Conservatorship Bond Calculator For California

Description

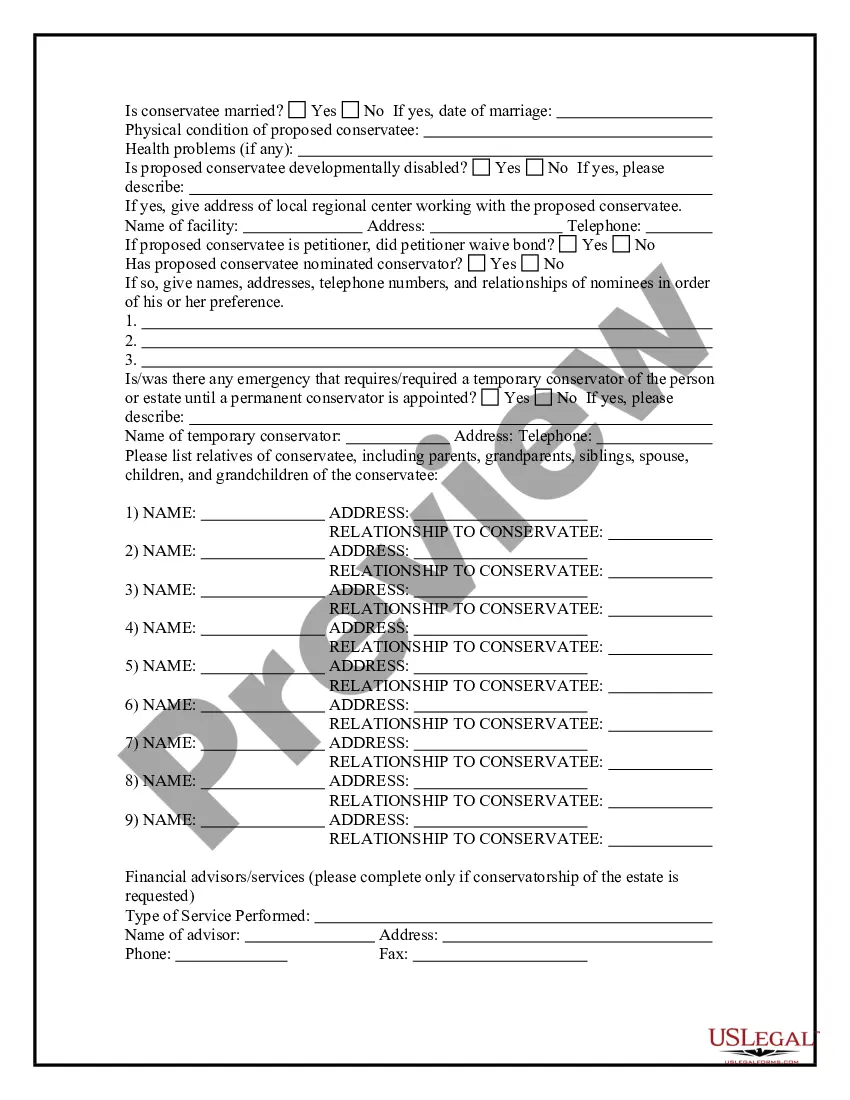

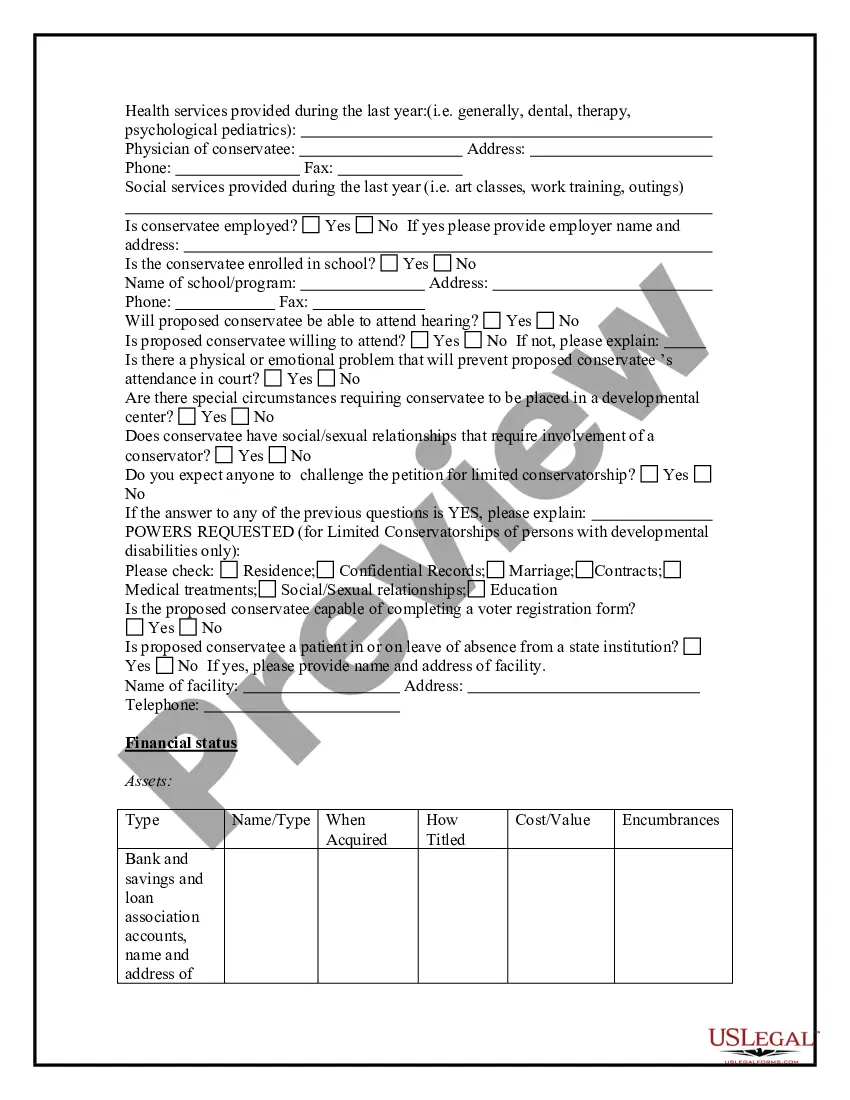

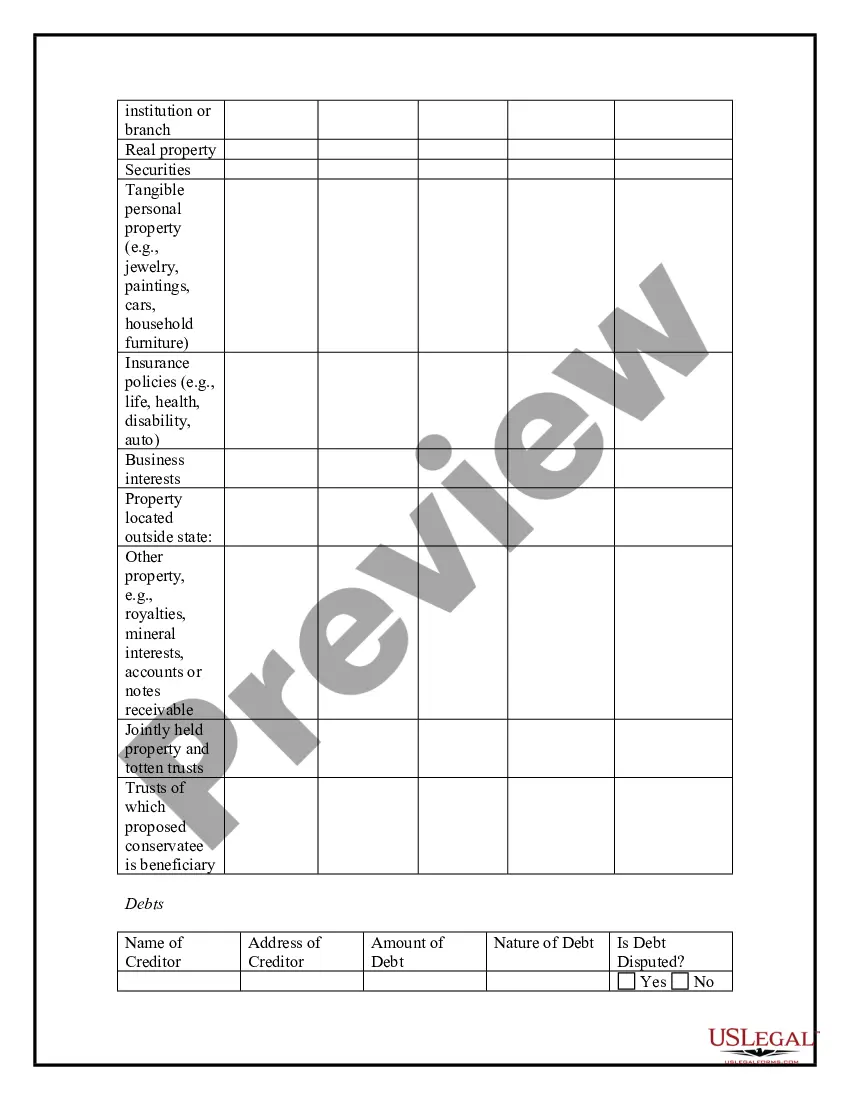

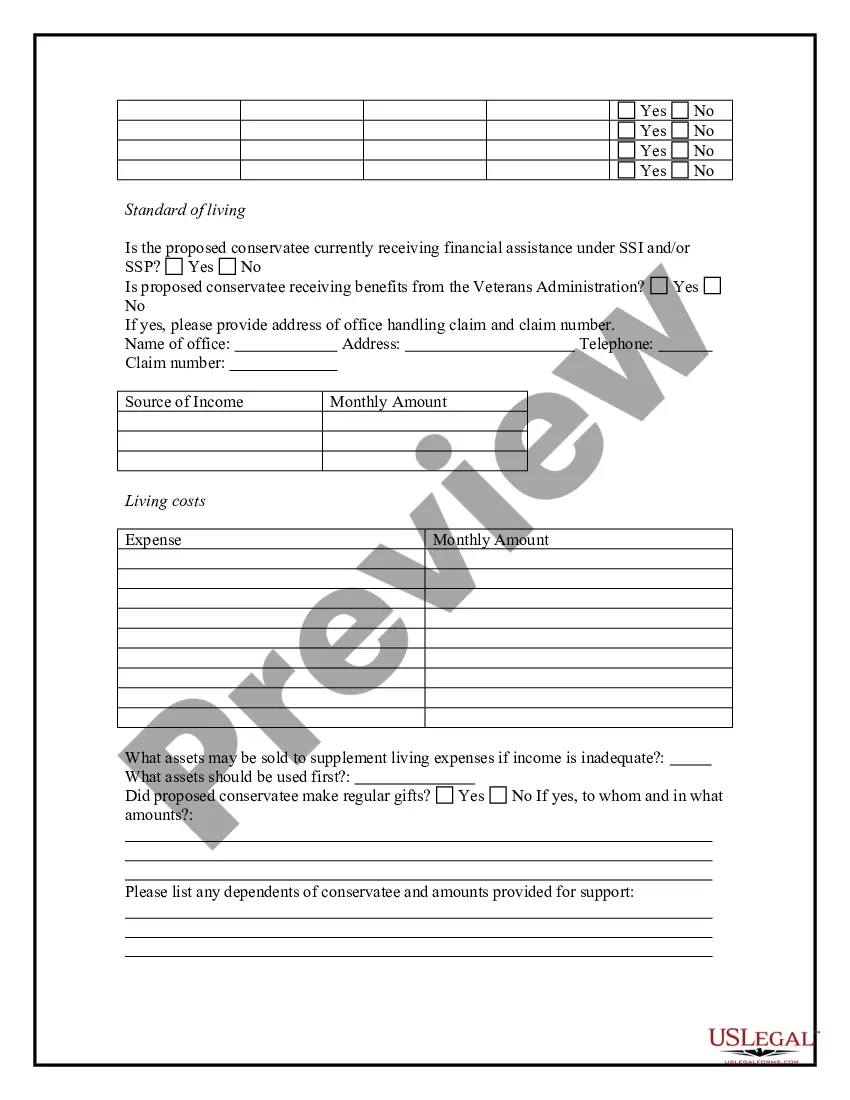

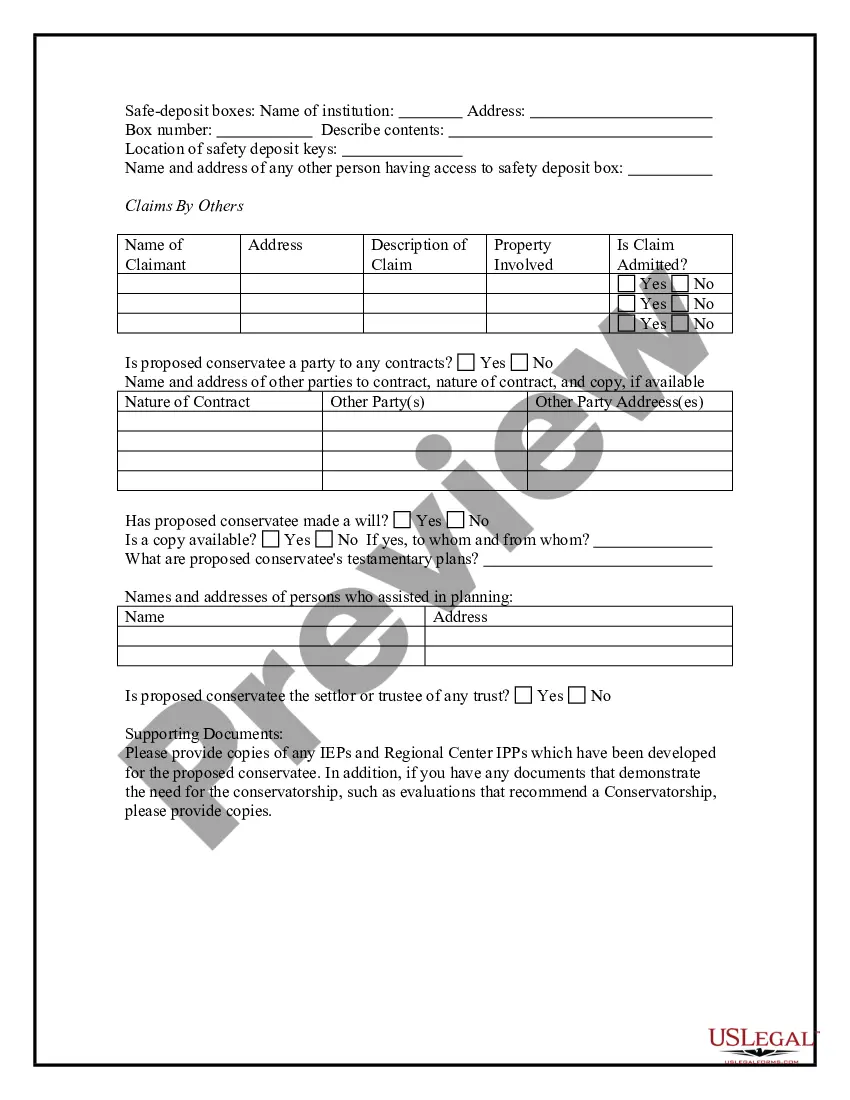

How to fill out Conservatorship Questionnaire?

Finding a go-to place to access the most current and appropriate legal templates is half the struggle of dealing with bureaucracy. Finding the right legal documents requirements accuracy and attention to detail, which is the reason it is crucial to take samples of Conservatorship Bond Calculator For California only from trustworthy sources, like US Legal Forms. A wrong template will waste your time and delay the situation you are in. With US Legal Forms, you have little to worry about. You can access and see all the details regarding the document’s use and relevance for your circumstances and in your state or region.

