Estate Planning Questionnaire And Worksheets

Description

How to fill out Estate Planning Questionnaire?

Managing legal documentation and processes can be an arduous extension to your day.

Estate Planning Questionnaire And Worksheets and similar forms usually require you to locate them and comprehend the most effective way to fill them out accurately.

For that reason, if you are dealing with financial, legal, or personal issues, utilizing a thorough and user-friendly online repository of forms at your disposal will greatly assist you.

US Legal Forms is the premier online platform for legal templates, boasting over 85,000 state-specific forms and a range of tools that will aid you in completing your documentation effortlessly.

Is this your first time using US Legal Forms? Sign up and create an account in a few minutes and you will gain access to the form library and Estate Planning Questionnaire And Worksheets. Afterwards, follow the steps below to complete your form: Ensure you have the correct form utilizing the Review feature and evaluating the form description. Select Buy Now when you are ready, and choose the subscription plan that suits you best. Click Download then fill out, sign, and print the form. US Legal Forms has twenty-five years of experience assisting users in managing their legal documentation. Acquire the form you require right now and streamline any process without hassle.

- Browse the library of relevant documents available to you with a single click.

- US Legal Forms offers you state- and county-specific forms available for download at any time.

- Protect your document management processes with a high-quality service that enables you to compile any form in minutes without incurring additional or hidden fees.

- Simply Log In to your account, search for Estate Planning Questionnaire And Worksheets and download it instantly in the My documents section.

- You can also retrieve previously saved forms.

Form popularity

FAQ

The 5 or 5 rule, similar to the 5 by 5 rule, allows a withdrawal of up to 5% of the total trust principal per year without facing a gift tax. This flexibility is crucial for beneficiaries who may need access to funds while the trust continues to grow. By understanding and incorporating this rule in your estate planning questionnaire and worksheets, you can offer your beneficiaries financial security and access tailored to their needs.

