Conservatorship Bond Calculator For Tennessee

Description

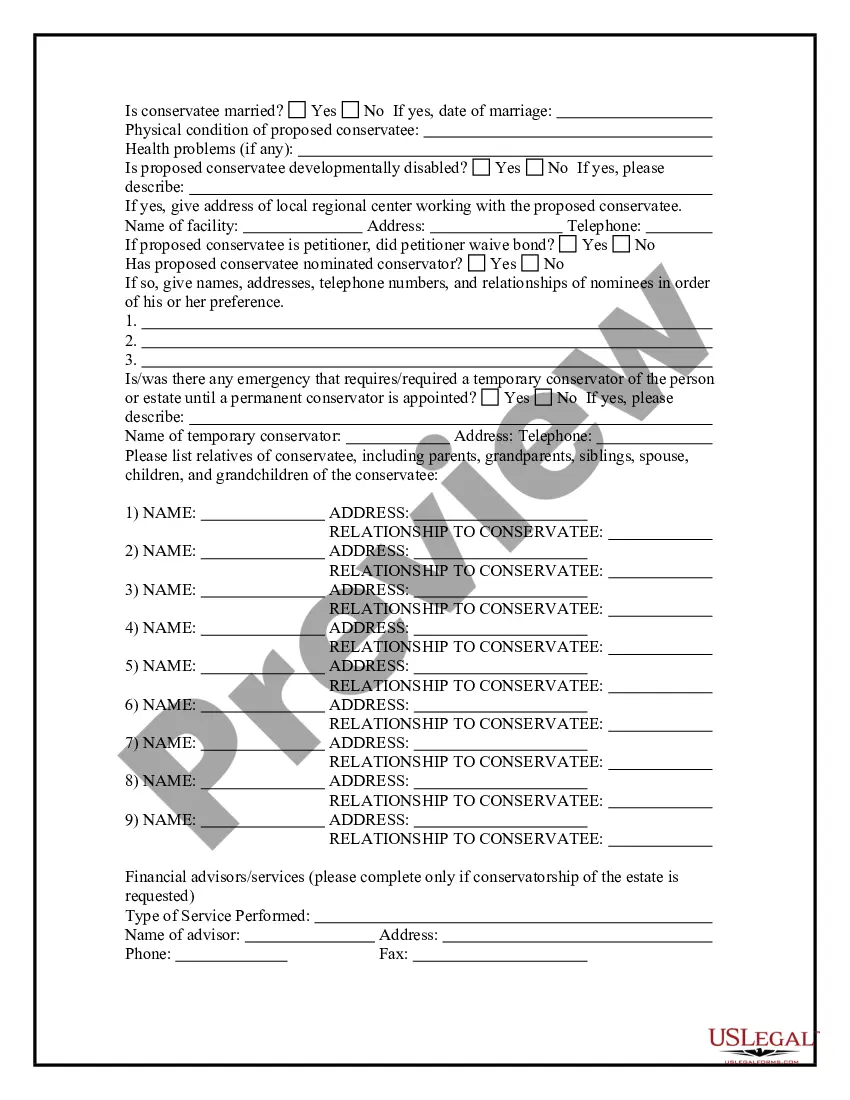

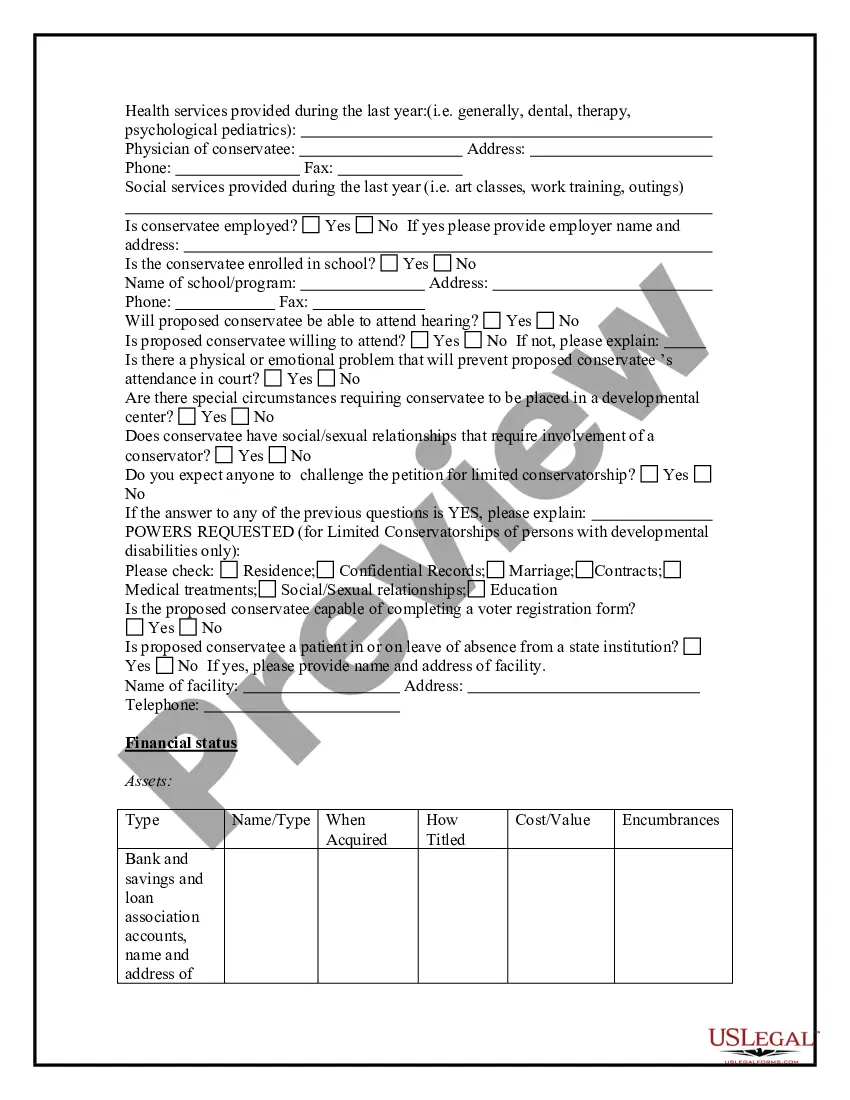

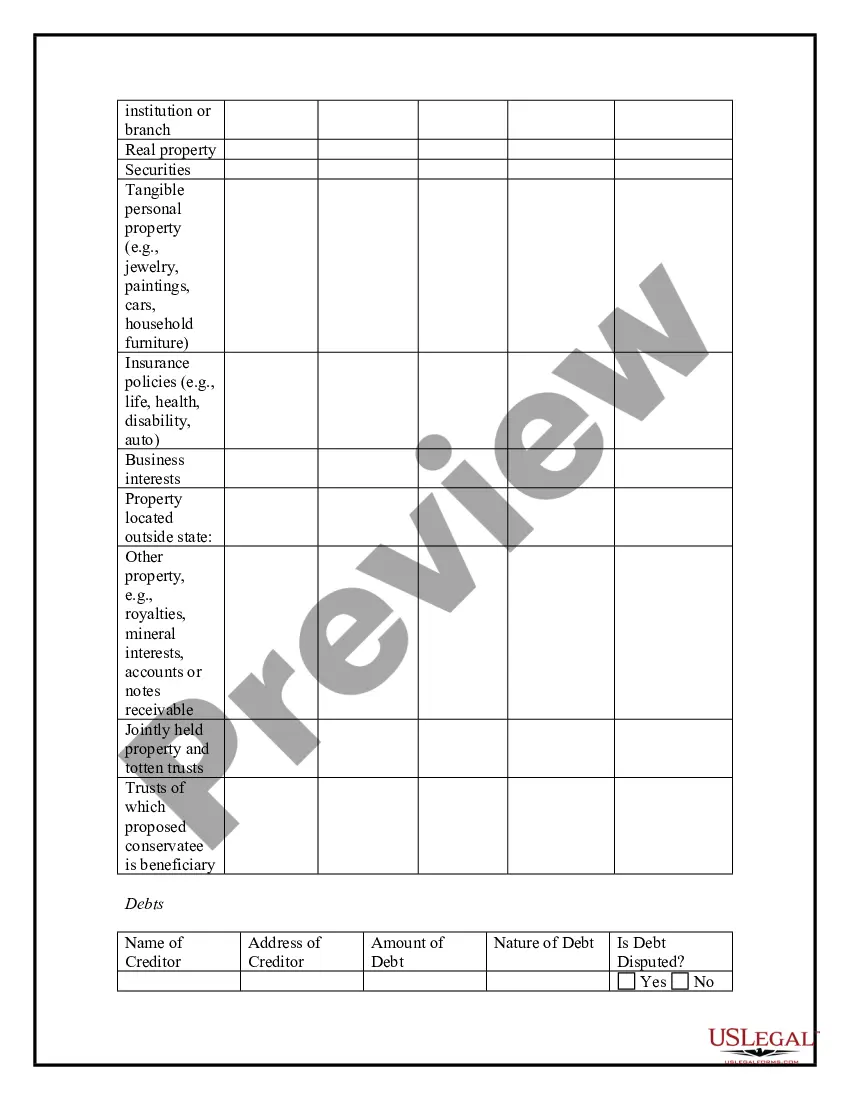

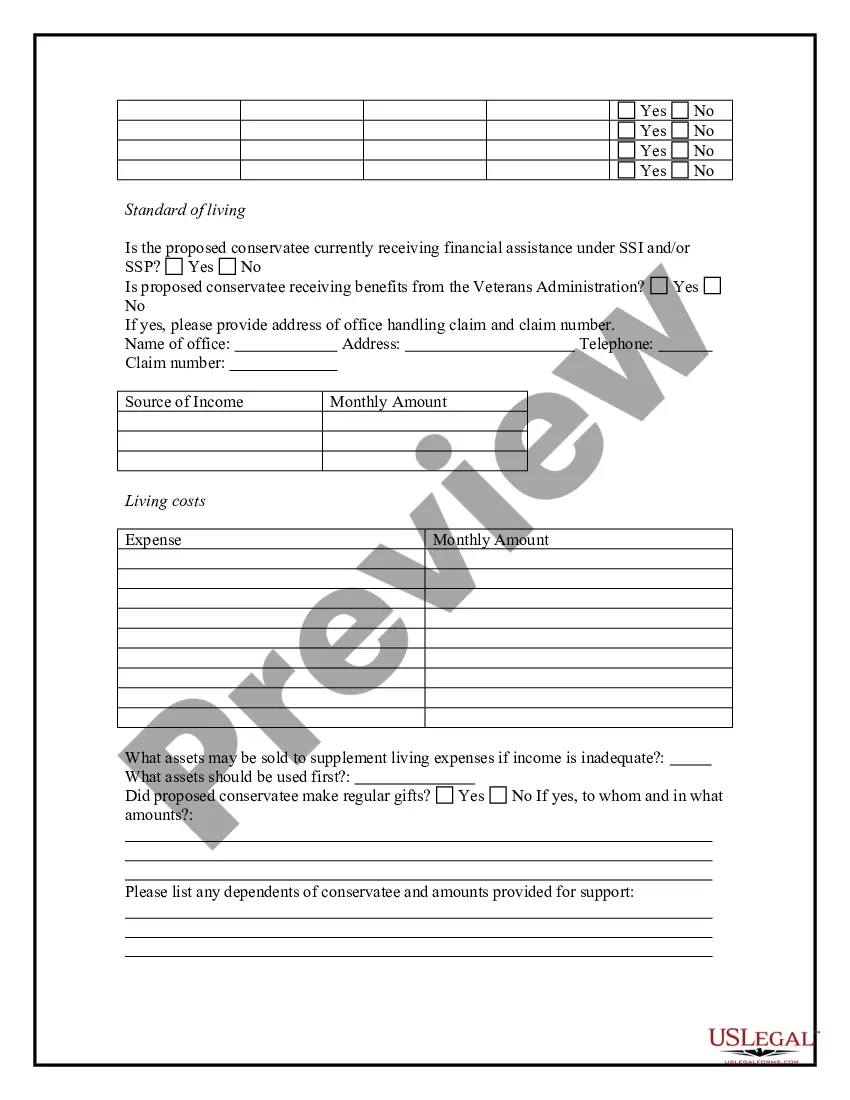

How to fill out Conservatorship Questionnaire?

Finding a go-to place to access the most recent and appropriate legal templates is half the struggle of handling bureaucracy. Finding the right legal papers calls for accuracy and attention to detail, which explains why it is vital to take samples of Conservatorship Bond Calculator For Tennessee only from reliable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have very little to be concerned about. You may access and check all the information concerning the document’s use and relevance for the circumstances and in your state or county.

Take the following steps to finish your Conservatorship Bond Calculator For Tennessee:

- Utilize the library navigation or search field to locate your template.

- Open the form’s description to check if it fits the requirements of your state and region.

