Opening A Conservator Bank Account

Description

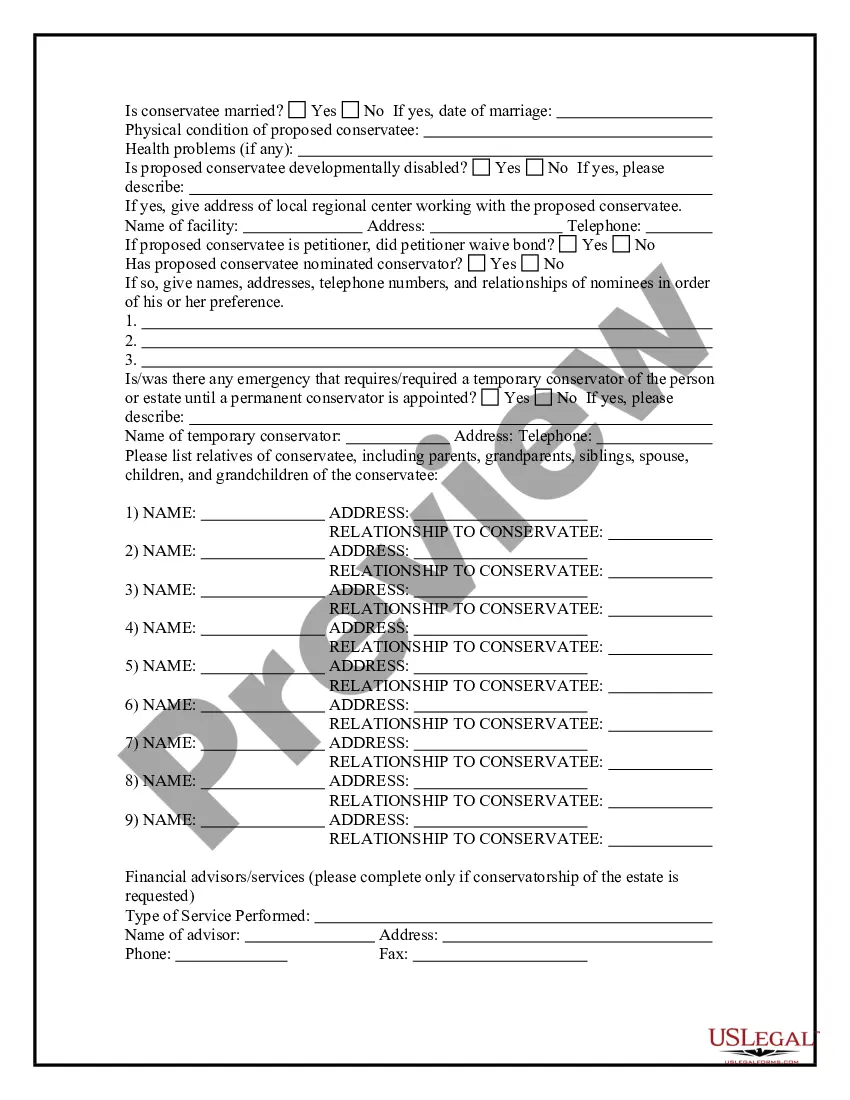

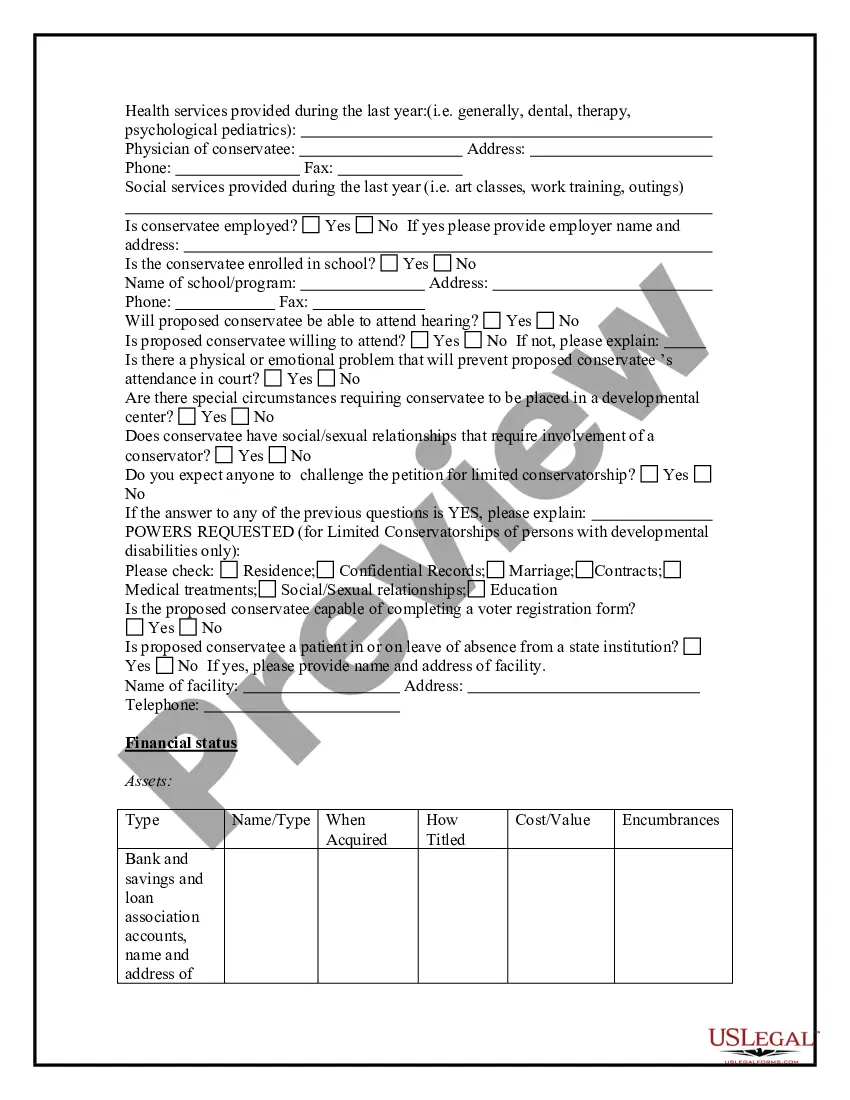

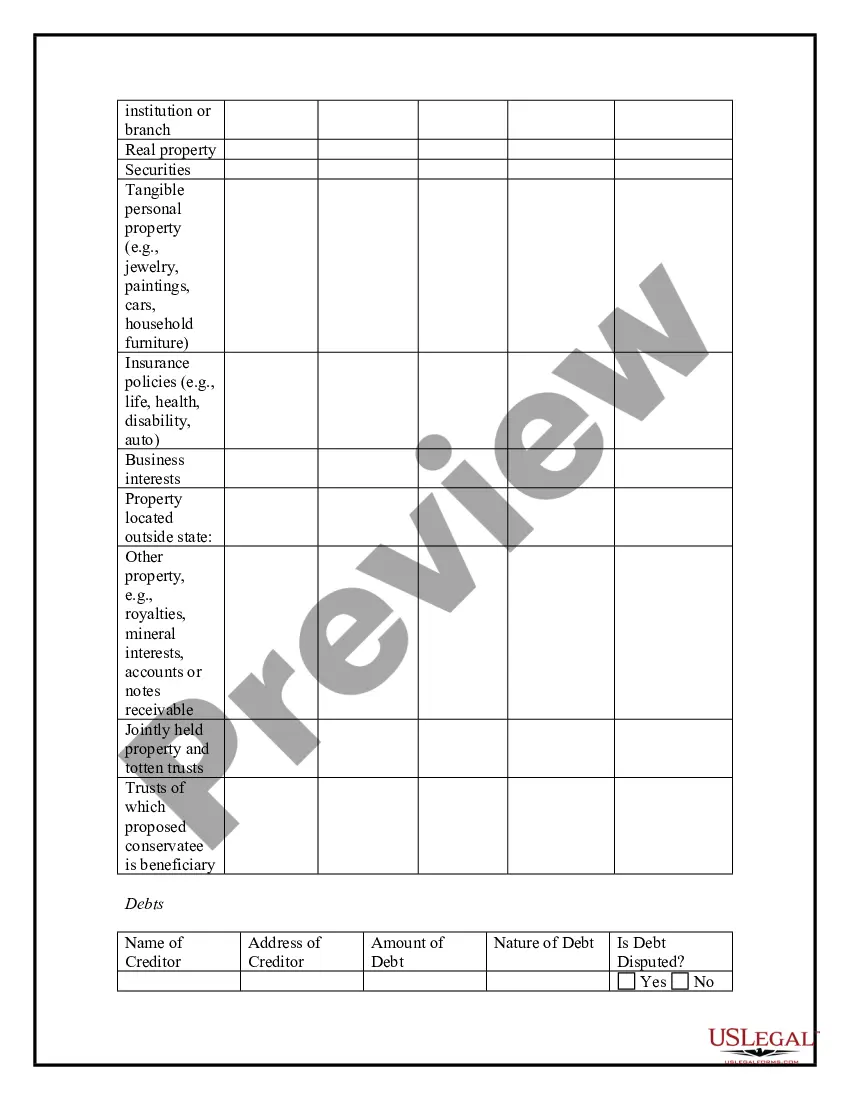

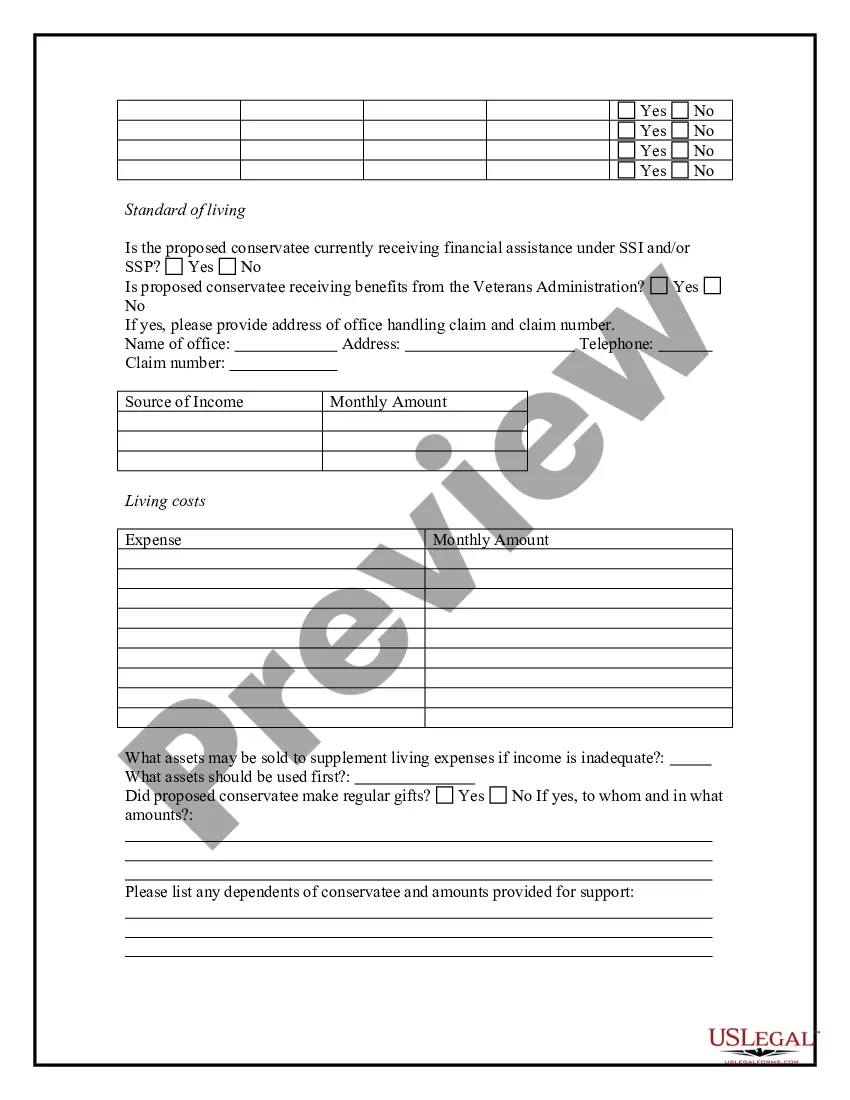

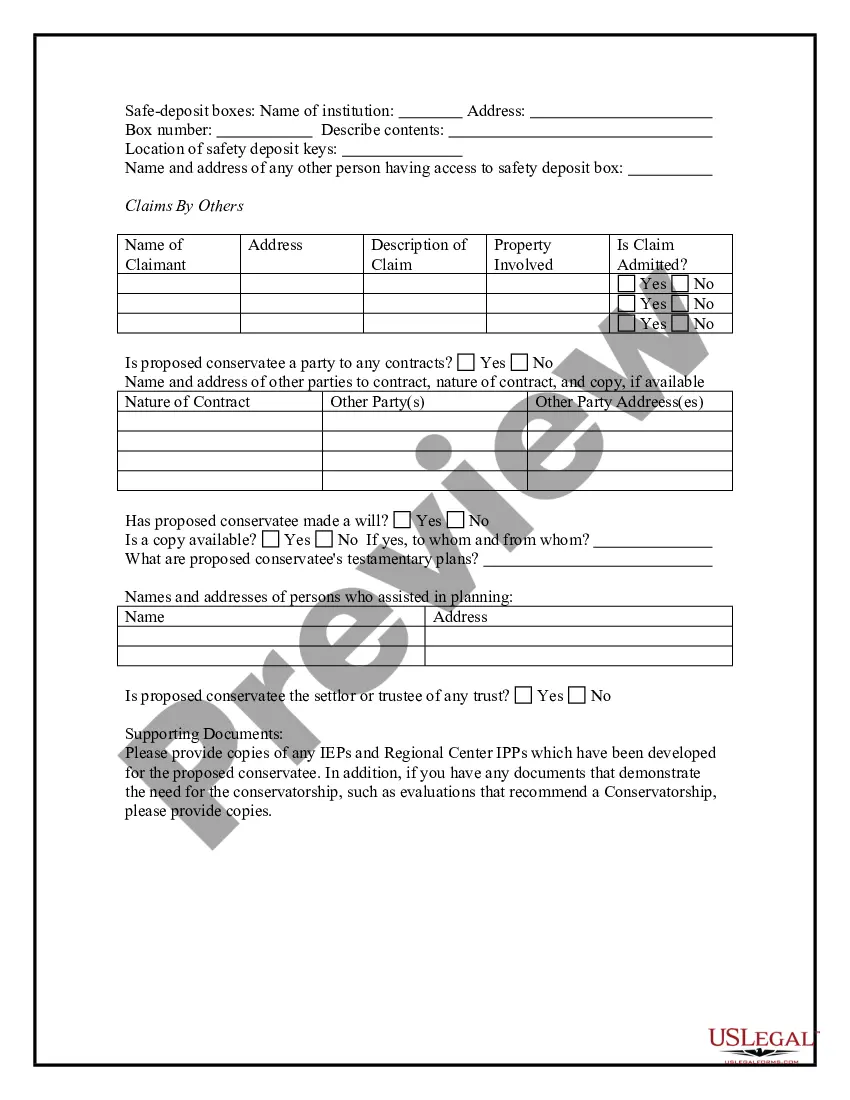

How to fill out Conservatorship Questionnaire?

Managing legal documents and processes can be a lengthy addition to your day.

Initiating a Conservator Bank Account and similar forms often require you to search for them and comprehend the best method to fill them out accurately.

For this reason, whether you are dealing with financial, legal, or personal issues, possessing a comprehensive and user-friendly online directory of forms when you need it will significantly help.

US Legal Forms is the leading online platform for legal templates, featuring over 85,000 state-specific forms and a multitude of resources to assist you in completing your documents with ease.

Is this your first experience with US Legal Forms? Sign up and establish an account in a few moments, and you will gain entry to the form catalog and Opening A Conservator Bank Account. Then, follow the steps outlined below to finish your form: Ensure you have the correct form by utilizing the Preview feature and reviewing the form