Consider the following steps to finish your Conservatorship Bond Calculator For California:

- Utilize the catalog navigation or search field to find your sample.

- Open the form’s information to see if it fits the requirements of your state and county.

- Open the form preview, if there is one, to make sure the template is definitely the one you are looking for.

- Resume the search and find the appropriate template if the Conservatorship Bond Calculator For California does not match your needs.

- When you are positive about the form’s relevance, download it.

- If you are a registered customer, click Log in to authenticate and access your selected forms in My Forms.

- If you do not have an account yet, click Buy now to get the form.

- Select the pricing plan that fits your needs.

- Proceed to the registration to complete your purchase.

- Finalize your purchase by selecting a payment method (bank card or PayPal).

- Select the file format for downloading Conservatorship Bond Calculator For California.

- When you have the form on your device, you can alter it using the editor or print it and finish it manually.

Remove the inconvenience that comes with your legal documentation. Explore the extensive US Legal Forms library where you can find legal templates, examine their relevance to your circumstances, and download them immediately.

Form popularity

FAQ

GC-310 Petition for Appointment of Probate Conservator. GC-020 Notice of Hearing. GC-320 Citation for Conservatorship. GC-314 Confidential Conservator Screening Form. GC-312 Confidential Supplemental Information. GC-335 Capacity Declaration (for dementia powers/medical consent only) GC-348 Duties of Conservator.

First, you have to visit the conservatorship litigation attorney to file the applicable papers with the court. You then have to inform all interested parties, including: The petitioning conservator. The proposed conservatee.

A probate bond is a court-mandated bond that helps protect an estate. They are often required of estate Administrators, Executors, Conservators, and Guardians during the probate process. Each state's probate court system requires bonds.

Except as otherwise provided by statute, every conservator or guardian of the estate must furnish a bond that includes an amount determined under (b) as a reasonable amount for the cost of recovery to collect on the bond under Probate Code section 2320(c)(4).

(a) The court in its discretion may fix the amount of the bond, but the amount of the bond shall be not more than the sum of: (1) The estimated value of the personal property. (2) The probable annual gross income of the estate.