- Open the form preview, if there is one, to make sure the template is the one you are looking for.

- Get back to the search and locate the appropriate template if the Conservatorship Bond Calculator For Tennessee does not match your requirements.

- If you are positive regarding the form’s relevance, download it.

- If you are an authorized customer, click Log in to authenticate and access your picked forms in My Forms.

- If you do not have a profile yet, click Buy now to obtain the form.

- Choose the pricing plan that suits your requirements.

- Go on to the registration to finalize your purchase.

- Complete your purchase by picking a payment method (bank card or PayPal).

- Choose the file format for downloading Conservatorship Bond Calculator For Tennessee.

- Once you have the form on your gadget, you can change it with the editor or print it and complete it manually.

Remove the inconvenience that accompanies your legal documentation. Explore the comprehensive US Legal Forms library where you can find legal templates, check their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

Massachusetts General Law 5-410 dictates that the bond must be in an amount determined by the court and will typically be in an amount equal to the value of the estate's real property and personal property that is in the conservator's control.

Bond Price = C* (1-(1+r)-n/r ) + F/(1+r)n F = Face / Par value of bond, r = Yield to maturity (YTM) and. n = No. of periods till maturity.

Tennessee certificate of title bond costs start at $100 for the state-required 3-year term. Exact costs vary depending on the surety bond amount required by the Department of Revenue. Bond amounts less than $10,000 cost $100. Bond amounts from $10,001 to $25,000 cost $10 for every $1,000 of coverage, starting at $100.

You must furnish the complete name and physical mailing address of your two sureties on the Surety Bond Application. You must also furnish General Tax Certification (?GTC?) (tax cards) (i.e. a copy of their most recent property tax bill showing their property tax information).