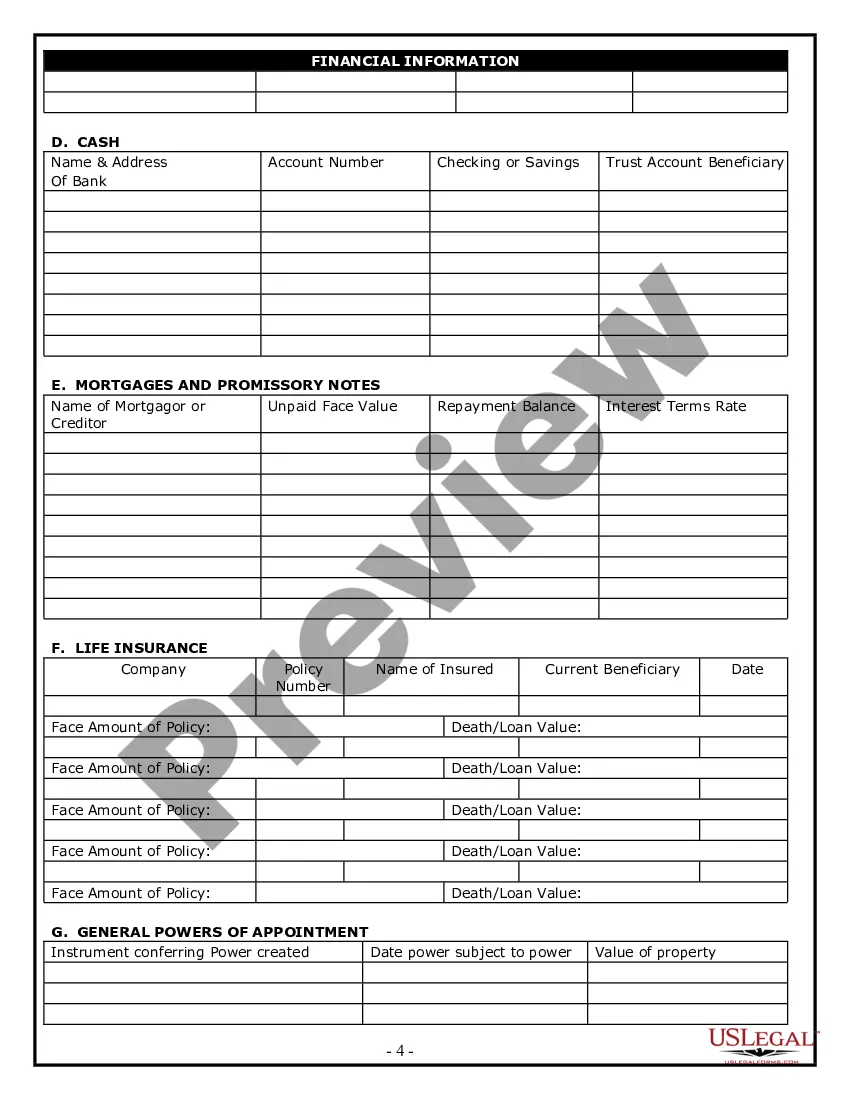

Filling out an estate inventory requires listing all assets owned by the deceased, such as real estate, bank accounts, and personal belongings. Begin by gathering appraisals, receipts, and any relevant documentation to ascertain the value of each item. Utilizing an estate questionnaire with an inventory section can help ensure you don’t miss any items. Finally, categorize and value each asset accurately for a comprehensive overview.

The wording of a Last Will and Testament typically includes an introductory statement identifying the testator, followed by declarations about revoking previous wills. You should clearly specify your beneficiaries and what they will receive. For guidance, consider reviewing examples or using an estate questionnaire with templates that can help you structure your document effectively.

Filling out an estate questionnaire involves answering specific questions about your assets, liabilities, and personal preferences. Begin by organizing your financial documents to provide accurate information. Using an estate questionnaire with clear sections can simplify this task, ensuring you cover all necessary details. Once completed, review your answers for accuracy and consistency.

To fill out estate paperwork, start by gathering necessary documents such as wills, trusts, and financial statements. Next, clearly follow the instructions provided with each form, ensuring you include all required information. If you encounter questions, consider using an estate questionnaire with guided prompts to streamline the process. Finally, review your completed paperwork thoroughly before submission.

Assets that typically do not go through probate include retirement accounts, life insurance policies, and properties held in joint tenancy. These assets transfer directly to beneficiaries outside of the probate process, simplifying estate management. To ensure you account for these assets, complete your estate questionnaire with our platform for a smoother planning experience.

An estate questionnaire is a document designed to gather crucial information about your assets, debts, and personal wishes for your estate. It serves as a foundational tool in estate planning, helping to ensure that your wishes are clearly communicated. By utilizing an estate questionnaire with our platform, you can streamline your planning efforts and provide clarity for your loved ones.

The 5 by 5 rule allows a beneficiary of a trust to withdraw up to $5,000 or 5% of the trust's value each year without incurring gift taxes. This rule provides flexibility and ensures beneficiaries can access funds without complications. Including this rule in your estate questionnaire with our services can simplify your planning process.