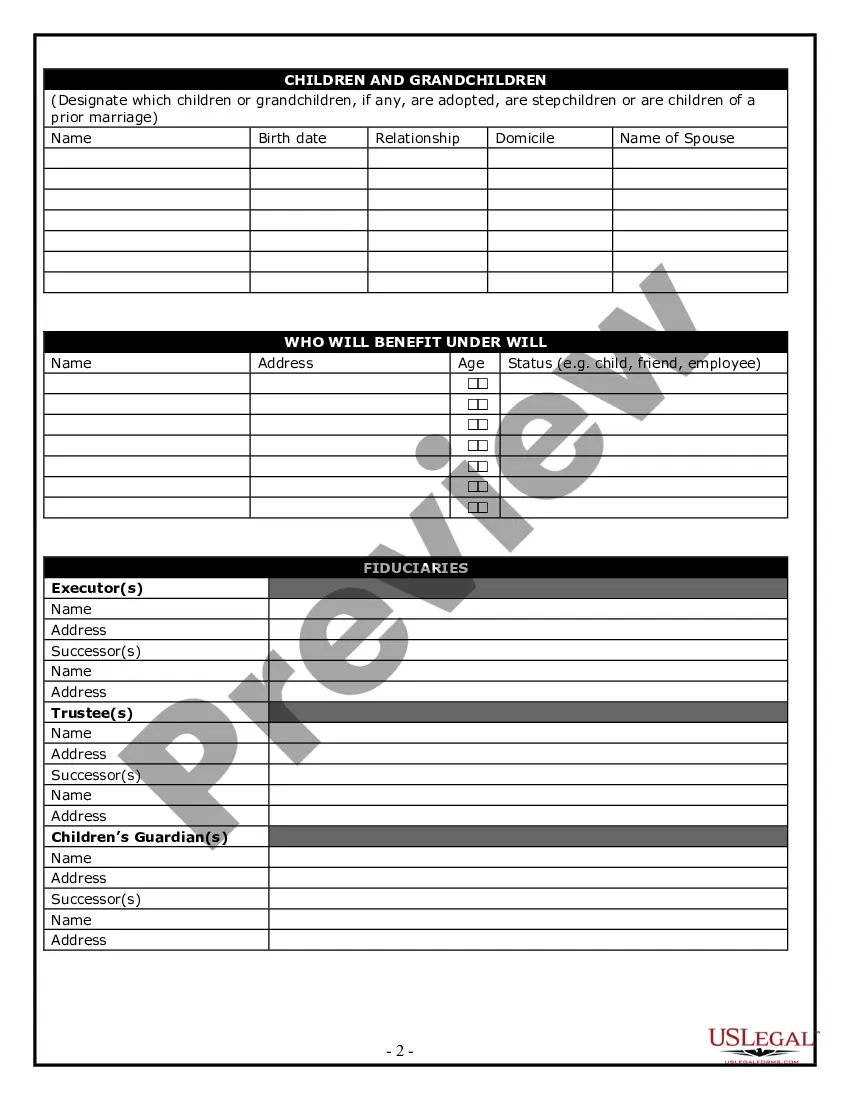

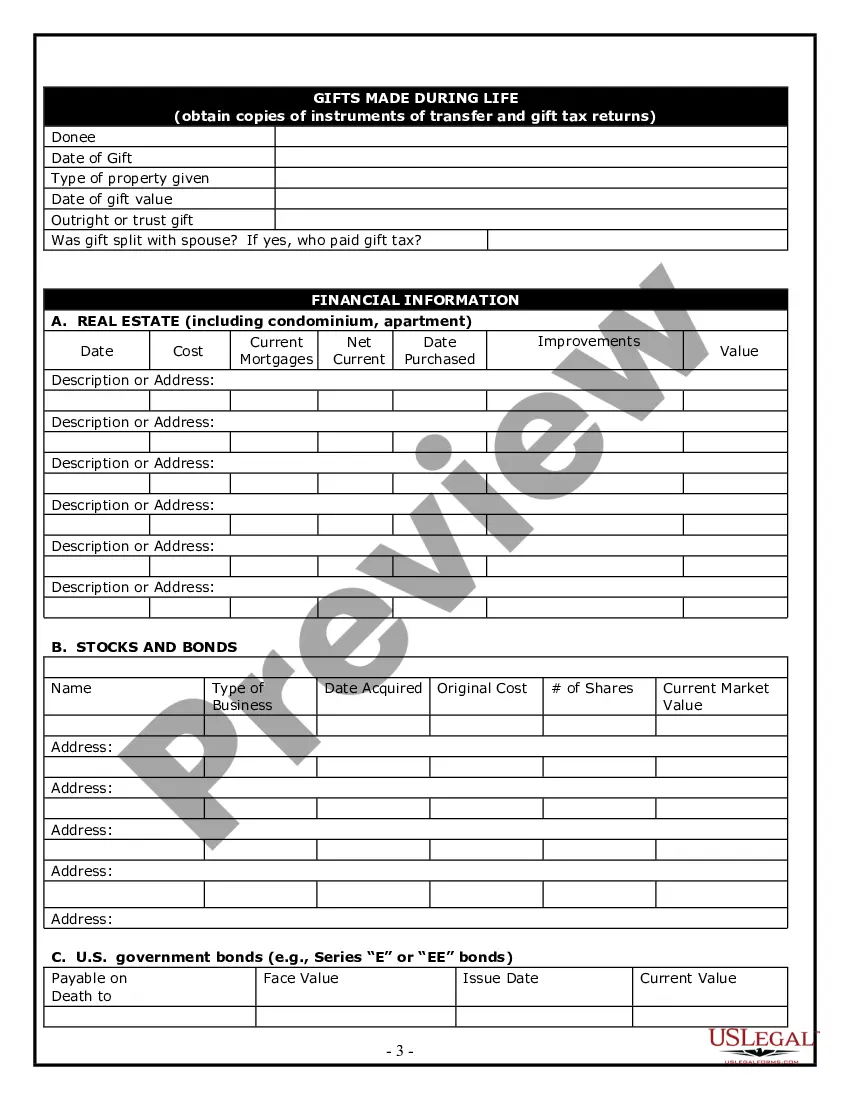

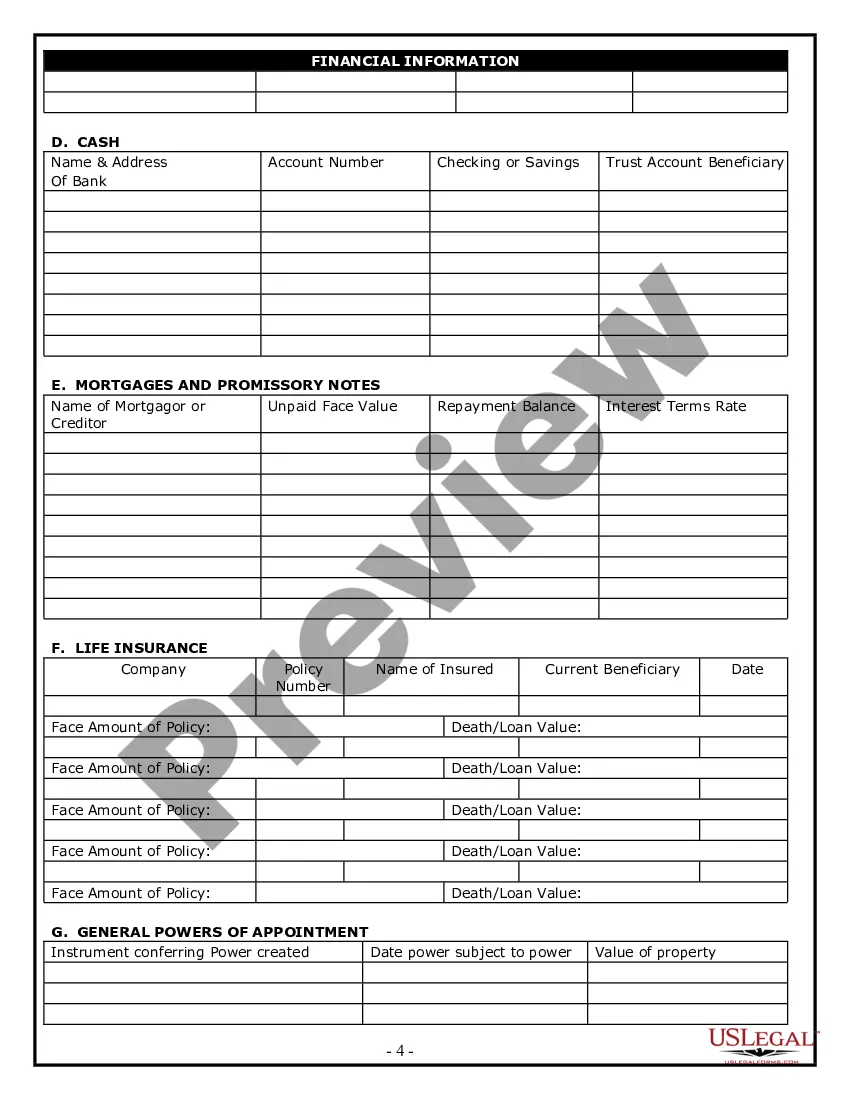

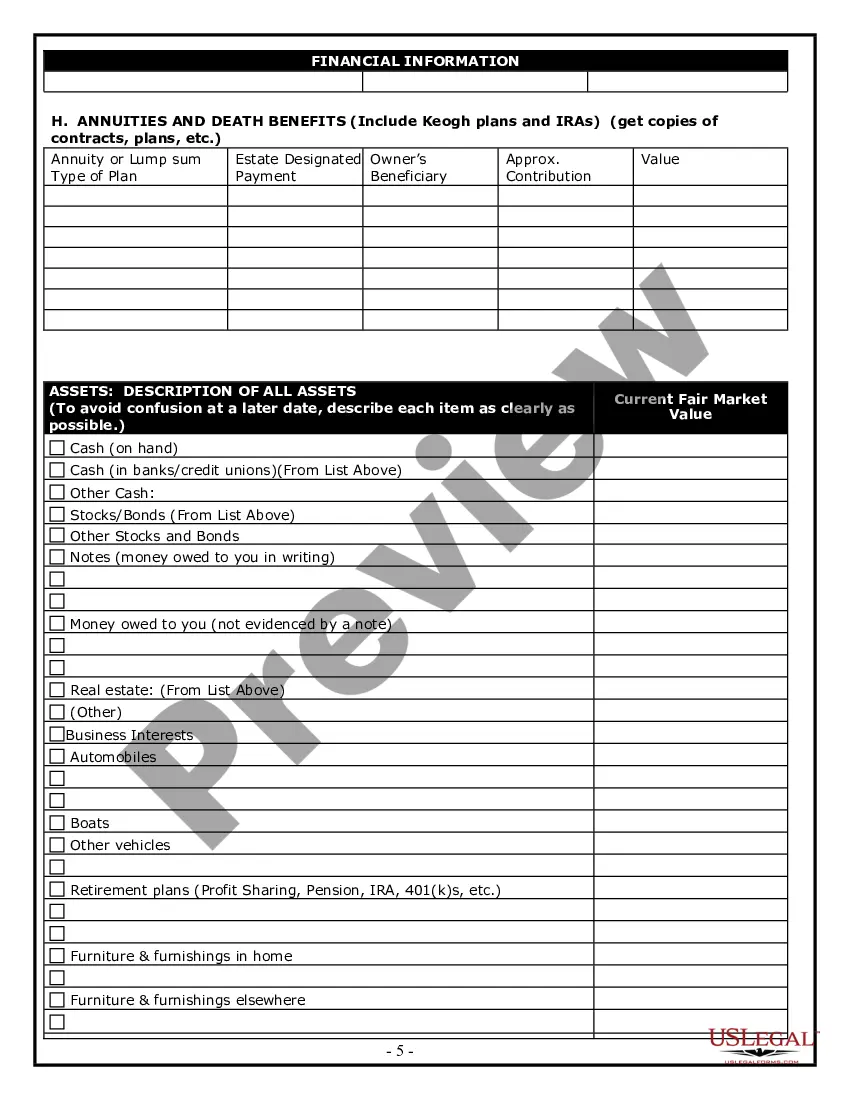

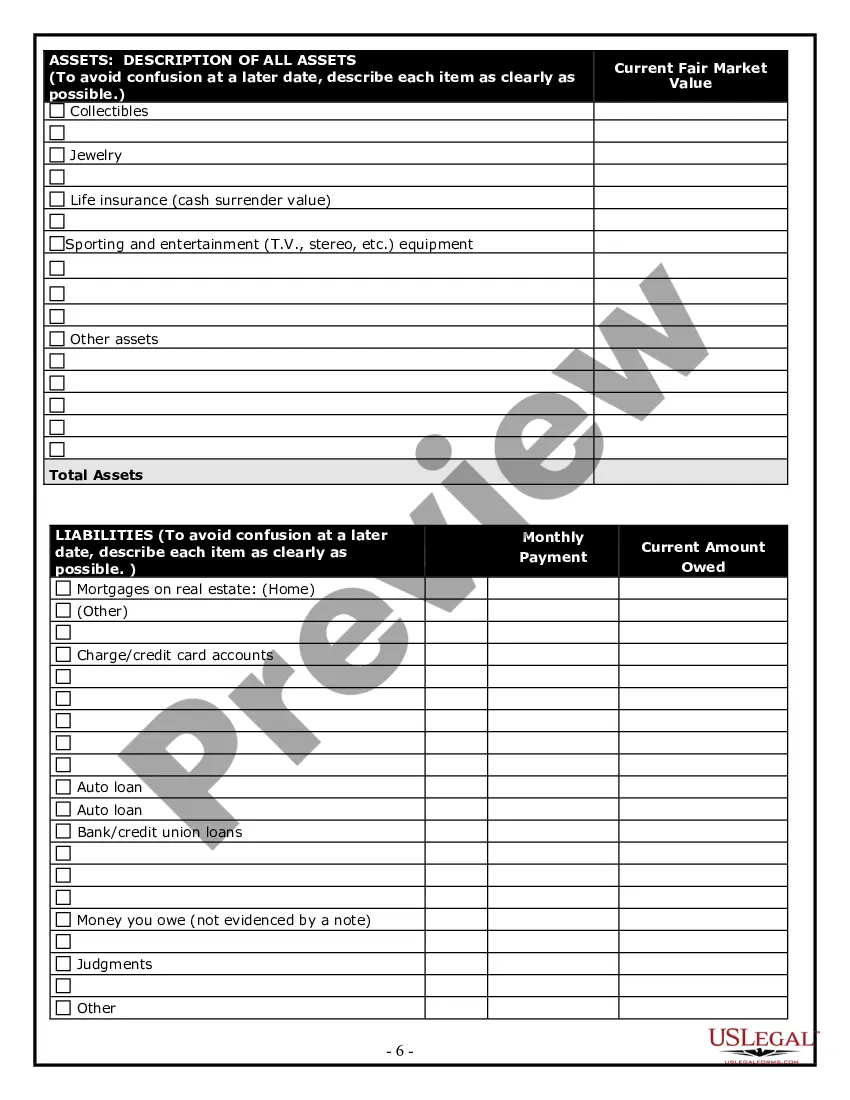

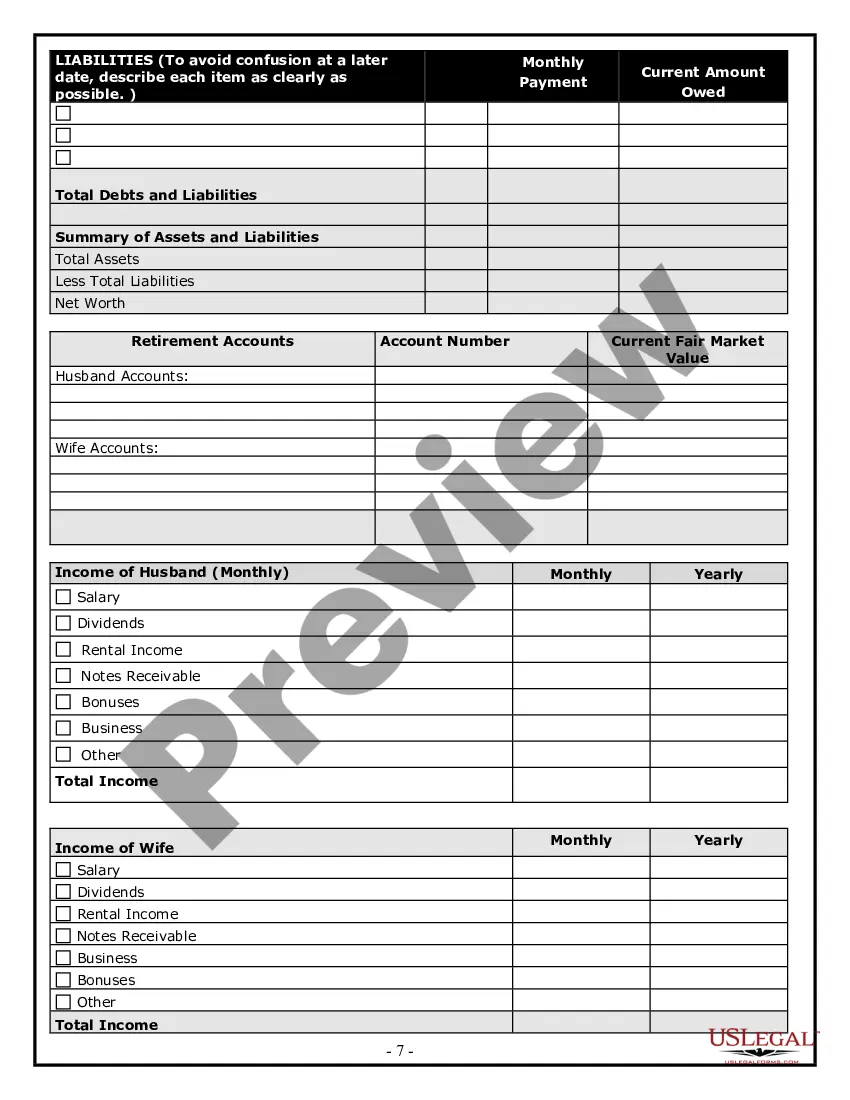

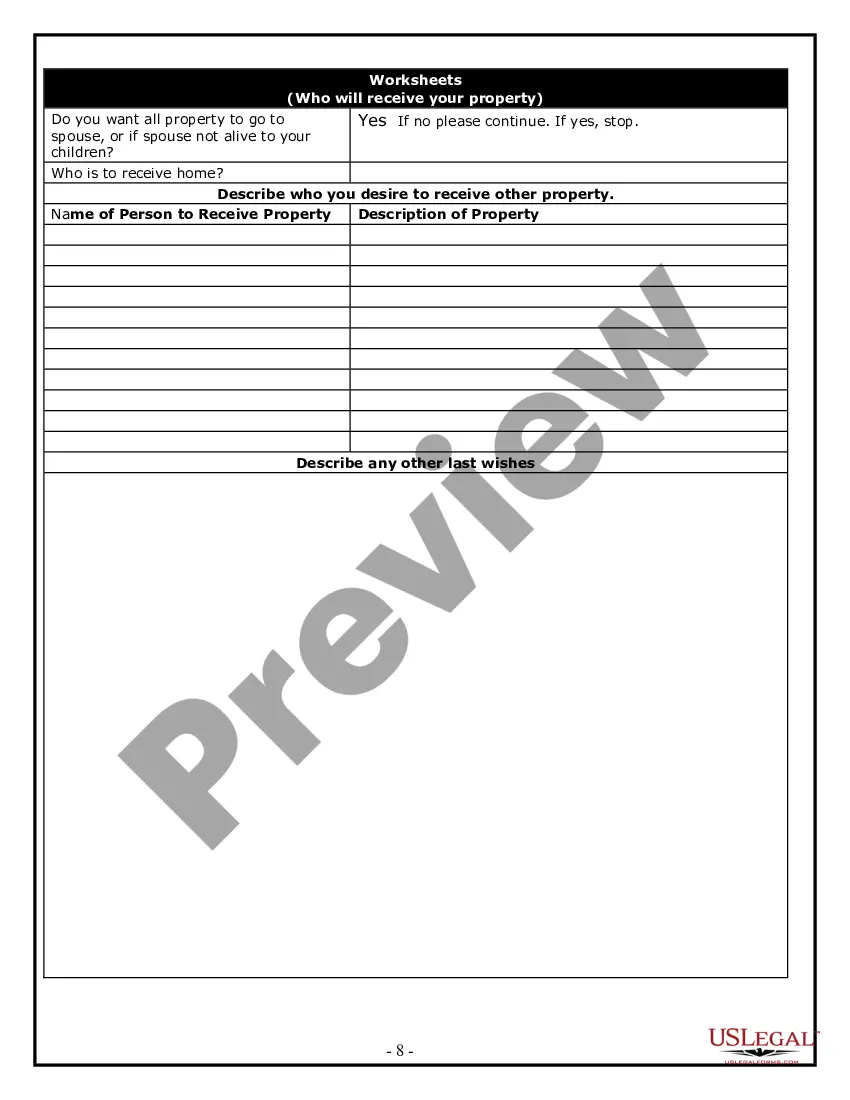

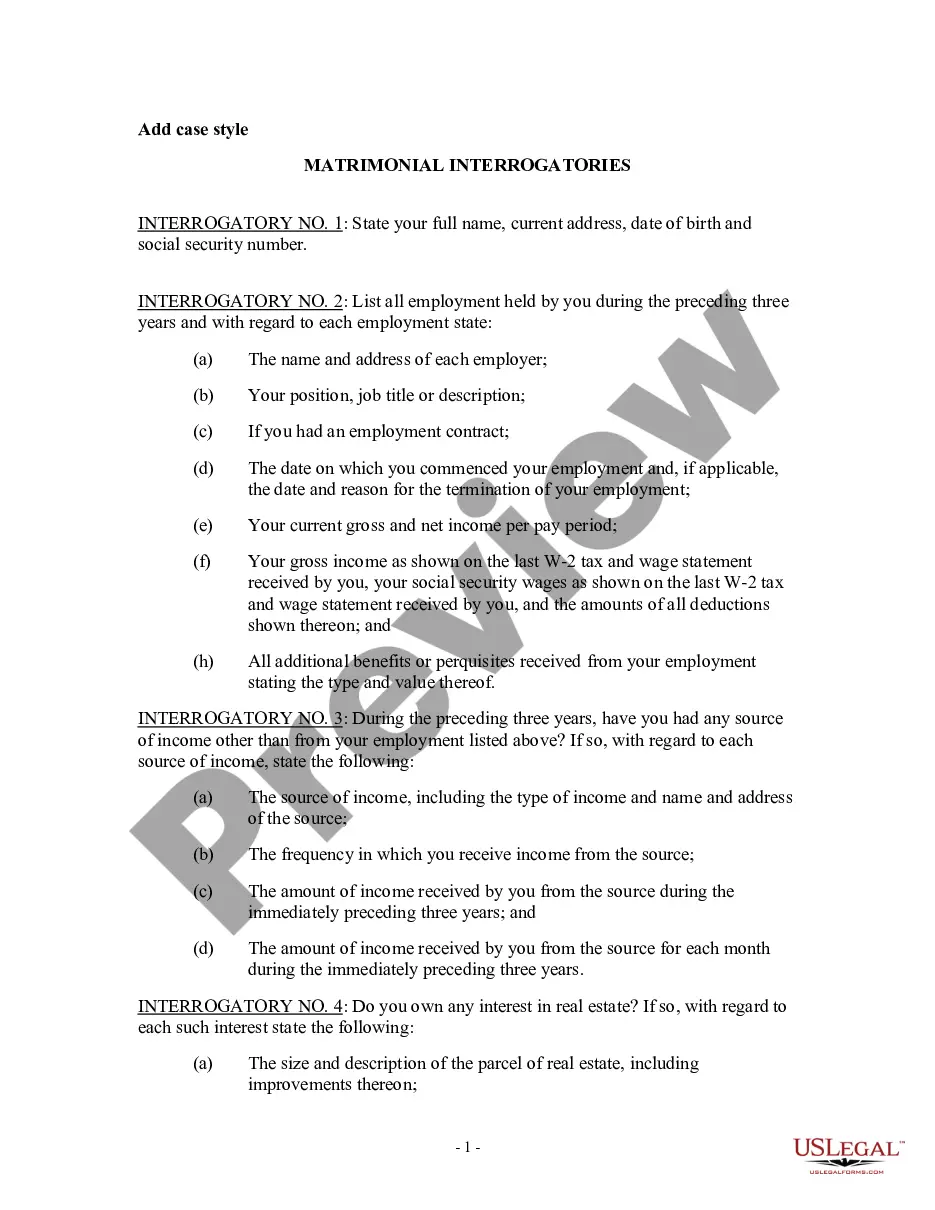

Filling out an estate planning questionnaire involves gathering essential information regarding your assets, liabilities, and wishes for asset distribution. Begin by listing your assets, including real estate, bank accounts, and personal items, then consider your beneficiaries and your preferred distribution method. Using detailed estate planning questionnaires and worksheets can streamline this process, allowing you to organize your thoughts and provide accurate information.