description. Select Buy Now when ready, and choose the subscription plan that fits your needs. Click Download then fill out, eSign, and print the form. US Legal Forms boasts 25 years of expertise in assisting clients with their legal documents. Find the form you need right now and simplify any process without exerting much effort.

- Browse the collection of relevant documents available with just a single click.

- US Legal Forms provides you with state- and county-specific forms accessible at any time for downloading.

- Protect your document management processes with a superior service that enables you to create any form within minutes without any extra or concealed fees.

- Just Log In to your account, find Opening A Conservator Bank Account, and obtain it directly from the My documents section.

- You can also retrieve previously saved forms.

Form popularity

FAQ

A conservator on a bank account is a person appointed by the court to manage the financial affairs of someone who is unable to do so themselves, often due to incapacity. This role involves overseeing the account, making withdrawals, and ensuring that funds are used appropriately for the benefit of the individual under conservatorship. If you are in the process of opening a conservator bank account, it's crucial to understand your responsibilities and the legal implications involved. US Legal Forms can provide valuable resources to clarify these duties.

Choosing between a Power of Attorney (POA) and a joint bank account depends on your specific needs. A POA grants someone the authority to manage your financial matters without sharing ownership of the account, while a joint account allows both parties to access and manage the funds directly. If you are considering opening a conservator bank account, a POA might provide more flexibility and security. Understanding these options can help you make an informed decision that best suits your situation.

To open a conservator bank account, you need to gather essential documents, such as the court order that appoints you as the conservator. Visit your chosen bank and provide them with this documentation, along with identification. The bank will guide you through the process of setting up the account and ensuring that it meets the requirements for managing funds on behalf of the individual under conservatorship. If you need help navigating this process, consider using US Legal Forms for templates and resources.

Relationship with a representative payee A guardian or conservator is not automatically a representative payee; they must apply with the agency for appointment as representative payee.

A conservator is a court-appointed role. The conservator is responsible for managing the financial and personal affairs of a person who is incapacitated, or a minor. Conservators are subject to scrutiny by the court. For example, they often must document their management of the conservatee's finances.

Absolutely. As long as the executor is acting on behalf of the estate, in ance with a will, and performing with a sense of fiduciary duty, withdrawing from the estate's account is a necessary and natural part of the probate and estate settlement process.

In order to open a guardianship account, the guardian must show a certified copy of a court order appointing them the guardian of an individuals account. If an individual can no longer serve as guardian of an account, because of death or some other reason, the court will appoint a new guardian for the account.

Executors and administrators of a decedent's estate can only access their bank accounts if the decedent had not designated a beneficiary for the account. The documents an executor/administrator generally will be required to present to the bank include: A valid government-issued ID.