The 5 by 5 rule refers to a common provision in trusts that allows a beneficiary to withdraw up to $5,000 or 5% of the trust's assets, whichever is greater, each year without penalty. This rule helps beneficiaries access funds while preserving the trust's integrity for long-term needs. Incorporating this rule into your estate planning questionnaire and worksheets can ensure that your beneficiaries have the flexibility they need.

One major mistake parents often make when establishing a trust fund is failing to communicate their intentions clearly with the beneficiaries. Without transparent guidelines, misunderstandings may arise, leading to disputes among family members. Utilizing estate planning questionnaires and worksheets can help clarify your goals and expectations, ensuring that your loved ones understand your wishes.

Suze Orman emphasizes four essential documents for any complete estate plan: a will, a trust, a durable power of attorney, and a healthcare proxy. Including these documents in your estate planning questionnaire and worksheets ensures you cover all bases regarding your estate. These components safeguard your wishes and provide for your loved ones, especially in times of need. Utilizing platforms like USLegalForms can further assist you in creating and managing these documents efficiently.

To effectively organize estate planning documents, first create a clear filing system based on categories such as wills, trusts, and powers of attorney. Using an estate planning questionnaire and worksheets can also aid you in summarizing critical information about each document. Regularly update your files, especially after significant changes in your life or finances. This structured organization simplifies the retrieval of documents and supports clear communication of your wishes.

The 5 by 5 rule in estate planning allows a trustee to distribute up to five different gifts, totaling no more than five percent of the trust’s assets, per year without facing tax implications. This rule is noteworthy for estate planning as it enables flexibility in managing trust distributions. By including this approach in your estate planning questionnaire and worksheets, you can strategize better tax efficiencies for your beneficiaries. This insight helps in ensuring your loved ones receive maximum benefits from your estate.

Maintain your estate plan documents by reviewing them at least once a year or after major life events. Utilize an estate planning questionnaire and worksheets to ensure all information remains up-to-date. Store your documents in a secure location, both physically and digitally, to prevent loss or unauthorized access. Regular maintenance guarantees your estate plan reflects your current wishes and circumstances.

To organize documents for estate planning, start by gathering all essential papers, such as wills, trusts, and insurance policies. Use an estate planning questionnaire and worksheets to categorize these documents systematically, making it easier for you to locate them when needed. Keeping physical copies in a secure location and digital copies in a cloud storage option can enhance accessibility. This approach not only simplifies your planning but also helps your loved ones understand your wishes.

An estate planning questionnaire is a tool designed to help you gather crucial information regarding your assets, beneficiaries, and desired outcomes. This worksheet simplifies your planning process by organizing key details, making it easier to create a comprehensive estate plan. Utilizing an estate planning questionnaire and worksheets can ensure that you cover all essential areas and make informed decisions. Platforms like USLegalForms provide excellent resources that make this task straightforward.